ProFrac Holding (NASDAQ:ACDC) is an interesting company with a bright future. Overall I like what they’re doing and how they’re doing it. They’re making good moves in the sector and seem to be positioning themselves well. We’ll discuss all of that in the course of the article.

I think by the end you’ll see why I find this name a buy opportunity, even given the potential climate of recession and commodity price drops. Their integration into upstream and rapid expansion via M&A is positioning themselves very uniquely with multiple potential revenue streams – to the point that they’re making money off of their competition.

Company Overview

ProFrac Holding Corporation was formed by a group of veteran industry leaders and is a vertically integrated oil & gas services company within the upstream sector of the oil & gas industry.

ProFrac has a unique, full-service offering with a group of companies that are all complimentary to each other’s business operations. The company provides hydraulic fracturing, completion, and other products and services to upstream oil & gas companies.

Operations

The totality of ProFrac Holdings group of companies provides solutions to the North American oil & gas industry that include project design and manufacturing, sand and chemical supply, logistics coordination and data reporting, automation technology, emissions reduction, and additive manufacturing.

The company operates through three segments – stimulation services, manufacturing, and proppant production. The company also manufactures and sell high-horsepower pumps, valves, piping, swivels, large-bore manifold systems, seats, and fluid ends.

ProFrac Holding Corporation operates through 5 subsidiaries – ProFrac, Best Pump & Flow, Alpine Silica, iO-TEQ, and EKU Power Drives. Geographically, the ProFrac has a large presence in some of the most prolific shale plays in North America. These shales include the Permian, Eagle Ford, Haynesville, Bakken, and more.

Frac

ProFrac provides pressure pumping services to onshore oil & gas producers in the upstream sector. These services are used by exploration and production (E&P) companies in the hydraulic fracturing part of the drilling process.

The company has approximately 40 active frac fleets, with one of the largest portfolios of next-generation frac fleets. ProFrac provides pressure pumping services to some of the biggest upstream companies in the most prolific shale plays in North America.

Proppant Production

A proppant is a solid material (typically treated sand or man-made ceramic materials) designed to keep an induced hydraulic fracture open, during or following a fracturing treatment – most commonly used for unconventional reservoirs (or shale plays).

ProFrac manufactures their own proprietary proppant that is used during the fracing part of the completion process. The company owns numerous mines with a ton of nameplate capacity in the Permian, Eagle Ford, and Haynesville shale plays.

Manufacturing

ProFrac Holdings also has a significant manufacturing presence in the oil & gas industry. The company manufactures a variety of products include internal frac fleets, fluid ends, power ends, high pressure iron, engine rebuilds, and manufactures common replacement parts.

ProFrac engineers and manufactures equipment at the company’s 130,000 square foot facility located in Cisco, Texas with capabilities to produce up to 30 frac units a month. Additionally, this facility includes 15k psi test stands with cooling units for extended runs and testing with the harshest environments in mind for multi-well operations.

Investments and Technology

A sizeable amount of the portfolio of companies for ProFrac is dedicated to technology & investment in the oil & gas industry. These technologies include electrification automation and technology, control systems, pressure control equipment and services, specialty chemicals, and emissions monitoring. The company also has best-in-class assets including 8 electric fleets with 4 newbuild electric fleets under construction.

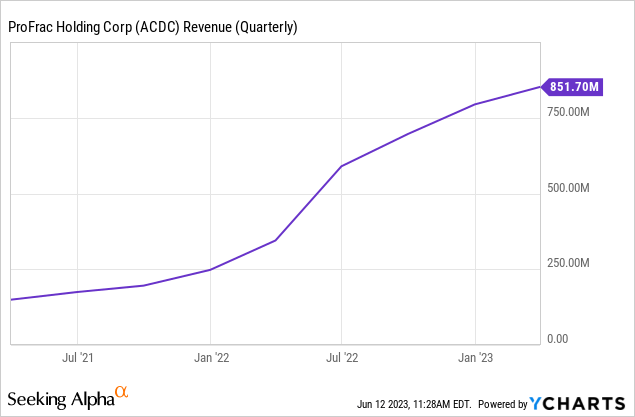

Revenue

ProFrac doesn’t have a ton of revenue history for us to go over here due to only going public a few years ago, but their growth so far is impressive. Overall they’ve significantly increased their revenue thus far through a combination of internal growth and M&A.

Let’s take a look at their revenue segments for Q1 of 2023 (numbers in $Millions):

| Q1 2023 Revenue | Stimulation Services | Proppant Production | Manufacturing |

| Intercompany | 3.5 | 32.2 | 63.7 |

| External | 786.7 | 50 | 3.4 |

| Total | 790.2 | 82.2 | 67.1 |

Taking a look at their segments a few things come to mind. Obviously frac is their cash cow, bringing home $786M in revenue in Q1. What’s also interesting is that they have an additional, and profitable, revenue stream in manufacturing proppants for other companies.

They use approximately $32M worth of proppant internally (which is a big bonus versus other frac companies), but actually sell more than that to external companies at $50M quarterly. I love this part of their business – they’re literally selling proppant to their competitors and making revenue off of them. Fantastic integration.

It doesn’t say in their segment breakdown exactly what the breakdown of manufacturing external sales are, but if I had to guess I’d say it’s high pressure iron although I might be wrong.

They definitely have some interesting opportunities here, especially with additional M&A financed by a very profitable stimulation division. Purchasing companies that can be synergistic with their proppant and manufacturing divisions, in excess of what they’ve already acquired, is something we’ll need to keep an eye out for.

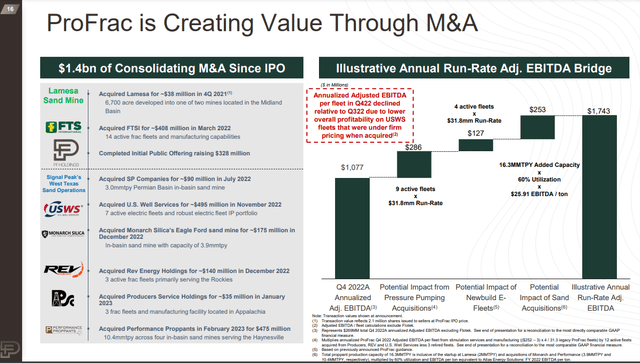

Here’s a list of their M&A since IPO (from their 1Q23 investor presentation):

ProFrac M&A (ProFrac Investor Presentation)

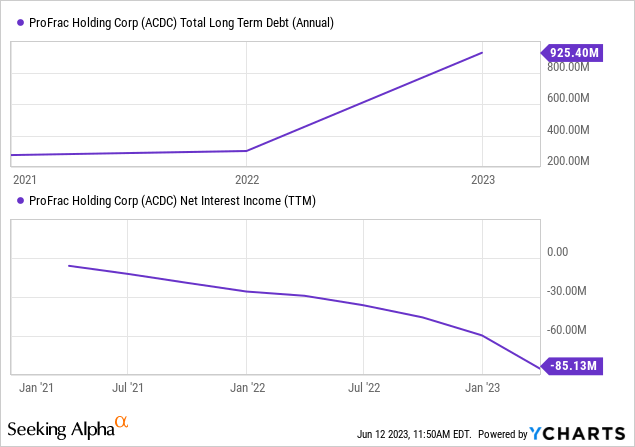

Debt

Their debt is mostly in a term loan that was recently amended for an additional $320M to purchase Performance Proppants. Overall their interest coverage ratio is about 6.5x, and they’ll have no problems servicing their debt load. They have some additional runway as well to continue to acquire additional synergistic companies. It’s worth noting that their term loan is due in 2025, so they’ll need to either pay it off or refinance. Refinancing shouldn’t be an issue at that point.

Returning Value to Shareholders

Unfortunately ACDC is one of the energy sector companies that does not pay a dividend. Most people interested in the energy sector are looking for that dividend so I feel that’s worth mentioning up front. However in their last conference call they touched on this topic (emphasis added by author):

Matt Wilks

So I think it’s a good time to jump on this. So as we look at our discretionary cash going forward, we’re going to be paying down our debt, and we’re also going to be going presenting to our board for approval, a return of capital program. And this proposal will be going to our board in the very near future in the next couple of weeks, where we outline what we’ll be doing with our discretionary cash, either a dividend or a buyback — and so we’ll get that over to them, and we’ll be updating shareholders as soon as possible.

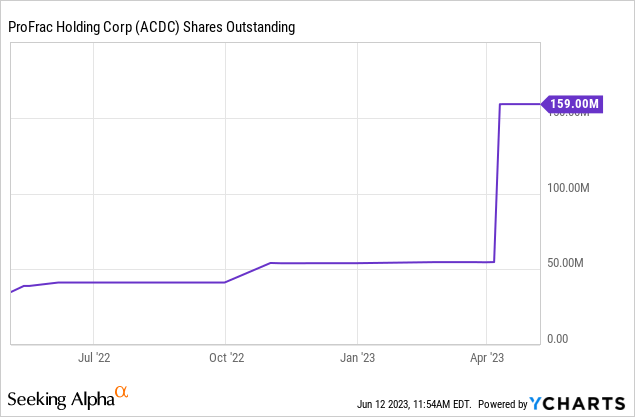

Now they significantly expanded their share float by 3x, but that ship has sailed. At this point a dividend would probably be more welcomed, especially by potential investors. A reasonable dividend would still allow them to raise capital via the equity markets at a cheaper interest rate than bank loans, and would potentially prop up share prices.

Valuation

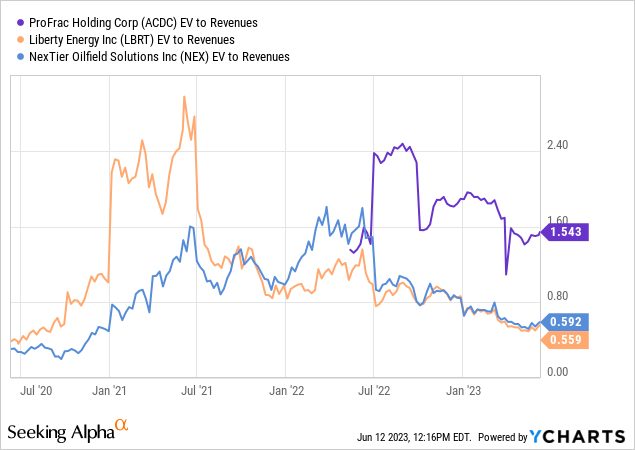

Compared to industry rivals Liberty and NexTier, ProFrac is still clearly valued quite high – even after it’s share float expansion and significant price drops. They both beat it handily in Price/Book as well.

After really considering it I have to say the ostensible overvaluation may actually be warranted. ProFrac has something unique in the way that it’s integrated into the fracing phase of well completion. All it needs is to start buying trucking companies at this point.

Latest Earnings Call

During the latest conference call, ProFrac talked about aggressively building out its platform with several key objectives in mind – delivering the safest and most consistent service quality, insulating the business from cyclicality, and maximizing free cash flow to its stakeholders.

The company also emphasized is position as a leading in-basin sand producer and one of the largest frac service providers in the country. ProFrac leadership prioritizes returns over market share and is well-positioned to deliver continued revenue growth despite industry challenges.

Investors should expect less capital spend in the coming quarters as the recent acquisitions in Q1 of this year have given the company an increase in inventory assumed from the acquisitions. The company also mentioned a constructive curve in the outlook of the gas market, with larger players maintaining steady CapEx programs as ProFrac sees a good outlook.

ProFrac remains confident in their position and expects to continue generating cash flow in the second quarter. Overall, the earnings call showed executives had an optimistic outlook for the future of the company. But isn’t that always the case?

Conclusion

ProFrac Holdings is well integrated into the upstream sector of the oil & gas industry. The company’s core business comes from manufacturing products and providing services to onshore oil & gas producers. While the company is vertically integrated within the upstream sector, the company does have significant risk exposure as the business is heavily reliant on drilling activity. If drilling activity declines, so will the demand for ProFrac Holdings portfolio of offerings. And vice versa – if drilling activity increases, so will the demand for ProFrac Holdings portfolio of offerings.

In the event of a potential recession, commodity prices will inevitably go down, posing a liability to the continued growth of ProFrac. With decreased commodity prices usually comes a decline in drilling activity – putting ProFrac’s revenues in jeopardy of falling.

However, the company has done a good job diversifying its portfolio within the upstream market. Potential negative effects from decreased drilling activity can be partially offset with the company’s green business. With multiple fully electric frac fleets, the company can greatly help producers seeking to meet environmental and carbon reduction goals as the net emissions from the electric frac fleets greatly reduce the total carbon footprint on new wells.

With those electric fleets also come potential issues however. Only time will tell how durable electric frac pumps will be in extreme climate conditions and what kind of maintenance costs they’ll incur down the line as they age. There are also questions of how well these will scale in the future. It seems to be a promising angle, but like all things new it has risk.

All in all, ProFrac Holdings is well-diversified within the upstream sector and the company has a great business model with vertical integration in the upstream sector to provide a complete offering of products and services to producers. The demand for the company’s electric frac fleets should continue to grow tremendously with more and more of the major producers committing to increasing carbon footprint reductions.

I have to take into account the potential drop of commodity pricing as I consider my recommendation on this name. I don’t personally believe we’ll see any sort of deep recession, but it could involve significant downside risk in energy tickers if the public gets even a whiff of recessionary effects.

I do believe this name is a buy. There may be potential headwinds in commodity pricing, but I believe that ProFrac can come out the other side just fine. They have a long runway for debt if they need financing, and their integration in upstream provides numerous sources of income. Overall I’m quite bullish on their future.

About this article: When I research stocks I start with a “bird’s eye view” of the target company. Many of the things I went through in this article are what I’ll look at first.

When this bird’s eye view is complete, I’ll decide if I want to avoid the company for the time being or if it’s a potential candidate for investment. This article that you are reading is the result of my bird’s eye view examination.

It is designed to be an overall high-level view of the company that you can read to determine if this company is something that you might consider as a candidate for investment. It is not possible to report everything about a company in the space of a single article, nor is it possible for me as an author to learn every detail about a company in the amount of time allotted to write an article.

You should not take my final conclusion on the company as your sole recommendation for investment, and you should conduct further in-depth research on your own to come to your final conclusions.

As a result of this, my “buy” recommendations come with an asterisk. And that asterisk is that this is only a high-level examination, and in-depth research that can take many hours, or days, of your time is still required. This is why my articles are short and to the point, with no fluff or filler. Just the facts that you need to know to move forward.

Read the full article here