Summary

Sprouts Farmers Market (NASDAQ:SFM) is a supermarket chain that sells organic, fresh produce. It offers a wide range of produce, from supplements to meat to dairy, and caters to health-conscious consumers.

SFM’s 3Q23 is mixed as it shows revenue growth, but gross margin is contracting and costs are rising. The gross margin contraction is due to inventory shrinks and distribution center expansion. However, gross margins are expected to remain flat in the long run. On its bottom line performance, management is expecting a stable operating profit margin in the long term as well. With its revenue still showing growth, strong e-commerce growth, and its successful partnership with DoorDash, I expect SFM’s future growth outlook to remain positive. However, due to the lack of any price appreciation opportunities, I am recommending a hold rating for SFM.

Financials/Valuation

As SFM is in the food retail sector, it is sensitive to inflation. When inflation spiked in 2022, it affected SFM negatively and it reported revenue decline of 5.70% and this is in addition to 2021 being a tough comps year as the low inflation and COVID recovery bolstered its revenue growth. Despite the fluctuating revenue, EPS has been growing consistently. In 2019, EPS was $1.25 and it has since grown to 2022’s $2.39. The robust EPS can be attributed to its strong operating income margin. In 2019, it reported 3.93% and it has grown by ~45% to 5.72% in 2022.

Valuation

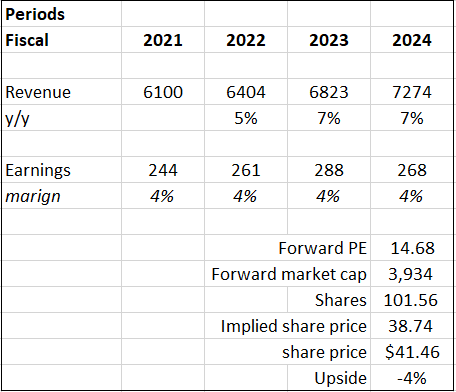

Based on my view of the business, I anticipate a 7% growth in SFM’s revenue for FY23 and FY24, aligning with the general market consensus. This projection is influenced by the successful partnership with DoorDash and its strong e-commerce performance and growth. However, it is experiencing gross margin contraction due to its expansion of distribution centers as well as inventory shrinks, and these impacts are expected to continue into FY24. However, in the long run, management is aiming for a flat gross margin and modest growth in EBIT and EPS, driven by prudent expense management. On a better note, its partnership with DoorDash and strong e-commerce performance will likely drive future growth and bolster its growth outlook.

Based on author’s own math

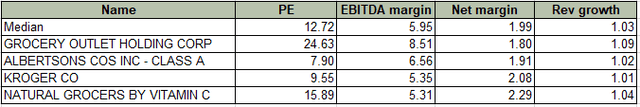

Peers overview:

Based on author’s own math

SFM now trades at 14x forward PE, higher than peers’ medians of 12.72x. This can be attributed to its superior margins and growth outlook. SFM’s EBITDA margin is 10.76%, while its peers’ is 5.95%. In addition, SFM’s net margin is 4.21%, while peers reported 1.99%. Lastly, SFM’s growth of 7% also surpasses peers’ 3%.

Comments

For 3Q23, net sales grew 6% to $1.713 billion. Adjusted gross margin declined year-over-year to 36.6%. As a whole, adjusted SG&A dollars rose 9.2% year-over-year to $503 million. Overall, it reported mix performance where net sales grew, but I am seeing pressure on gross margin as well as rising SG&A costs. As a result of these, the operating income margin contracted in the quarter when compared to the previous quarter.

In the quarter, the company’s expansion of its distribution centers and inventory shrink were the main drivers of its gross margin contraction, which decreased year over year to 36.6%. According to SFM, margins will be impacted for the next 12 months due to the recent expansions of the distribution centers. Leverage on the investment is expected to start in 24 months when the growth of new stores begins to absorb the additional capacity. With an eye on mix and pricing, the company aims to keep gross margins close to flat in the long run, and 4Q will most likely mirror 3Q in appearance.

Strong Q3 comps are a sign of improving volumes. The company achieved a top-line beat of approximately 2% as a result of comp store sales that were up 3.9%. While traditional grocery products have seen volume declines following two years of inflation-justified price increases, SFM stands out with strong e-commerce numbers and improving foot and online traffic. Management attributes the strong performance to consumer demand for attribute-based products, and the comp growth implies a return to positive volumes. The recent partnership with DoorDash to enhance digital offerings drove e-commerce sales, which accounted for over 12% of total Q3 sales for the company. However, considering that the company can only identify approximately 13% of customers, there is still untouched space to fully utilize customer data to enhance offerings and provide more tailored recommendations.

With SG&A rising as a proportion of sales and gross margin falling year over year, EBIT margin contracted. The management is confident in their ability to maintain a flat year-over-year gross margin in 2024, which suggests that they will use SG&A leverage to keep the operating profit margin stable. I anticipate that the general market will keep an eye on the progress of margins in light of the fast-paced store expansion, wage inflation pressures that the company is facing, and potential rises in marketing expenses to promote the brand in newer regions. In addition, management has set long-term goals of low-single-digit percentage compensation growth, stable EBIT margins, and low-double-digit percentage EPS growth. This means that, unlike the previous seven years, the team expects to be able to either increase gross margin or stabilize SG&A expenses.

Risk & Conclusion

SFM’s comps might end up being better if inflation lasts longer than expected. This is because inflation raises products’ nominal values, which will lead to an increase in revenue reported. Stores like SFM that focus on providing good value to customers may see an uptick in foot traffic and average purchases as a result of higher inflation.

In conclusion, I expect SFM to continue growing in the next two years, and this is driven by its strong e-commerce growth and its successful partnership with DoorDash. Despite facing gross margin pressures due to distribution center expansions and inventory shrinkages, SFM is trading at a higher forward PE compared to peers, reflecting its better margins and growth prospects. Although SG&A costs are rising and gross margins are contracting, leading to a contraction in EBIT margins, management remains confident in achieving a flat gross margin and stable operating profit margin in the long term. However, despite all these, it seems like its current share price has already priced in all its strengths. Hence, I recommend a hold rating for SFM.

Read the full article here