Proximus PLC (OTCPK:BGAOF) is Belgian’s telco company. Like many others in Europe, it is undergoing massive capex to modernise its copper networks and bring fibre to the people. This capex is a massive overhang, and they are beholden to it not only for business reasons but also because of the state owning large shares in the company. The dividend is not really sustainable on business performance, which we think is the reason for the increasingly perennial discount on the stock relative to other developed market telco players. Finally, the failure to IPO Telesign has been a disaster for the stock, and that potential catalyst remains locked behind still shut IPO markets. There are many potential headwinds for Proximus and it would be safe to stay away.

Considerations

Let’s start with capex. It is growing meaningfully YoY, although a lot more of it is now in things unrelated to fibre. Still, while the fibre investment has gone down since last year, it hasn’t decreased by much at all, and with only 23% progress in the fibre rollout there is still a lot more burden to be taken by the company to make the rollout complete.

In our last article on the company we thought that there might be another 3 billion EUR in capex left in store for the company. With every additional 10% or so costing 300 million EUR. We think that there is still about 2.6 billion EUR or so to go. This capex does nothing for their performance, it is merely a duty to improve the infrastructure to match European standards. The majority shareholders of the Belgian State might be happy about that, but it isn’t great for shareholders. Of course, we note that regardless of ownership European companies are all doing this sort of rollout.

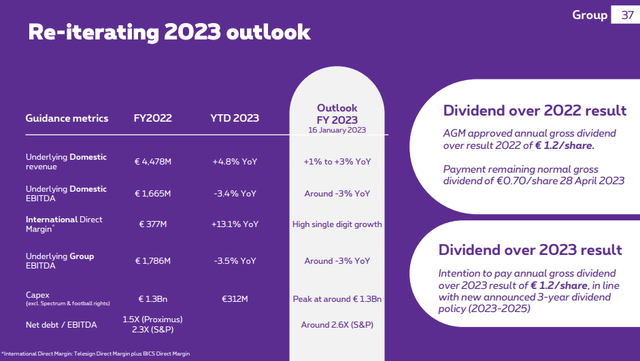

Proximus Outlook (Q1 2023 Pres)

The telco markets aren’t bad. There is pricing action across Europe, and mobile plans are a resilient market, as well as broadband plans. It is resilient, and outlook looks favourable. The company is even reiterating the dividend, even though it is unsustainable with FCF well into negative territory just on the fibre rollout capex.

In our last article we pointed out that even when adding on the capex burden, the Proximus EV looked low relative to peers. When considering that they were planning to IPO their Telesign business at a nice valuation, the EV/EBITDA multiple ended up looking even better. The Telesign IPO failed. They couldn’t find a primary market for the business in 2022 because interest in growth stocks had completely been destroyed, together with the SPAC boom and other major growth oriented markets. Together with the continued capex burden and dividend questions, the price cratered. Still, even without considering Telesign there was a discount.

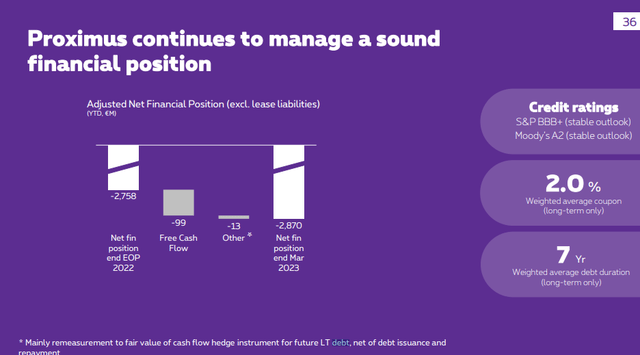

This comes down to the dividend which we think is unsustainable. EBITDA is around 400 million EUR per quarter. Capex is beyond 300 million. D&A shouldn’t be ignored, they are real costs on a network that is intended to be grown and kept up to date and will eventually come home to roost. Then there are taxes. Interest is thankfully pretty limited with 7 year maturity profile on fixed coupon 2% debt. Great financial management, but when it comes down to it the earnings are insufficient to keep the dividend going. Net debt grows quarterly by about 5%.

Debt (Q1 2023 Pres)

Bottom Line

The catalysts are Telesign to lend some value to the company as well as an end to the capex burden which will make the dividend sustainable again. The capex burden won’t end, which means the dividend remains a question mark. While the company remains consistent with it, we have no faith that they will keep it going when it’s growing the company’s leverage. They have debt capacity, but it’s not a good thing to see, and it would probably be best for them to cut it though many shareholders would have a tantrum.

The other thing is Telesign. We cover the IB and advisory space widely. We have seen that there is an uptick in IPO activity and related capital markets advisory, but it is not broad-based. Some ECM and DCM divisions remain dead, while other companies have managed to win some mandates. It is looking better than the trough H2 of 2022, but it is still not good and there are further recessionary pressures on the horizon to hurt those markets. We do not expect Telesign to be a catalyst, and surely not at a $1.3 billion valuation.

Really there are just too many headwinds and things that could go wrong for Proximus and nothing imminent to help them up, except for their very depressed price. We think they could be cousins to a rally in ECM and DCM activity were they to pursue the Telesign IPO again, but whether they make the effort again anytime soon is very unclear, and we would not expect that to be a catalyst.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here