Company Overview

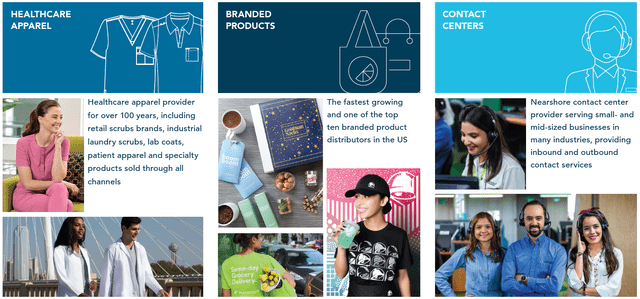

Superior Group of Companies (NASDAQ:SGC) is a prominent manufacturer and distributor of corporate identification garments, uniforms, and promotional products. SGC’s Uniforms/Branded Products business covers the design, manufacture, and distribution of uniforms and related garments, as well as the design and sale of promotional products and branded merchandise. The company’s Healthcare Apparel segment focuses on serving the unique apparel needs of the healthcare and medical sectors (such as scrubs, lab coats, protective apparel, and patient gowns), and while the Contact Center business focuses on providing remote staffing and call center solutions, including nearshore business process outsourcing.

The Uniforms and Branded Products division provides uniforms and branded products to a variety of industries, including food service, hotel, transportation, and retail. Custom uniforms, career apparel, and chef wear are among the products available in this area. The company also offers a variety of services such as design, sourcing, and distribution. Promotional Products offers a wide variety of promotional products and branded merchandise, including garments, bags, drinkware, and technology products. Healthcare, finance, technology, and education are among the industries served by Promotional Products.

Superior Group of Companies is predominantly based in the United States and has a significant presence in the North American market. The company was established in 1920 and is based in Seminole, Florida. SGC has also recently increased its global presence through acquisitions and collaborations, such as the 2019 acquisition of CID Resources, which increased its reach in the European market.

Company Investor Presentation

Strategic Investment Case & Competitive Advantages

The Strategic investment case for Superior Group is driven by a number of factors starting with SGC’s efforts to develop a diversified product portfolio over time. The company provides a vast array of goods and services, including uniforms, professional attire, promotional products, and branded merchandise. This diversification lessens the company’s reliance on any one market, enables it to serve a wide range of industries and cross-sell products to end customers.

Additionally, Superior Group of Companies has a robust in-house design and sourcing team, which enables the company to develop and manufacture customized products for its clients. This capability allows SGC to provide clients with customized solutions that satisfy their specific requirements and use cases.

SGC’s distribution network, which includes multiple distribution centers strategically located throughout the United States, also contributes positively to the investment thesis for SGC. This network enables Superior Group of Companies to quickly and efficiently distribute its products to customers across the United States. This speed is particularly important for the Healthcare Apparel segment where customers often don’t have time to wait for refreshed garments and also can’t afford to run out of stock / supplies.

Regarding branded/promotional products, the company has a lengthy history and a solid reputation in the uniform and promotional products markets. This brand recognition aids in building consumer trust and has allowed SGC to become the “default” provider of branded products for many of its clients.

Recently, SGC has also committed to a strong emphasis on sustainability, which is gaining importance among end consumers. The company has instituted sustainable supply chain practices, including the use of eco-friendly materials and waste reduction. Customers who are focused on ESG compliance are beginning to view SGC’s emphasis on sustainability as a differentiator.

Growth Opportunities

SGC’s growth prospects are supported by substantial market opportunities in each of its end markets. According to the company’s investor presentation, the US-Domestic TAM for Healthcare Apparel is $4.1 billion, $25.8 billion for Branded Products, and $101 billion for Contact Centers. SGC estimates that its market share for each of these segments is 6%, 2%, and 0.1%, respectively, indicating that the company has ample room for expansion if it can capture more market share.

While the TAMs emphasize SGC’s overall growth potential, the company is actively pursuing a number of growth-enhancing opportunities. In recent years, SGC has conducted trials and tests into new geographic markets. Historically, the company has focused on the North American market, but it has recently begun to serve clients in the EMEA region.

Given SGC’s extensive and diverse customer base, the opportunity to cross-sell and up-sell to existing customers could fuel substantial growth in the future years. Management continues to believe that its primary industries are highly fragmented and ripe for sales/market share expansion and consolidation.

Throughout its history, SGC has been opportunistically acquisitive. Although the current M&A climate is not necessarily favorable, the fragmented nature of SGC’s targeted operating markets will likely continue to present opportunities to acquire strategic and value-adding acquisition targets over the long term.

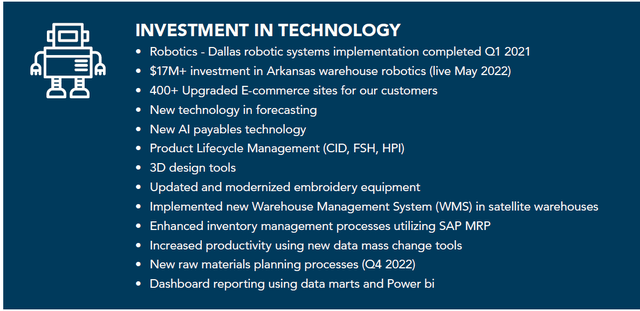

As demonstrated by the graph below, SGC has also begun prioritizing technology and R&D initiatives in order to promote growth and efficiency. Despite the fact that these activities may not have an immediate impact, many of these initiatives will yield positive results for the top and bottom lines over time.

Company Investor Presentation

Potential Investment Risks

Although there a number of growth opportunities available for SGC to pursue, the company is also facing significant operating and financial risks. At the moment, execution risk is one of the primary risk factors for potential investors to evaluate. SGC is operating businesses in 3 distinct end-markets, often with differing customer bases. Each end market comes with its own set of logistics and complexities to solve, all of which require management time and attention. Although SGC has historically been able to increase Revenue at double digits across these segments, the growth is not consistently translating to bottom-line profits and SGC has frequently taken hits for inventory writedowns and goodwill impairment. Although the potential is there, operating efficiencies do not yet seem to be consistently materializing across SGC’s core segments.

Similarly, it’s also worth highlighting that SGC operates in 3 highly competitive markets and faces competition from much larger and more established industry participants. As a result of the high level of competition, SGC’s pricing power appears to be low. While this alone does not make the company uninvestable, swings in profitability levels will likely occur during recessionary periods or generally during less favorable industry & economic conditions.

A final watch area for potential investors to consider is the company’s supply chain. The branded products and healthcare apparel segments are both dependent on global supply chains and inputs. Any disruptions could negatively impact SGC’s ability to fulfill customer orders. Although global supply chain pressures have eased recently, SGC will need to continue to invest in its supply chain capabilities to ensure a steady flow of products and materials during times of tight conditions.

Financial Overview & The Dividend

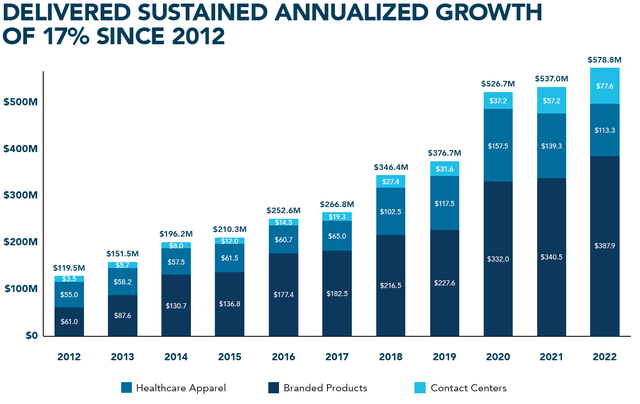

Across its core lines of business, SGC has demonstrated a sustained track record of growing sales. As indicated in the chart below, SGC has achieved 17% annualized revenue growth over the last 11 years and has seen total sales increase nearly 3.7x since 2012. In recent years, growth has been driven by the Branded Products and Contact Centers segments.

Company Investor Presentation

Moving down the income statement, we also see that gross margins have been largely consistent over the last decade, hovering in the 33-35% range. Gross profits have expanded for SGC in all but 1-year throughout the prior 10-year period.

With solid sales growth and consistent gross margins, it’s not surprising that SGC has also generated positive net income in 9 of the last 10 years. Unfortunately, SGC appears to have hit a bit of speed bump recently. After hitting $41M of net income in 2020, net profits fell to $29.4M in 2021 and all the way to -$32M in 2022. The lack of profitability in 2022 is largely due to $38M of non-cash inventory writedowns and goodwill impairments. Given that sales have expanded significantly in recent years, investors will want to keep a close watch on net profitability to see if management can restore the company to previous levels and further scale the business.

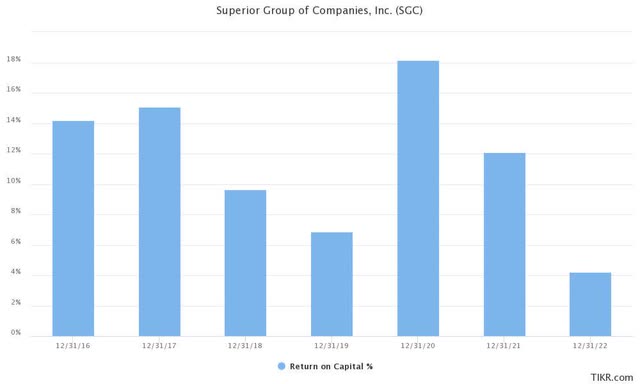

One of the bigger red flags for SGC is the Return on Capital. After consistently standing in the 10-15% range, ROC slipped all the way to 4.2% in 2022. While sales may be steadily growing, the chart below clearly shows that SGC is spending more capital to generate additional earnings.

TIKR

Turning to the balance sheet, SGC listed $17.7M of cash at YE 2022. Although this is the highest cash balance in years for SGC, it may not be enough to fund the company’s growth plans and the 7.4% dividend (more on the dividend coming below).

Total long-term debt also ballooned by 50% in 2022 to $150M and SGC’s debt-to-equity ratio now stands at 84%. Although the increase is a bit of an eye opener, the company seems to be in good shape to service the debt with an EBIT/Interest Expense ratio of 3.0x.

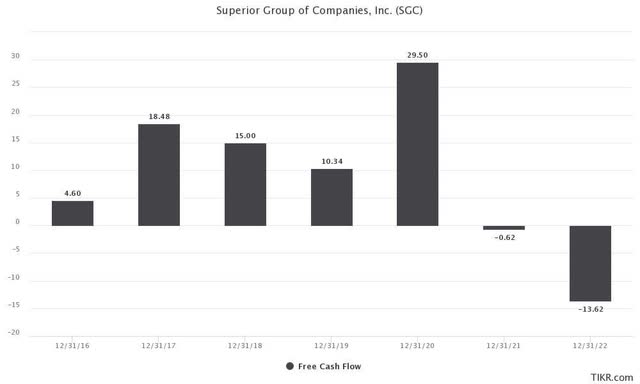

The free cash flow picture for SGC is also one of decline. As illustrated in the chart below, FCF has been increasingly negative over the past 2 years. Although the FCF cash burn is not at an alarming level, the trend really needs to be reversed given the recent slowdown in sales growth over the past few years. Burning cash without a solid growth story really doesn’t create much value in the long run.

TIKR

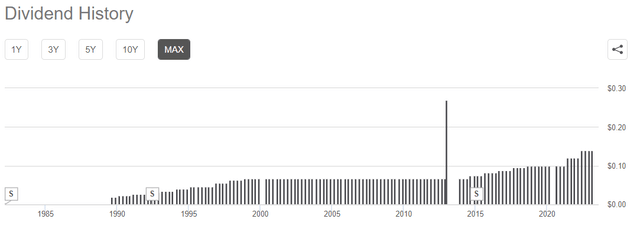

The final area of the financials to touch on is the dividend. Currently, SGC offers a very healthy dividend yield of 7.4%. If management hits its own projected earnings targets this year ($0.92 EPS) then the dividend appears to be well funded with a payout ratio of 61%. SGC also likes to tout that it has paid dividends every year since 1977. Technically, that is true. The problem here is that the company tends to frequently get ahead of itself in good times, only to have to pause the dividend for a few quarters during tougher times. As indicated in the chart below, the company had to pause dividends in 2000, 2009, 2013 and 2020. In 3 of those 4 years, recessions were either occurring or bubbles were bursting or both. Here we are in 2023 and according to many economists, a recession is looming. If that occurs, it wouldn’t be surprising to see SGC again pause the dividend given the current cash and earnings picture at the company.

Seeking Alpha

Overall, SGC gets an “average grade” for its financials. Credit is due for the consistent sales growth and gross profitability. Unfortunately, the company has underperformed on some of the most important metrics in this analyst’s view including FCF and ROC. Meanwhile, the dividend appears questionable within the current macro environment.

Valuation & Outlook

In their March 15th earnings call, SGC management guided toward 2023 full year revenue of $585 – $595M vs. 2022 sales of $579M and EPS of $0.92 – $0.97. The sales growth guidance of just 3% is a bit disappointing given that management has highlighted multiple growth opportunities and has not pointed to significant headwinds in 2023. The EPS guidance is also significantly lower than 2021 EPS of $1.91 (source: Seeking Alpha). For comparative purposes, industry analysts are projecting sales of $596M this year and EPS $1.01. Next year, sales growth resumes with analysts projecting revenue of $645M (8% growth) and EPS of $1.51. At the moment, the market is valuing SGC at just 7.5x 2023 earnings and just 5.0x projected 2024 earnings. Both valuations are significantly lower than the historical average multiple which has typically been in the 12x – 15x range over the last decade. Although it’s tempting to call SGC a value at this level, and even to suggest that the bad news is priced into the stock, it’s not completely clear that management’s execution plan is taking hold. There appear to be several factors that could further dent the stock price including a possible dividend pause, a broader market recession and finally SGC just not hitting its internal targets. As a result of these risk factors, SGC is a hold. Due to the risk, a more reasonable entry point for this stock would be $6.50.

Read the full article here