Healthcare assets have historically outperformed during tough economic periods, and are therefore a prime choice for many long-term and risk-averse investors. By narrowing healthcare focus towards more niche groups like pharmaceuticals, I believe one is likely creating unnecessary risk and volatility without generating potential returns of the same caliber. This is a result of greater concentration risks and threats that are specific to pharmaceuticals. For these reasons, I rate the VanEck Pharmaceutical ETF (NASDAQ:PPH) a Sell.

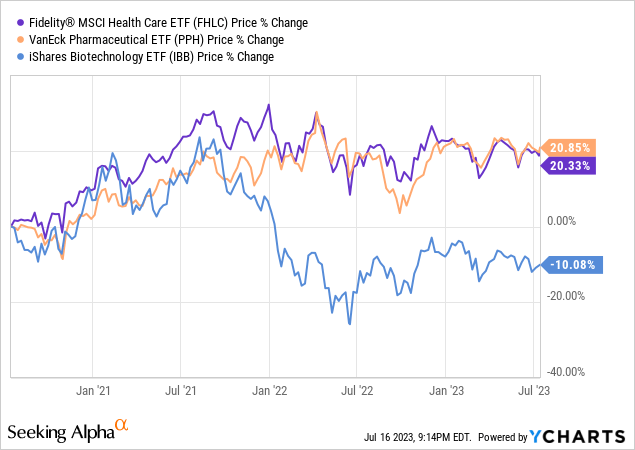

When comparing PPH and the iShares Biotechnology ETF (IBB) to the Fidelity MSCI Health Care Index ETF (FHLC), PPH and IBB seemingly generate stability problems compared to if one just took a broader approach to healthcare investing. ETFs that are more narrowly focused on niches like biotechnology or pharmaceuticals oscillate heavier and tend to deliver similar or subpar returns than more broadly-focused funds.

Strategy and Holdings Analysis

PPH tracks the MVIS US Listed Pharmaceutical 25 Index and uses a full replication technique. Securities within this index are weighted by market capitalization, which must be at least $1B. Individual holdings are capped at 10%, making PPH technically diversified according to the Securities and Exchange Commission (SEC). Furthermore, such stocks must also have a minimum daily trading volume of 50,000 shares.

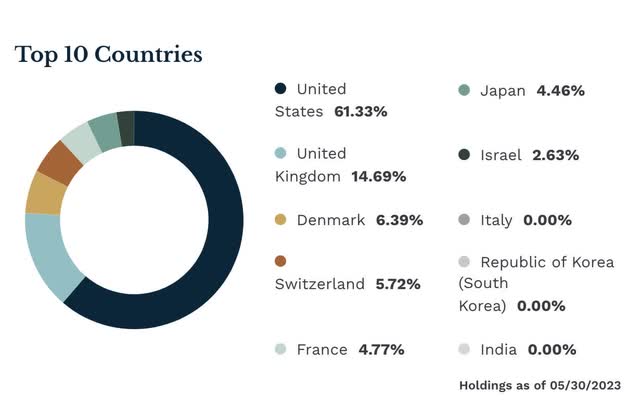

This ETF invests in healthcare stocks within a variety of locations that include but are not limited to the United States, the United Kingdom, and Denmark. This exclusive sector focus combined with geographical diversity reflects the healthcare sector’s strong international presence.

etf.com

Individual holdings within PPH are quite dispersed, with the Sanofi (SNY) representing just over 5% of this fund and the top 10 holdings falling just short of half this ETF’s total composition. This makes PPH almost equally weighted.

Seeking Alpha

Investors might want to consider how they could spare themselves from concentration risk for the price of momentum.

Seeking Alpha

Technical Analysis

PPH most recently peaked in April before incurring a downtrend from which it’s yet to break even from. As seen in the chart below, this ETF made two new lows before a more sudden decline in the second half of May.

TradingView

PPH broke back above the 50-day exponential moving average (EMA) in early July after rebounding from the same level of support that propelled it above the 50-day EMA roughly a month before.

TradingView

Despite this reinstated momentum, I believe this rebound will likely not last based on movement in the average directional index (ADX).

TradingView

Historically, the downtrends in this ETF have gained more momentum in shorter periods of time compared to the uptrends, and this last price increase was relatively weak based on how the ADX declined sharply at the base. I believe the most recent increase in the ADX signifies a future bearish movement. Therefore, PPH still has a downside for the time being and is likely still range bound between the two support and resistance points (labeled in purple) seen in the graphic below.

TradingView

Pharmaceuticals and Artificial Intelligence

Artificial Intelligence (AI) has and will likely continue to enhance operations within many industries, pharmaceuticals just being one. I believe specific processes like drug discovery and personalized medicine have relatively large margins for improvement.

Drug Discovery

AI is resolving many barriers within drug discovery, such as identifying new drug targets, designing new molecules, and analyzing vast amounts of data for clinical trials. Companies capitalizing on this trend include but are not limited to Exscientia plc (EXAI), AbCellera Biologics (ABCL), and Recursion Pharmaceuticals (RXRX).

Personalized Medicine

AI is also revolutionizing the way personal medicine is practiced. This primarily involves overcoming the barriers like the lack of data and the high cost associated with developing personalized treatments. AI’s ability to quickly analyze large amounts of data can speed up the process of matching patients with the right medicines and even make customized drugs. Companies capitalizing on this trend include but are not limited to BioXcel Therapeutics (BTAI) and Insmed Incorporated (INSM).

Threats to the pharmaceuticals industry and PPH

Capital intensity and regulatory risk

The demand for healthcare products such as pharmaceuticals is somewhat inelastic, however, their associated operations are far from cheap. Therefore, pharmaceutical companies are vulnerable to economic downturns in their own way. Furthermore, the rules and regulations surrounding new medicines and procedures are constantly changing, and are generally quite strict. Pharmaceutical companies are also often under heavy scrutiny by government regulators, patient advocacy groups, and the media in general. This may add an extra layer of volatility to PPH that investors might want to be aware of.

Ethical Dilemmas and liabilities

Similar to the healthcare sector as a whole, pharmaceutical securities bring their own risk that stems from their involvement in human life. For example, Novo Nordisk (NVO) recently made headlines after their diabetes drug Ozempic and weight-loss treatment Saxenda allegedly prompted suicidal ideations in some users. Though the stock price didn’t react adversely, this doesn’t mean a similar event can’t shake the pharmaceutical industry in the future.

Conclusion

The pharmaceutical industry is well-positioned for growth in the long term but may have extra layers of volatility compared to healthcare as a whole. Furthermore, technical analysis of PPH may indicate that this ETF continues to fight an uphill battle after its most recent dip. For these reasons, I rate PPH a Sell.

Read the full article here