Earnings of Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) will likely remain flattish this year as loan growth will counter weakness in the margin and lower income from Bankers’ Healthcare Group. Overall, I’m expecting the company to report earnings of $7.05 per share for 2023, down by just 2% year-over-year. The year-end target price suggests a moderate price upside. Further, the company’s risk level seems manageable. Therefore, I’m adopting a buy rating on PNFP stock.

Management Looking to Curb Loan Growth

The loan growth momentum remained strong during the first quarter in continuation of last year’s trend. Going forward, the recent team expansion will support loan growth. Pinnacle Financial added 26 new revenue producers during the first quarter of 2023, as mentioned in the conference call. Each of these bankers had over a decade of experience, so they hit the ground running.

However, the management has reduced its loan growth target for the year as it has started to tighten its lending in the commercial real estate segment. In the fourth quarter’s presentation, the management projected loan growth to be in the mid-teens range, whereas, in the latest presentation, the management is projecting growth to be in the low to mid-teens range.

This strategy to curtail loan growth makes sense because deposit growth has trailed loan growth in the last five quarters. To bridge the gap, Pinnacle Financial has relied on expensive borrowing, thus hurting the margin. I’m anticipating loan growth to match deposit growth in the year ahead, which should ease the pressure on the margin. The first quarter’s results show that Pinnacle Financial has remained safe from the deposit runs that plagued SVB Financial (OTC:SIVBQ) and First Republic Bank (OTCPK:FRCB). Therefore, I’m not worried about balance sheet growth.

Overall, I’m expecting the loan portfolio to grow by 12% in 2023. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 17,624 | 19,693 | 22,139 | 23,151 | 28,741 | 32,290 |

| Growth of Net Loans | 13.2% | 11.7% | 12.4% | 4.6% | 24.1% | 12.3% |

| Other Earning Assets | 3,847 | 4,338 | 8,268 | 11,047 | 8,092 | 10,842 |

| Deposits | 18,847 | 20,181 | 27,706 | 31,305 | 34,961 | 38,960 |

| Borrowings and Sub-Debt | 2,033 | 2,938 | 1,887 | 1,464 | 1,083 | 2,782 |

| Common equity | 3,966 | 4,356 | 4,687 | 5,093 | 5,302 | 6,119 |

| Book Value Per Share ($) | 51.2 | 56.7 | 62.0 | 67.1 | 69.6 | 80.5 |

| Tangible BVPS ($) | 27.3 | 32.4 | 37.3 | 42.7 | 44.9 | 55.8 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Deposit Mix Shift to Undermine Higher Asset Yields

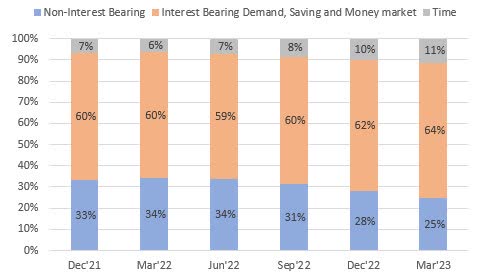

The net interest margin dipped by 20 basis points in the first quarter of 2023, which negatively surprised me. Apart from the surge in costly borrowings mentioned above, changes in the deposit mix were also responsible for the margin decline. Pinnacle Financial’s deposit mix worsened substantially during the first quarter as deposits migrated from non-interest-bearing accounts to higher-rate accounts, especially time deposit accounts.

SEC Filings

Further migration away from non-interest-bearing deposits cannot be ruled out. I’m expecting the up-rate cycle to end in June, but it’s likely that depositors will continue to shift their funds toward higher rate accounts well into the third quarter of 2023 in order to lock in high rates ahead of expected rate cuts next year.

On the plus side, the loan additions at higher rates will lift the asset yield, and consequently the margin. Further, a small balance of fixed-rate loans will come due over the next few quarters, so Pinnacle Financial will have an opportunity to raise its yields. As mentioned in the conference call, fixed-rate loans totaling around $100 million will renew in each of the last three quarters of 2023, carrying rates of between 4.5%-5.0%. The management is targeting the renewal rate to be above 6.5%. According to my calculations, the renewal can increase the average loan yield by 1-2 basis points.

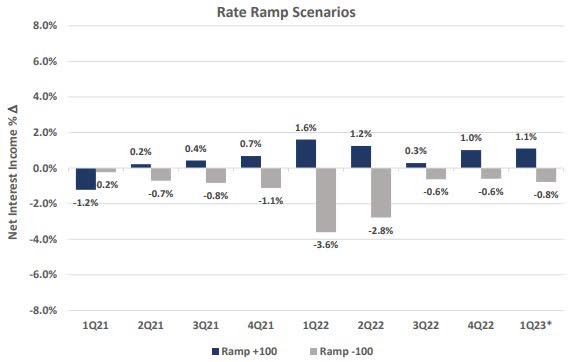

The results of the management’s rate-simulation model show that a 100-basis points hike in rates can increase the net interest income by just 1.1% over twelve months.

1Q 2023 Earnings Presentation

Considering these factors, I’m expecting the margin to dip by a cumulative ten basis points in the second and third quarters before stabilizing.

Expecting Earnings to be Somewhat Flattish

The anticipated loan growth will likely counter the effect of margin compression this year, leading to higher net interest income compared to last year. On the other hand, the non-interest income will likely be lower this year because of the poor performance of the Bankers’ Healthcare Group (“BHG”) in the first quarter. Through BHG, Pinnacle Financial lends to patients and medical and other professionals. BHG mostly impacts the fee income because of its gain-on-sale model.

Overall, I’m expecting Pinnacle Financial to report earnings of $7.05 per share for 2023, down by just 2% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 736 | 766 | 822 | 932 | 1,129 | 1,303 |

| Provision for loan losses | 34 | 27 | 192 | 16 | 68 | 85 |

| Non-interest income | 201 | 264 | 318 | 396 | 416 | 369 |

| Non-interest expense | 453 | 505 | 577 | 660 | 780 | 899 |

| Net income – Common Sh. | 359 | 401 | 305 | 512 | 546 | 536 |

| EPS – Diluted ($) | 4.64 | 5.22 | 4.03 | 6.75 | 7.17 | 7.05 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Risks Appear Manageable

Pinnacle Financial focuses on established relationships instead of start-ups. The management mentioned in the conference call that “the borrowers then have extended relationships with our relationship managers over in many cases, decades of working with each other.” While this strategy means that Pinnacle loses out on good opportunities, at least the strategy ensures that the risk level remains low.

Further, although uninsured and uncollateralized deposits make up a hefty 33% of total deposits, I’m not worried because these deposits are well covered. Available liquidity from different sources, including the Fed discount window and FHLB, was 1.55 times the uninsured/uncollateralized deposits, as mentioned in the presentation.

Although Pinnacle Financial may not feel compelled to sell its securities portfolio at a loss in the event of a deposit run, the management may still decide to dispose of some of its securities and realize the as-yet-unrealized losses on them. Gross unrealized losses on the available-for-sale securities portfolio totaled $280 million at the end of March 2023, as mentioned in the 10-Q filing. To put this number in perspective, $280 million is only as big as 5% of the total equity at the end of March.

Due to these factors, I believe Pinnacle Financial’s risk level is low to moderate.

Adopting a Buy Rating

Pinnacle Financial is offering a dividend yield of 1.8% at the current quarterly dividend rate of $0.22 per share. The earnings and dividend estimates suggest a payout ratio of 12.5% for 2023, which is in line with the five-year average of 12.7%. Therefore, I’m not expecting an increase in the dividend level in the year ahead.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Pinnacle Financial. Peers are trading at an average P/TB ratio of 1.09 and an average P/E ratio of 6.76, as shown below.

| PNFP | ONB | VLY | OZK | FNB | CADE | Peer Average | |

| P/E (“ttm”) | 6.34 | 6.06 | 6.22 | 6.52 | 7.07 | 7.92 | 6.76 |

| P/E (“fwd”) | 6.87 | 6.11 | 6.01 | 5.67 | 6.73 | 7.19 | 6.34 |

| P/B (“ttm”) | 0.64 | 0.71 | 0.58 | 0.84 | 0.66 | 0.76 | 0.71 |

| P/TB (current) | 0.98 | 1.22 | 0.85 | 0.98 | 1.20 | 1.19 | 1.09 |

| Source: Seeking Alpha’s Peer Page for P/E and P/B, Charting Page for P/TB | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $55.8 gives a target price of $60.7 for the end of 2023. This price target implies a 22.4% upside from the May 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.89x | 0.99x | 1.09x | 1.19x | 1.29x |

| TBVPS – Dec 2023 ($) | 55.8 | 55.8 | 55.8 | 55.8 | 55.8 |

| Target Price ($) | 49.5 | 55.1 | 60.7 | 66.2 | 71.8 |

| Market Price ($) | 49.6 | 49.6 | 49.6 | 49.6 | 49.6 |

| Upside/(Downside) | (0.1)% | 11.1% | 22.4% | 33.6% | 44.9% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $7.05 gives a target price of $47.6 for the end of 2023. This price target implies a 3.9% downside from the May 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 4.8x | 5.8x | 6.8x | 7.8x | 8.8x |

| EPS 2023 ($) | 7.05 | 7.05 | 7.05 | 7.05 | 7.05 |

| Target Price ($) | 33.5 | 40.6 | 47.6 | 54.7 | 61.7 |

| Market Price ($) | 49.6 | 49.6 | 49.6 | 49.6 | 49.6 |

| Upside/(Downside) | (32.4)% | (18.1)% | (3.9)% | 10.3% | 24.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $54.1, which implies a 9.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.0%. Considering the total expected return and the risk level, I’m adopting a buy rating on Pinnacle Financial Partners.

Read the full article here