Investment Thesis

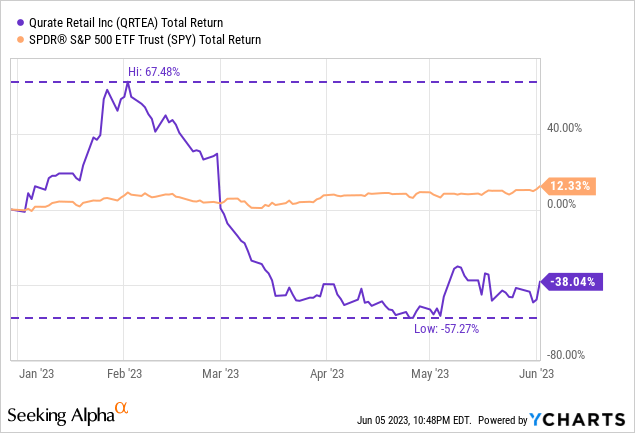

Qurate Retail (NASDAQ:QRTEA) has had a volatile few months, when it rose as much as 67% at one point during the year, despite currently being down -38% YTD.

Recently, in an unexpected turn of events, management also announced that it had sold Zulily to an investment company, which we believe can be seen as a positive for investors. Therefore, we discuss recent developments at Qurate Retail, the sale of Zulily, and why we are taking a more cautious stance on the stock.

The Sale Of Zulily

On May 24, the management of Qurate unexpectedly announced that it had sold Zulily, their retail brand aimed at mothers, to an investment company called Regent. However, it did not disclose many details, but as things stand, we do see this sale of Zulily as positive.

One of the details disclosed is that Zulily will no longer be a co-borrower in QVC’s bank facility and has repaid the outstanding loan of about $80 million. They also announced that there is a possible earn-out in the future for Qurate, but details are not yet known. This may be a blow to investors, as Qurate initially paid $2.4BN for Zulily in 2015. And while we think that by not disclosing the sale price, Qurate is probably indicating that it would not make a material difference, it can still be seen as a positive as Zulily has recently been a drag on QxH’s performance. Not only that, it also improved the company’s leverage slightly from 2.5x as of Q1 2023 to 2.3x, including the sale of Zulily.

QVC, Inc.’s leverage as defined in its credit agreement as of March 31, 2023, assuming the Zulily divestiture had occurred prior to such date, would have been reduced to 2.3x. Based on the terms of the sale agreement, there is potential for Qurate Retail to receive an earnout in future years. (Qurate Press Release)

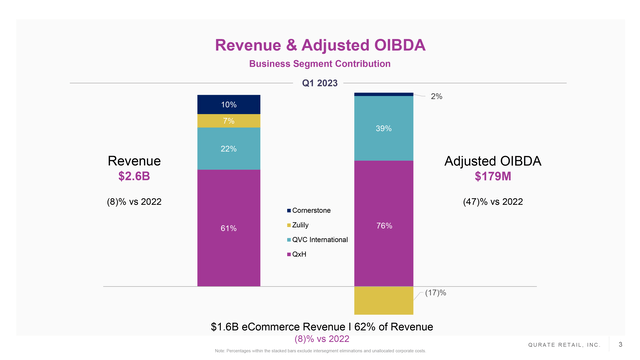

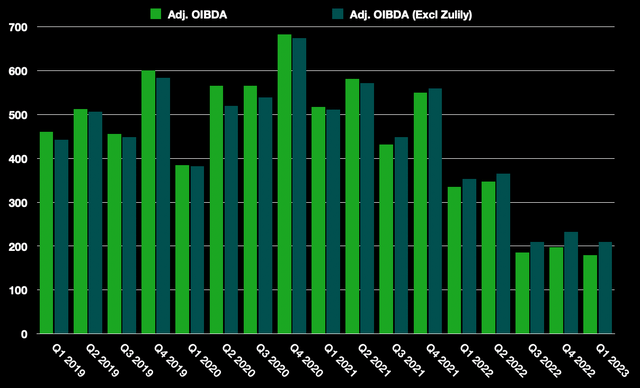

Qurate has also seemingly stopped disclosing in-depth numbers for Zulily as of Q3 2022 and has consolidated it into one of their other segments, making it a little harder for us to estimate what the impact will be in the coming quarters. What we do know from the last two quarters is how much Zulily has lost as a percentage of OIBDA (Operating Income Before D&A).

Qurate IR

That is essentially what we have done. Excluding the negative impact of Zulily, we can estimate that Qurate’s OIBDA has arguably been slightly higher than reported over the past few quarters. According to our estimate, if we exclude Zulily, Qurate would have generated an average of over $217 million in OIBDA per quarter over the past three quarters.

Author’s Visuals

To measure Qurate’s true profitability, we may also need to include $14M in revised yield provisions and $21M in costs associated with Project Athens. Adding these costs together, we believe Qurate’s average OIBDA is actually closer to $244M, which we further take into account in our valuation.

In particular, in the first quarter, our adjusted OIBDA was pressured by $21 million of costs associated with Project Athens’ transformation that were included in SG&A. These costs are non-recurring in nature or non-operating in nature, sorry, and we expect to incur additional expense associated with the transformation through 2023, after which these costs should dissipate. (Q1 Earnings Call)

Fundamental Developments

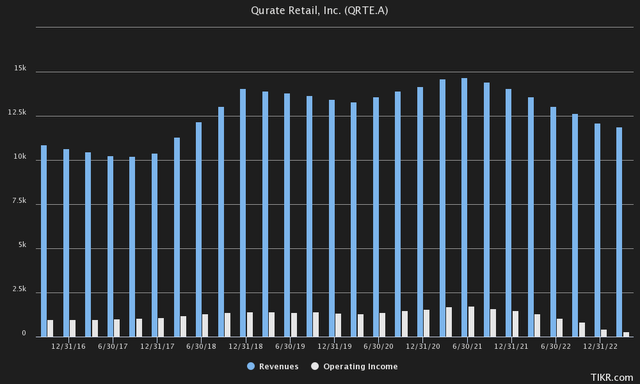

Much has changed at Qurate Retail since our last valuation. Some for the better, some for the worse. From a bird’s-eye view, on a trailing 12-month basis, sales have continued to decline and are currently stabilizing around $11.87BN. But a final decline is likely expected now that Qurate is disposing of Zulily, which had $1BN in sales as of Q3 2022.

TIKR Terminal

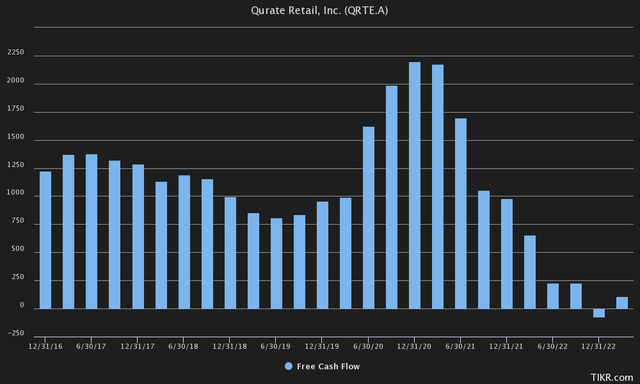

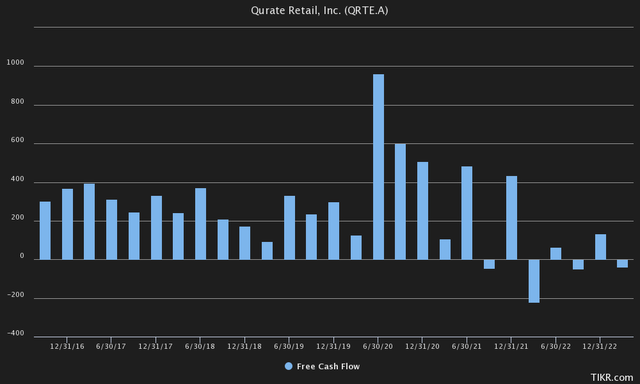

Operating income also declined further to $301M, excluding approximately $433M in interest expense over the same period. From a free cash flow perspective, the same can be said with Cash From Operations mainly down and free cash flow (CFO-CapEx) currently only $110M on a trailing-12 months basis.

TIKR Terminal

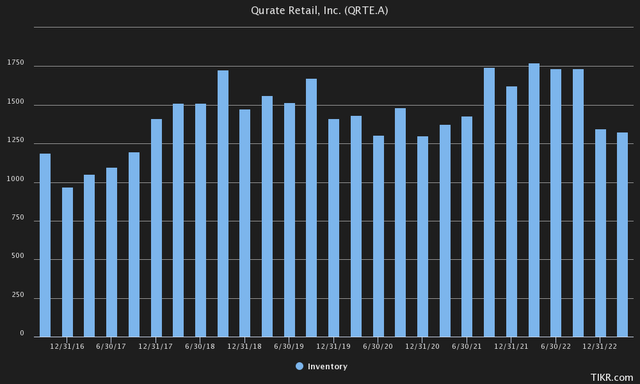

On the other hand, looking at the balance sheet, a key development is the massive reduction in inventories, which we expect to positively impact margins. Management indicated last year that they were pre-emptively reducing inventories, despite short-term headwinds, to optimize Qurate’s long-term potential.

TIKR Terminal

This was mostly cited as a headwind in the past because too much inventory led to poor product mix and lower margins. It also had a negative impact on their net working capital, at a time when liquidity was already under pressure.

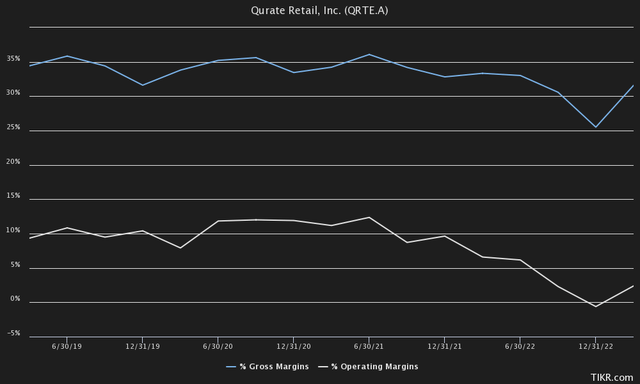

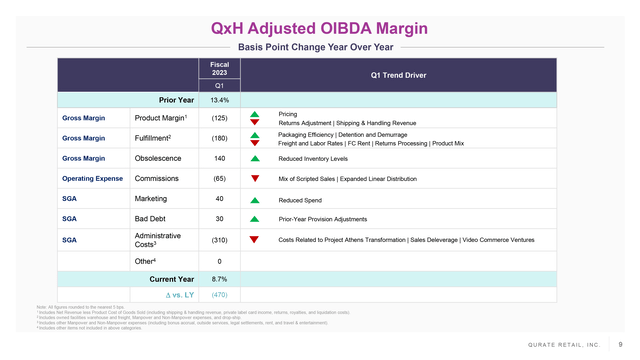

Overall, we are already starting to see a recovery in both gross margins and operating margins, although they are still far from returning to their base levels of 34-35% gross margins and 10% operating margin.

TIKR Terminal

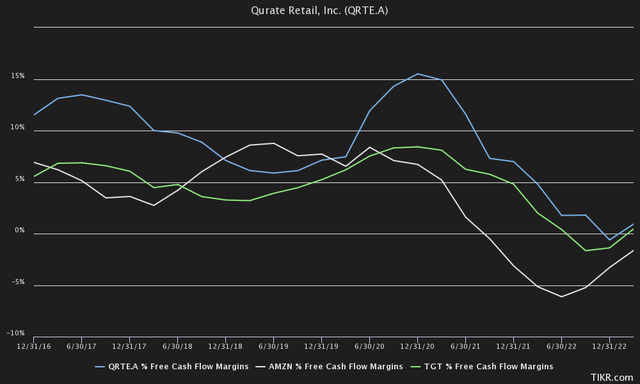

It is also worth noting that Qurate was not the only retailer to struggle in 2021 and 2022, as supply chain disruptions and rampant inflation caused Free Cash Flow margins of most retailers to plummet. If we compare Qurate’s FCF margins with those of Amazon and Target, we see a similar trend in terms of recovery across all companies. Perhaps, macro-economically, things are finally starting to stabilize for retailers.

TIKR Terminal

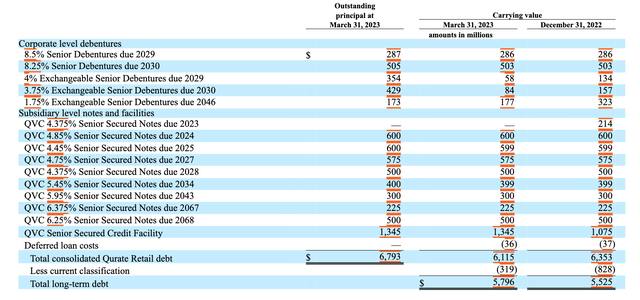

However, the biggest question with the company remains whether it will be able to manage its staggering debt of $6.79BN accordingly, in an environment where interest rates are rising. Looking at the short term, we have to agree with Fitch, which also believes that Qurate should be able to meet its obligations over the next two years, amounting to $600M in 2024 and 2025, or $1.2BN in total.

They should be able to meet these repayments with a combination of outstanding cash of $1.3 billion, their remaining revolver capacity, and additionally some free cash flow.

SEC, Qurate Retail

However, things become less clear after 2025, with their revolving credit line expiring in the second half of 2026. Especially in an interest rate environment, while Qurate is receiving rating downgrades from multiple credit agencies.

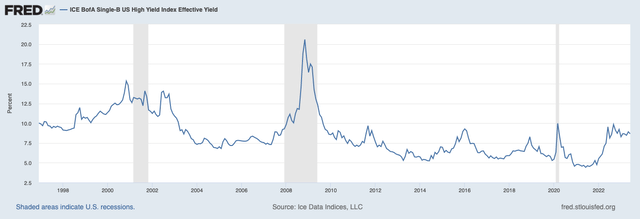

Currently, for example, Qurate’s long-term issuer default rating has been downgraded to B from BB- by Fitch. Looking at the Federal Reserve’s website, the effective yield for Single-B rated securities is currently 8.66%. This is quite far from the average blended yield we calculated for Qurate, which is approx. 5.5%, taking into account all of Qurate’s long-term maturities. In other words, we expect Qurate is currently paying about $374M in interest on its $6.79BN of debt. However, if all the company’s debt were financed at 8.66%, interest payments would be $588M.

That means that if Qurate were able to refinance these maturities after 2026 at a higher interest rate, the interest payments are expected to be quite a bit higher than the $374M they currently have to pay.

Federal Reserve (FRED)

Returning to the $244M in expected OIBDA that Qurate currently generates on a quarterly basis, rising interest costs could have serious implications for valuation.

If we take this OIBDA and accept it on an annual basis, we arrive at $976M if results remain relatively constant for the foreseeable future. If we subtract from this depreciation and amortization, which we expect to be $110M per quarter, we are left with $536M in EBIT. However, that’s where the tricky part comes in: the interest paid on their debt. As mentioned earlier, at current rates, we expect Qurate to pay about $374M in interest on their debt with a 5.5% interest rate. That would leave Qurate with $162M in pre-tax income (EBT). With financing at 8.66% however, with $588 million in interest expense, the EBT drops to -52 million. And that does not reflect the risks in terms of further margin and revenue headwinds, if any.

So it is really a question of whether interest rates don’t get too high, whether Qurate has the ability to keep its customers/revenues stable, and whether it is able to perhaps deliver Project Athens and increase margins again. In other words, Qurate seems like a highly speculative play, with the outcome likely to be either a big recovery or bankruptcy.

TradingView, Wright’s Research

From a technical perspective, we see that Qurate has strong support around the $0.70 level, and we would probably set our stop loss at that support level if we had a position. Personally, from a technical perspective, we would be more confident if Qurate broke through the $1.50 level first, after which we would find a recovery scenario more likely.

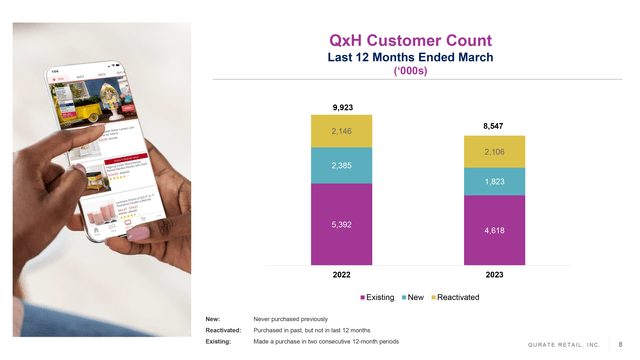

In general, the stock could remain a very nice speculative play, especially if investors believe that interest rates are likely to move back toward 0%, or in the event that investors believe in management’s ability to execute Project Athens to bring both OIBDA and FCF margins back to previous levels. Personally, we did not expect the number of customers to decline as rapidly as it has generally in recent quarters, which is why we remain cautious on the stock. We also expected some of Project Athens’ results to be visible by Q1 2023, but we still see quite an impact on gross margins due to freight and labor rates, product mix, and SG&A costs affecting profitability below the line.

In fact, our biggest concern is that Project Athens may not be able to meet its targets, that margins remain under pressure and that operating income/FCF remains neutral as a result of these cost reductions.

Qurate IR

Our estimate of $162 million in generated EBT for Qurate would still mean that customer numbers remain stable, revenues stabilize, and interest costs do not increase significantly, which already seems like a daunting task in the current environment where consumer confidence is hampered. It also remains to be seen from a free cash flow perspective whether Project Athens will have a meaningful impact and restore the steady flow of FCF.

TIKR Terminal

Thus, Qurate’s preferred stock (QRTEP) also prices in the likelihood that these headwinds may hit Qurate soon, as it currently trades at $32.99 and pays a whopping 24.25% dividend. As things stand, we think the current valuation of $360M is a fair price for any future headwinds, whether in terms of interest rates, retail headwinds, or management actions.

However, if further improvements are visible in the next few quarters or if there are signs that Project Athens is bearing fruit, we would be happy to change our mind.

Qurate Retail IR

Popular hedge fund manager Michael Burry also recently closed out his position in Qurate retail as it no longer appears in the 13F of his Scion Asset Management hedge fund.

The Bottom Line

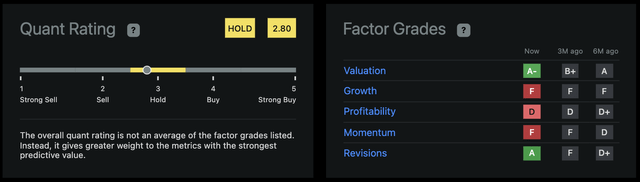

We currently agree with Seeking Alpha’s Quant Rating and would rate Qurate Retail as “hold,” as we believe the current valuation reflects the headwinds that could exist in the future, both in terms of financing at higher interest rates and continued headwinds in terms of margin pressure.

We are also more cautious about a possible outcome where Project Athens does not significantly improve the long-term viability of the company. If an insider were to show conviction in Qurate’s turnaround plan, and we saw an insider buy or meaningful improvements in operating results in the coming quarters, we would be happy to reconsider our current rating.

Seeking Alpha

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here