Shoe Carnival (NASDAQ:SCVL) currently operates 401 stores under Shoe Carnival and Shoe Station names, with the stores ranging across 35 states. In addition to physical retail stores, the company sells through its website. As can be guessed from the company’s name, Shoe Carnival retails shoes. The company sells well-known brands such as Nike, Adidas, Skechers, Converse, and Crocs.

The stock has performed modestly with a CAGR of 5.0% in appreciation in the past ten years. On top, the company pays out a dividend with a current expected yield of 2.03%.

Ten Year Stock Chart (Seeking Alpha)

Financials – Sustainable Margin Level at Question

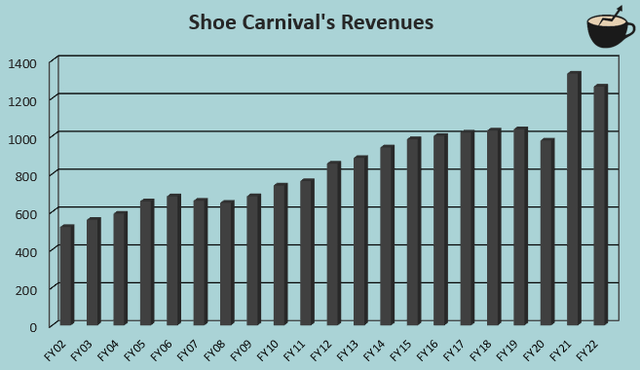

From FY2002 to FY2022, Shoe Carnival’s revenue CAGR has been 4.5%. The achieved growth is mostly organic, as the company’s only cash acquisition in the period was made in FY2021, when Shoe Carnival acquired Shoe Station for around $67 million, adding around $100 million in revenues into Shoe Carnival’s figures:

Author’s Calculation Using TIKR Data

Revenues have started to decrease after a very strong FY2021. The company relates the weakness into a weaker macroeconomic state due to inflation, as well as poor weather conditions concerning demand. From FY2021, current trailing revenues have decreased by -10.8% as of Q3/FY2023.

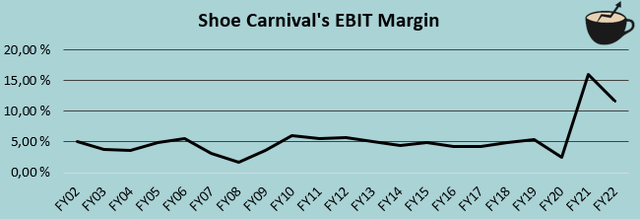

Shoe Carnival’s EBIT margins should be looked at closely. The company’s EBIT margin level stayed very stable through FY2002 to FY2019 with an average of 4.5%, but with strong revenues in FY2021 the margin rose into 16.0% predominantly due to higher gross margins – if even partly maintained, Shoe Carnival’s EBIT level could be very much above the company’s historical figures.

Author’s Calculation Using TIKR Data

The margins have begun coming down after the strong FY2021 financials into a current trailing figure of 8.6%. Despite a rough macroeconomic situation and a communicated negative effect from hot weather – in my opinion, it seems reasonable to expect that Shoe Carnival will achieve margins above the long-term historical level as the company doesn’t seem to currently have any tailwinds boosting the achieved trailing margin. The acquisition of Shoe Station should also have contributed slightly to the improved margin level, as the acquisition was communicated to have a normalized operating income margin level above ten percent.

Sustainable CFO at Question

Shoe Carnival’s CFO has changed twice within 2023. The company announced a change in CFO in March as W. Kerry Jackson retired after a lengthy career in the company. In Jackson’s place as CFO, Shoe Carnival appointed Erik Gast from Fleet Farm Group noting Gast’s expertise in the retail industry, M&A, and strategic planning – the appointment wasn’t communicated to be in an interim position. After just five months in the position, Shoe Carnival announced in September that Patrick Edwards will be replacing Erik Gast in the CFO position as Gast will depart the firm. It doesn’t seem that Erik Gast has left the company due to finding a more prestigious position as Gast hasn’t posted to be under a new company in his LinkedIn profile. Investors are left wondering about the fast switch up in the CFO role – from an outside perspective, the move doesn’t look very good for Shoe Carnival.

A Reasonably Priced Stock

At the time of writing, Shoe Carnival trades at a forward P/E multiple of 7.9, below the company’s three-year average of 8.9:

Historical Forward P/E (TIKR)

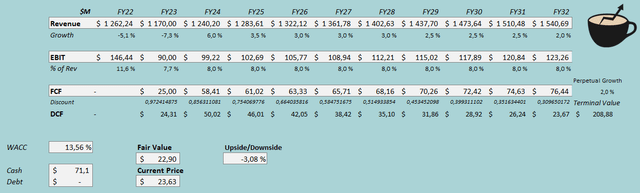

As the P/E multiple seems low, Shoe Carnival’s future performance seems to be priced to be quite poor. To estimate a rough fair value for the stock, I constructed a discounted cash flow model in my usual manner.

In the DCF model, I estimate Shoe Carnival to hit the middle point of the company’s FY2023 revenue guidance, corresponding to a decrease of -7.3%. After the year, I estimate the revenue level to stabilize from poor macroeconomic conditions and a poor weather effect with a growth of 6%. Going beyond, I estimate the growth to slow down into a more historical level with slight decreases, ending the growth up at 2%. For Shoe Carnival’s margins, I estimate an EBIT level of 7.7% in FY2023, signifying an expected weak Q4. As the previously mentioned factors improve, the company’s EBIT margin should slightly rise – from FY2024 forward, I estimate an EBIT margin of 8.0%, above Shoe Carnival’s long-term average but a reasonable future expectation.

With the discussed estimates along with a cost of capital of 13.56%, the DCF model estimates Shoe Carnival’s fair value at $22.90, around 3% below the stock price at the time of writing. The markets seem to price in margins that are above Shoe Carnival’s historical level, but well below the figures achieved in FY2021 and FY2022. I believe that the priced-in scenario is a good baseline scenario for investors.

DCF Model (Author’s Calculation)

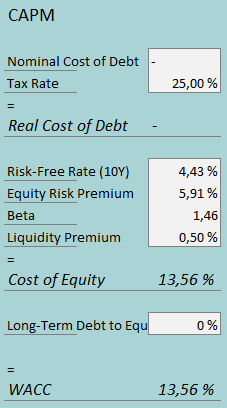

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Currently, Shoe Carnival doesn’t hold interest-bearing debts for financing purposes – the very nominal interest expenses seem to come from capital leases. I don’t see the company’s management as having initiatives for changing the capital structure, either – I estimate Shoe Carnival’s long-term debt-to-equity ratio to be 0%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.43%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, made in July. Yahoo Finance estimates Shoe Carnival’s beta at a figure of 1.46. Finally, I add a small liquidity premium of 0.5%, crafting a cost of equity and WACC of 13.56%.

Takeaway

Shoe Carnival’s margins have fluctuated widely after a very stable long-term margin history. After a strong FY2021, the company’s margins have decreased back closer to historical levels, although still very significantly higher. I would expect that the current higher margin level is sustainable, as I don’t see tailwinds boosting the trailing level, and the level does have headwinds from the macroeconomy and weather. Markets also seem to price in a future margin level in line with my expectation – for the time being, I believe that Shoe Carnival deserves a hold rating.

Read the full article here