Potbelly Corporation (NASDAQ:PBPB) reported generally solid Q1 2024 results, but appears to be dealing with slightly soft traffic trends. As a result, Potbelly has trimmed its full-year guidance around both same-store sales growth and adjusted EBITDA growth.

Potbelly’s original 2024 guidance (released in March 2024) was in-line with my February 2024 expectations for it. Potbelly’s revised guidance calls for its same-store sales growth to be a couple percent lower than before, while its adjusted EBITDA expectations appears to be around $1 million lower than before.

I’ve trimmed my estimate of Potbelly’s value to $9.50 to $10.50 per share now. I had previously expressed my belief that its shares were getting relatively pricey, but now that its stock is down nearly 40% from its 52-week-high, it appears slightly undervalued.

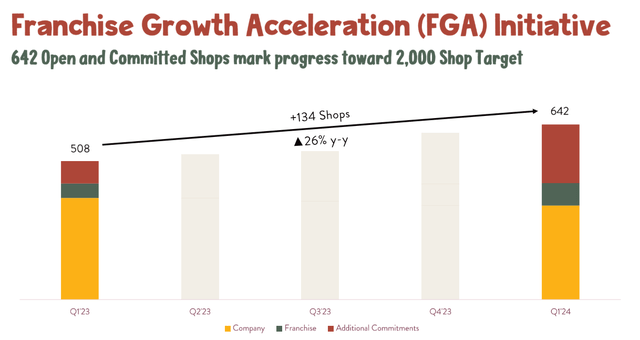

Growth In Franchises

Potbelly is aiming to get to around 2,000 shops next decade, with around 85% (or 1,700) of those shops being franchises. At the end of Q1 2024, Potbelly had 427 open shops, including 345 company-operated shops and 82 franchise shops. It also had commitments for another 215 shops.

The number of open shops were mostly unchanged from the 426 open shops that Potbelly had at the end of Q1 2023. However, Potbelly has been converting company-operated shops into franchise shops, so the mix is changing. At the end of Q1 2023, Potbelly had 373 company-operated shops and 53 franchise shops, with commitments for another 82 shops.

Potbelly’s Shop Targets (potbelly.com (Q1 2024 Earnings Presentation))

Q1 2024 Results

Potbelly’s Q1 2024 results were decent, with same store sales down -0.2% compared to Q1 2023. This was within (although towards the low end of) Potbelly’s guidance range of -0.25% to +0.5% same-store sales for the quarter. Potbelly indicated that it was doing better than the overall restaurant industry and the fast casual restaurant segment, and gaining in terms of market share.

Potbelly also noted that January was the softest month of the quarter. Based on overall industry results, I estimate that Potbelly’s January same-store sales ended up around -3%, and its February and March same-store sales ended around +1%.

Potbelly’s adjusted EBITDA ended up at $5.7 million in Q1 2024, above its guidance range of $4.4 million to $5.2 million. However, Potbelly’s Q1 2024 results also benefited by $1.1 million from a one-time legal settlement.

Potbelly’s year-over-year results were helped by reduced food costs and its labor optimization efforts. These items contributed to a 1.5% improvement in shop-level margins (from 12% in Q1 2023 to 13.5% in Q1 2024) despite Potbelly also increasing its brand fund spending.

Full-Year Outlook For 2024

Potbelly’s original guidance for low-to-mid single digit same-store sales growth in 2024 was largely the same as my expectations (from a couple of weeks before Potbelly released its guidance) for +2% to +5% same-store sales growth in 2024.

Potbelly has lowered its full-year expectations to low-single digit same-store sale growth now. It expects +0% to +2% same-store sales growth in Q2 2024, continuing the trend of slightly positive same-store sales growth that it saw in February and March 2024. I believe that +1% to +2% same-store sales growth is now a reasonable expectation for Potbelly’s full-year results. This would translate into flat or slightly lower traffic levels year-over-year, given that Potbelly expects price increases to contribute several percent to its same-store sales growth.

Potbelly now also expects mid-to-high single digit adjusted EBITDA growth in 2024 compared to 2023 (when it reported $28.3 million in adjusted EBITDA). Thus, Potbelly is now guiding to around $30 million to $31 million in adjusted EBITDA for 2024.

Potbelly’s original guidance was for high-single to low-double digit adjusted EBITDA growth, which would translate into $31 million to $32 million in adjusted EBITDA for 2024.

A 2% reduction in sales growth would typically have a greater than $1 million impact on adjusted EBITDA, but Potbelly is attempting to mitigate that through cost controls, pricing and other levers.

Effect On Valuation

I had previously noted that Potbelly’s share price (at over $12 per share) seemed a bit optimistic and appeared to be pricing in 5% to 7% same-store sales growth for 2024.

I had estimated Potbelly’s value at $10 to $11 per share, instead using more modest sale growth expectations that were in-line with Potbelly’s original guidance.

Due to Potbelly’s downward revision in sales growth expectations in 2024 and the $1 million reduction in adjusted EBITDA guidance for 2024, I am now estimating Potbelly’s value at $9.50 to $10.50 per share. This is a $0.50 per share reduction from before.

As Potbelly is trading at under $9 per share, I believe it is slightly undervalued now. There is some risk is that restaurant traffic trends soften more, though. Potbelly has been gaining market share, but it is still vulnerable to its same-store sales growth turning slightly negative if the overall industry deteriorates more, though.

Conclusion

Potbelly’s Q1 2024 results were decent, although its same-store sales growth was near the low-end of its guidance range and its adjusted EBITDA would have also been towards the low-end of its guidance range without the benefit of a one-time legal settlement.

Potbelly is dealing with a slight slowdown in sales due to overall market conditions. It is still gaining market share, but made a downward revision to its sales guidance for the full year. Potbelly now expects low-single digits same-store sales growth for the year.

This is also resulting in a $1 million reduction in adjusted EBITDA expectations for the full year, and I am now estimating Potbelly’s value at $9.50 to $10.50 per share. This is a slight reduction from my earlier estimates, reflecting the weaker overall restaurant environment. With Potbelly’s shares under $9 now and down close to 40% from its 52-week-high, I now consider it slightly undervalued.

Read the full article here