Powell Industries, Inc. (NASDAQ:POWL) shocked the market with its May Q1 earnings results. Revenue was up 34% year over year, EPS were up 700% year over year and these results beat analyst expectations by 16% and 250%, respectively. As big of a surprise as this was, the most eye-opening part of the report for me was the news that Powell’s backlog hit $1 billion during the quarter. For context, the backlog at the end of FY 2022, about 6 months ago, was $596 million.

Backlog is arguably the most important metric for Powell as most of its revenue is from one time contracts awarded to the company and these contracts are not awarded on a recurring basis.

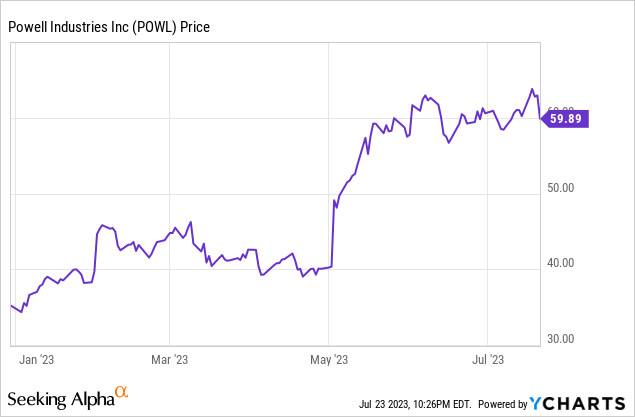

The market reacted to this surprise as one would expect: the stock was up about 22% the day the results were released, and it has risen another 22% since then as investors digested the results. After this rise, it’s easy to assume the stock is overvalued after a quick look at its trailing valuation numbers. The stock trades at around 26 times trailing earnings per share, and Powell’s EV is about 18 times trailing twelve months EBITDA. This looks quite high when compared to the typical market multiple, but what’s interesting is that the stock has actually gotten cheaper year to date, despite the fact that it’s up about 75% in that time. This was due to huge growth in earnings that outpaced the growth in the stock.

What can investors expect from Powell moving forward? At the moment the stock has momentum on its side, but over the next few quarters, the stock will move based on its performance relative to expectations. Expectations are quite high after the stellar Q1, but I think that Powell will exceed those already high expectations in Q2, and the stock could have up to 21% more upside following the Q2 report. In this article, I’ll discuss what I expect for Powell in the rest of FY 2023 results and why the stock has more upside based on my expectations.

Business Overview and Past Financial Results

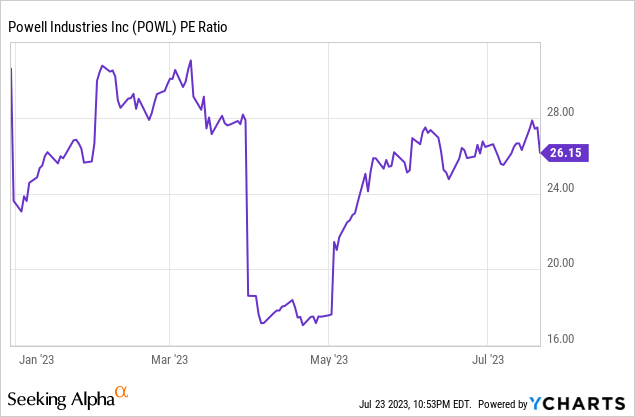

Powell Industries primarily manufactures electrical products for the oil and gas refining, onshore and offshore oil and gas production, petrochemical production, LNG terminal, pipeline, terminal, mining and metals production, light rail traction power, electric utilities, pulp and paper, and commercial end markets.

Powell Industries End Markets (Q1 2023 Earnings Presentation)

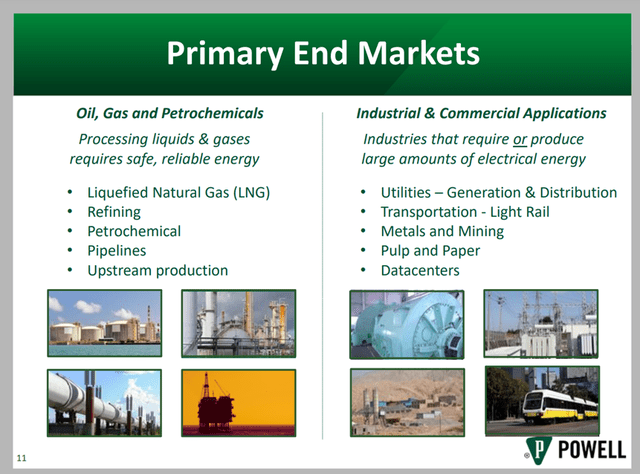

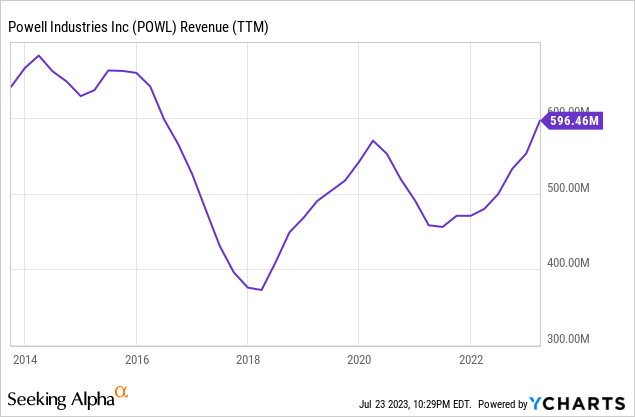

Revenue is earned from winning contracts from customers in these markets. As most of these markets involve energy, oil and commodities, Powell’s revenue is very cyclical and dependent on the state of U.S. and global economy. Specifically, Powell’s revenue is very much tied to oil and gas capital expenditure.

To illustrate this, it is worth looking at the financial results from the years ending September 2015 through September 2017. In these years, revenue declined from $661 million in 2017, to $565 million in 2016, to $395 million in 2015. In that time, operating income dropped from $24 million in 2017 to $(18) million. Also in that time, the stock dropped about 50% from peak to trough.

These poor results were due to the fact that U.S. oil and gas capital expenditures fell off of a cliff as an investment cycle came to an end. This investment cycle was driven by the price of oil.

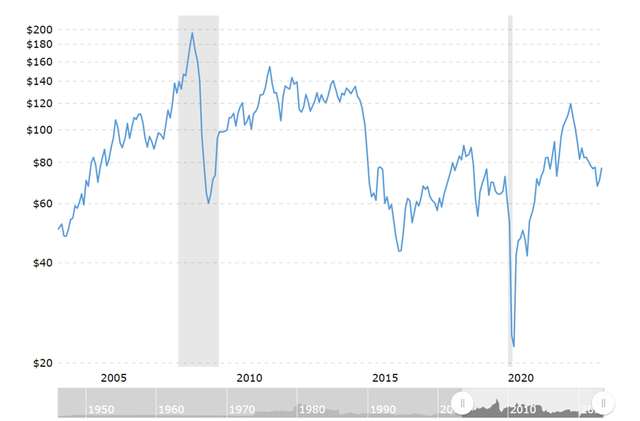

2010-2021 Oil and Gas Industry Capital Expenditures (Statista) Chart of Oil Price (MacroTrends)

After the 2008 financial crisis, oil rebounded and stayed above $100 per barrel until 2015 when it started to drop. Oil and gas capital expenditures respond to oil prices with a bit of a lag, so they bottomed a year after oil hit this regional low in 2015.

As it relates to Powell Industries, their revenue and earnings respond to oil and gas capital expenditures with a lag, as these results are based on their backlog which is based on contract awards in the previous year. Oil and gas capital expenditures bottomed in 2016, so Powell had its worst year in 2017.

This connection to oil prices through its connection to oil and gas capital expenditures makes it necessary for long term investors in Powell Industries to have some sort of opinion on the future of oil.

However, in the shorter term, profitable trades on Powell industries’ stock can be made based on supply driven analysis of the oil industry or the economy at large, or based on analysis relating to beliefs of quarterly earnings surpassing or missing the market’s expectations.

Set Up for Q2 Earnings

Powell Industries is a relatively small company, with a market cap of $710 million and an EV of $548 million due to its significant net cash position. Its small size means that there are not as many investors looking at it and that there are fewer analysts covering the stock. However, the few analysts that do cover it raised their FY 2023 revenue expectations quite a bit after Q1. Right now, revenue expectations for FY 2023 are $650 million and EBIT margin expectations are 4.8%.

I believe both of these estimates are far too low and that Powell’s upcoming Q2 results will cause the market to revise its FY 2023 expectations higher. The stock should follow these revised expectations.

I am coming to this conclusion by examining the history of Powell’s backlog and how it relates to revenue. The following is a breakdown of Powell’s backlog over the past 10 years as of the dates listed:

| September 2012 |

$361m |

|

September 2013 |

$435m |

|

September 2014 |

$507m |

|

September 2015 |

$441m |

|

September 2016 |

$291m |

|

September 2017 |

$250m |

|

September 2018 |

$260m |

|

September 2019 |

$419m |

|

September 2020 |

$476m |

|

September 2021 |

$419m |

|

September 2022 |

$592m |

|

March 2023 |

$1,000m |

And the following is a breakdown of Powell’s revenue in that same time period:

|

September 2013 |

$641m |

|

September 2014 |

$647m |

|

September 2015 |

$661m |

|

September 2016 |

$565m |

|

September 2017 |

$395m |

|

September 2018 |

$448m |

|

September 2019 |

$517m |

|

September 2020 |

$518m |

|

September 2021 |

$470m |

|

September 2022 |

$532m |

From these numbers, it is evident that Powell’s revenue in a given year is consistently larger than its backlog reported in the prior year. Even on down years like 2017 when the backlog was low due to a decline in oil and gas capital expenditures, revenue in the following year was $200 million more than the backlog. In the past decade, this was not the case, only once in 2021 when revenue was actually a bit lower than the 2020 backlog due to supply chain issues that prevented the recognition of revenue.

Compared to 2023 revenue estimates of $650 million, I think actual 2023 revenue will come in closer to $700 or even $750 million due to the size of the 2022 backlog and the recent massive increase in the backlog. This is in line with how the backlog has related to revenue in the past, and it could even be conservative given the strength of the backlog and management’s positive commentary on fulfilling it.

In the Q1 2023 earnings call, in response to a question about having the capacity to support the $1 billion backlog, Powell’s CEO Brett Cope responded:

We absolutely have the capacity for this. We’ve been planning this for years in terms of the investments in the tools, processes and systems. More recently, not just as — we’ve taken the order and worked with our customers and their engineering partners to lay out the schedules to be predictive and credible into what we could deliver, supporting the brand.

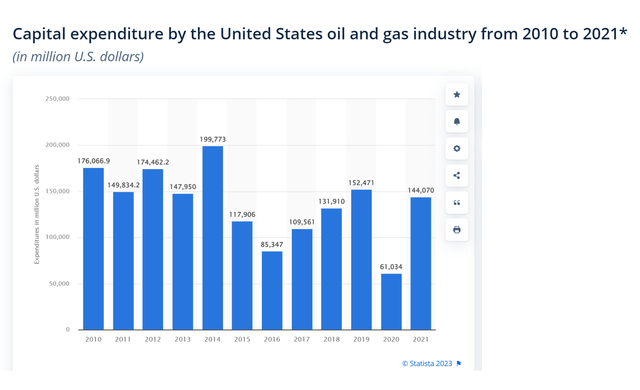

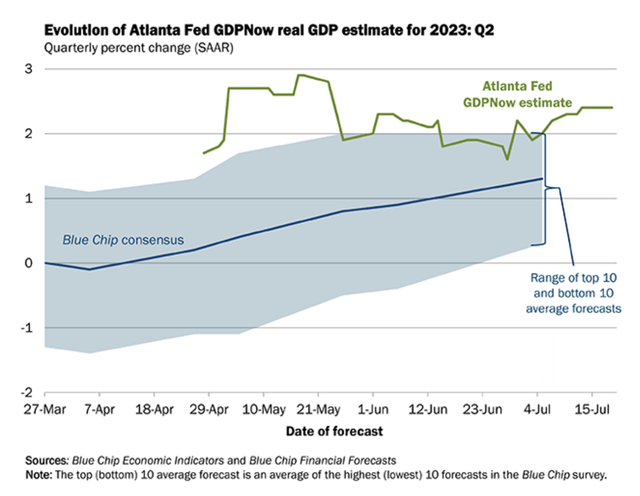

Additionally, signs are pointing to GDP growth staying strong through the end of the year, as the Atlanta Fed’s GDPNow real GDP growth estimate for 2023 has been rising since falling a bit in May and June. This is only an estimate, but should provide some confidence for investors in Powell Industries through the end of the year.

Atlanta Fed GDPNow Real GDP Estimate (Atlanta Fed)

In general, I think that 2023 will be an unprecedented year for Powell in terms of revenue and that the market will understand after Q2 results. After this happens I believe the stock will rise to 25 times 2023 EPS which, by my estimate, could be $2.90. This EPS estimate assumes a 6% operating margin, $3.6 million in interest income, a 23% tax rate, and 12 million shares outstanding. At 25 times 2023 EPS of $2.90 the stock would trade at $72.50 and would provide 21% upside from today’s price.

Risks

I believe a long position in Powell Industries’ stock before Q2 earnings is a good trade, but investors should be aware of the volatility that comes with earnings reports. My prediction could be wrong, and even if my prediction is correct, the market may react negatively to other news, for example news that relates to the backlog or to economic data that suggests upcoming economic weakness.

Powell’s small market cap will also amplify volatility, both to the upside and downside. The stock is up 50% in the past 3 months, but it could fall just as much, just as fast. It would be best for more risk averse investors to make this a small position or to not make this trade at all.

Final Thoughts

Powell Industries has momentum on its side as its stock is up 75% year to date. Along with this momentum, I believe Powell has more room to run because there is a good chance they beat the market’s FY 2023 revenue estimate of $650 million. I think revenue will be more in the range of $700-$750 million based on the relation of the backlog to revenue over the past decade, the unprecedented size of the current backlog, and management’s positive commentary in the Q1 earnings call on their capacity to meet that backlog. I believe there is up to 21% upside for the stock after Q2 earnings results as the market adjusts its expectations to account for higher expected revenue in 2023.

Read the full article here