Plains All American Pipeline (NASDAQ:PAA) reported strong cash flows for the 1st quarter allowing management to continue its positive full-year guidance. Recent weakness in crude oil pricing has lowered active drilling rigs for shale to under 600. For the first time since 2020, it is down year over year. The noisy crude oil price patterns created from economic uncertainty negatively affected producer confidence continuing this slow downward drift in drilling at a critical junction point. For its growth to continue, the opposite is necessary. Looking at trends and signs creates a warning, something in which investors must take notice. We aren’t suggesting a sell on PAA stock, but rather a change in investment strategy, one which just might be in order.

Quarter & Coming Year Expectations

Strong 1st quarter results dominated the call. From the prepared remarks,

“Reporting adjusted EBITDA attributable to PAA of $715 million. As a result of our first quarter performance and our outlook for the balance of the year, we are reaffirming our adjusted EBITDA guidance range of $2.45 billion to $2.55 billion for 2023. Additionally, we continue to expect free cash flow generation of approximately $1.6 billion and common distribution coverage of 215%, which includes our recent $0.20 per unit annualized distribution increase.”

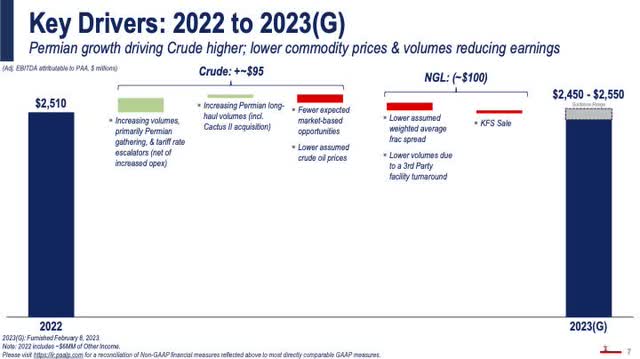

Management continued touting its plans to focus on free cash flow trying to generate enough for adding $0.15 per year in distributions while closing out meaningful levels of debt. A key part of that planned increase resides with outputs from the Permian Basin shown in the upper left portion of the next slide.

Plains Presentation

The slide’s summary guides for a flat EBITDA year over year. Estimates for crude are up $100 million and down for NGL, though hedged heavily, $100 million. The prepared remarks continued its heavy focus on the importance of the Permian Basin.

“We continue to capture increasing volumes on our system and we expect production growth of plus or minus 500,000 barrels a day exit-to-exit in 2023 based on an assumed 2022 exit production of approximately 5.65 million barrels a day.”

Management noted that enough horizontal rigs were in operation, 340, to support the estimate.

With respect to NGL, future investment plans are in the works and will be discussed later in the year.

The company still expects to generate $2.3 billion in cash with $1.6 billion free and pay $1.0 billion in distributions. The leverage drops to 3.5x by year’s end. The expansion capital budget continues at $300 to $400 million.

What’s at Risk

So what’s at risk with everything seemingly so positive? A very experienced and valued author from OilPrice, David Messler, pointed out in his, U.S. Shale Production Is Set For A Rapid Decline, that the drop in rigs coupled with quickly vanishing untapped past drilled wells, (drilled but uncompleted wells (DUC) won’t support crude growth from the shale regions, in particular, the Permian. He makes some compelling points beginning with the economic worry warts, our wording, combined with short selling hedge fund managers drove crude pricing lower significantly against the backdrop of falling inventories and increasing demand. We begin with a graph included in his article followed by several of his comments.

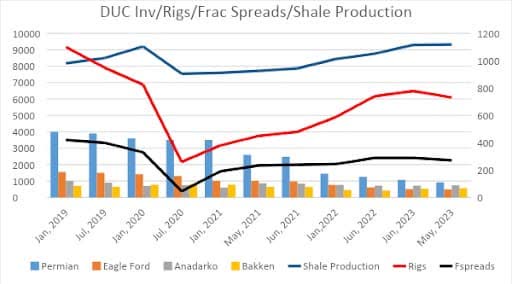

OilPrice

The multi-colored, vertical bars show changes in the drawdown of Drilled, but Uncompleted (DUC) wells over the last four years. Low oil prices from 2019 through December, of 2021 drove a decline in DUCs from ~4,000 to 1,446, more than 75%. During this period, oil companies desperate for revenue and needing to control costs thanks to oil prices below $70 per barrel, turned to DUCs to maintain output. Post-January 2022, higher oil and gas prices drove a rapid increase in drilling, and attenuated the trend toward DUC activation as the year wore on. From January of 2023, both DUC withdrawals and drilling have declined and shale output has essentially flatlined around 9,300 mm BOPD, according to the monthly EIA-Drilling Productivity Report.

It continues with an obvious observation, after 2020, putting into service DUCs drove crude production growth. He continues by pointing out that rig count doesn’t rise over 600 until last summer. The 600 is important because his past evaluations have shown that level is needed to grow production. He concludes his discussion of the chart with this observation, “Daily shale output is nearing an inflection point and may soon start a rapid decline, that will be impossible to reverse, absent a huge increase in the rate of drilling new wells that cannot be sustained in today’s market.”

He closes his well thought through article with this admission.

Noteworthy also is the surprise factor for the markets when, and if, my projections bear out. No one is forecasting a decline in shale production at this point, making me something of a heretic. The most recent EIA – Today in Energy forecasts shale production rising to 11 mm BOPD by year-end 2024. We can’t both be right.

Messler opines on an almost inevitable event without sudden about faces in investment something in this environment not probable. In short, the issue, for a short-time, is drilling is waning at a time it is most needed to strengthen.

It must be noted that others have different thoughts. Plains’ itself, noted that the rig count in the regions important for it remained on target with assumptions. NuStar Energy (NS) noted lumpiness with production changes from the Permian thus lowering its production target slightly for 2023.

Distribution

Before we continue, it seems important to note the formula Plains is using to determine distribution growth going forward. In the 4th quarter presentation, management included this statement, “Targeting distribution increases of ~$0.15/unit annually, subject to a 160% coverage ratio…” With the company expected to meet this criterion in 2023, investors should expect another increase toward year’s end. But…

Risk & Rewards

Regardless of what happens to growth, Plains is on solid financial ground. It will leave this year self-funding all expenses with something near $600 million in additional cash. What is at most risk is future growth after this year unless the investment in shale regions significantly changes. Although we expect that to happen with production falling followed by huge price increases, the issue is the significant dead time between investment and production. In our view, Plains will continue to pay a nice and growing return through this year followed by a break. An investment style change might be in order one from buy and hold to one which includes selling short calls and pocketing that money. Plains’ unit price is in the $14 minus range, already anticipating a distribution increase to $1.2 per year. As the summer progresses, we plan to begin adding calls to our strategy with the likelihood of price becoming range bound. Growth passed this year seems likely stunted for a bit, not because of demand, but from failing investment. Understanding this might offer investors a chance to increase yields, something we enjoy very much. We continue our hold rating on Plains, which could change to a buy under $12. This company is in the right spots and is well managed, but it is likely caught in the crosshairs of the marketplace.

Read the full article here