Valued at an EV/EBIT of ∼1.3, Stellantis (NYSE:STLA) is such an easy value pitch. Even if the company were to structurally lose market share against Tesla (TSLA) or Chinese low-cost producers BYD (OTCPK:BYDDF) or XPeng (XPEV), an investment in Stellantis will very likely yield handsome returns for years to come. But interestingly, is not showing signs of giving in to the competition: In Q1 2023, the European car conglomerate achieved an exceptionally strong performance, beating market expectations with regards to both car shipments (volume) and pricing.

Reflecting on a strong earnings report, paired with confident management guidance, I update my EPS expectations for Stellantis through 2025; and I now calculate a fair implied target price of $37.66/ share.

For reference, Stellantis stock has outperformed YTD: Since the start of the year 2023, STLA shares are up about 15%, as compared to a gain of close to 10% for the S&P 500 (SP500).

Seeking Alpha

Stellantis’ Strong Q1 2023

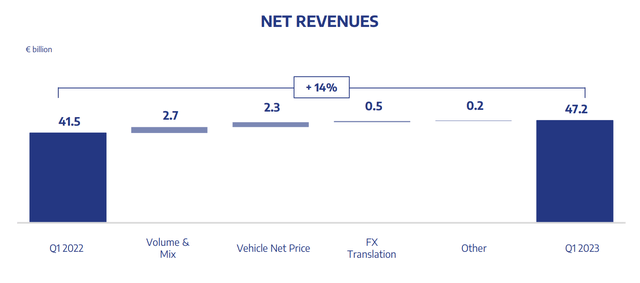

Stellantis reported strong Q1 2023 results, comfortably topping consensus estimates with regard to both shipments and revenues. During the period from January to end of March, the European car giant generated group revenues of EUR 47.2 billion, an increase of approximately 14% as compared to the same year prior, and about EUR 2 billion above analyst consensus estimates (according to data collected by Refinitv). While management did not share insights regarding profitability, management confirmed a >10% EBIT margin, which would bring the group’s operating profits in the EUR 4-5 billion range. For reference, this would be an annualized operating profit of EUR 16-20 billion, as compared to an enterprise value of about EUR ∼26 billion!

Stellantis strong Q1 performance was supported by favorable pricing, as well as volume expansion. For the group, consolidated shipments experienced a 7% increase compared to the first quarter of 2022, primarily attributed to improvements in fulfilling semiconductor orders. However, there was a decline in market share in North America (-160 basis points) and EU30 (-170 basis points) YoY, despite shipments being up 6% YoY in both markets. On the positive side, South America saw a slight increase (+20 basis points on 10% YoY shipments growth) in market share, while the Middle East & Africa region showed significant gains with a rise of 230 basis points in delivered share (shipments up 24% YoY in the region). Stellantis’ key luxury brand Maserati reported a 95% YoY jump in shipments and a 65% YoY expansion in revenue, as the new Grecale and GranTurismo models enjoyed favorable market reception.

Stellantis Q1 2023 reporting

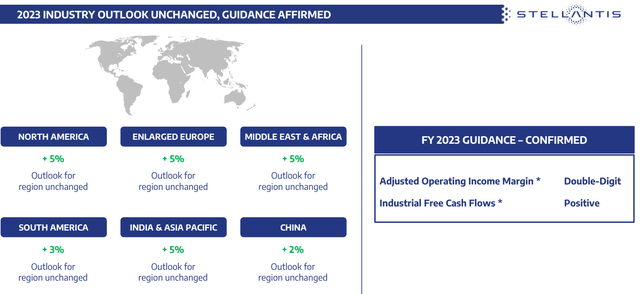

Looking into Q2 2023 and beyond, management confirmed significant YoY growth in shipments across regions, averaging around ∼5 percent. Similarly, Stellantis reaffirmed FY 2023 guidance of double-digit operating income margin and positive free cash flow.

Stellantis Q1 2023 reporting

Now, the implications of Stellantis’ strong financial performance are clear — exceptional shareholder distributions. On May 4th, Stellantis distributed about EUR 4.2 billion in dividends. And for the FY 2023, the group plans to complete about EUR 1.5 billion of buybacks, with the first EUR 500 million tranche expected to be completed as early as June 2023. Referencing a EUR ∼50 billion market capitalization, I would like to point out that Stellantis equity yield pushed well above 11%!

Inventory Risk Looks Manageable

Stellantis’ total inventory of new vehicles saw an upward trend, reaching 1.3 million units by the end of March. The company’s inventory now corresponds to approximately 2.5 months of sales, clearly above the average of 2.0 months from the previous year. This increase in inventory has raised concerns among investors who fear that an extended period of high inventory, coupled with weakened demand, may eventually lead to targeted price adjustments and lower margins.

In general, investors are right to point out fading EBIT margins in the auto industry and other well-known headwinds that pressure legacy ICE carmakers, including the BEV transition risk, Elon Musk’s price war, and a general cyclical risk due to a combination of falling consumer sentiment, inflation and high interest rates. But overall, I argue that Stellantis is less dependent than peers on macro pressure, as the gradual realization of merger synergies, and extensive scale/ cost advantages are likely to support adequate profitability even in less buoyant economic times.

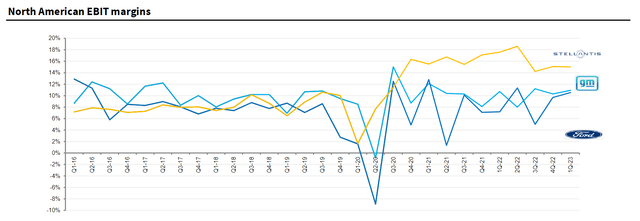

Referencing profitability, Societe Generale’s equity research team highlighted that Stellantis is materially outperforming US peers. In the fiscal year 2022, the European car conglomerate reported an adjusted EBIT margin of 16.4% (in NAM), while Ford’s (F) and General Motors (GM) adjusted EBIT margin was reported at 8.4% and 10.1% respectively. In fact, Stellantis EBIT margin is higher than Tesla’s, which is currently anchored at approximately 15%.

Societe Generale Equity Research

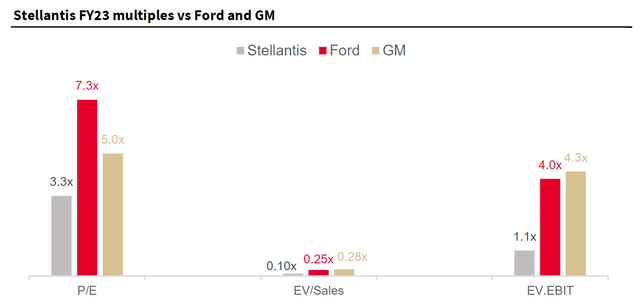

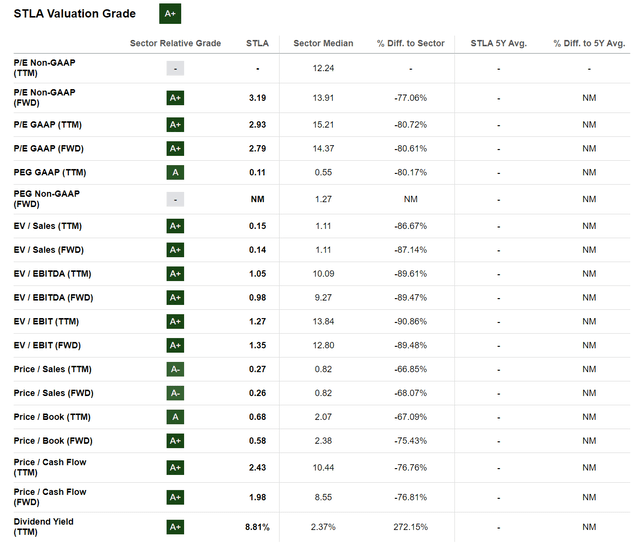

Interestingly, despite Stellantis strong profitability and solid execution on a low-cost business model, the company’s equity is priced at a steep discount. On an unlevered basis (Enterprise value) the discount is even steeper.

Societe Generale Equity Research

In general, Stellantis’ valuation almost looks like a ‘joke’ when compared to peers. According to data collected by Seeking Alpha, STLA is currently trading at an EV/Sales of x0.3 and an EV/EBIT of x1.3, which would imply a discount to the automotive industry median of approximately 87% and 89% respectively.

Seeking Alpha

Target Price Update

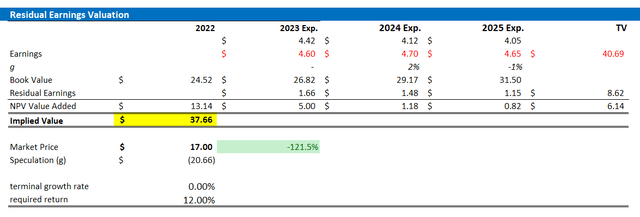

Reflecting on a supporting interest rate environment for all asset classes, paired with solid business model/strategy execution from CEO Carlos Tavares and team, I upgrade my EPS expectations for STLA through 2025: I now estimate that Stellantis’ EPS in 2023 will likely expand to somewhere between $4.5 and $4.7. Moreover, I also raise my EPS expectations for 2024 and 2025, to $4.7 and $4.65, respectively. Notably, my estimates are approximately +/-10% in line with consensus EPS, according to data collected by Refinitv, and also in line with management’s 2023 strategy — based on a double digit operating profitability on a EUR ∼210 billion of revenue.

I continue to anchor on a 0% terminal growth rate (clearly reflecting conservatism), and I increase my cost of equity estimate by 200 basis points, to 12%, accounting for the most recent ‘price war’ in the BEV market.

Given the EPS update as highlighted below, I now calculate a fair implied share price for Stellantis equal to $37.66.

analyst consensus; author’s calculation

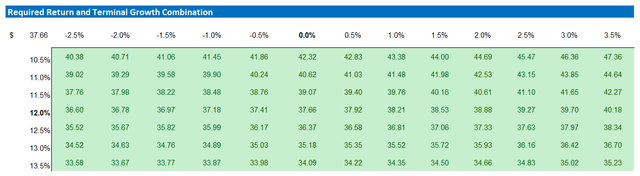

Below is also the updated sensitivity table.

analyst consensus; author’s calculation

Risks

As I see it, there has been no major risk-updated since I last covered Stellantis stock. Thus, I would like to highlight what I have written before:

As for Volkswagen, similar downside risks apply to Stellantis: 1) slowing consumer confidence globally, and especially Europe, due to inflation outpacing wage growth; 2) geopolitical risks including the Ukraine war and Stellantis’ exposure to China add to business uncertainty; 3) supply-chain challenges including semiconductor shortages, which could become even more challenging due to the Covid-19 lockdowns in China; 4) higher than expected CAPEX and R&D investments in order to realize the strategic repositioning towards an electric mobility provider; 5) timid EV adoption due to concerns about the EV technology and charging infrastructure build-up; 6) macroeconomic uncertainty relating to the monetary policy actions of the ECB and actions of the European/German government against Russia. And finally, following the FCA – PSA merger, integration of the two entities into one single conglomerate might prove more timely, costly and challenging than currently estimated.

Conclusion

Stellantis communicated a strong start into 2023, beating analyst consensus estimates. The better-than-expected topline numbers were driven by supportive volume shipments, as well as favorable net pricing. Admittedly, inventory accumulation was negative; however, the risk looks manageable from a profitability perspective, as Stellantis reaffirmed FY 2023 guidance of double-digit operating income margin and positive free cash flow.

Reflecting on a super cheap valuation of close to x1.3 EV/EBIT, despite a very competitive industry position, I reiterate a “Strong Buy” rating for Stellantis; I raise my TP to $37.66/ share.

Read the full article here