Investment Thesis

SMART Global Holdings, Inc. (NASDAQ:SGH) is in the midst of changing its business model from one that focuses on memory modules to one that’s predominantly seeking to provide tailored high-performance computing manufacturing and LED-based products for general lighting applications.

Here, I lay out my assumption for why paying 10x next year’s EPS for this business now makes sense.

Rapid Recap Of What Put Me Off This Business

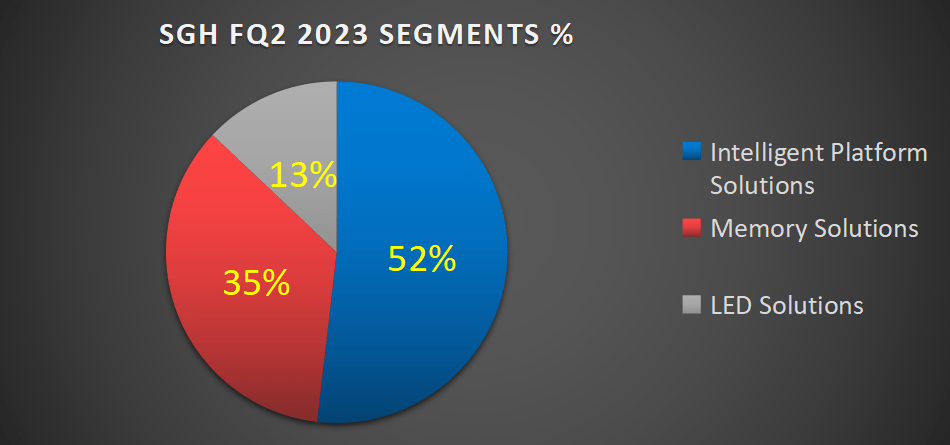

Consider the graphic that follows.

Author’s work on SGH

Let’s recap what I said in my previous analysis:

SGH’s Intelligent Platform Solutions segment was meant to be the crown jewel that would allow SGH to grow its AI and machine learning opportunity. SGH’s IPS business unit delivers tailored high-performance computing manufacturing.

[…] The problem here is that investors are having to buy the whole business. Yes, the IPS segment, but the Memory Solution business too, which was down 42% y/y in the fiscal Q2 2023.

[…] There’s only so far a company can cut back on its Memory Solutions business to extract cash flows. It will get to a point where all the surplus costs will have been taken out of the business.

This was my contention. SGH’s IPS is terrific. This provides customized high-performance computing manufacturing solutions.

That side of the business is performing substantially above most investors’ expectations, my own included, too. With ”bumpy” but fast organic growth rates, which last quarter crossed 100% y/y, and substantially more inorganically.

The problem weighing on the stock had been its Memory Solution (under the brand SMART Module).

This segment is sometimes described as SGH’s Brazil Memory business. This side of the business was suffering. It was being operated to maximize cash flows, but I had my doubts over how much one can ultimately cut back on a memory business and still be able to sell memory.

After all, with Moore’s Law, you either step up and invest or you might as well step out.

Essentially, memory is a business with very high barriers to entry. And in a brutal downturn, as the memory sector is presently navigating, I couldn’t see any positive outcome for a fledgling memory business.

And that would have been the end of this story. However, yesterday, there was a significant announcement that changed this investment thesis.

The Spinoff for Cash

SGH announced yesterday that it was seeking to divest its Brazil Memory business. The main details are that SGH will sell 81% of its Brazil business, which is involved in assembling and testing modules for OEMs in Brazil, for $166M in cash.

SGH plans to use the proceeds of this divestiture to improve its balance sheet. Note, the Brazil business accounted for about a third of its Memory Solutions segment.

At the end of last quarter, SGH’s balance sheet carried approximately $435 million of net debt. Consequently, this spinoff will see SGH’s balance sheet improve and is likely to see SHG’s net debt position improve over the next 12 months, to around $260 million of net debt.

Further, by the end of the decade, there are arrangements in place to divest the remaining 19% of the Brazil memory business.

Near-Term Prospects

I make the case that, with SGH spinning off a third of its memory business, plus seeking to divert its focus away from its struggling memory business, this will allow SGH to reposition itself as a growing and prosperous high-performance computing manufacturing service.

Given that SGH states that it ”expects this transaction to be accretive to its non-GAAP gross margins immediately post-closing,” I believe it’s possible that next fiscal year, SGH’s EPS could reach $2.50.

This leaves SGH stock today priced around 10x next year’s non-GAAP EPS. A valuation that I think is more than fair.

The Bottom Line

SMART Global Holdings, Inc. is transitioning its business model to focus on tailored high-performance computing manufacturing and LED-based products for general lighting applications.

The spinoff of its struggling Brazil Memory business, along with the shift in focus, positions SGH for growth and improved financials.

The recent announcement of selling 81% of the Brazil business for $166M in cash should improve SGH’s balance sheet and reduce its net debt.

The transaction is expected to be accretive to non-GAAP gross margins, and I estimate that SGH’s EPS could reach $2.50 next fiscal year. With SMART Global Holdings, Inc. stock priced at around 10x next year’s non-GAAP EPS, the valuation appears fair.

Read the full article here