Summary

I recommend a sell rating on Rocket Companies (NYSE:RKT) as I expect near-term results to be poor due to the weak macro environment.

This is a reiteration of my sell rating for RKT stock previously which I believed the company’s size and scope, as well as a greater reliance on refinancing activity, present additional difficulties if mortgage rates stay elevated for an extended period.

What does the company do?

RKT is a collection of personal lending and mortgage finance businesses RKT has, over time, built a unified, end-to-end tech platform that is simplifying originations and shaking up a multi-trillion dollar mortgage industry. RKT’s rise to the top of a large, fragmented, profitable, and established market is the central argument for its bullish case

Industry overview and growth

RKT competes in two key industries: Personal lending and Mortgage financing, both are very big industries that have huge dollar TAM for RKT to capture share.

Starting with the Personal Lending market, according to Mordor Intelligence research, the US digital lending market size is expected to grow from ~$410 billion in 2023 to ~$720 billion by 2028, at ~12% CAGR over the next 5 years. As for Mortgage financing, the US mortgage market size is an extremely large one with ~11.92 trillion residential mortgage as of 4Q22.

RKT competes with both traditional banking players and digital players for growth. For instance: LendingTree, CAN Capital, Kiva Microfunds, and the major big banks.

My expectation for the industry is negative in the near-term due to the high interest rates that will taper demand. The next wave of positive demand momentum would come when the macro economy inflation rate taper, resulting in the Fed cutting rates.

My thoughts on the business

I believe there is support for a potential further recovery in margin, as RKT’s GoS [gain-on-sale] margins increased by 22bps sequentially in 1Q23 and management provided a positive outlook on the mortgage industry. However, in my opinion, this will be determined by the volume performance, which in turn will be determined by the state of the macro economy. Keep in mind that home sales in RKT have returned to levels not seen since 2008, and this is before we even reach the worst of the macro situation.

However, RKT’s other non-mortgage businesses, which I expect to continue growing by capturing share from incumbent, will mitigate the cyclicality of RKT’s revenue, so there is some silver lining. Management has seen positive engagement across all platforms, and RKT continues to execute on customer engagement. The launch of the credit card is an example of successful execution despite the economic downturn, and it is likely to contribute to growth in the near future. In addition to lowering customer acquisition costs, this tactic has recently shown promising results, with the Rocket Rewards test group achieving a conversion rate more than twice that of the control group.

My thoughts on the financials

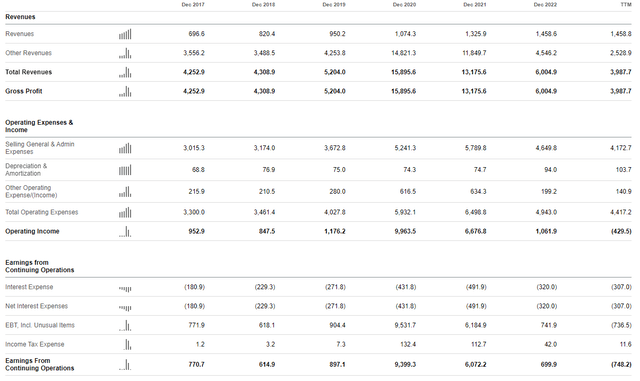

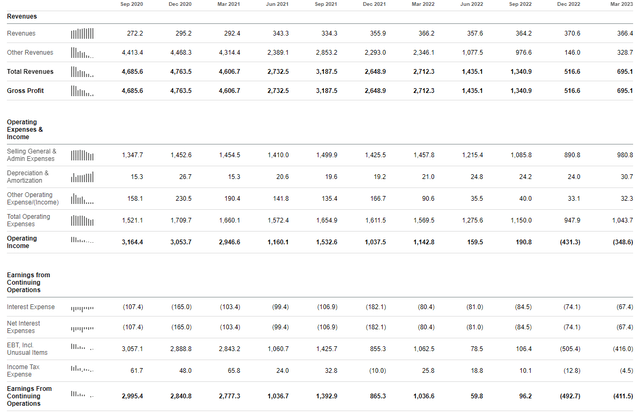

Seeking Alpha

Seeking Alpha

RKT has been a high growth company given its digital platform that is disrupting the industry. However, growth has been weak recently due to the rise in interest rates, which has an inverted relationship with the business (Note: high interest rates hurt loan origination volume). As such, I expect revenue growth to be weak in the near term, probably for the rest of FY23 and likely 1H24, unless the macro economy turns for the better.

Consequently, I believe profits at all levels to decline due to the potential steep decline in revenue. While the business does not have as much fixed cost as a typical hard-asset business, given the sharp decline in revenue, I expect margins to decline significantly as well in the near-term. However, I believe the market is not focusing so much on the profits yet because it is a high growth business.

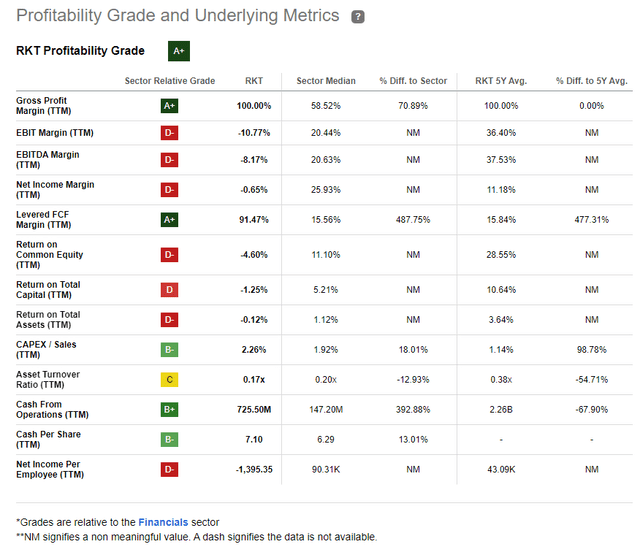

Seeking Alpha

If we compare RKT profitability against the industry, it performs very poorly, which I think its justifiable as the business was reinvesting to grow. However, if RKT is not able to regain its high-growth “status”, the market might shift their focus to profits, and at that point, RKT stock might face pressure as investors look to invest in peers that have much better profit profile. Hence, this is a potential risk to take note.

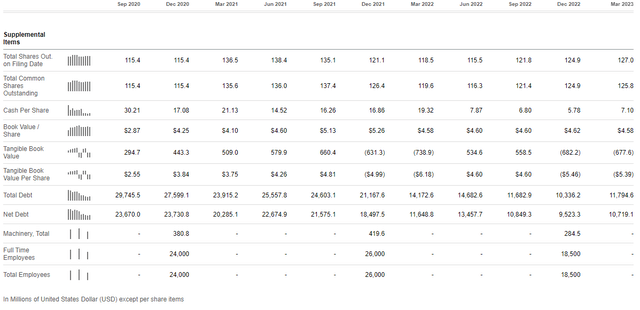

Seeking Alpha

RKT has around $900 million of cash and a net debt of $10.7 billion. As I mentioned, I expect steep decline in revenue and profits in the near-term, as such, this high debt level is not something that I am comfortable with. In particular, we do not know how long this entire macro turmoil is going to end. However, as RKT has around $900 million of cash, it should be able to sustain for the near-term without raising capital.

Valuation

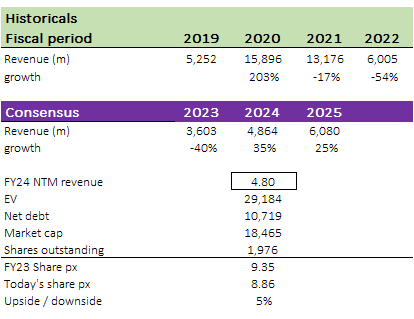

As RKT is not a profitable company today, I used its expected revenue to calculate its fair value. I expect FY23 to be a very bad year, with a decline of 40% in revenue (slightly better than FY22), followed by recovery in FY24 and FY25, 35% and 25% respectively. I expect the stock to continue trading at the current levels (3.7x forward revenue) as I expect it to recover back to FY22 levels by FY25. Even with my positive assumption of a recovery in FY24 (which might not be true), the stock is simply fair valued in my opinion. But given the current macro environment which is full of uncertainties with rates possibly going higher, I reiterate my sell rating.

Own model Seeking Alpha Seeking Alpha Seeking Alpha

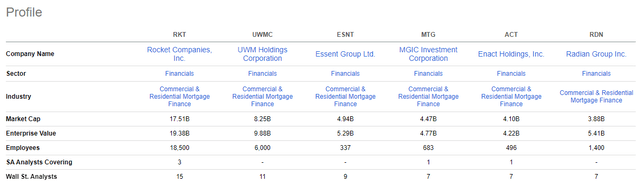

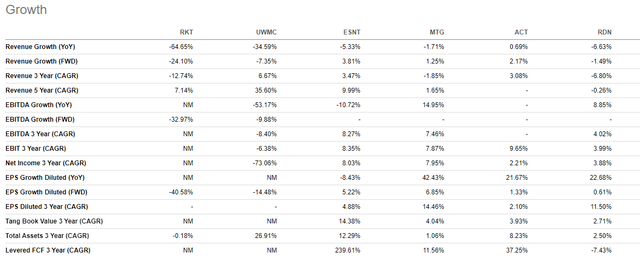

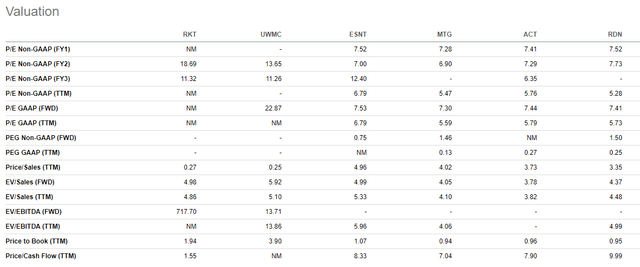

Comparing RKT against peers, I expect valuation to remain pressured in the near-term as its revenue growth has been the worse so far and is expected to drop much more in the next 12 months. Hence, I think there is a risk that valuation might fall further from here (note that RKT ev/fwd sales is not exactly cheap vs comps even though its growth profile is not great).

Risk

Borrowing costs for a mortgage could further rise in response to an increase in interest rates, which is a major factor that could reduce originations and squeeze GoS margins. Operating leverage from the platform increases the possibility of margin compression and losses for RKT in the event of a significant drop in revenues, which could happen in the current macro environment.

Conclusion

RKT operates in the personal lending and mortgage financing industries, which offer significant growth potential. However, the near-term outlook is dampened by high interest rates impacting demand. RKT’s margin recovery and revenue growth will depend on the state of the macro economy. Valuation remains under pressure due to poor revenue growth and potential further decline. Overall, while RKT’s unified tech platform presents opportunities, the current macro environment and financial performance warrant caution.

Read the full article here