Introduction

Regeneron Pharmaceuticals (NASDAQ:REGN) is a pioneering biotechnology company engaged in the invention, development, manufacturing, and commercialization of medicines for serious illnesses. Their portfolio includes products and product candidates for the treatment of eye diseases, allergic and inflammatory diseases, cancer, cardiovascular and metabolic diseases, pain, hematologic conditions, infectious diseases, and rare diseases. Regeneron’s strategy lies in maintaining a solid base in scientific research and discovery-enabling technologies, upon which they build their clinical development, manufacturing, and commercial capabilities. They aim to be an integrated, multi-product biotechnology company providing patients and medical professionals with vital medicines for disease prevention and treatment. Their products include Eylea, Dupixent, Libtayo, and more, addressing various diseases globally.

Recent developments: Regeneron faced a setback as the FDA declined to approve an 8mg dose of its eye disease therapy, Eylea (aflibercept). This decision led to an approximately 8% drop in Regeneron’s shares. The FDA cited an ongoing review at a third-party filler as the reason for the rejection. As a result, Canaccord Genuity downgraded Regeneron Pharmaceuticals’ rating from Buy to Hold. The downgrade was attributed to the anticipation of a possible delay in Eylea’s approval until 2024 and increased competition in the eye disease drug market.

Q1 2023 Earnings

Let’s first review the Regeneron’s most recent financial report. In Q1 2023, total revenues increased by 7% to $3.162 billion compared to Q1 2022, despite a 6% decrease in Eylea’s U.S. sales. Significant growth was seen in Libtayo and Evkeeza sales. The company’s collaboration revenues also increased, especially with Sanofi due to higher Dupixent sales. However, operating expenses rose, with a 30% increase in GAAP research and development (R&D) and a 34% increase in GAAP selling, general, and administrative (SG&A) costs. The GAAP effective tax rate reduced to 4.7% from 8.3% in Q1 2022, and GAAP net income per diluted share decreased to $7.17 from $8.61 in Q1 2022. A $694 million worth of common stock was repurchased in Q1 2023, and an additional share repurchase program of up to $3 billion was authorized.

REGN Stock Assessment

Per Seeking Alpha data, REGN appears to present a mixed investment picture. While earnings per share [EPS] estimates indicate moderate growth in the next few years (from $41.14 in 2023 to $44.64 in 2025), it has experienced several downward revisions (56% Down, 44% Up), impacting its earnings revisions score (C-).

Although its valuation seems slightly high with a forward P/E of 17.52 and an EV/EBITDA of 12.78, the company’s profitability is robust. With a gross profit margin of 55.84%, a net income margin of 33.81%, and a return on equity of 19.27%, it has earned an A+ rating for profitability.

However, the company’s growth score [F] is a point of concern, with YoY revenue dropping by 25.07% and levered free cash flow dropping by 70.75%.

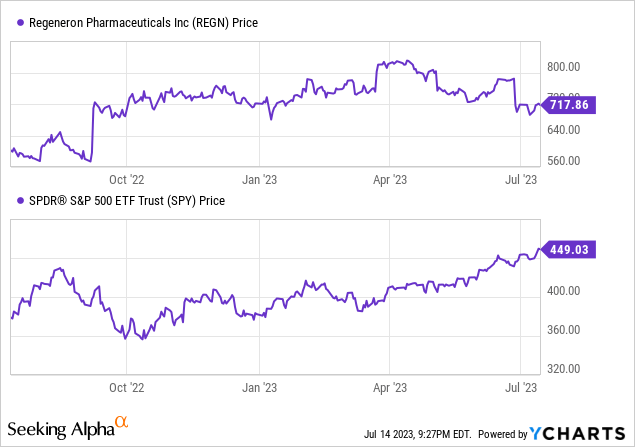

Its momentum score (B-) shows a -13.17% return over the past three months but a +19.76% return over the past year, suggesting some medium-term volatility.

With a market cap of $77.22B, Regeneron remains a significant player in its sector, and its financial health is further bolstered by $8.96B in cash reserves.

Regeneron’s Eylea 8 mg FDA Setback: Implications and Temporary Delay

Regeneron, facing an FDA setback for the 8 mg dose of Eylea (aflibercept), its key eye disease treatment, saw its shares fall by around 8%. Eylea, currently approved at a 2 mg dosage, treats conditions such as wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR).

The 8 mg dosage was proposed to allow less frequent administration, providing patient convenience without sacrificing treatment effectiveness. Despite promising trials showing the higher dose’s non-inferiority to the 2 mg version, approval was delayed due to an ongoing review of a third-party filler, not because of safety, efficacy, or manufacturing concerns.

Eylea’s importance to Regeneron is underlined by the fact it made up approximately 45% ($1.434 billion) of the company’s total Q1 2023 revenues of $3.162 billion. Hence, delays in approval can significantly impact the company’s financials.

Despite being a setback, it’s significant to note that the delay isn’t tied to clinical efficacy, safety, or drug substance manufacturing issues, but to an ongoing review at a third-party filler. This suggests that while the delay is a temporary hurdle, it is likely to be resolved given that the FDA hasn’t asked for additional clinical trials or data.

My Analysis & Recommendation

Regeneron’s recent stumble with the FDA’s deferral of the higher dose Eylea approval, while initially disconcerting, should be viewed in a broader perspective. The FDA’s concerns were solely related to a third-party filler, not the drug’s clinical efficacy or safety. This signals that once these issues are addressed, the company should be able to move forward.

In the meantime, Regeneron continues to have a robust product portfolio and shows resilience with its diversified revenue stream. Even with the 6% decline in Eylea sales, total revenues increased by 7% in Q1 2023 due to the growth of other drugs like Libtayo and Evkeeza.

Furthermore, its financial position is solid with substantial cash reserves and a high profitability rate, even though its valuation might seem high and the growth score is concerning. It’s crucial to note that it remains a significant player in the sector with a market cap of $77.22B.

The future of Regeneron hinges on its ability to successfully navigate the current Eylea challenge while continuing to develop and market its other products. The delay of Eylea’s 8mg dosage approval is indeed a setback, but it’s likely to be a temporary one.

Investors should also look beyond Eylea, considering the company’s ongoing drug development activities, and its existing products and pipeline’s potential.

Considering these factors and the anticipation of the Eylea delay being resolved, my suggestion regarding Regeneron’s stock would be to maintain a ‘Hold’ position. The optimal strategy at this point is to observe how effectively the company handles the third-party filler concern and its performance in the upcoming quarters. Before considering an upgrade in rating, it would be preferable for Regeneron to address the Eylea CRL and reduce its dependence on Eylea for revenue, while simultaneously continuing to grow Eylea’s revenue.

Read the full article here