Investment Thesis

The spin-off process itself is a fundamentally inefficient method of distribution stock to the wrong people. Generally, the new stock isn’t sold, its given to shareholders who, for the most part, were investing in the parent company business. Therefore, once the spinoffs shares are distributed to the parent company shareholders, they are typically sold immediately without regard to price or fundamental value.

Source: You Can Be A Stock Market Genius by Joel Greenblatt

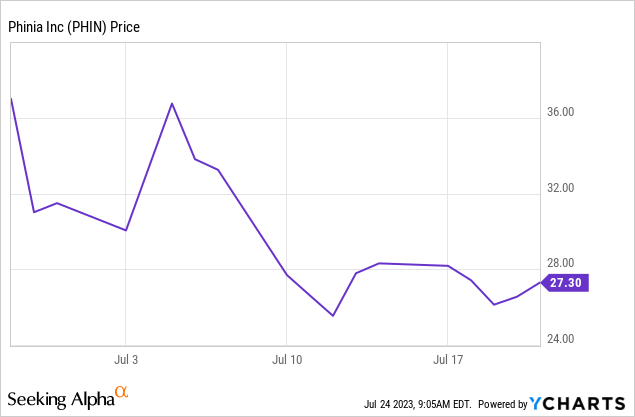

We believe this is exactly what’s going on with PHINIA. In December 2022 BorgWarner (BWA) announced its plan to spin-off its fuel systems and Aftermarket segments into a new company called PHINIA (NYSE:PHIN). Existing shareholders of BWA seem to want nothing to do with these businesses, but rather with their faster growing electric products and technology. As a result, the indiscriminate selling from BWA shareholders has caused PHINIA to fall 27% since becoming public, which has created a great opportunity to buy a quality company at a depressed price.

Overview

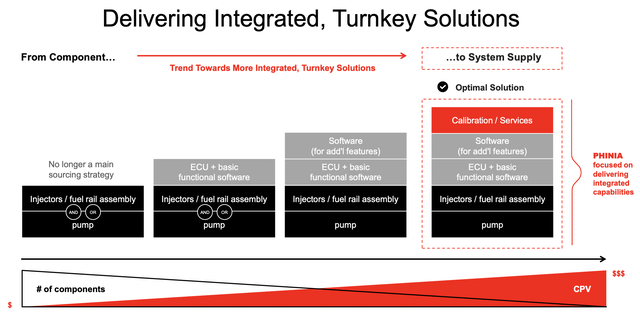

PHINIA is a leader in combustion and hybrid propulsion technologies for OEMs and aftermarket customers. As we mentioned before, the company operates two segments:

On the one hand, the fuel systems division creates and produces parts and systems that help gasoline and diesel engines work efficiently. Their portfolio of products includes pumps, injectors, starters, alternators and calibration services, among others.

PHINIA Investors Presentation

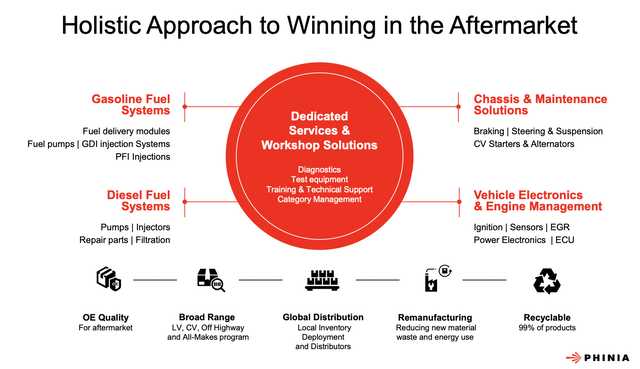

On the other hand, the Aftermarket segment sells both new and remanufactured products to independent aftermarket and OES customers. It also includes maintenance, test equipment and vehicle and industrial equipment diagnostics solutions.

PHINIA Investors Presentation

Their operations include 17 major manufacturing facilities and 7 major technical centers utilizing a regional service model. They have a presence in 24 countries and a team of approximately 1,500 scientists, engineers and technicians.

Financials

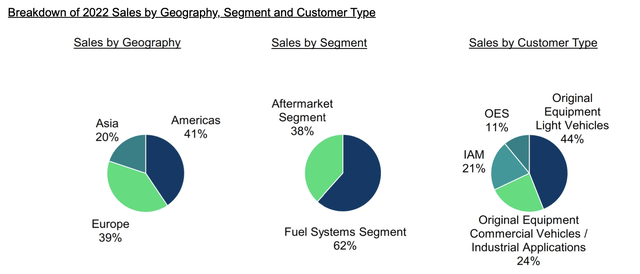

PHINIA reported pro-forma revenue of $3.44 billion in 2022 and $285 million in operating income. If we adjust it for-one time costs, mainly related to restructuring expenses, operating income would have reached $362 million, equivalent to 10.5% of sales. Adjusted EBITDA, on the other hand, was $504 million, or a 14.7% margin, and FCF was $196 million. Here is the revenue breakdown by geography, segment, and customer type:

PHINIA 10-K

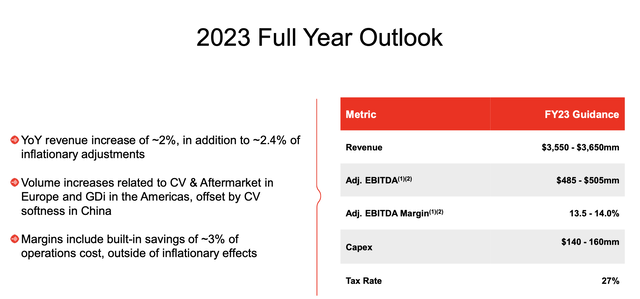

For 2023 they expect revenue to be in the range of $3.55-$3.65 billion and EBITDA to be between $485-505 million. Overall it’s a solid business which is not in growth mode, but rather focused on returning capital to shareholders. They have no plans to pay a dividend or repurchase shares yet, but we think it won’t take long before they do. Thinking further ahead, for 2025 they estimate revenue will reach $3.7 billion (a. 7.5% increase from 2022), maintain a 14-15% EBITDA margin and a net leverage of 1x.

PHINIA Investors Presentation

Valuation

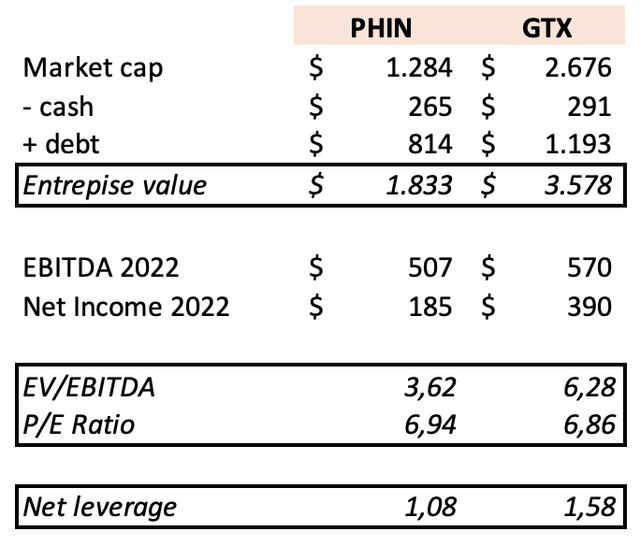

PHINIA currently trades at $27 per share, which equates to a $1.28 billion market cap. If we subtract the current cash position ($265 million) and add the total debt ($814 million), it results in an enterprise value of $1.83 billion. Taking into account that the company did $507 million in EBITDA in 2022, the stock is currently trading at 3.6x EV/EBITDA. In our view, this is extremely cheap. For comparison, Garrett Motion (NASDAQ:GTX), which we believe is PHINIA closest comparative, is currently trading at 6.3x EV/EBITDA and at the same P/E ratio, even though GTX has a higher net leverage ratio than PHINIA (1.6x vs 1x).

Author

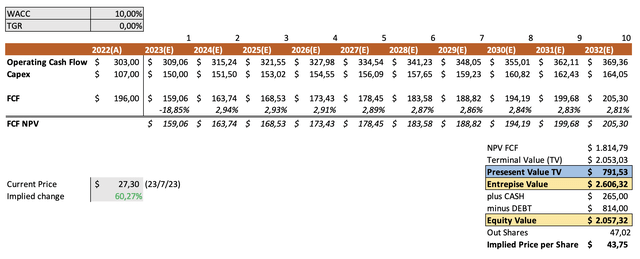

The valuation seems very compelling if we do a DCF model as well. We assumed that operating cash flow will grow by 2% while capex will increase by 1% for 10 years. We also assumed a WACC of 10% and a TGR of 0%.

Author

With these assumptions, we arrived at the conclusion that shares are undervalued. The implied price per share is almost $44, which represents an 60% increase from current levels.

Risks

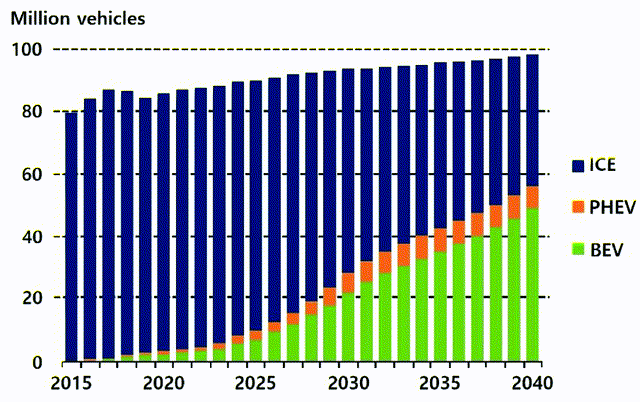

PHINIA is very exposed to internal combustion engines and its facing secular challenges from increased electric vehicle penetration:

ResearchGate

An acceleration in this trend may hurt PHINIA top and bottom line harder than expected, and a failure to adapt their business model to the new market needs may affect the value of the stock significantly.

Also, while doing our research we encountered a few opinions arguing that PHINIA should trade at a discount relative to GTX because of the higher exposure to internal combustion engines. If the market thinks this as well, our analysis of PHINIA’s value may be incorrect.

Takeaway

The spin-off and recent price drop have created a perfect opportunity to buy PHINIA in our view. It may not be an exciting business model, but we believe the current valuation is a reason good enough to make it part of your portfolio.

Read the full article here