Investment thesis

RBC Bearings (NYSE:RBC) is in one of the best moments in its history despite the current complex macroeconomic landscape. Net sales have doubled since the fiscal year prior to the coronavirus pandemic crisis boosted by a major acquisition that took place in November 2021, and the company enjoys very high profit margins thanks to the high added value of its products.

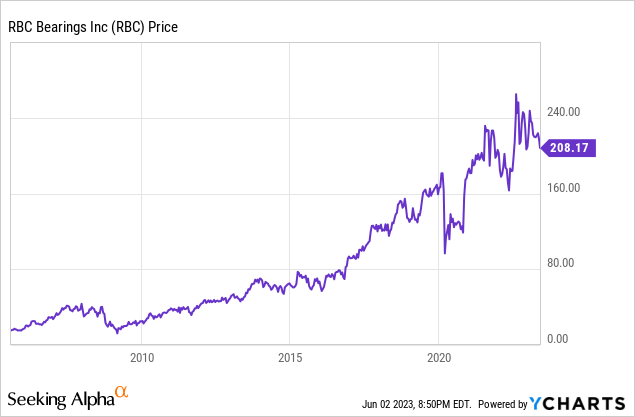

Still, growing concerns about a potential recession as a result of recent interest rate hikes at a time when the company is deleveraging its balance sheet are causing some worries among investors, and the share price declined by ~21% from all-time highs as a consequence. But despite weakening macroeconomic conditions, the company has already reduced long-term debt by $400 million since 2021 and cash from operations is high enough to keep deleveraging the balance sheet as the company significantly improved the profit margins of the recently acquired business. Furthermore, inventories are very high, which should allow for even higher cash from operations in the coming quarters. For these reasons, I strongly believe that RBC Bearings has a bright future ahead and that the recent fall in the share price presents a good opportunity for long-term investors.

A brief overview of the company

RBC Bearings is a global manufacturer of highly engineered precision bearings, components, and essential systems for the industrial, defense, and aerospace industries with 52 facilities, of which 37 are manufacturing facilities, distributed among 10 countries, including Canada, Mexico, France, Switzerland, Germany, Poland, India, Australia and China. The company was founded in 1919 and its market cap currently stands at $5.75 billion, employing over 5,000 workers worldwide.

RBC Bearings logo (Rbcbearings.com)

The company’s operations are divided into two main categories: Industrial Market and Aerospace/Defense. Under the Industrial Market category, which provided 71% of the company’s net sales in fiscal 2023, the company manufactures bearings, gearing, and engineered components for a wide range of industrial markets, including construction and mining, oil and natural resource extraction, heavy truck, aggregates, rail and train, food and beverage, packaging and canning, material handling semiconductor machinery, wind, and the general industrial markets. And under the Aerospace/Defense category, which provided 29% of the company’s net sales in fiscal 2023, the company manufactures bearings and engineered components for commercial, private, and military aircraft and aircraft engines, guided weaponry, space and satellites and vision and optical systems, and military marine and ground applications.

Currently, shares are trading at $208.17, which represents a 21.43% decline from all-time highs of $264.94 in August 2022. This recent decline has been caused by growing concerns about a potential recession after a major acquisition in 2021 that caused a strong rise in long-term debt, but the balance sheet appears to be strong enough thanks to huge inventories, and furthermore, the company has recently improved its profit margins by finding synergies in the recently acquired business while net sales are skyrocketing.

Recent acquisitions and divestitures

In April 2015, the company completed the acquisition of the Sargent Aerospace & Defense business of Dover Corporation (DOV), a leader in precision-engineered products, solutions, and repairs for aircraft airframes and engines, rotorcraft, submarines, and land vehicles, for $500 million.

After deleveraging the balance sheet, in November 2018, the company sold the Avborne Accessory Group, which provides maintenance, repair, and overhaul services for a wide variety of aircraft accessories, for $21.5 million. Later, in August 2019, the company acquired Swiss Tool Systems AG, a leading worldwide supplier of modular tooling systems and high-precision boring and turning solutions for metal cutting machines, for ~$33.9 million.

Still, the most significant acquisition took place in November 2021 when the company completed the acquisition of the DODGE mechanical power transmission division of Asea Brown Boveri (OTCPK:ABBNY), a leading manufacturer of mounted bearings and mechanical products, for ~$2.9 billion. As a result of the acquisition, net sales have skyrocketed, but the company now entered a new deleveraging phase.

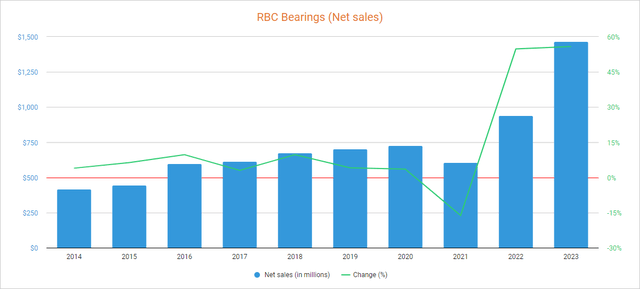

Net sales are skyrocketing boosted by the DODGE acquisition

The company has managed to significantly increase its sales over the years, and despite a temporary drop in fiscal 2021 as a result of the disruptions caused by the coronavirus pandemic in calendar 2020, sales have recently skyrocketed thanks to the acquisition of DODGE. In this regard, net sales of $1.47 billion in fiscal 2023 represent a 102% increase compared to net sales of fiscal 2020, the fiscal year before the coronavirus pandemic crisis. Using fiscal 2023 as a reference, 88% of net sales are generated within the United States, whereas the rest is produced in international markets.

RBC Bearings net sales (Seeking Alpha)

As for the fourth quarter of fiscal 2023, net sales increased by 9.92% year over year, and by 12.18% quarter over quarter, which means the positive trend continues in force. Furthermore, net sales are expected to increase by 8.16% in fiscal 2024, and by a further 5.66% in fiscal 2025, which should help to slightly dilute the debt pile and make it easier to pay it off and finally digest the DODGE acquisition.

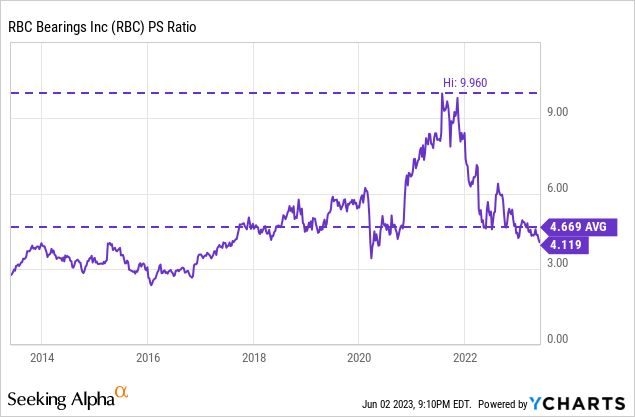

But the recent decline in the share price along with skyrocketing net sales boosted by the acquisition of DODGE caused a sharp decline in the P/S ratio to 4.119, which means the company currently generates net sales of $0.24 for each dollar held in shares by investors, annually.

This ratio is 11.78% below the average of the past decade and represents a 58.64% decline from the recent high of 9.960 reached in 2021. This ratio has declined more significantly than the share price as sales have skyrocketed, and this shows how investors are placing less value on the company’s sales not only because of the risk of a potential recession but also because of its current high level of debt. Still, and although a P/S ratio of 4.119 may seem too high at first glance, the company’s margins are very high and reflect the differentiation of its products in the markets in which it operates.

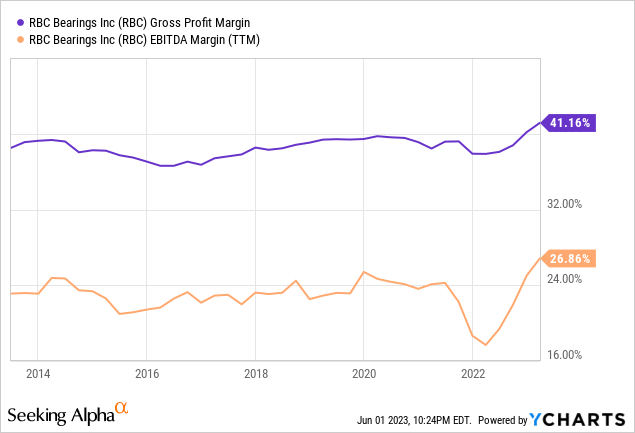

Margins are very high and the company is highly profitable

The company has historically enjoyed very high profit and EBITDA margins thanks to the differentiation of its products. In this regard, the trailing twelve months’ gross profit margin currently stands at 41.16%, and the EBITDA margin is at 26.86%.

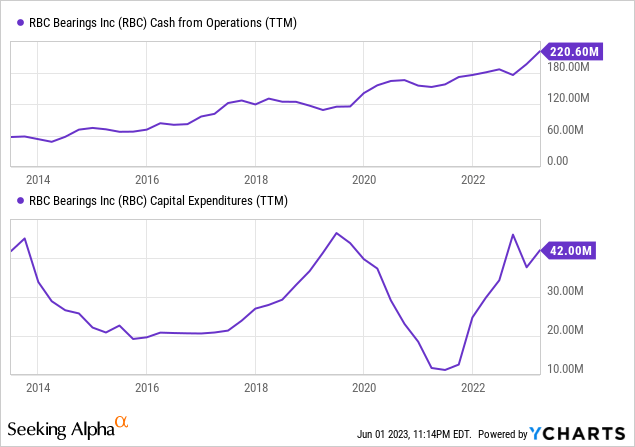

As for the past quarter, the gross profit margin stood at 42.20% and the EBITDA margin at 26.47%, which means that profit margins remain high despite the current macroeconomic context marked by strong inflation rates, in part thanks to increasing volumes. Furthermore, the company has added 7 percentage points to the gross margin contribution of DODGE thanks to synergies. This has enabled high cash from operations year after year to $221 million as cash from operating activities was $71.4 million vs. $46.9 million during the same quarter of fiscal 2022.

This cash from operations is more than enough to cover the annual capital expenditures of ~$40 million and interest expenses of ~$80 million, which suggests that the company should be able to successfully deleverage the balance sheet as the quarters go by.

The deleveraging phase is in process

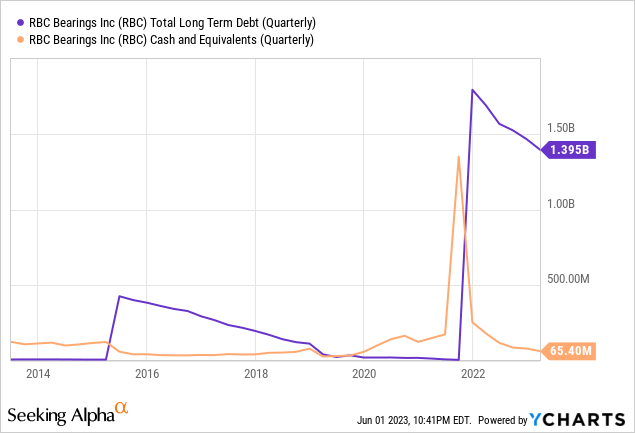

The company’s long-term debt reached $1.80 billion in fiscal 2022 due to the acquisition of DODGE but has successfully decreased to $1.40 billion since then as the company paid down $400 million of long-term debt, but cash and equivalents is currently very low at $65 million.

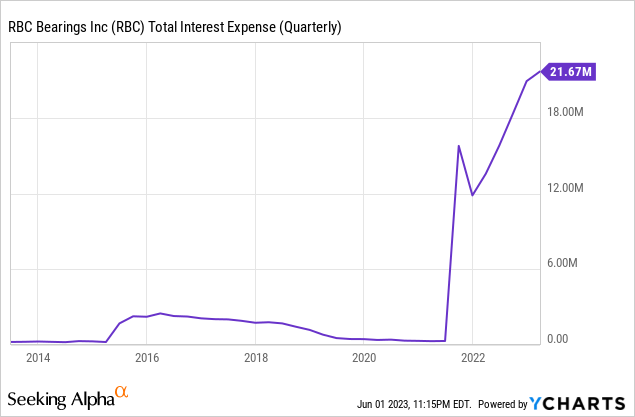

This surge in long-term debt has caused a significant increase in interest expenses, which reached $21.67 million during the fourth quarter of fiscal 2023, and the management expects annual interest expenses in the range of $80 million and $84 million.

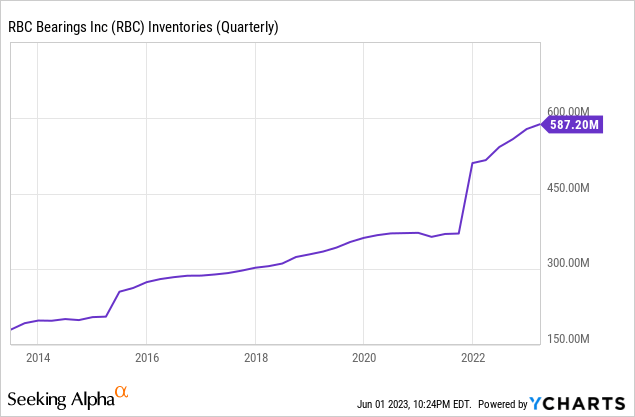

But despite low cash and equivalents, the company currently holds enough inventories to keep deleveraging the balance sheet. In this regard, the company’s inventories are very high at $587.20 million, which suggests that cash from operations could improve further in the foreseeable future, which should allow for a relatively fast deleveraging process.

Interest expenses will decrease as the company reduces its debt level, freeing up more cash that can be reinvested in the company or used to pay down debt more quickly. In addition, opportunities to continue growing through more acquisitions will open up as debt becomes more manageable.

Risks worth mentioning

Overall, I consider RBC Bearings’ risk profile to be very low due to very high profit margins and inventories, growth expectations, and very manageable debt, but still, and given the volatility to which companies are currently exposed due to the current complex macroeconomic context, I would like to highlight the risks that I believe investors they should keep in mind.

- First, it is true that the company is fully prepared to face a recession without a significant impact on its balance sheet since profit margins are very high and inventories should allow for high cash from operations in the coming quarters. But despite this, a recession could lower investor expectations and drive share prices below current levels.

- If a recession finally materializes and demand for the company’s products declines, the company could see its volumes decline, which could negatively affect not only sales, but also profit margins due to unabsorbed labor. In addition, the company could encounter problems to successfully emptying part of its inventories to continue deleveraging the balance sheet.

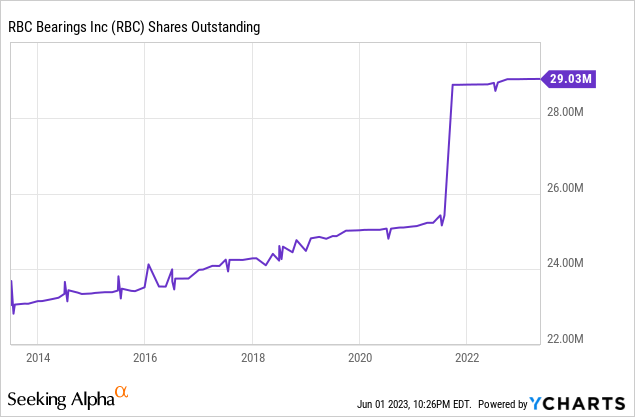

- Another risk that I would like to emphasize is that of share dilution. The total number of outstanding shares has increased by 25.91% in the past 10 years, which means that each share now represents a smaller slice of the company. Much of the share dilution took place during the DODGE acquisition, and since there is no tradition of buybacks in the management, I wouldn’t expect any share buyback to undo that impact until at least the balance sheet is debt-free again, for which there are still many years left.

In this regard, I highly recommend keeping an eye on the number of outstanding shares as shares could continue to dilute in the future.

Conclusion

Personally, I think that the future of RBC Bearings is bright and I believe that it represents a good company for long-term investors in times as complicated and volatile as the current ones since it is a company that can be conservatively held for many years. The company is highly profitable as profit margins are very high due to the added value of its products, and the management should be able to keep reducing the debt incurred to carry out the DODGE acquisition thanks to high cash from operations and inventories, which should eventually drive the share price to new levels. For these reasons, I strongly believe the recent share price decline represents a good opportunity for the long term as the P/S ratio currently stands at 11.78% below the average of the past 10 years.

Read the full article here