Last week’s article outlined expectations for bullish continuation in the S&P 500 (SPY). With the strong close to June and Q2, this was the logical conclusion (and it still is). However, anything can happen, and inflection points are designed to keep us on the right side of trends when the unexpected happens. The break back below 4422 warned all was not well and the drop can still target “4362, even 4325 again” as outlined in the last article.

The question next week is whether more unexpected drops can flip the bigger picture uptrend negative or whether the dip from the 4458 ‘top’ is just another detour on the way higher.

To answer this, a variety of technical analysis techniques will be applied to the S&P 500 in multiple timeframes. The aim is to provide an actionable guide with directional bias, important levels and expectations for price action. I will then use the evidence to make a call for the week ahead.

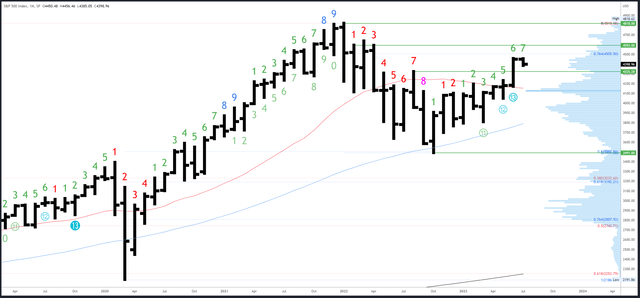

S&P 500 Monthly

The July bar has not made a higher high above the June top, and without this any reversal is suspect. Or to put it another way, there is still a bullish bias for more highs above the June high, even if these are minimal (see January 2022 and December 2021 bars for an example).

SPX Monthly (TradingView)

The monthly levels are unchanged from last week –

There is minor resistance at the 76.4% Fib at 4505, followed by monthly references starting at 4593.

4325 is potential support, then 4230 at May’s high, with 4195-200 a major level just below.

An upside Demark exhaustion count is on bar 7 (of 9) in July. We can expect a reaction on either bar 8 or 9 should new highs be made (compared to the other bars in the count) so it could be over two months until we see higher timeframe exhaustion.

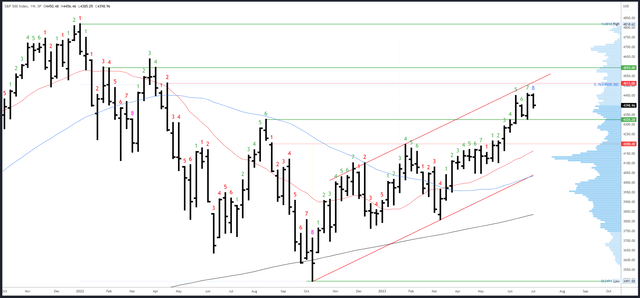

S&P 500 Weekly

Following last week’s very bullish ‘outside bar’, this week’s ‘inside bar’ is neutral, even bullish given the context. However, this relies on a weekly close above the 4328 low.

The weekly Demark count will complete upside exhaustion on bar 9 next week if the close is above 4409. This could lead to more correctional action and failed rally attempts as the exhaustion is reset. Inflection points such as 4325-28 will be important in signaling whether any downside reaction is part of bullish consolidation or the start of a larger reversal.

SPX Weekly (TradingView)

4505-4513 is the next resistance at the 76.4% Fib and weekly pivot high. This will also line up with the channel highs should it be reached.

4325-28 is now initial support, and there is a weekly gap fill at 4298.

As mentioned earlier, an upside (Demark) exhaustion count will be on bar 9 (of 9) next week.

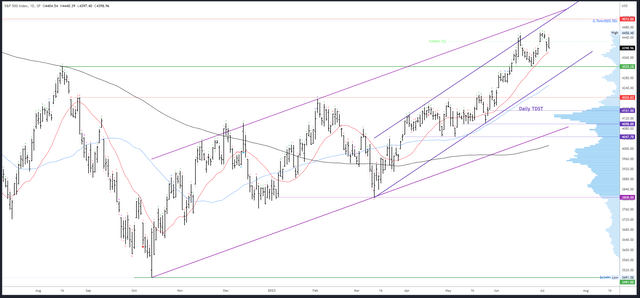

S&P 500 Daily

The break below the 4422 gap has compromised the rally from the 4328 low and likely leads to more weakness early next week. Thursday’s 4385 low looks vulnerable, as does the 20dma which is in the same area.

It’s hard to say exactly where a break of 4385 will target as this is short-term issue and needs to be calculated each session rather than at the weekend. 4362 is the first support, but if Monday’s session gaps down and drives lower, 4325-28 could come quickly.

SPX Daily (TradingView)

Resistance is 4440-58.

Potential support is at 4362, 4325-28, then the channel, which will be around 4276 on Monday and rising 6 points each session.

Events Next Week

Friday’s move (and close) suggests NFP is not fully factored in and Monday’s session could still be a reaction to events from last week, especially the rise in yields and the 10Y passing 4%. The odds of a July hike have risen to 93%, but a September is now only 24% probable.

CPI on Wednesday and PPI on Thursday are the main data releases next week but unlikely to change the outcome of the July meeting. Headline CPI could drop sharply to around 3%, but core is still a problem, especially if it fails to moderate to the expected 0.3%.

Probable Moves Next Week

While weakness is expected in the first half of next week, the higher timeframe bullish bias should ensure any dip gets bought. 4325-28 should hold on a weekly closing basis and 4505-4513 remains the initial target, although this might not be reached next week.

The near-term issue is how any dip plays out, and as mentioned earlier, this is hard to call when I am writing this on a Saturday morning. Maybe in the future I should do daily updates?!

One option is for a slow decline to form a wedge and in this case, upper support such as 4362 could hold.

The other main option is for a much stronger drop and this will come to the fore with a gap below 4385 on Monday. This should reach 4325-28 directly, and the weak bottom made at 4328 can finally be flushed (remember the lack of capitulation at this low?!). In this scenario, a drop all the way to the 4298 weekly gap is possible, but bulls would want to see a recovery back over 4325-28 into the weekly close.

Read the full article here