Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) puts out Q1 2023 results that positively delight investors. SoFi continues to highlight steady progress toward positive GAAP net income margin.

For investors, this is terrific news and highlights the bull case, that SoFi is much more than just a bank, but an asset-light fast-growing fintech operation.

Or at least that’s what SoFi Technologies wants to be perceived as and given credit for being, with a commensurate multiple on its stock.

However, I continue to make the argument, despite the impressive progress the company is making, there’s just so much more to this story than a compelling narrative. As always, the details often matter more than the headline story. Here’s why I’m not bullish on SOFI.

Revenue Growth Rates for 2023 Could Reach +30% CAGR

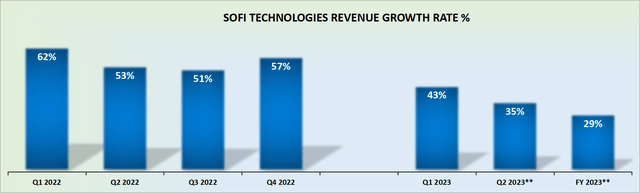

SOFI revenue growth rates

In the first instance, I’m going to highlight some bullish considerations, before describing why I’m staying clear of deploying my own hard-earned capital into this business.

The graphic above is a reminder that SoFi is still in high-growth mode. Case in point, the newly raised 2023 outlook points to its top line growing by around 30% CAGR.

That being said, SoFi’s upward revised guidance was in name only. Because tangibly, the new outlook is only around 1% to 2% higher at the high end compared with the previous outlook.

Next, in the graphic that follows, I highlight what proportion of SoFi’s revenues came from its Lending business.

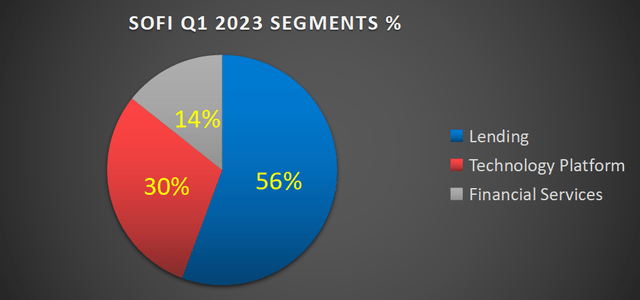

SOFI Q1 2023

As you can see above, more than half of its total revenues come from its Lending segment.

However, keep in mind that this segment is the crown jewel of the investment thesis. After all, SoFi’s Lending business delivers contribution margins of 65% in Q1 2023, which is substantially better than the 19% contribution margin associated with its Technology Platform segment, or its clearly unprofitable Fintech Services segment.

Put another way, even though SoFi’s Financial Services were up nearly 250% y/y, delivering astounding growth to $81 million of net revenues, SoFi is only able to invest in its Financial Services offerings, given that its Lending business is able to yield such high EBITDA margins.

Path to Profitability in 2023

The bull case that SoFi extolls to investors is that its business could by Q4 2023 and beyond consistently report GAAP net income.

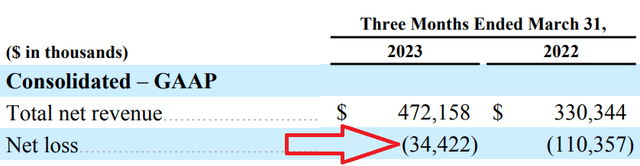

SOFI Q1 2023

As you can see here, given that Q1 2023 was negative $34 million, it isn’t just a huge jump needed to reach company-wide positive GAAP net income.

That being said, beyond its income statement there are other weighty considerations that are keeping me clear of SoFi.

Indeed, it’s often said that one problem with investing in a bank is that everyone is extremely clear on the liabilities side of the balance sheet. But there’s often some uncertainty over the quality of a company’s banking assets.

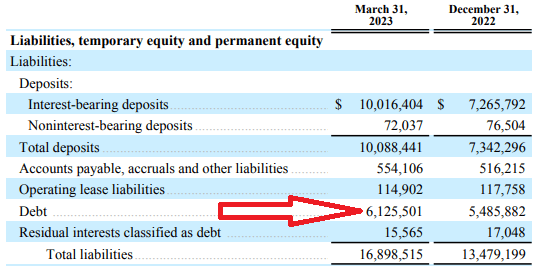

SOFI Q1 2023

What we see above is that in 90 days since the end of Q4 2022, SoFi’s debt has increased by over $600 million, or an increase of about 10% of its market cap in the form of debt.

Bulls will be quick to highlight that over the same short period, SoFi’s cash balance is up more than $1 billion.

And, in fact, although I fully recognize the progress that SoFi is making on its path to profitability, I remain perturbed by just how leveraged this fintech business has become.

In sum, even if SoFi Technologies, Inc. is making a lot of progress on its operations, I don’t believe that paying 20x forward EBITDA for a leveraged bank is all that compelling. Or put another way, new investors looking at this stock will struggle to find much upside from this valuation.

The Bottom Line

In SoFi Technologies, Inc.’s press release, the term ”record” results shows up 12 times. However, keep in mind, that even if a business’s revenue growth rates were to decelerate year-over-year, while still posting some y/y revenue growth, that would inevitably lead to record revenues.

With the share price having gone essentially nowhere fast this year, and the stock down since its IPO, I wonder whether the time has come for SoFi Technologies, Inc. to be slightly more humble in its enthusiastic proclamation of its record results and more transparently discussing its recorded leveraged balance sheet, with more than $3 billion of net debt, while SoFi Technologies, Inc. is barely reporting positive profitability.

Read the full article here