Saia, Inc. (NASDAQ:SAIA) recently delivered a quarterly decline in the volume transported, and management remained quite cautious about 2023. With that, I believe that recent investments in property and equipment offer SAIA large competitive advantages over competitors, and new planned expansion could bring further FCF generation. Even considering potential risks from inflation, supply chain constraints, or labor unavailability, my DCF model implied a valuation that is higher than the current stock price.

SAIA Invested Significantly In Property And Equipment, And Expects To Continue Further Investments

Established in Georgia and with operations that extend throughout the United States, SAIA offers transportation and distribution of cargo through its own network of heavy trucks.

The company’s operations are currently active in 46 states, and its services extend to both Mexico and Canada through distribution line agreements with third parties.

The cargo industry has three types of actors, private fleets and the other two fleets are for contracted transportation groups. The first of these actors consists of carriers who own their own fleet and transport their goods. The other two are those in which companies are contracted for distribution, and their variation is not given by the type of cargo and its weight, but by the type of service that varies in full trucks and LTL trucks. Although the largest portion of the market belongs to full trucks, the LTL segment, wherein SAIA operates, allows certain facilities in relation to time and compliance for private customers that the other segment does not offer. I believe that this is a competitive advantage for SAIA.

SAIA has its only segment of operations, dedicated entirely to LTL cargo, which deserves greater amounts of capital for the assembly of distribution networks and terminals. In addition, the investment in technology is much higher in this case, as the daily customer base is broader, and the logistics in this sense is more complex. This ultimately makes the LTL transportation segment the most concentrated within the transportation market, with fewer competitors. I believe that the outlook given by management was quite savvy, but I miss out having a few more figures about what may happen in 2023. Management noted that future earnings may depend on a series of factors that include inflation, labor availability, diesel fuel prices, and supply chain constraints. The following words are worth having a look at by shareholders.

Our outlook for 2023 is dependent on a number of external factors, including strength of the economy, inflation, labor availability, diesel fuel prices and supply chain constraints. The potential impact of these factors on our operations, financial performance and financial condition, as well as the impact on our ability to successfully execute our business strategies and initiatives, remains uncertain and difficult to predict. Source: 10-Q

With that about the predictability of 2023, I believe that SAIA appears well equipped to deliver beneficial results. Management expects to continue its expansion, which may bring margin improvements and cost benefits.

If we build market share, including through our geographic and terminal expansion, we expect there to be numerous operating leverage cost benefits. Conversely, should the economy continue to soften, we plan to match resources and capacity to shifting volume levels to lessen unfavorable operating leverage. Source: 10-Q

Balance Sheet: Total Assets Increased, And Long-Term Debt Decreased By 26%

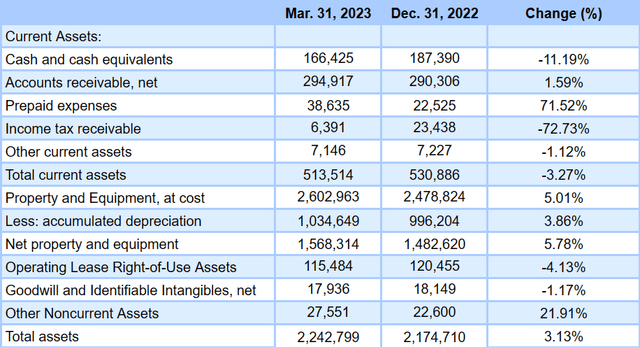

I believe that the total amount of assets and liabilities show adequate financial stability. The company recently reported a bit less cash in hand, -11% q/q. I assumed that the company used some cash to reduce its total amount of debt, and increased its prepaid expenses. At the same time, it is beneficial that the total amount of property and equipment increased.

As of March 31, 2023, the company reported cash and cash equivalents worth $166 million, accounts receivable of about $294 million, and prepaid expenses of $38 million. Total current assets are equal to $513 million, close to 2x total liabilities. Hence, I am not really worried about any future liquidity issue.

Non-current assets include property and equipment worth $2.602 billion, operating lease right-of-use assets of about $115 million, goodwill and identifiable intangibles of $17 million, and total assets worth $2.242 billion. The asset/liability ratio appears quite healthy.

Source: Quarterly Report

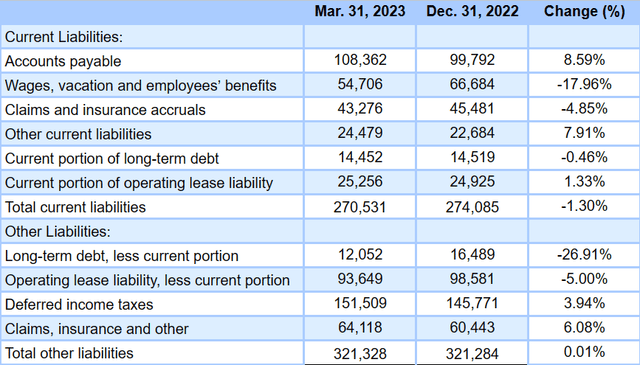

The total amount of liabilities did not increase much. SAIA reported 8.59% q/q increase in accounts payable as well as increases in other current liabilities and insurance claims. I found it beneficial that wages and other benefits payable decreased by close to 17%, and the long-term debt decreased by about 26%. I believe that lower financial debt may be appreciated by stock market participants.

More in particular, SAIA reported accounts payable worth $108 million, wages, vacation, and employees’ benefits worth $54 million, and claims and insurance accruals close to $43 million. Also, with a current portion of long-term debt of about $14 million, long-term debt stood at $12 million with operating lease liabilities of $93 million.

Source: Quarterly Report

My Assumptions Imply A Valuation Of $485 Per Share

A few years ago, SAIA initiated a strategy to offer direct service to new regions in the United States, where the company was not present. With new investments in property and equipment in the Northeast primarily for revenue equipment, real estate, and technology, future net sales will likely trend north in the coming years. I believe that further increases in capacity will likely accelerate the FCF growth.

In my view, further reduction in the age of SAIA’s fleet, improved fuel economy, and perhaps reduced carbon emissions will likely make the company a bit more appealing for clients and investors. As a result, I would expect further net sales improvement as well as an increase in the stock demand.

Under my DCF model, I also assumed that enhancement of safety and successful execution of SAIA’s plans for additional volume growth will be catalysts for further business growth. In this regard, I assumed that the decline in LTL shipments per workday and LTL tonnage per workday that we saw in April will be mostly temporary.

In April 2023, final LTL shipments per workday declined 5.7%, LTL tonnage per workday declined 1.1% and LTL weight per shipment increased 4.9% to 1,460 pounds compared to 1,392 pounds in April 2022. In May 2023, LTL shipments per workday declined 4.2%, LTL tonnage per workday declined 2.0% and LTL weight per shipment increased 2.3% to 1,453 pounds compared to 1,421 pounds in May 2022. Source: Quarterly Report

I am not worried about the previous decline in volume. I believe that further increase in the number of regions, where SAIA is present, and addition of freight terminals will most likely lead to volume increases. In this regard, I believe that investors may want to read some of the comments reported by management.

We actively monitor opportunities to add freight terminals where there is sufficient market potential. Source: 10-k

I also believe that management will successfully maintain a healthy compromise between prices, income, and operations. As a result, I would expect FCF margin improvements in the coming years, which may have a beneficial impact on the stock valuation.

This element of our business strategy involves managing both the price we charge for our services and the mix of freight we transport to operate our network more profitably. Source: 10-k

Also, management would likely focus on excellent services and optimization at the operational level in all areas, and will continue growth in active regions through the improvement of facilities. I assumed that further continuation with the trend of approaching the needs of its employees and strengthening existing ties with customers and the community could be quite beneficial.

Finally, I would expect successful human resources practices and successful retention of employees. I think that management is making a lot of efforts to keep its talented employees. I would just expect that the efforts would not diminish. I also believe that further hiring of women would most likely be appreciated by market participants.

To foster retention, employees with ten or more years of service do not pay premiums for participation in the medical program. In addition to standard medical coverage, we offer eligible employees dental and vision coverage. Source: 10-k

Our 12,300 union-free employees are comprised of about 50% licensed commercial drivers, about 24% dock workers (approximately one-quarter of whom are part-time) and the remaining 26% work in sales, technology and administration to support our business. Of SAIA’s workforce, approximately 88% are male. Source: 10-k

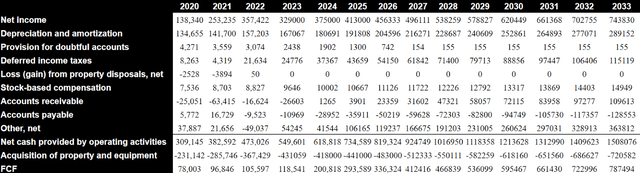

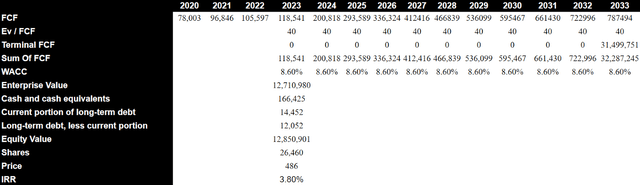

Under the previous beneficial assumptions, my financial model includes 2033 net income close to $743 million, 2033 depreciation and amortization of about $289 million, and 2033 stock-based compensation close to $14 million. Also, with changes in accounts receivable of close to $109 million and changes in accounts payable worth -$129 million, the net cash provided by operating activities would stand at $1.508 million. Finally, assuming acquisition of property and equipment close to -$721 million, 2033 FCF would be about $787 million.

Source: My DCF Model

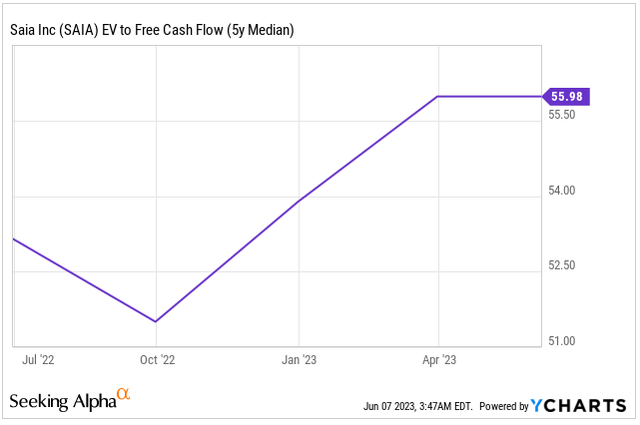

If we assume an EV/FCF close to 40.55x, 2033 terminal FCF would be close to $31.455 billion. With a conservative WACC of 8.655%, the enterprise value would be about $12.7155 billion. The EV/FCF 5 years median currently stands at close to 55.5x FCF, so I believe that my terminal EV/FCF multiple appears conservative.

Source: Ycharts

If we add cash and cash equivalents worth $166 million, and subtract the current portion of long-term debt of about $14 million and long-term debt close to $12 million, the equity value would be $12.85 billion. Finally, the implied price would be $485 per share with an IRR of 3.855%.

Source: Ycharts

There Are Large Barriers To Enter The Market Because Of Investments In Technology And Infrastructure; However, There Are Other Competitors Out There

In recent years, the industry’s operating margins have tightened, causing many small distributors to disappear or be acquired by larger companies. With that, the market is still competitive, and is made up of companies with national distribution networks and regional competitors that in many cases meet expectations and have knowledge of the needs of customers in specific areas.

Due to the nature of the market, the larger the area to cover, the greater the costs and complexities, which is why there are few companies with a national scope. The conditions for entering this market are high due to the need for infrastructure and investment in technology. With this in mind, it is worth noting that SAIA may have to invest a lot of new money to make expansion into new territories.

In addition to competing with the participants in the LTL cargo market, SAIA also competes with players in other transportation markets, such as truckload, air or rail distribution, logistics companies, and some digital alternatives that have emerged in recent years.

Risks

All the companies in this sector are highly conditioned by the variations of the economy in general and the increase in inflation levels and transport prices. Above all, they are within a business that is affected by the development of other innovative technologies. Changes in any of these factors may affect the cash flow statement, which may lead to lower stock valuations.

Together with the possible unionization of its employees, the recent disruptions in supply chains that led to delays in distribution or geographic concentration of customers are other risk factors to keep in mind. With regard to the location of clients, the company explains with the following terms how cash flows could be affected.

We have operations throughout the South, Southwest, Midwest, Pacific Northwest, West and Northeast. As a result, changes in the economic climate, consumer trends, market fluctuations or supply shortages could decrease demand for our services in one or more of these regions. Adverse market conditions in one or more of these regions could materially adversely affect our financial condition, results of operations, liquidity and cash flows. Source: 10-k

Conclusion

SAIA made meaningful investments in property and equipment in the past, and expects to make further investments, which will likely offer an advantage over other competitors and potential new entrants in the market. In the last quarterly report, the company reported a small decrease in the final LTL shipments per workday, which I considered a temporary decline. In my view, further additions of direct service to new regions in the United States, optimization at the operational level, and economies of scale will most likely lead to FCF generation. There are risks coming from inflation, labor unavailability, diesel fuel prices, and supply chain constraints, however I believe that the stock price could trade at higher marks.

Read the full article here