Introduction

SigmaTron International (NASDAQ:SGMA) is a global electronic manufacturing services (EMS) provider that earlier this year breached its debt covenants due to $23.1 million impairment charges at its pet tech business. The latter was sold in April, and I think that the FY23 financial results released on July 21 were decent. With the backlog remaining high at the end of April, I think that FY24 is likely to be a strong year for the company with EBITDA of about $30 million. In my view, SigmaTron looks undervalued based on fundamentals as it’s trading at just 4.19x EV/EBITDA based on the FY23 results of its EMS business. Let’s review.

Overview of the business and financials

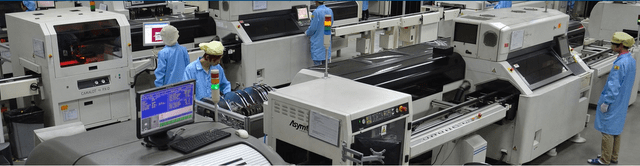

SigmaTron was founded in 1994 and is a full-service EMS provider with a total of seven production facilities across the USA, Mexico, China, and Vietnam. The company’s portfolio includes printed circuit board assemblies, electro-mechanical subassemblies, and completely assembled (boxbuild) electronic products which are then incorporated into finished products in the appliance, consumer electronics, gaming, fitness, industrial electronics, medical/life sciences, semiconductor, telecommunications, and automotive sectors among others. SigmaTron has about 2,950 full-time employees, some 500 of which are located in the USA.

SigmaTron

In 2021, the company ventured into the pet tech sector with the purchase of a US company named Wagz. The main product of the latter is a shock-free wireless fence and wellness system for dogs named the Freedom Smart Dog Collar. Under the deal, SigmaTron issued a total of 1,546,592 shares which were worth $16 million on the closing date. The company expected to see synergies in the areas of design, manufacturing, and distribution and thus boost its operating margins.

Wagz

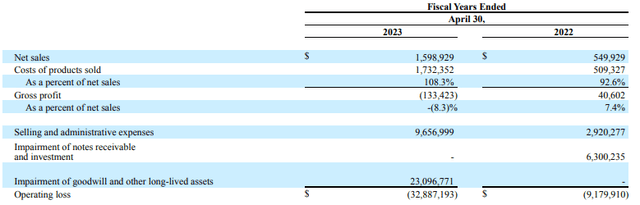

Unfortunately, the purchase of Wagz didn’t live up to expectations. In May 2023, SigmaTron said that the sales of the latter were negatively impacted by a shortage of parts for several months, which led it to miss the holiday season. Looking at the FY23 results of SigmaTron, Wagz booked sales of just $1.6 million and its gross profit margin slipped into negative territory. In addition, selling and administrative expenses soared to $9.7 million due to elevated research and development spending as the company was getting ready to launch three new products in the middle of 2023. SigmaTron decided that the carrying amounts for the goodwill and long-lived asset groups were impaired and this resulted in a non-cash impairment charge of $23.1 million, bringing the operating loss for Wagz to $32.9 million for FY23.

SigmaTron

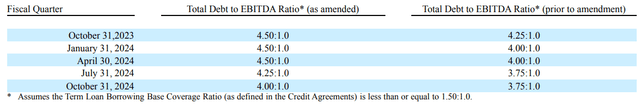

As a result, SigmaTron breached its debt covenants and following negotiations with secured lenders, an 81% stake in Wagz was offloaded to a company run by the latter’s founder for just $1 on April 28. Also, the credit agreements were amended and the required total debt/EBITDA ratio was revised upwards, giving SigmaTron some breathing room for the next few years.

SigmaTron

As of April 30, the company’s total debt stands at $93.3 million while the EBITDA of the core EMS business for FY23 came in at $30.8 million. The total debt/EBITDA ratio thus stands at 2.87x and I think that SigmaTron should easily avoid a default event in the coming years.

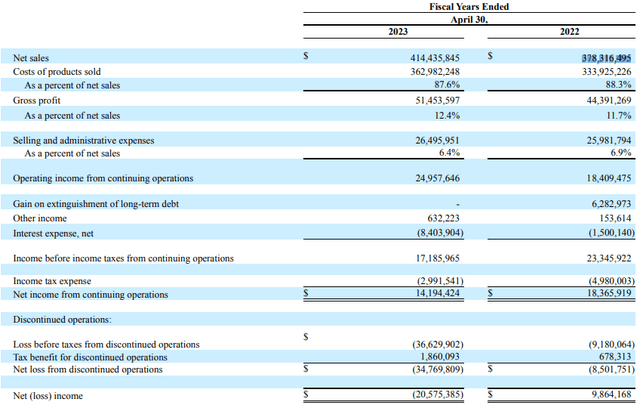

Turning our attention to the financial performance of the EMS business, I think that FY23 was a decent year as net sales grew by 9.5% year on year to $414.4 million and economies of scale boosted the gross profit margin to 12.4% from 11.7% a year earlier. The operating income margin, in turn, rose to 6% from 4.9%. Unfortunately, rising interest rates and higher debt levels boosted interest expenses to $8.4 million.

SigmaTron

Looking at what to expect for FY24, I’m optimistic that net sales could remain close to the levels of FY23 as orders remain strong. As of April, SigmaTron had a backlog of firm orders for $387.4 million (see page 10 here) and a significant part of them is expected to ship in FY24. Thanks to this, EBITDA should remain close to $30 million for the year.

Turning our attention to the valuation, SigmaTron has an enterprise value of $129.1 million as of the time of writing and is trading at an EV/EBITDA ratio of 4.19x based on the FY23 EBITDA of the EMS business. Considering that the latter has been growing steadily over the past few years (revenues went up from $290.6 million in FY19 to $414.4 million in FY23), I think that the company should be trading at above 5x EV/EBITDA. This translates into $9.40 per share or an upside potential of 76.4%.

Looking at the risks for the bull case, I think there are two major ones. First, SigmaTron mentioned in its FY23 financial report that it continued to face supply chain challenges at the start of FY24 (see page 5 here). While the situation is expected to improve, any additional supply chain disruptions could negatively affect revenues and margins over the coming months. Second, the strong backlog could decrease in FY24 if some of the main markets of SigmaTron experience a slowdown. It’s possible that some customers cancel or reschedule deliveries of products, which would affect net sales. In addition, investors should keep in mind that this is a thinly-traded microcap stock. Considering the daily trading volume seldom above 20,000 shares, we’re likely to see significant share price volatility. In my view, it could be challenging to close a large position in SigmaTron.

Investor takeaway

SigmaTron’s foray into the pet tech sector with Wagz just didn’t pan out but the company has a solid EMS business that I expect it to book EBITDA of about $30 million in FY24. The debt agreements have been amended and SigmaTron should repay a significant portion of its loans in FY24. While the market capitalization of the company has more than doubled since the middle of April, I think the stock still looks cheap and that there is a significant margin of safety here. My rating on SigmaTron is a speculative buy.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here