The stock market has many adages and one of my favorites is “The Safest Dividend Is The One That’s Just Been Raised.” Hence, as someone who has generally agreed with Seeking Alpha’s quant ratings so far, I found it surprising that while Smith & Wesson Brands, Inc. (NASDAQ:SWBI) has the warning shown below, the company has recently increased its dividend by almost 20% as Seeking Alpha has reported here. Is the dividend at risk as warned, or does the recent dividend increase signal the sky is clear? Let us find out with a deep dive.

SWBI Warning (Seekingalpha)

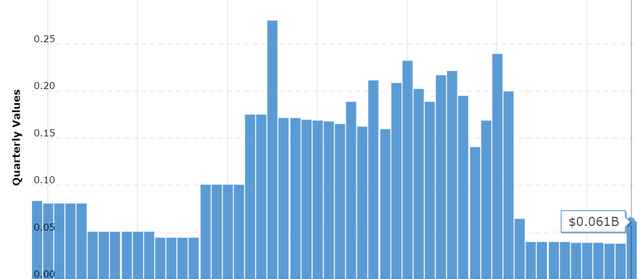

Free Cash Flow Analysis

- Total outstanding shares were 46 million at the end of the most recent quarter.

- New quarterly dividend is 12 cents per share.

- Hence, Smith & Wesson Brands is committing $5.52 million per quarter towards dividend payments. That is, 46 million shares times 12 cents/share. As I am typing this, I am thinking, there is no way a publicly listed company cannot come up with about $6 million consistently. But the numbers below surprised me and will likely surprise you as well.

- Smith & Wesson Brands reported the following free cash flow [FCF] numbers in the last 4 quarters, that is trailing twelve months, for a cumulative cash flow of -$72.72 million. Ouch.

- $13.03 million

- -$18.25 million

- -$63.15 million

- -$4.35 million

- So, at surface level, I concur here with the “F” rating on Free Cash Flow Yield to Dividend Yield Ratio [TTM] for now but there is a catch. It is well known that Smith & Wesson is in the midst of a relocation and consolidation of its office/manufacturing locations. Any relocation is expensive, just ask the millions of families in the US that have relocated at some point in their lives. Now, add 170 years of history (Smith & Wesson has been in Massachusetts since incorporation in 1852), closing down facilities in two states, and thousands of employees to understand the scale of this move. It should not surprise anyone that the company’s expenses have gone up during this phase, including borrowing. Interest payments don’t impact Free Cash Flow but sure do suppress earnings.

- If we look at the 4 quarters preceding the relocation announcement, (July 2020 to July 2021), Smith & Wesson reported $44.77 million, $57.34 million, $115.15 million, and $103.39 million in Free Cash Flow. That’s an average of $80 million/qtr. While that sounds like plenty to cover the dividend commitment based on 46 million shares at 12 cents in dividend/quarter, there is once again a catch. This period was during COVID when demand for Smith & Wesson products went through the roof.

- In short, I am saying 2020 and 2021 were outliers to the upside while 2022 and 2023 have been outliers to the downside. Hence, 2019 is the most recent year with no major incidents that I can recall. In that year, Smith & Wesson managed -$9.41 million in FCF, which while not sufficient to cover the current dividend, is far better than the -$72 million in current TTM FCF.

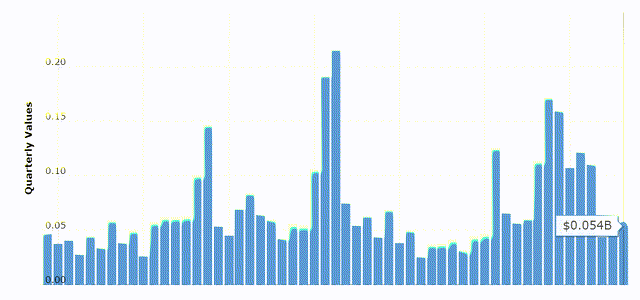

Debt and Cash Situation

Quite often, small caps are neck deep in debt and that usually is the reason their stock price remain suppressed. Smith & Wesson, with its near $600 million market cap has a relatively low debt load of $62 million. Since reaching a peak debt level of $275 million in 2015, the company has done a remarkable job of reducing its debt by nearly 80%.

SWBI Debt (macrotrends.net)

The debt level becomes even less of a concern when you factor in the company’s cash and short-term equivalents, which at $54 million, is nearly 90% of the debt level.

SWBI Cash (Macrotrends.net)

Overall, it is not surprising that the company has one of the lowest debt to equity ratios I’ve seen at 0.065.

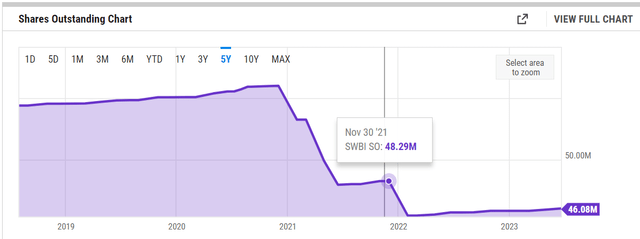

Share Buybacks

Smith & Wesson has retired 15% of its outstanding shares in the last five years. As I’ve written before, truly retiring (not merely offsetting dilution) shares has two magical effects on stocks that pay dividends. Not only does the earnings per share go up but the capital needed over the long-term to pay dividends is reduced as a company buys back its shares.

SWBI Shares Outstanding (YCharts.com)

Outlook and Conclusion

- Outlook: I don’t expect the company’s recent expenses and FCF woes to continue forever. If anything, once the relocation is complete, I expect the company to see substantial savings as it consolidates in Tennessee compared to having multiple facilities in Connecticut and Missouri. At the same time, I don’t expect the company to see the anywhere close to the demand it saw during the pandemic. I do expect FCF to return to a level that should comfortably cover the company’s dividend once the company settles down with the relocation. After all, the company produces a product that many consumers are passionate about. (Please see additional disclaimer below).

- Stock Valuation: At a forward multiple of 13.90, the stock is trading at a Price-Earnings/Growth (“PEG”) ratio 0.90, which is rare these days. This is based on the company’s expected 5-year growth rate of 15%/yr.

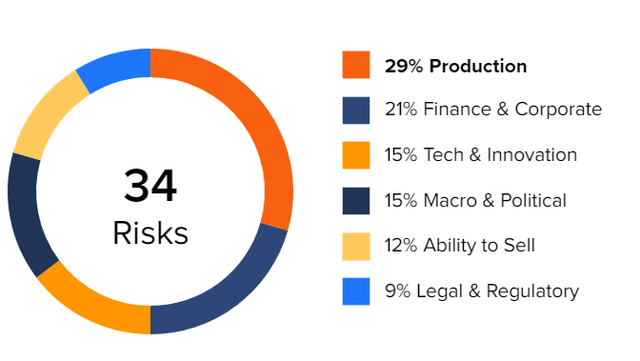

- Risks: The primary risk for this company is political, especially with the presidential campaign beginning to gather steam with a list of serious candidates all but set. Production and supply chain risks have also impacted the company in the past. Competitors like Sturm, Ruger & Company, Inc. (RGR) are in the mix as well as an alternative for both consumers and investors. However, given the company’s brand recognition, it should remain at the top of the food chain even as the overall industry demand ebbs and flows.

SWBI Risk Factors (tipranks.com)

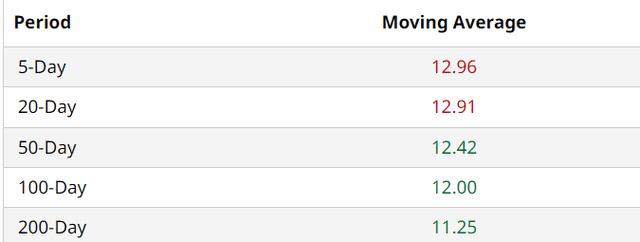

- Technicals: SWBI stock has now moved past its 50-, 100-, and 200-Day moving averages. Should overall market conditions remain the same or get better, I am inclined to believe the stock is ready for its next leg up based on these moving averages and the stock’s 14-day Relative Strength Index (“RSI”) of 48.

SWBI Moving Avgs (Barchart.com)

Conclusion:

To conclude, I don’t believe the stock’s dividend is at risk yet and post-relocation, the numbers should start improving. SWBI is both cheaper in terms of valuation and yields higher than closest stock alternative, RGR. Personally, I don’t find either stocks attractive here given their cyclical nature and especially SWBI with its near 50% run YTD. That does not mean the stock is a “Sell” nor is its dividend at imminent danger. Hence, I rate the stock a “Hold”.

Additional Disclaimer: Finally, please note that I analyzed SWBI just like I would and have done other dividend paying stocks. I’d like to steer clear of political and moral discussions about the company’s line of business.

Read the full article here