Many Fed metaphors have walked the metaphorical hallways of the financial discourse over the years. There is the famous punchbowl metaphor; the Fed can run out of bullets and get bailed out by a fiscal bazooka; Alan Greenspan called monetary policy like steering a barge down the river. Milton Friedman compared it to a thermostat. One of my favorites compares the Fed as being in control of the water supply of the “farm.”

Wendorf

However, one particular Fed metaphor is about to come to get its fifteen minutes of fame in the American economic lexicon; the soft landing. Contrary to what it might sound like, a soft landing isn’t all rosebuds and celebrations. Many people could lose their jobs, and economic activity could slow down, just not enough to cause a significant recession.

CME Group

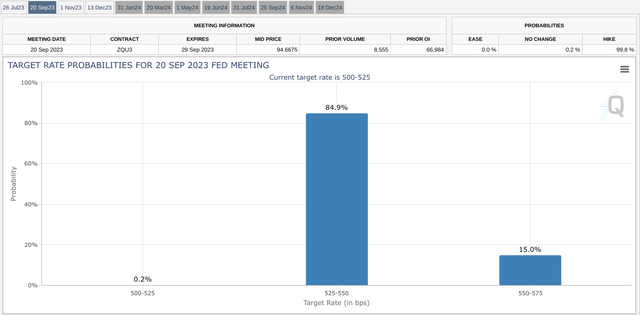

There is an FOMC meeting starting Tuesday, with the interest rate announcement and the press conference on Wednesday. While a hike this week is essentially a certainty, the odds for a hike in September have materially diminished since the better-than-expected June CPI reading, which showed persistently sticky core inflation coming down.

I have covered this hiking cycle extensively:

- Before Silicon Valley Bank’s collapse, I postulated that the Fed was calling the bond market’s bluff that it would “break something” and actually had a better grip on financial stability than consensus afforded.

- After the last Fed meeting, I stated that I believed the Fed would hike zero times or only one more time (one and done). That is now the consensus view, but it was not then.

- Now, I am confirming that notion. This next hike will be the last in a gauntlet of a hiking cycle.

- Positive economic data are increasingly validating the possibility of a soft landing. Inflation is coming down convincingly and potentially persistently.

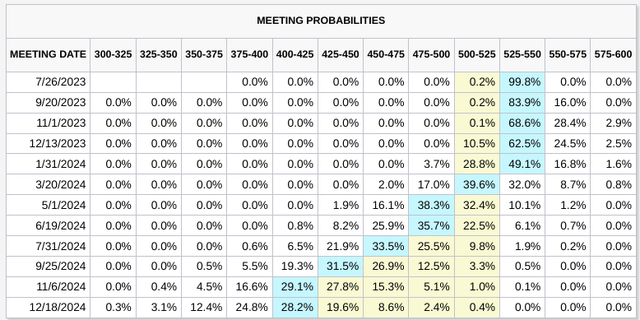

The current probabilities derived from Fed Funds futures suggest that the Fed will likely keep rates elevated at least through the end of 2023 and potentially further. The most probable path of rates currently implied shows that the Fed Funds rate would remain above 4% until 2024.

CME Group

Another PCE is reading at the end of the week that could bear on the Fed’s September rate decision, but the recent data has primarily favored the doves. Consider the following:

- Used cars were a key component resulting in eye-popping inflation readings, which are coming down significantly and likely continue to.

- June PPI was down after the June CPI reading, which was positive on several counts and showed critical elements of core inflation letting up.

- Atlanta Wage Tracker showed positive movement for the Fed’s goals.

- Job openings may be artificially high, and if they come down significantly, fewer people will lose their jobs than usually occurs in such a severe tightening.

- The stock market performance has broadened to include cyclicals and industrials, although recently, defensives have caught up a bit.

The bears have plenty of ammunition for their argument, but their time is also running out. At least, they won’t be able to insist that this prodigious rally has been a mere “bear market rally” anymore due to the time that has passed since the bottom in October.

Still, I love remembering what Professor Jeremy Siegel said when a TV interviewer asked if the market “had to capitulate with a VIX reading over 40.” Professor Siegel said, “The market doesn’t have to do anything.

Countervailing Forces in the US Economy and the Yield Curve that Cried Wolf

The aircraft carrier was, for a moment, the most essential weapon in the world. During the Second World War, it allowed the United States to take the fight to much of the areas recently conquered by the Empire of Japan in its ultimately successful island-hopping campaign. They still are a crucial part of US and allied military power across the globe. If you look at the title picture, you might think there’s not enough room for that giant plane to land.

Under normal circumstances, you’d be entirely correct. Still, in this case, the aircraft carriers have arresting cables that catch hooks on the plane and permit it to land in a much shorter space by dulling the enormous momentum of the giant aircraft. The planes are also sometimes assisted in take-off with a catapult system that enables the aircraft to accelerate faster than otherwise possible. On landing, the countervailing force of the arresting wires permits a much smoother landing than would otherwise be possible.

Landings, Soft and Hard: The Federal Reserve by Alan S. Blinder

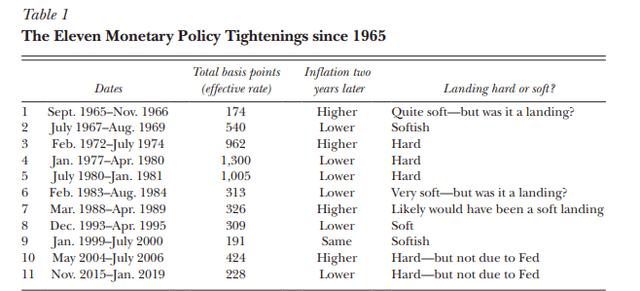

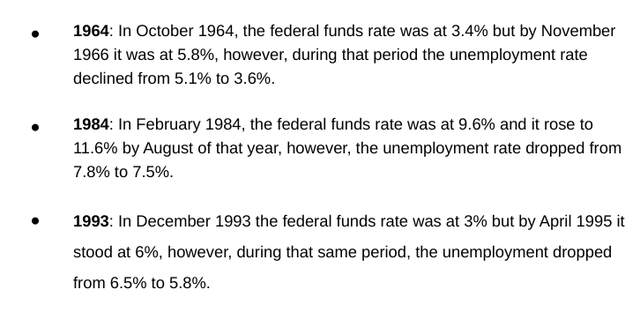

There are many different takes on how many soft landings there have been in post-war Federal Reserve history. I think Dr. Alan Blinder has a fascinating piece where he argues that they’re a lot more common than many folks would suggest. Of course, I am always attentive to what Professor Siegel has to say, and I find his recent comments on the economy particularly encouraging and supportive of the soft-landing scenario coming to fruition.

For Chairman Powell’s part, he has publicly stated that he considers the above three instances of Federal Reserve monetary policy outcomes to have qualified as “soft landings.”

Marcia Wendorf (Seeking Alpha)

One of the most oft-cited reasons for the bears to predict an oncoming recession that hasn’t materialized despite cries it will over an increasingly long period is a badly inverted yield curve. And the curve is ugly, to be sure. But there’s always debate about why the yield curve is doing what it’s doing. Long-term rates may be sending the signal that inflation is temporary, and the Fed will be able to cut in due time.

There are also positive countervailing forces in the opposite direction of the Fed’s robust tightening actions, both monetary and balance sheet. Massive government spending from President Biden’s three significant legislative accomplishments is starting to permeate through the economy. The other positive force is the alleviation of that supply chains stressed by the pandemic normalizing.

Furthermore, if recent visits by Secretaries Yellen or Blinken yield any positive results in alleviating economic tensions, this could also be a positive force in the Fed’s corner. Cooling economic tensions and reducing tariffs or export bans would be disinflationary.

Risks and Where I Could Be Wrong

Generally, this week is fraught with risk because of the high profile Technology earnings occurring concurrently and after the Fed decision. Given the prolific rise of the “Magnificent Seven,” any earnings misses could result in some tactical market carnage. Still, given the size of these firms and the persistent strength of the consumer, I think it’s possible that Big Tech will outperform and even shows some AI chops that shareholders like.

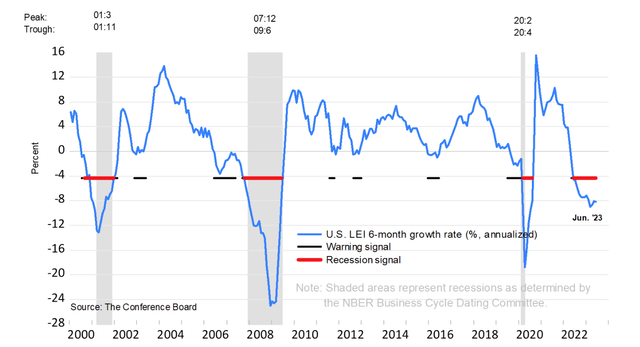

The Conference Board

Of course, if I’m wrong, and there’s a lousy data print that shows inflation persistently high, I could be wrong. The lag of monetary policy could suddenly hit the economy like a linebacker and knock the ball out of the bull’s hands. This is certainly a possibility. Furthermore, if the following risks ignite recession and panic, it could squash my thesis.

- Monetary policy lag and QT cause a rapid reversal of economic conditions.

- Debt-strapped companies start to buckle under the weight of higher rates, causing unemployment and diminished energy demand.

- Inflation returns.

- Fed policy error.

- Escalation of geopolitical tensions.

- OPEC.

Despite the risks, I’m increasingly confident that building animal spirits in the market will help climb the wall of worry. Yet, the slowing labor market and flat or flattish growth should be able to keep a lid on inflation. The consumer could buckle under the weight of rates as well, as some evidence shows is occurring in the housing market. Hard landings occurred in 1970, 1974, 1980, 1990, and 2008. This year could very well join their ranks.

Conclusion

Increasingly, there are growing calls that a soft landing is becoming possible because the data supports it. In May, June, and July, you can count the number of bad data releases on the one hand, and that is saying a lot given the tumultuous ride we’ve had since COVID. But that’s the thing; COVID is diminishing in the rearview mirror. With it is the historical significance of a lot of data that occurred before the cycle.

What this effectively means is that people are flying blind and that it is tough to orient yourself as to where we are in the economic cycle. However, countervailing economic forces are making a soft landing that might seem impossible by some vantage points much more likely. Part of the gap here is perception. The data is repeatedly coming in positive, but the sentiment remains negative. Bull markets begin on pessimism, and this is still evident in institutional positioning.

The upcoming Fed meeting may contain hawkish rhetoric from Powell trying to wrangle a coalition amongst the uncertainty. However, I still think this is likely the last hike in a brutal Fed hiking cycle. The data points to extraordinary resilience in the US consumer and economy, suggesting a soft landing is increasingly likely.

Read the full article here