Growth stocks can be a risky proposition due to their higher volatility, which conservative investors may find hard to stomach. It can also be hard to “pick the right horse”, as what many investors are trying to do with names like Nvidia (NVDA), C3.ai (AI), and Palantir (PLTR).

However, one can still profit off “growth chasing” with asset managers that benefit from a rising tide. Such I find the case to be with T. Rowe Price (NASDAQ:TROW), which I last covered here back in March, noting its robust capital returns to shareholders.

TROW’s stock price hasn’t done much since my last bullish take on it, with the price being virtually flat, while the S&P 500 (SPY) has risen by 7.4% over the same timeframe. In this article, I discuss why that’s actually a great thing for investors and why now may be a good time to pick up this asset manager.

Why TROW?

T. Rowe Price was founded in 1937 and is one of the oldest asset managers on the market today and serves clients in 51 countries. It offers a full range of investment products including equities, fixed, income, blended, and target-dated retirement funds.

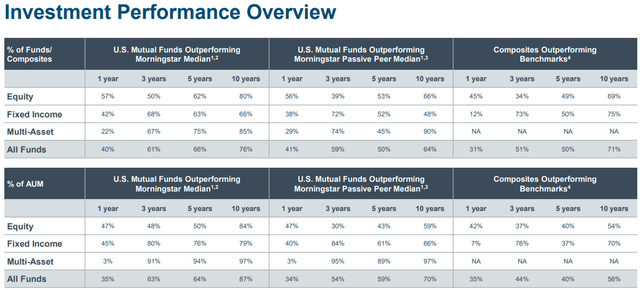

What sets TROW apart from other asset managers is its strong track record of outperformance in active managed investment funds. As shown below, well over half of TROW’s funds across its equity, fixed income, and multi-asset mutual funds have outperformed the Morningstar median over the past 3, 5, and 10 year periods.

Investor Presentation

At the same time, TROW is one of the few companies in the S&P 500 to carry virtually no long-term debt. This is reflected by LT debt standing at just $30 million, sitting very comfortably against $2.1 billion in cash on hand, resulting in a negative net debt balance. This makes TROW immune to the current high interest rate environment from a balance sheet perspective.

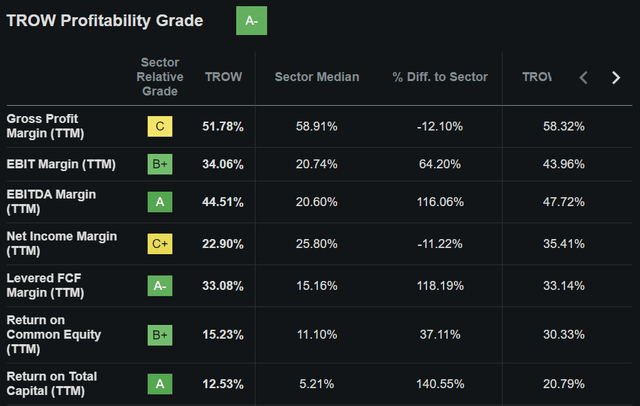

TROW has also earned a reputation for high profitability as it’s not a capital-intensive business. As shown below, TROW scores an A- grade for profitability, with sector-leading EBITDA margin and return on total capital of 44.5% and 12.5%, respectively.

Seeking Alpha

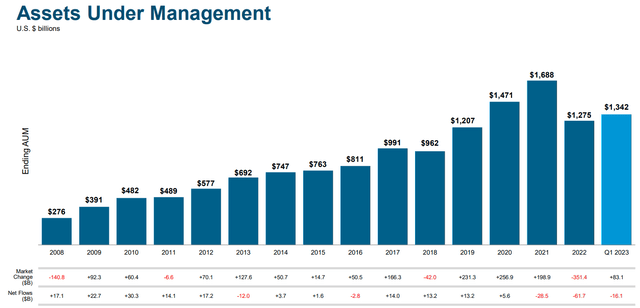

Those who closely follow TROW and the asset management industry as a whole would know that the times have been challenging for this sector over the past 18 months. That’s because higher interest rates had pressured growth stocks, resulting in lower AUM. TROW also set net client outflows of $16 billion during the first quarter.

While $16 billion may seem like a large number, it’s worth mentioning that it represents just 1.2% of TROW’s total AUM of $1.34 trillion. Moreover, as shown below, it appears that the tide started turning for TROW during the first quarter, as AUM ticked up by $67 billion since the end of last year.

Investor Presentation

This reversal appears to be continuing, as AUM edged up by 0.8% sequentially in April compared to March. Net outflows also slowed down to $3.7 billion in April compared to $4.5 billion in March.

Looking ahead, I would expect for AUM to continue rising for the remainder of Q2, as equity markets rebounded in May, led by tech-heavy names that are profiting from the AI-fueled boom. Plus, TROW’s AUM should also benefit from a stabilizing fixed income market. This is supported by markets anticipating that the Federal Reserve will skip an interest rate hike at its next meeting after 10 straight increases.

This stabilization, combined with a better-than-expected May employment report, in which payrolls rose by 339,000 jobs (ahead of the 190K jobs estimated by economists), bodes well for the economy as a whole and the stock market. This is reflected by the Dow Jones Industrial Index rising by 701 points in response to this report on June 2nd.

Meanwhile, TROW currently yields an attractive 4.4%, which is supported by a 68% payout ratio. TROW is also a dividend aristocrat with 36 years of consecutive growth under its belt. While TROW’s recent dividend growth has slowed compared to its 5-year CAGR of 14.9%, I believe investors are being compensated with the higher dividend yield with potential for a resumption to meaningful growth with a recovery in equity markets.

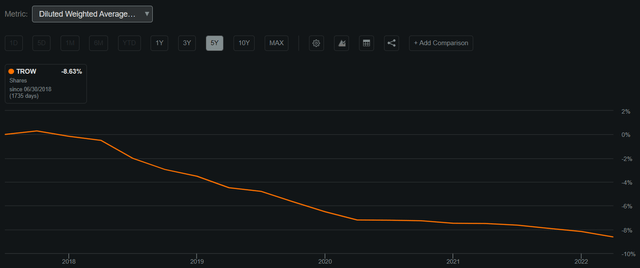

Importantly, TROW remains a compelling total return story, as in addition to dividends, it returns capital in the form of buybacks. As shown below, TROW has retired a respectable 8.6% of its outstanding float over the past 5 years alone.

Seeking Alpha

Lastly, TROW represents good value at the current price of $110.92 with forward PE of 16.2. This is considering the strength of its business model, stellar balance sheet, and analyst expectations for growth to resume in the near term, with 4% to 10% annual EPS growth in the 2024 – 2025 timeframe.

Investor Takeaway

In short, I believe TROW is an attractive investment at the current price, with a dividend yield that is nearly 3x that of what the S&P 500 offers. With its outperformance in active managed funds, fortress balance sheet, and steady capital returns to shareholders, investors could see potentially strong long-term returns despite short-term market noise.

Furthermore, with better-than-expected economic data coming out of May and a stabilizing rate environment, TROW could see more of a near-term boost. As such, income investors may want to consider layer into the stock at present levels.

Read the full article here