Skyline Champion Corporation (NYSE:SKY) manufactures factory-built housing in the U.S. and Canada. It provides manufactured and modular homes, accessory dwelling units, park models RVs, and modular buildings. They build homes under Champion Home Builders, Athens Park Models, Atlantic Homes, New Era, and ScotBilt Homes brands in the U.S. and SRI and Moduline homes brands in Canada. SKY recently announced its FY23 and Q4 FY23 results. In this report, I will analyze its annual and quarterly results and talk about the challenges it might face in FY24. I think it is currently overvalued. Hence I assign a hold rating on SKY stock.

Financial Analysis

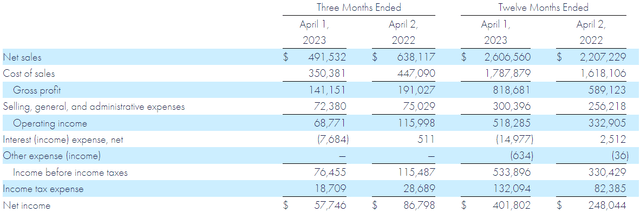

SKY recently posted its FY23 and Q4 FY23 results. The net sales for FY23 were $2.6 billion, a rise of 18% compared to FY22. I believe increased average selling prices per home and $200 million of disaster relief housing revenue recorded in the first half of FY23 were the main reason behind the revenue increase. Their gross profit margin for FY23 was 31.4%, which was 26.6% in FY22. I believe the increase in gross margins was mainly due to operational efficiencies, higher price levels, and a disaster-relief housing mix. The net income for FY23 was $401.8 million, a rise of 62% compared to FY22. I think a significant rise in its revenues and operating income led to a rise in the net income.

SKY’s Investor Relations

The net sales for Q4 FY23 were $491.5 million, a decline of 23% compared to Q4 FY22. I believe the volume decline in the U.S., which was caused by retailer inventory destocking, was the main reason behind the decline. The number of homes sold in the U.S. in Q4 FY23 was 4900, a decline of 25.5% compared to Q4 FY22. Their factory-built home sales in Canada also declined by 38.5% in Q4 FY23 compared to Q4 FY22, which also impacted its revenues in Q4 FY23. Its gross profit margins in Q4 FY23 were 28.7% compared to 29.9% in Q4 FY22. I believe lower volumes impacted its gross margins in Q4 FY23. Their net income also declined by 33.4% in Q4 FY23 compared to Q4 FY22.

Despite tough market conditions in 2022, they were able to boost their revenues, and their margins improved significantly, which is quite impressive, but we have to be careful as the housing market industry is facing challenges, and we could see its effects on the company’s Q4 FY23 results. I will further discuss it later in the report.

Technical Analysis

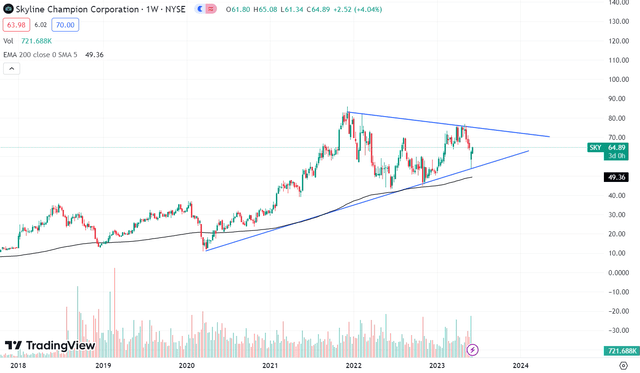

Trading View

SKY is trading at the $65 level. The stock has been creating higher highs and higher lows since 2020 and is currently in an uptrend, but recently it failed to create a new higher high and formed a lower high which can be a sign of trend reversal and can be a matter of concern. It is currently stuck in an ascending triangle pattern, and if it breaks the lower trend line, which is around $54, then the stuck might go in a downtrend. So, I believe there is no buying opportunity in SKY right now. One should only buy it if it breaks the upper trendline, which is at $76, but till then, I think one should stay away from the stock.

Should One Invest In SKY Stock?

First, talking about the positives of the company. By the end of March 2023, they had cash and cash equivalents of $747.4 million and a minimal long-term debt of $12.4 million. In addition, along with its gross profit margins, its adjusted EBITDA margins expanded 490 basis points in FY23, and they have a healthy three-year revenue [CAGR] of 23.92% and diluted EPS three-year [CAGR] of 90%. They were able to deliver these numbers amidst tough market conditions, so it makes it even more impressive. So its fundamentals and its balance sheet look solid, but some headwinds might hamper its growth in FY24. First, it is facing challenges like inventory destocking due to low demand, and we can see its effect in its Q4 FY23 results. Their sales and margins dropped significantly in Q4 FY23. Although inflation is now pretty much under control, the material and labor costs are still high in the U.S. In addition, the interest rates are still elevated, and it is highly unlikely to drop in 2023. So looking at the challenges, I think they might face difficulties in maintaining its growth rate in FY24.

Now talking about SKY’s valuation. I will use P/E and EV / Sales ratios to judge its valuation. One can calculate the P/E ratio by dividing a firm’s market share price by its EPS, and EV / Sales ratio can be calculated by dividing enterprise value by a firm’s annual sales. SKY has a P/E [FWD] ratio of 17.48x compared to the sector ratio of 14.04x and has an EV / Sales [FWD] ratio of 1.49x compared to the sector ratio of 1.15x. After looking at both valuation metrics, I believe SKY is currently undervalued.

Hence looking at the headwinds, weak technical chart, and high valuation. I think it is best to avoid SKY for now. Hence I assign a hold rating on SKY.

Risks and Downsides

They are governed by many environmental rules that cover the storage, discharge, handling, emission, generation, use, and disposal of chemicals, solid and hazardous waste, and other poisonous and hazardous materials used in producing or arising from their products.

One cannot anticipate the nature, extent, or impact of potential future regulatory obligations that could apply to its business or how current or potential laws would be applied or construed. Materials, goods, or practices that have not previously been regulated may be subject to regulation.

The expenses of adhering to new, stricter regulations or of more zealous enforcement of these or existing restrictions may be substantial. Environmental regulations demand them to uphold and abide by a number of licenses, authorizations, and approvals, as well as to uphold and update training programs and safety information about the materials used in its procedures. Financial penalties and other enforcement actions may be taken in response to violations of these standards.

Additionally, they can be asked to stop one or more aspects of their business until the violation is remedied. The expenses of correcting infractions or ending enforcement actions that the government might bring could be high and might have an impact on the company’s operations and finances

Bottom Line

SKY had an amazing FY23, but there are many headwinds they might face in FY24. So I think FY24 might not be as good as FY23 in terms of growth. In addition, its technical chart is showing weakness, and the valuation also seems high. Hence I assign a hold rating on SKY.

Read the full article here