All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

I cover oil and gas stocks a lot. Not only because I’m fascinated by the industry and the importance of energy in every single supply chain imaginable but also because I believe in a long-term bull case that could likely send oil into triple-digit dollar territory the moment tight supply gets support from rising economic demand.

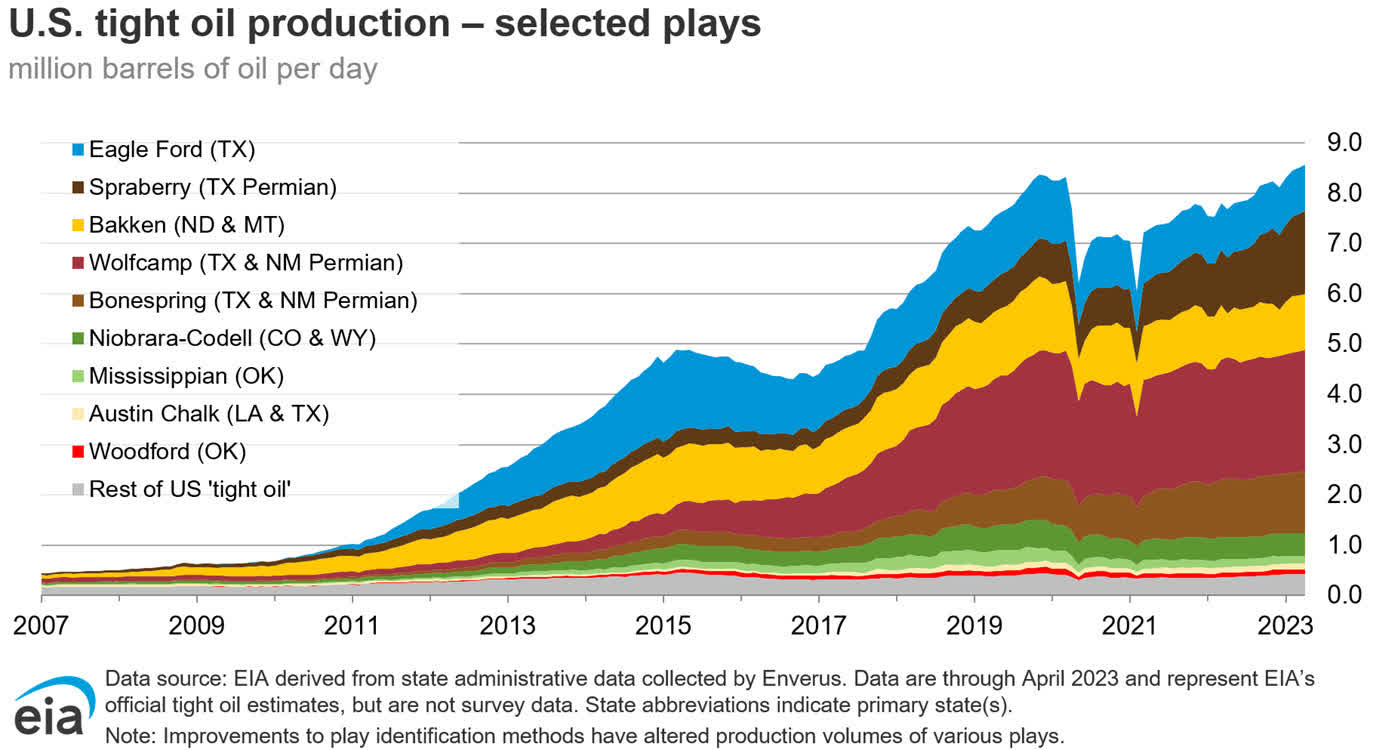

In my most recent article on this topic, titled My Top Energy Crisis Picks: 2 Dividend Powerhouses, I highlighted my view on the supply situation, which comes with a steep deterioration in tight oil production growth in the United States, which was the supply engine since the Great Financial Crisis.

Energy Information Administration

This is great news for the Canadians, who sit on massive oil reserves. Especially with prices increasing, companies are reducing debt, increasing dividends, and using buybacks to indirectly distribute cash to shareholders.

One Canadian star that has made a comeback is Suncor Energy (NYSE:SU), an integrated oil giant with a market cap of $53 billion in Toronto.

The company has high-quality reserves, efficient operations, and a well-integrated network of upstream and downstream assets.

It also yields 5%, which is why many readers asked me to take a closer look at this company. After all, I consider the energy space to be one of the best places for a high yield in the coming years – maybe decades.

So, let’s get to it!

What’s Suncor Energy?

Founded in 1919, Suncor Energy has a rich history in the Canadian energy industry. The company’s headquarters are located in Calgary, Alberta. Suncor is known for its expertise in oil sands development, which involves extracting oil from the massive oil sands reserves in Alberta.

Suncor Energy’s operations extend beyond oil sands to conventional oil and gas production. The company has a diverse portfolio of assets that includes oil and gas fields, refineries, and retail outlets across North America.

Suncor also has investments in renewable energy sources such as wind power and biofuels, reflecting its commitment to sustainability and reducing its environmental footprint, which has become common among major integrated oil companies.

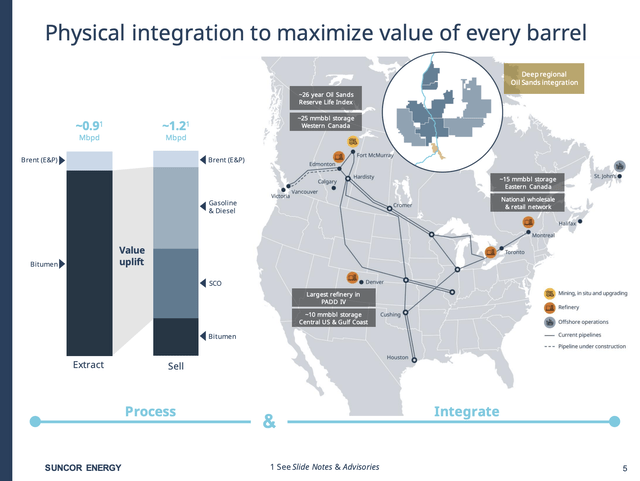

The overview below elaborates on this, as it shows the company’s operations in the Canadian oil sands, where it has roughly 26 years’ worth of proven reserves and massive storage facilities, allowing the company to run a massive refinery network with assets in various Canadian states and Colorado.

Suncor Energy

Furthermore, slightly more than half of the company’s production consists of oil sands, which have a very low decline rate and reservoir risks. This makes the Canadian players pillars of safety in an industry that relies on high-quality supply.

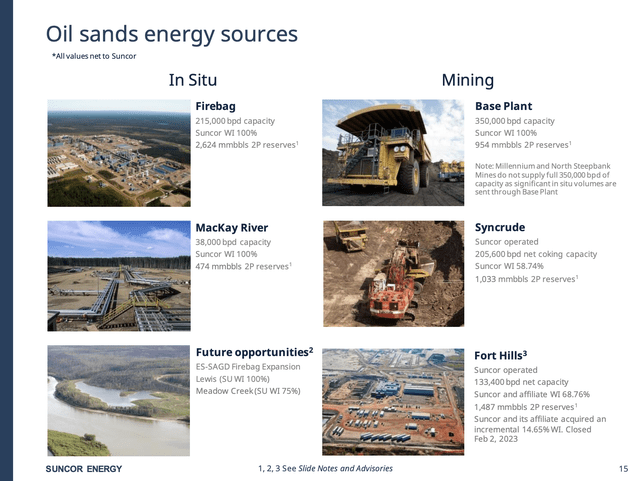

In its upstream operations, the company has In Situ operations, which refers to methods of oil sands production that use drilling and steam to produce bitumen. It also has mining operations. Two of these operations are joint ventures with other energy companies.

Suncor Energy

Offshore, the company has a stake in five drilling rigs. Four of them are operated by other energy companies.

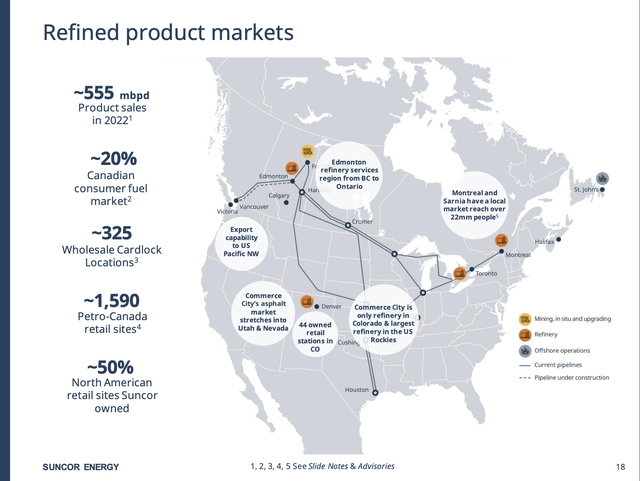

The company also operates four major refineries that have strategic benefits, given that they are perfectly in sync with the most available feedstock. In Canada, that’s oil sands. In Colorado, it’s from local basins that come with premium pricing.

Suncor Energy

Furthermore, because most of its production is used in its own refineries, the company generated 63% of its 2022 revenues in its Refining and Marketing segment (before inter-segment eliminations)

On a full-year basis, the company expects to produce between 740K and 777K barrels of oil equivalent per day. Up to 425K of this is expected to come with its fully-owned oil sands operations.

However, in its 1Q23 earnings call, the company noted adjustments to the 2023 production guidance due to the removal of expected production from Terra Nova and the impact of acquiring a lower-than-expected stake in Fort Hills. Hence, Suncor expects to be near the bottom of its upstream production guidance range for 2023.

Furthermore, the company announced the acquisition of Total Energies Canada for $5.5 billion, which includes a non-operated working interest in Surmont and a working interest in Fort Hills.

This acquisition adds high-quality bitumen production capacity to Suncor’s portfolio, strengthening its long-term free cash flow potential.

Suncor also mentioned the sale of UK E&P assets for 1.2 billion and the strategic partnership with Canadian Tires for long-term fuel supply.

Refinery sales are expected to be at least 550K barrels of oil equivalent with a minimum utilization rate of 92%.

Where’s The Shareholder Value?

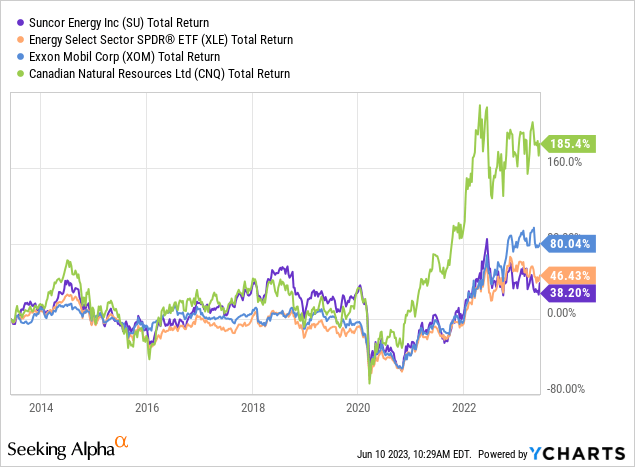

Over the past ten years, NY-listed Suncor shares have returned 38%, which includes dividends. The company underperformed the already disappointing performance of the Energy Select Sector ETF (XLE) and the 80% return of its much larger peer Exxon Mobil (XOM). Its Canadian peer, Canadian Natural Resources (CNQ), which I am a huge fan of, returned 185%.

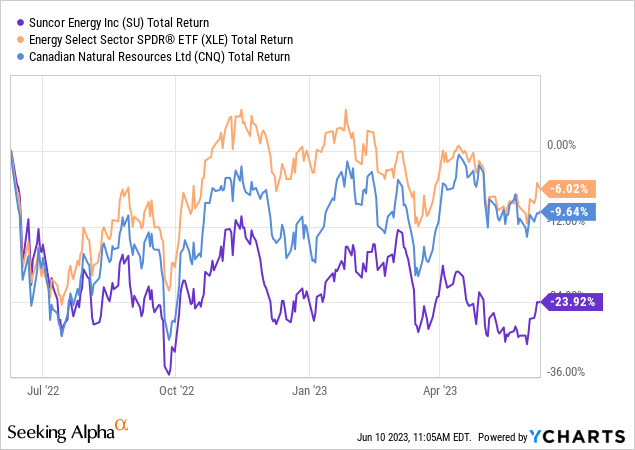

Over the past 12 months, SU shares are down 24%, which is much worse than its peers.

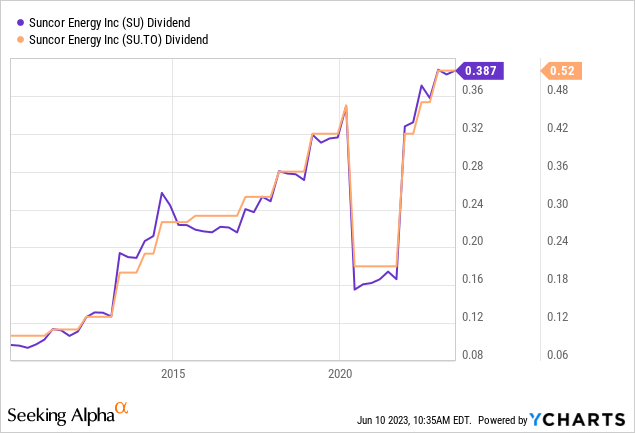

Despite the underperformance, SU shares have been a source of steadily rising dividends for a long time – except during the pandemic, which did a number on oil prices and refining demand. The company currently pays $0.52 per share per quarter, which translates to a yield of 5.1%.

On a side note, please be aware that Suncor pays its dividend in Canadian dollars, which means that for non-Canadians, currency translations will have an impact on the dividend just as much as official dividend payout changes.

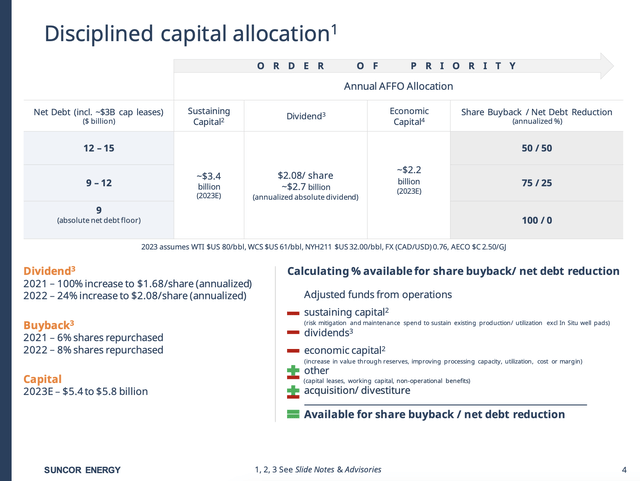

With that said, the company has a very straightforward capital allocation plan.

- Sustaining capital of roughly $3.4 billion in 2023. This supports existing operations and allows the company to operate without neglecting the quality of its assets.

- The dividend. Currently, 5.1% of its market cap.

- Economic capital to increase value through reserves, improving processing capacity, utilization, and margins. This is often known as growth CapEx.

- Share buybacks and debt reduction. Excess cash is spent on buybacks and debt reduction. In 2022, the company bought back 8% of its shares.

As the table below shows, the company’s capital priority changes as it lowers its net debt. The lower its net debt, the more money it shifts from debt reduction to buybacks. The company believes in a net debt floor of $9 billion, which would result in 100% of excess free cash flow being used for buybacks.

Suncor Energy

This year, the company is expected to lower net debt from $13.6 billion to $12.3 billion (0.7x expected EBITDA), which means 75% of free cash flow is expected to be used for buybacks. In 2025, net debt is expected to fall below $8 billion – excluding buybacks. After all, once the company hits $9 billion in net debt, debt reduction will stop.

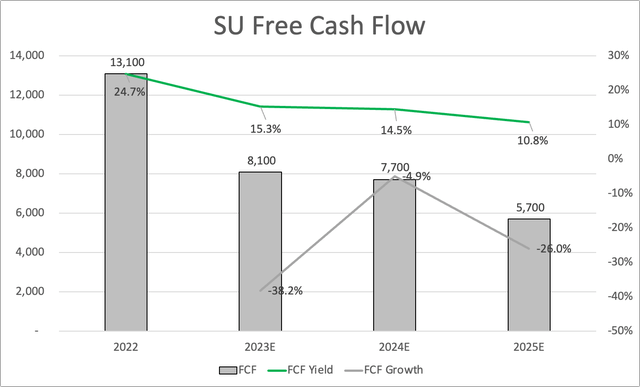

Looking at longer-term free cash flow estimates, we see that even if free cash flow were to moderate to $5.7 billion in 2025, the company would still have a double-digit free cash flow yield, which means its 5.1% dividend yield is protected, aggressive dividend growth is possible, and SU can buy back 3-4% of its shares per year.

Leo Nelissen

That said, analysts are pricing in moderation in oil prices, which I disagree with. I do not believe that SU will generate annual free cash flow below $8 billion if economic demand returns. Hence, I anticipate much stronger buybacks in the years ahead – on top of consistent dividend growth.

Given the company’s focus on buybacks and the impact this has on per-share values, I do not believe that SU will underperform the XLE ETF.

However, I’m also not putting SU on my watchlist. As much as I like Suncor, I prefer stocks that prioritize dividends over buybacks. I’m also not looking for refining exposure, which I own through my Valero Energy (VLO) investment.

I’m not saying this to keep people from buying Suncor but to explain why it won’t be a part of my portfolio. It wouldn’t be a great fit. I prefer pure-play oil and gas stocks with a focus on dividends.

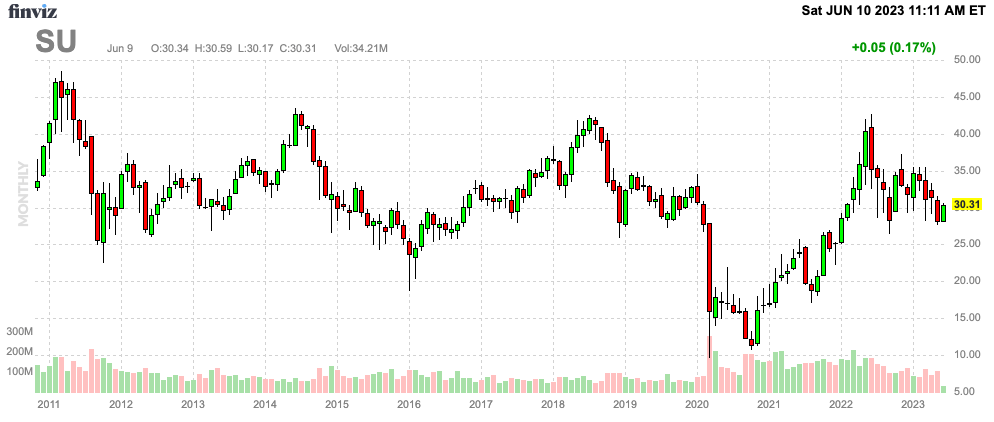

That said, I’m bullish on the stock, as the company has fantastic operations and a healthy balance sheet allowing it to reward investors. While the stock may fall to US$25 if economic headwinds persist, I believe that the long-term uptrend will push shares well beyond their all-time high.

FINVIZ

Needless to say, investors interested in energy stocks need to be aware of above-average volatility. Energy stocks are fun to own when economic demand improves. During downswings, not so much. However, that’s part of being a long-term investor.

Takeaway

With high-quality reserves, efficient operations, and a well-integrated network of assets, Suncor is well-positioned to benefit from increasing oil prices.

While SU shares have underperformed in recent years, they have provided steadily rising dividends, currently yielding 5.1%. Suncor’s capital allocation plan focuses on sustaining existing operations, dividends, economic capital for growth, and share buybacks and debt reduction.

As net debt decreases, the company plans to allocate more excess cash flow to buybacks.

While analysts may be expecting moderation in oil prices, I believe that SU’s strong operations and healthy balance sheet will enable it to generate higher-than-expected free cash flow and drive long-term shareholder value.

Read the full article here