Dear readers/followers,

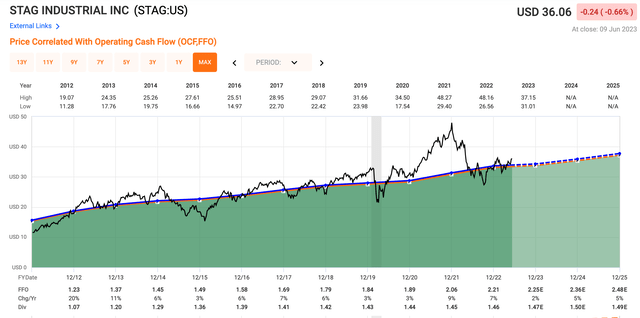

Last I wrote about STAG Industrial (NYSE:STAG) was back in February in my original article here. At that time, the stock was trading at $36 per share, which was roughly 16.5x their 2022 FFO. Since this was above the historical average P/FFO, I couldn’t reasonably expect to earn a positive return from multiple expansion. In other words, unlike so many other high-quality REITs, STAG simply wasn’t trading at a discount to NAV.

And since going forward the REIT was only expected to grow its FFO by about 4% per year and paid a dividend of 4% on top of that, I saw better opportunities elsewhere and decided to pass on the stock with a HOLD rating. I even mentioned that if the stock dipped below $32 per share, I would consider buying. And luckily it did dip below $32 (although briefly) so I started a small position there. Additionally, the company has reported two quarters of earnings since then (most recently Q1, 2023) so it’s time to update my thesis.

Seeking Alpha

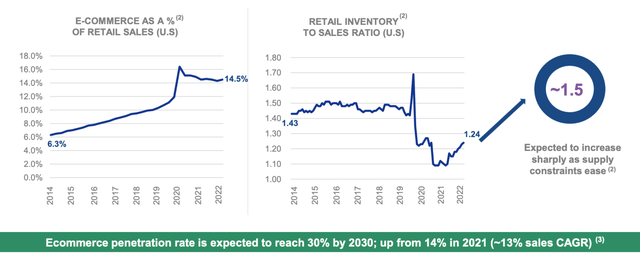

If you recall my original article, the logistics industry is expected to experience serious tailwinds over the rest of the decade. This is hardly new, but still it’s worth mentioning the two main drivers of demand for space. (1) Firstly, e-commerce as a percentage of sales is expected to continue the upward trajectory it’s been on and grow from 14.5% today to 30% by 2030. That’s a 13% CAGR that the 31% of STAG’s portfolio that handles e-commerce will directly benefit from. (2) And secondly, the amount of inventory as a percentage of sales is expected to revert from current levels of 124% back to the long-term (pre-pandemic) average of 150%, as soon as supply constraints ease (and that’s already happening). These two drivers combined should deliver 15%+ growth of the logistics industry.

STAG Presentation

Industrial REITs that own warehouses will be the main beneficiaries of this growth. Of course the biggest players will benefit the most and the sector is completely dominated by Prologis (PLD) whose market cap of over $100 Billion is triple the sum of its next 10 competitors. Still, STAG is a major player with a market cap of $6.5 Billion and shouldn’t be overlooked. Its smaller size also arguably makes it easier to grow. Beyond e-commerce and on a company level, management also expects that the on-shoring of manufacturing will be another tailwind, especially as several major projects that have been announced coincide well with STAG’s geographical presence near the Mexican border. In any case, the growth runway is definitely long for industrial REIT.

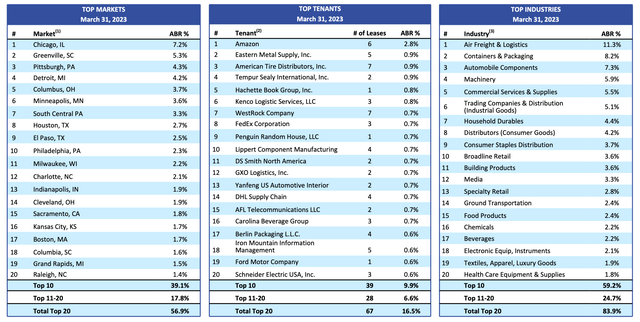

Below is an overview of STAG’s top markets and tenants. What’s noteworthy is their geographical presence is very well diversified across the whole country and has significant presence near the Mexican border, which is in contrast to competition which tends to be concentrated near major import ports (mainly Los Angeles for imports from China). This makes STAG safer and more stable in my opinion, especially because it will allow it to benefit from the increasing volume of imports from Mexico (rather than China).

STAG Presentation

The company’s operational results over the last two quarters have been pretty impressive. Occupancy remains very high at 98.1% as Q1 leasing results surpassed expectation. As of the end of April, 10 million square feet of space have been leased year-to-date, which already covers 78% of the full year leasing target. What’s even more impressive is that these leases were signed at a 30.6% cash spread. Such high spreads on new leases, combined with a solid built-in rent escalators that average more than 2.5% annually, contributed to 5.9% YoY same-store NOI growth.

Following such strong performance, management has increased their 2023 NOI growth guidance by 25 bps to 5% at midpoint. If achieved, this should translate into per share FFO of $2.25 (up from $2.21 last year).

In addition to strong internal growth, the company is also doing a good job of recycling its capital and growing externally. Despite only one small acquisition over the last two quarters (115,000 sft at a nearly 8% cap rate), the REIT is continuing to work on their development projects. In particular, a 715,000 square foot development project in Greer, South Carolina is expected to be completed within a couple of weeks and is seeing strong interest from tenants. On the sale side, STAG sold two non-core assets in Q1 for a total of $37 Million. The pricing implies a cap rate of 5.2%.

Internal as well as external growth is expected to fuel FFO growth beyond this year of roughly 4-5% this year. And again, I expect STAG to grow a bit slower than peers that are more concentrated near ports, because those will benefit from e-commerce related growth the most. The flip side of that is a more stable and predictable performance.

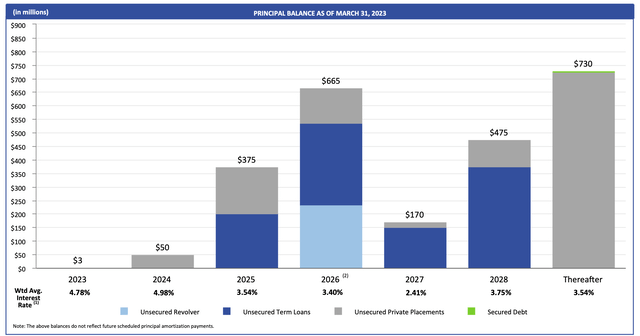

This stability will be underpinned by a very healthy BBB rated (Fitch, unrated by S&P) balance sheet with a reasonable net debt / EBITDA of 5x. With all debt (except for the line of credit) fixed-rate and essentially no debt maturities early 2025, I consider the debt well staggered and don’t expect any interest expense surprises.

STAG Presentation

Shareholders receive a monthly dividend of $0.1225 per share, which yields just over 4% and is well covered with a forward payout ratio of 65%. Historically, STAG has only increased the dividend very slowly, with a 5-year average growth rate of just 0.7%. This was mainly because the payout ratio was relatively high and management wanted to bring it lower to more manageable levels before driving the dividend higher. Now that we’re at a 65% payout ratio, though, I see no reason why the dividend should grow slower than FFO. This is why I expect dividend growth to pick up to 4-5% per year.

Once again, that brings us to valuation. The stock price has barely moved since my last article, but FFO estimates have increased slightly. The stock now trades at 16.2x FFO and an implied cap rate of 5.5%. The implied cap rate in particular suggests that we’re getting a decent deal, because it’s above the average cap rate achieved on disposal of non-core assets. Overall, STAG is not cheap here, but it is not expensive either. As Warren Buffett says, “you should try to buy great companies at a good price, rather than good companies at a great price” and STAG is definitely a quality business worth considering if you’re looking for income and stability with market level returns.

Fast graphs

I expect STAG to return the following:

- 4% dividend, growing at 4-5% per year

- 4-5% annual FFO growth

- potentially some upside from multiple expansion in a bull market

- Total expected annual return of 9%

That’s clearly not something that will make you rich, but stability has its place in a portfolio. With this in mind and because I already bought shares (though at $32 per share) I upgrade STAG to a “BUY” here at $36 per share.

Read the full article here