Plains All American (NASDAQ:PAA) is one of the cheapest stocks in the midstream sector, and has plenty of growth in from of it.

Company Profile

PAA is a liquids focused midstream company that operates in two segments. Its Crude segment generates the bulk of its EBITDA and is the steadier of the two businesses. Its NGL segment is more of a spread business, as thus has more variability to its results.

Crude Segment (83% of EBITDA)

PAA’s crude system consists of over 18,000 miles of active crude oil transportation pipelines and gathering pipes throughout the Permian Basin, Eagle Ford, Mid-Continent, Gulf Coast, Rocky Mountains, and Canada. The pipelines consist of both gathering, intra-basin, and long-haul pipelines.

Its transportation assets generate revenue through the use of tariffs, pipeline capacity agreements, and other transport fees. Its storage assets use a combination of monthly to multi-year agreements, as well as throughput and loading and unloading fees, as well as fees from condensation processing services. The segment also generates revenue from commercial and merchant activities that supply volumes to its transportation and storage assets.

The Crude segment is very tied to the Permian Basin, where about 60% of its EBITDA come from.

NGL Segment (17% of EBITDA)

PAA’s NGL segment consists of 4 natural gas processing plants and 8 fractionation plants. It also has NGL storage capacity of 28 million barrels, 1,620 miles of NGL pipelines, and 16 NGL rail terminals, with 4,100 rail cars and 220 trailers.

Approximately 40% of the segment’s EBITDA comes from fees, while 60% comes from fracs spreads and marketing. The company uses 12+ month rolling hedges for frac spreads. It typically hedges 65-90% of volumes.

Most of the NGL segment is located in Canada, in particular western Canada.

Opportunities

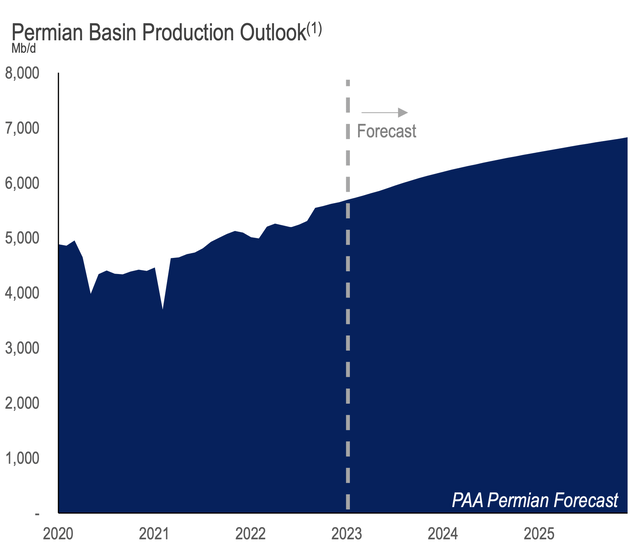

PAA’s biggest opportunity is that it is a major liquids midstream player in the most prolific oil basin in the U.S. in the Permian. At the same time, its infrastructure in the Permian has largely been built out and is currently underutilized. Thus, it can grow nicely in this segment without much CapEx spending.

Discussing overall U.S. oil growth, Devon (DVN) CEO Richard Muncrief noted that the Permian would be where most growth comes from, saying: “But it’s going to be, I think, in aggregate, [oil growth is] going to be somewhat moderate. And so it all comes down to the Permian. And I think the Permian will continue to be the only basin that grows substantially. But even with the Permian, I think you’ll start seeing impacts of things like the supply chain pinch and others.”

Company Presentation

Distribution growth is another area of opportunity for PAA. The company raised its distribution by 20 cents this year, with expects 15-cent annual increases thereafter, as long as its coverage ratio is above 1.6x.

The company has also done a good job of deleveraging, both through driving free cash flow after distributions following a large distribution cut in 2020, as well as through selling non-core assets. In fact, the company has reduced debt by over $2.7 billion since year-end 2020. With its robust free cash flow after distributions and being towards the bottom end of its leverage target, the company is well set up to use the excess cash to execute the capital allocation plan it views best.

Risks

PAA derives its revenue through liquids transport and storage, so it is tied to oil volumes and indirectly prices. The company is also exposed to the Permian basin. While this is generally a good thing, the prolific basin has seen its midstream crude infrastructure be overbuilt. However, it does appear that the situation is improving.

Speaking at a conference in September, PAA CEO Wilfred Chiang said he thought the Permian would grow production by 2 million barrels a day in the next few years. If accurate, that would certainly eat a lot into that ~8 million barrels a day takeaway capacity in the region The company also has some contract roll-offs in 2025 and 2026, but Chiang thinks that could be beneficial.

At the conference, he said:

“Production’s growing and spare capacity of roughly 2 million, 2.5 million barrels a day of capacity is starting to shrink. And as that happens, the margin starts to improve. And so tariffs, if you think about 2023, it is roughly in the $0.80 a barrel range. And then in 2024, it’s $1.20, $1.25 a barrel. And so the reason I’m telling you all this is that integrated strategy across the basin, ultimately going to the rest of the world. Our focus is to try to fill the barrels and get the long-haul numbers to go to the coasts. And when that works, with the improving margin on the tariffs, that helps us. We definitely think additional production puts some support behind tariffs. And ultimately, it’s not just the MVCs that we have, we’ve got some contracts that are rolling off in ’25, ’26. But as you think about what I’m just saying now, it’s — at that point in time, we do think the tariffs are going to be a healthier range. And it’s probably going to be good timing as we renew some of those.”

Within the Permian, PAA is also exposed to natural gas takeaway bottlenecks. While PAA doesn’t own nat gas infrastructure in the region, E&Ps could be a bit more reluctant to just flare associated gas given a bit more focus on ESG issues. Make no mistake, flaring is still going on and has been increasing in the basin, but larger operators still face a lot of scrutiny. Thus, a lack of natural gas takeaway could slow the growth Permian oil production. However, new takeaway projects are scheduled to come online later this year.

The basin has also seen a lot of cost inflation on the services side, as well as supply constraints. These issues could cool Permian production growth in the near term. However, most operators have said they are seeing costs start to flatten.

PAA’s NGL segment is also exposed to frac spreads, which is essentially the difference between NGL and natural gas prices. The company gets extraction rights when it processes natural gas, allowing it to take out the higher-valued NGLs. It then has to buy natural gas to replace the thermal content attributable to the NGL that was extracted. Strong frac spreads last year allowed the company to over-earn by $100 million versus what it expects frat spreads to look like in 2023.

The NGL segment in general is more variable than many midstream business, impacted by things like weather, frac spreads, differentials, and time spreads.

Valuation

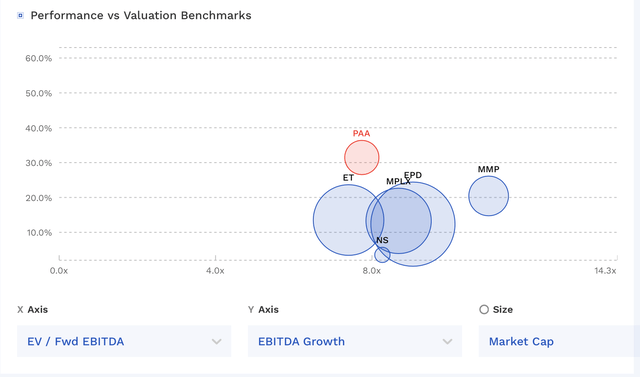

PAA currently trades at 7.7x the 2023 EBITDA consensus of $2.54 billion, and 7.5x the 2024 EBITDA consensus of $2.61 billion.

It trades around 9.3x its core Crude segment ’23 EBITDA of approximately $2.1 billion.

On a FCF basis, the stock has a FCF yield of 14% based on a 2023 FCF forecast of $1.33 billion. For some reason the company includes assets sales when it discusses free cash flow, but I leave that $270 million out of the calculation. The stock yields nearly 8%.

PAA trades at one of the cheaper valuations among its midstream peers.

PAA Valuation Vs Peers (FinBox)

Conclusion

Like many midstream MLPs, PAA had a number of issues in its past, from IDRs to over-leverage to pipeline spills. However, it also had some additional issues. A decade ago, the company had a very successful Supply & Logistics business that in 2013 was generating around $1 billion in EBITDA. However, unlike with natural gas, crude oil market arbitrage opportunities began to evaporate to the point that the business was generating no EBITDA for the company when it eventually just folded the segment into its Crude Segment in Q4 2021, saying that the former segment’s purpose was now just to help drive utilization for its assets and not generate a profit.

The second big issue the company has had to deal with was that when the Permian became the hottest oil basin in the U.S., there was a rush to build crude midstream infrastructure in the basin. That led the basin to be overbuilt, and what went from crude pipeline operators being able to charge a premium due to lack of capacity, quickly turned to a market with pipelines at half capacity. Oil companies, meanwhile, were able to get shorter contracts, and thus much better rates once they expired, and spot rates collapsed.

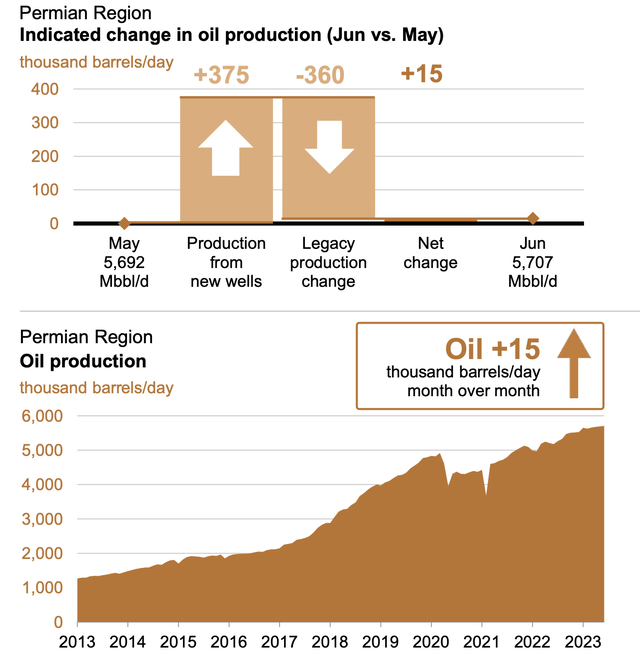

Today, the situation in the Permian is starting to improve. Oil production in the basin is expected to hit a record of 5.7 million barrels per day in June, according to EIA (U.S. Energy Information Administration). PAA has some contracts rolling of in 2025-26, but that could be a good thing. Natural gas bottlenecks and supply constraints that have slowed Permian oil production growth, meanwhile, are soon set to improve.

Permian Oil Production (EIA)

PAA is attractively valued on the results of its Crude segment alone. Given that its Permian pipes have plenty of capacity, it has a nice runway for growth without the need for spending a lot on CapEx. The overbuild capacity of the basin also looks like it is starting to improve, and the company could see some improving tariff rates in a few years. Meanwhile, investors are getting the NGL segment and its cash flows for free, which the company can use to deleverage or buy back shares.

The planned continued growth of the distribution should make the stock increasingly more attractive to individual investors, while institutional investors should like its improve balance sheet and FCF yield.

At $17, the stock would trade at only an 8.5x multiple on 2024 EBITDA. As such, I rate the stock a “Buy.”

If any readers want to avoid K-1s, PAA’s GP – Plains GP Holdings (PAGP) – essentially owns units of PAA and doesn’t issue a K-1.

Read the full article here