With property taxes, there are countless state-specific and even local-specific bits of information to take into consideration. This article will cover some of the more relevant details, but more importantly, I want to get you thinking about property taxes in a strategic way. Let me begin by asking a question:

Would you rather invest in a 7% cap rate property in a high property tax city or a similar 7% cap rate property in a low property tax city?

Or the same question as it relates to investing in a REIT.

Would you rather invest in a 12X FFO REIT with highly taxed properties or lightly taxed properties?

The obvious answer is to go with the lower taxation.

The obvious answer is wrong.

Both cap rates and FFO are post-tax measures. Thus, the taxation delta is already in the numbers, so preferring the lower tax on already post-tax numbers would be double accounting. Instead, what one should prefer among equal NOI properties (or equal FFO REITs) is the one that is less likely to have tax increases in the future.

Current taxes are already in the numbers, but future changes to taxes are rarely factored in.

With that in mind, let us go over some background information on property taxes and then follow with the related opportunities in REIT investments.

National data

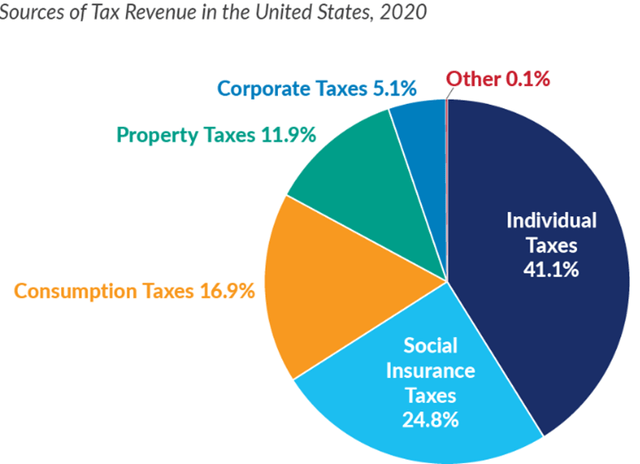

Property taxes are a large portion of tax revenue in the United States, coming in at 11.9%.

taxfoundation.org

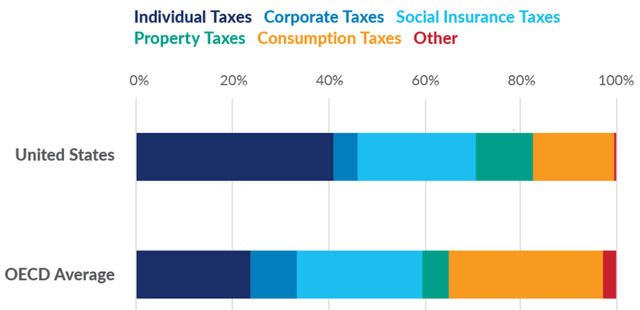

This makes U.S. properties among the most aggressively taxed in the world as property is just a slight fraction of tax revenue in the OECD composite.

taxfoundation.org

Most other developed nations derive a significantly higher portion of their tax dollars from sales tax or other consumption taxes while the U.S. typically has light sales tax opting instead for property taxes.

My purpose here is not to say whether this is good or bad, but to get a sense of where it could go from here. Since the U.S. already has among the highest property taxes, I think it is unlikely to rise significantly in the future as there would be significant pushback.

State and local level property taxes

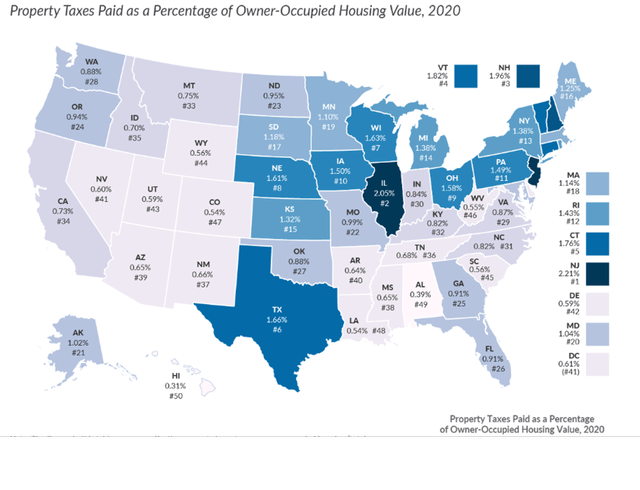

Within the U.S. there is quite a spectrum of rates. Hawaii comes in the lowest at 0.31% with New Jersey the highest at 2.21%.

taxfoundation.org

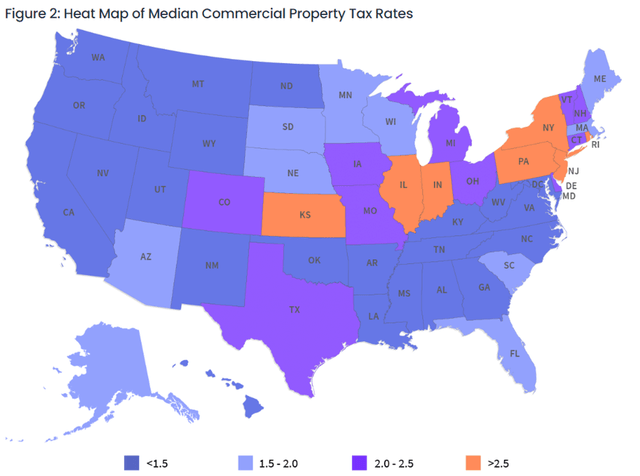

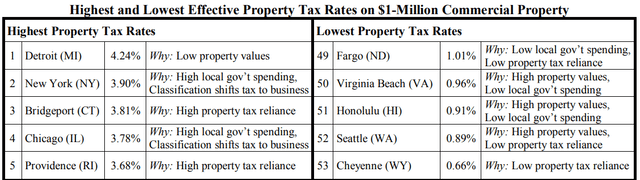

The above chart is for personal residential real estate. Commercial real estate pays a different and usually higher property tax rate, although the pattern is remarkably similar in terms of which states have higher rates.

CoreLogic

Factors that seem to affect the rate:

- Level of local government spending

- Inverse correlation with property values

- Other sources of revenue

Wyoming generates income from oil and gas, and a portion of this goes back to the local government. This alternate source of revenue allows the state to have lower property taxes, which is likely why WY comes in the lowest for commercial property tax at 0.66%.

Lincolninst.edu

Assessed level has as much impact as rate

The above rates are applied according to a property’s assessed value. Unlike market values which change in real-time, the taxable assessed value is usually only determined once a year and the assessed value is often quite different than the real value.

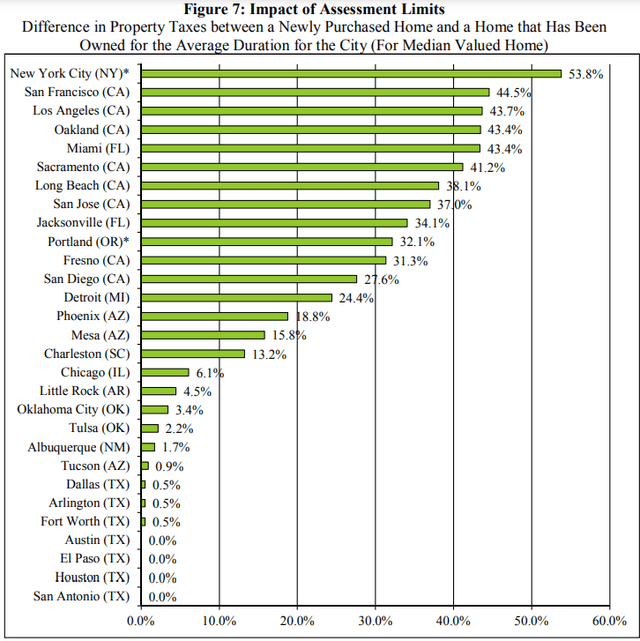

Many states have a cap on how much assessed value can go up each year. If, for example, property values went up by 15% in a year, these states might only be able to raise the assessed value by 2%. Over time, real estate appreciation has greatly exceeded the caps, so the gap between real value and assessed value has grown.

Lincolninst.edu

In most cases, the assessed value will reset to close to real value when the property is transacted while properties held by the same owner for a long time will have significantly lower assessed values.

As seen in the chart above, it tends to be the coastal cities that have caps on assessment increases while the southern cities tend to allow assessments to float with market value. Indeed, we have heard quite a bit of griping by multifamily REITs such as NexPoint Residential (NXRT) or Camden Property (CPT) about real estate tax increases.

Differences by property type

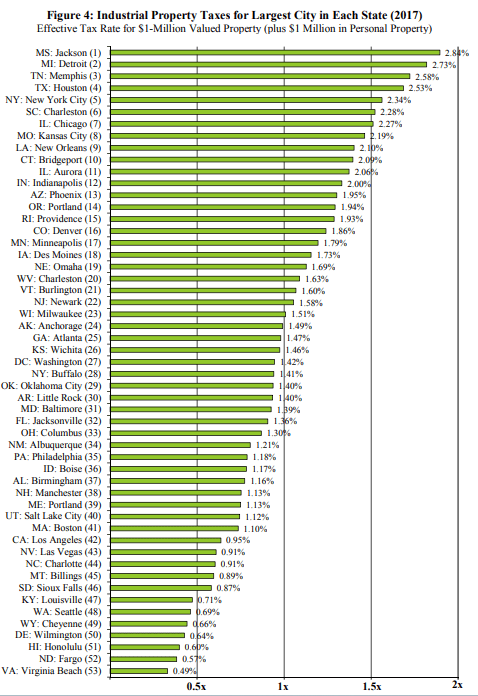

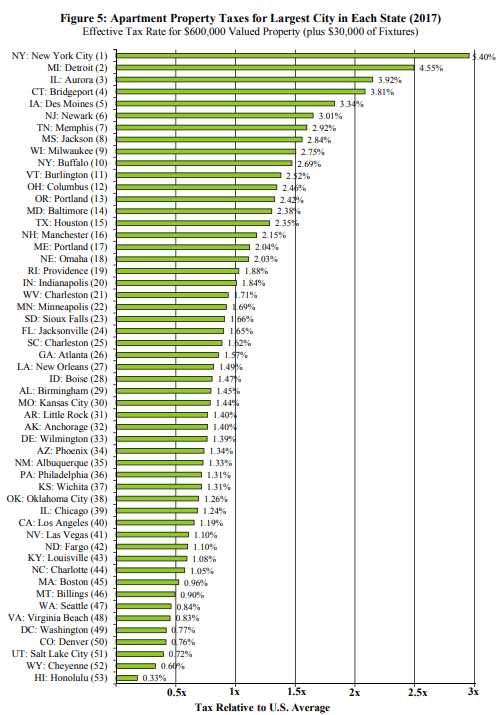

As discussed above, commercial property generally has higher real estate taxes than private residential property, but there are also differences between the sectors.

Industrial seems to have reasonably low property tax rates, averaging just over 1%.

Lincolninst.edu

In contrast, multifamily apartments average closer to 2% with NYC as high as 5%.

Lincolninst.edu

Property taxes are a significant consideration in buying real estate properties or REITs, but the application of this knowledge is not as straight-forward as it might seem.

Property tax-advantaged investing

As discussed at the beginning, the absolute level of taxation in some ways does not matter because it is already reflected in NOI, cap rates, and FFO. Thus, a strategy of simply buying in areas that go light on taxation would be flawed.

It is the change in taxation that affects growth. We want to avoid significant tax increases and instead invest in areas that are likely to have stable or lower taxes going forward.

This is going to be a very local thing. In my city of Madison, for example, commercial assessments increased by 12.9% in 2022 as compared to 2021. One can find this data post-hoc, but in order to invest strategically, you have to be able to anticipate it in advance.

Best and worst property tax markets (in my opinion)

Tax advantages are going to be related to the real estate cycle.

Earlier in the cycle when prices were rising rapidly (20% to 80% depending on property type and location) it was arguably better to be invested in areas where assessments were capped. Thus, while your property appreciated in value significantly, tax increases were capped at maybe 2%. That is a great deal.

Over the long run, I anticipate real estate values to continue to rise, but in the short to medium term I think there might be a bit of a pullback. Most real estate investors seem to think somewhere in the ballpark of a 10% decrease in property value, and that seems about right to me. The obvious driver here is higher interest rates, which will cause cap rate expansion. Interest rates may have already peaked out, but cap rates usually lag by a couple of quarters as sellers are reluctant to lower their prices.

The cap rate expansion will be partially offset by increased NOI, but in the short term, the cap rate impact is larger, which results in property values probably declining a bit.

Given this information, I think it is more advantageous to invest in areas where property tax assessments are marked to market.

Texas, for example, might be a tax-advantaged area because its assessments presently reflect what might be the near-term peak in real estate values. So if real estate values do in fact decline a bit, there might even be some reduction in property tax bills.

In contrast, areas like NYC and San Francisco, where tax assessments are substantially below market values, will still see 2% or so upticks in assessments even if property values drop.

Thus, the paradigm has shifted. Coastal cities have been property tax advantaged over the past five years, but for the next few years, the mark-to-market assessment areas are likely better.

It’s a bigger number than it may seem

At first, property taxes being 1%-2% of a property’s value might seem like it is not a huge impact on profitability, but recall that cap rates for most real estate types are still in the 6%-7% range. Thus, property taxes are as much as 25% of net of tax NOI.

So, if a property has its taxes increased by 10% that is a huge bite out of NOI compared to other properties that might only have had taxes go up by 2%. This explains why coastal REITs have had higher same-store NOI for much of this cycle, despite having similar increases in rental rates.

The bottom line

REITs that have had their growth stifled by property taxes in the past five years are now the ones with an advantage.

Read the full article here