Amid the resurgence of optimism in the markets, we have to be careful of one thing: with investors piling back into tech stocks, we need to make sure we’re watching valuations, as low post-correction valuations were one of the key drivers that allowed tech stocks to rebound this year.

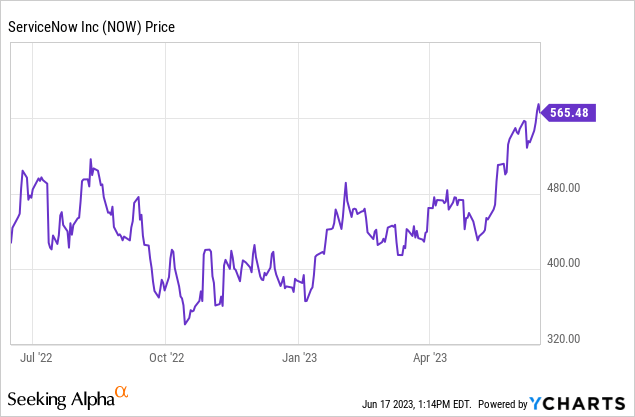

Year to date, ServiceNow (NYSE:NOW) – already one of the largest software companies in the market with a >$100 billion market cap – has jumped more than 40%, buoyed by strong results that seem barely impacted by the macro headwinds that all of its peers are reporting. NOW stock has been on a bigger tear since late April, owing both to a very strong fiscal Q1 earnings print as well as the rising tide in the markets since then.

I, however, take a more sober approach on ServiceNow. While I certainly acknowledge that ServiceNow is a category-leading software vendor that is arguably the best-known name in IT service management products, I view the company as a relatively mixed bag of positives and negatives.

On the bright side for ServiceNow:

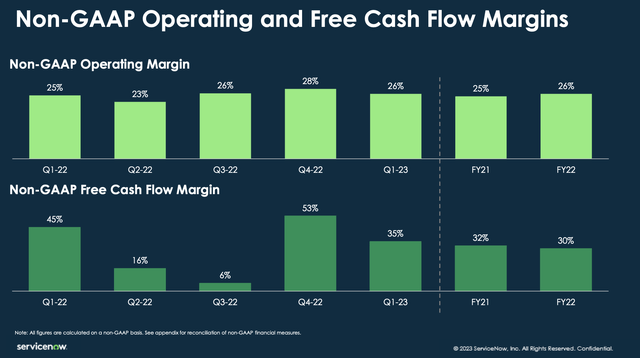

- Not only is ServiceNow displaying growth at scale, but it’s also a rare Rule of 40 company. Despite hitting nearly an ~$10 billion annualized revenue run rate, ServiceNow is still managing to grow revenue in the mid-20s, which is a feat achieved only by the top-tier of the cloud software sector (think Salesforce (CRM), Workday (WDAY), and the like). And on top of that, ServiceNow is also generating mid-20s pro forma operating margins, which easily puts the company in the “Rule of 40” category that many software vendors aspire to.

- Defendable moat. Salesforce is the king of CRM, Workday is the titan of HCM, and ServiceNow is the leader in digital workflows and IT Service Management. A recent partnership with Nvidia (NVDA) to offer AI services to customers will bring additional technological edge to this name.

At the same time, however, I don’t think it’s a perfect bull case for ServiceNow. In particular, I’m watching out for the following:

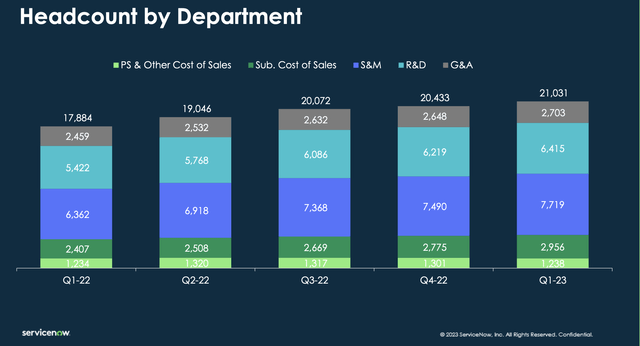

- Aggressive headcount growth is limiting margin expansion. Though it’s true that ServiceNow already has an enviable margin position as a “Rule of 40” company, it’s also aggressively growing its headcount – which is limiting y/y operating margin expansion exactly at the same time that other companies are shedding expenses to boost margins.

- Saturation. ServiceNow already services 85% of the Fortune 500, and it has already expanded overseas, with international contributing to one-third of the company’s revenue. Though we haven’t seen substantial deceleration yet, we have to wonder where ServiceNow goes from here.

The biggest worry for ServiceNow, of course, is its valuation: the stock is a classic “high price for high quality” name that I don’t think will fare well in this market rebound. At current share prices near $565, ServiceNow trades at a market cap of $115.21 billion. After we net off the $7.15 billion of cash and $1.49 billion of debt on ServiceNow’s most recent balance sheet, the company’s resulting enterprise value is $109.55 billion.

For the next fiscal year FY24, meanwhile, Wall Street analysts have a consensus revenue target of $10.75 billion for the company, representing 22% y/y growth (data from Yahoo Finance). This puts ServiceNow’s valuation at 10.2x EV/FY24 revenue: a steep multiple that doesn’t leave much room for upside.

The bottom line here: there’s no doubt that ServiceNow is a fantastic company that has a strong track record of producing good results. But at the same time, that strong fundamental profile is already priced into the stock at a double-digit revenue multiple. I’d prefer to stay on the sidelines here until prices come down.

Q1 download

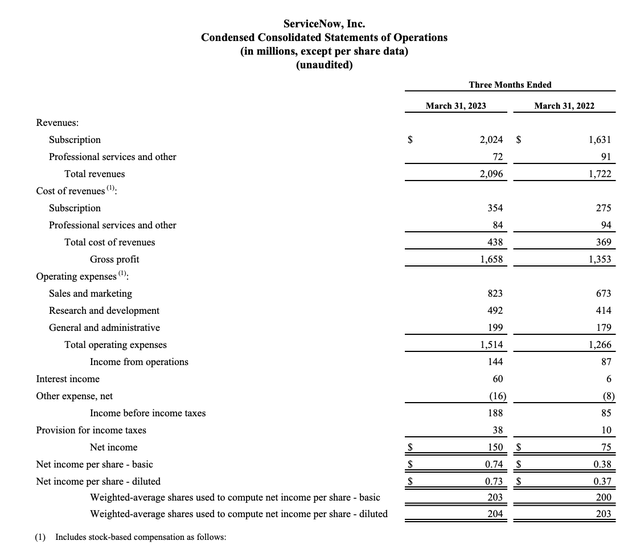

Let’s now go through ServiceNow’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

ServiceNow Q1 results (ServiceNow Q1 earnings release)

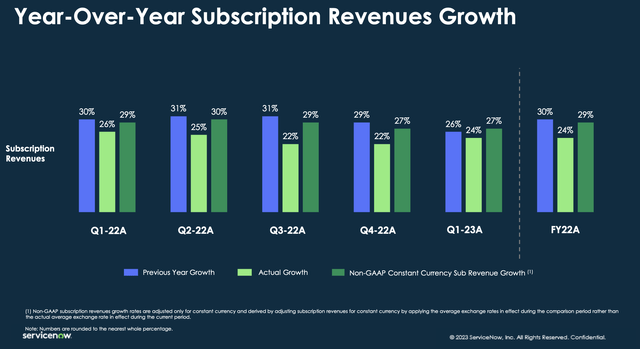

ServiceNow’s revenue grew 22% y/y to $2.10 billion, beating Wall Street’s expectations of $2.09 billion (+21% y/y) by a relatively slim one-point margin. Impressively, however, the company’s subscription revenue growth of 27% y/y on a constant-currency basis did not decelerate from last quarter, and decelerated only slightly from an average ~29-30% growth pace in the first half of 2022 – despite macro headwinds that are impacting the rest of the sector.

ServiceNow subscription revenue trends (ServiceNow Q1 earnings release)

Management notes that it’s because of the fact that ServiceNow’s automation of workflows helps remove manual labor and eliminates that the product has continued to sell well in this recession. And from a sector perspective, the company notes that Q1 saw particular strength in the utilities, energy, transportation, government, and education sectors.

Customer dynamics remained strong, and the company is citing a strong pipeline heading into the remainder of the year. Per CFO Gina Mastantuono’s remarks on the Q1 earnings call:

New customer ACV growth remained an area of strength, and the average deal size was up significantly year-over-year. Our renewal rate was a best-in-class 98% in Q1, continuing to demonstrate the stickiness of our business as the Now Platform remains a mission-critical part of our customers’ operations.

Our customer cohorts have also continued to show solid expansion. We ended the quarter with 1,682 customers paying us over $1 million in ACV, up 20% year-over-year. We’re continuing to see healthy customer engagement with enterprise buying patterns demonstrating the extensibility of the Now Platform. We closed 66 deals greater than $1 million in net new ACV in the quarter, up from 52% a year ago. In Q1, 18 of our top 20 deals contained five or more products, showcasing how ServiceNow is providing customers the single platform they need to orchestrate their technology value chain […]

Moving to our outlook. Our pipeline continues to look robust for the remainder of the year, and we’re excited about what the Utah release and Now’s 2023 can further contribute to those opportunities. While we’ve seen market resiliency, we continue to prudently factor in the evolving macro cost with each of our guidance.”

Unlike many of its tech peers, however, ServiceNow has remained committed to growth without much emphasis on cost reduction. Headcount, in particular, grew by ~600 heads sequentially and up 18% y/y to 21k total employees:

ServiceNow headcount trends (ServiceNow Q1 earnings release)

With opex growth in line alongside revenue growth, pro forma operating margins of 26% was effectively flat to last year (though we do still applaud the company’s “Rule of 40” score of 48):

ServiceNow margins (ServiceNow Q1 earnings release)

Key takeaways

Ultimately, I am neutral on ServiceNow. Investors should be mindful of the fact that the stock has already enjoyed a healthy near-50% gain on the year, and though it remains a strong growth player with enviable Rule of 40 metrics, its double-digit revenue multiple doesn’t leave much room for upside when growth is likely only to decelerate from here.

Read the full article here