Sea Limited (NYSE:SE) investors are likely on tenterhooks as the leading Singapore-headquartered e-commerce and gaming company prepares to report its first-quarter earnings release on May 16.

The financial media has reported constructive commentary on the company over the past week. Bloomberg highlighted on May 8 that the company would implement a “5% pay increase for most employees starting in July,” suggesting that the worst in SE could be over.

SE reacted last week as it surged toward its April highs after pulling back nearly 20%. However, momentum buyers who lifted SE failed to re-test its those levels decisively, suggesting sellers likely took the opportunity to rotate out of their positions, cutting exposure.

Could Sea management be celebrating too early, as investors and Wall Street analysts mark up their expectations for the company, raising the bar for outperformance?

Wall Street analysts estimates have been revised upward, expecting Sea Limited to post an adjusted EBITDA of $1.6B for FY23 compared to last year’s adjusted EBITDA loss of $878M. Sea Limited is also expected to report a full-year GAAP net income of $727M.

On an adjusted basis, Wall Street analysts expect the company to post an adjusted EPS of $3.31 for FY23, a significant improvement from FY22’s loss of $1.69.

Therefore, investors are likely expecting management to report a robust first-quarter release, bolstering the company’s momentum toward meeting the upgraded projections.

Sea Limited has proved its ability to navigate against highly challenging growth headwinds as CEO Forrest Li is confident that the company has reached “self-sufficiency.”

The recent shift toward “one-ply toilet paper,” among other notable cost-cutting measures, is expected to improve its near-term results. However, I believe the company needs to demonstrate how Shopee (Sea’s e-commerce segment) can chart a sustainable growth inflection in its gross merchandise value or GMV over the medium term.

Keen investors should recall that Shopee’s YoY GMV growth fell to -1.1% in FQ4’22, down from the 53% growth it achieved in the previous year.

However, management updated last quarter that investors should not expect to receive quarterly metrics on GMV moving forward impacting investors’ ability to estimate its take rates evolution.

While Shopee increased its take rate to 11.7% in FQ4’22 (up from FQ4’21’s 8.8%), it could lower the progress of its GMV recovery over the medium term.

DBS Research highlighted that it downgraded its forecasts for e-commerce GMV growth in the ASEAN region to 9% from 13% previously. The significant cuts reflected “increased take rates, reduced incentives, and the recovery of offline sales.”

Moreover, it highlighted that investors would need to watch for increased competition from TikTok (BDNCE) as it grew its e-commerce clout last year, with GMV reaching $4.4B. While it accounted for just 6% of Shopee’s FY22 GMV, TikTok’s aggressiveness in expanding its e-commerce cannot be understated, as it “more than quadrupled” over the past year.

With TikTok facing tepid uptake in the US market as it dealt with regulatory and geopolitical headwinds, the company could invest more efforts to develop its ASEAN business, putting more pressure on Shopee.

Moreover, Alibaba’s (BABA) restructuring could also significantly bolster its international commerce business, taking on Shopee with increased vigor and aggressiveness. Bloomberg reported recently that Alibaba “is exploring a potential US IPO to spur growth for the business.

Analysts value the unit at a midpoint of $34B (compared to SE’s current market cap of $48B). As such, it could transform Alibaba’s international commerce unit into a behemoth in the region, providing significant firepower against Shopee and challenging its dominance.

Moreover, investors will still need to watch the foundation of Sea Limited’s business, which is built on the profits of its gaming unit, Garena. Accordingly, Garena accounted for 52% of its total adjusted EBITDA in FQ4’22.

Sea’s gaming segment could continue to come under pressure moving forward. Sanford C. Bernstein articulated that Garena’s “performance is likely to decline further as the current game, ‘Free Fire,’ matures, and no new games have been released.”

As such, investors will need to watch the developments in its gaming segment carefully, given its outsized influence on the company’s ability to maintain its profitability.

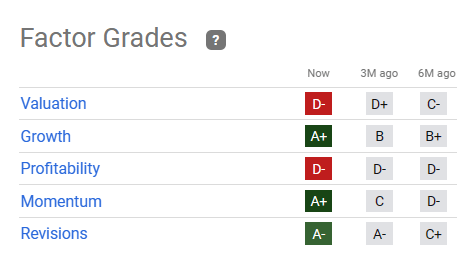

SE quant factor ratings (Seeking Alpha)

SE’s valuation remains aggressive, rated by Seeking Alpha with a “D-” valuation grade, normalized from the “C-” grade six months ago.

While its growth metrics and revisions are constructive, driving SE’s recent momentum, I assessed that SE seems fairly valued at best.

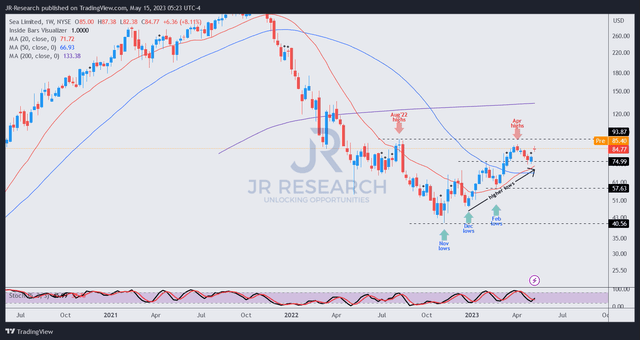

SE price chart (weekly) (TradingView)

As seen above, SE’s momentum has recovered remarkably from its 2022 lows. Therefore, I assessed that momentum buyers have likely driven the recent recovery as it’s no longer in a medium-term downtrend.

As such, it opens up more opportunities for dip buyers looking to buy steep pullbacks, with fewer uncertainties about catching “falling knives.”

With last week’s surge, the market has likely priced in a more upbeat performance for Sea Limited’s upcoming earnings release. Hence, investors should remain patient for a more attractive risk/reward entry.

With several headwinds discussed earlier, coupled with more challenging Wall Street estimates for Sea to cross, disappointing news moving ahead could lead to a steep pullback as SE’s valuation is no longer significantly undervalued.

Rating: Hold (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here