Talos Energy (NYSE:TALO) is partnering with Grupo Carso for Zama, selling a 49.9% interest in Talos Mexico for $124.75 million. This helps reduce Talos’s debt a bit, while giving it a strong Mexican partner.

Talos’s 2023 financial results are being negatively affected by well underperformance as well as weaker commodity prices. As a result, I now project it to end up with $40 million in cash burn at current strip. Talos’s 2024 financial results should be stronger as the bulk of its 2023 capex budget is for projects with first production in 2024.

I now estimate Talos’s value at approximately $17 to $20 per share in a long-term $75 WTI environment.

Zama Deal

Talos has agreed to a deal with Grupo Carso to sell it a 49.9% interest in Talos Mexico (which holds a 17.4% stake in Zama). This deal is expected to close in Q3 2023. Talos is receiving $124.75 million in the deal, including $74.85 million paid at closing and $49.9 million due at first production. S&P Global believes that first production could happen in 2026. The achievement of undisclosed milestones may also increase the purchase price.

Talos had 125.6 million outstanding shares at the beginning of May. Thus the deal values Talos’s full 17.4% stake in Zama at approximately $2 per share. I had previously not included any value for Zama in my calculations but believed that Zama could be worth around $2 to $4 per share to Talos if development went ahead. Thus this deal is roughly in-line (albeit towards the lower end) with my expectations around Zama’s value at this stage of development. This deal also gives Talos a strong Mexican partner.

Downward Revision To Production Guidance

Talos made a significant downward revision to its full-year production guidance as part of its Q1 2023 update. It mentioned that January and February production was in-line with expectations for both Talos and EnVen. However, various factors resulted in it lowering the midpoint of its 2023 production guidance by 5,500 BOEPD.

Talos indicated that delays in first production and underperforming early production rates from its Bulleit and Mount Hunter wells reduced its guidance by approximately 2,500 BOEPD (at midpoint of expected impact). Another 1,500 BOEPD was attributable to faster than expected production declines from existing wells, while 1,250 BOEPD was attributable to unplanned downtime with its operated Neptune facility as it attempts to optimize flow assurance there.

Talos has maintained its cost guidance, so the reduced production may result in a roughly $110 million impact to Talos’s projected free cash flow.

Updated 2023 Outlook

At current low-$70s WTI strip and Talos’s revised production guidance, I now expect it to generate $1.381 billion in revenues before hedges. Talos’s 2023 hedges have an estimated positive $14 million in value for the full year.

|

Type |

Barrels/Mcf |

$ Per Barrel/Mcf |

$ Million |

|

Oil |

18,250,000 |

$69.50 |

$1,268 |

|

NGLs |

1,700,000 |

$22.00 |

$37 |

|

Gas |

30,450,000 |

$2.50 |

$76 |

|

Hedge Value |

$14 |

||

|

Total |

$1,395 |

Talos has maintained its full-year cost guidance but did note that capital and operating expenses were trending below plan so far. Thus for some of Talos’s cost items I am using the low end of its guidance ranges.

|

$ Million |

|

|

Cash Operating Expenses |

$410 |

|

Cash G&A |

$90 |

|

Cash Interest Expense |

$125 |

|

Capital Expenditures |

$650 |

|

CCS Investments |

$80 |

|

P&A Expenditures |

$80 |

|

Total |

$1,435 |

This results in a projection that Talos will end up with $40 million in cash burn during 2023 at current strip prices. Further improvements in cost reductions may lower this burn rate.

Talos has also been repurchasing shares. By the end of Q1 2023 it repurchased 1.9 million shares for $26.6 million, leaving $73.4 million remaining under its $100 million stock repurchase program.

If Talos doesn’t do any further share repurchases, it should end 2023 with around $1.045 billion in net debt (its current level), before any impact from working capital changes. This doesn’t include the receipt of any Zama related payments. The first payment from Grupo Carso would reduce its projected year-end 2023 net debt to approximately $970 million.

Talos’s financial performance should be improved in 2024 since a large part (70%) of its 2023 D&C capex is for projects with first production in 2024. Talos will need those projects to start meeting expectations though, unlike its recent underperformance.

Estimated Valuation

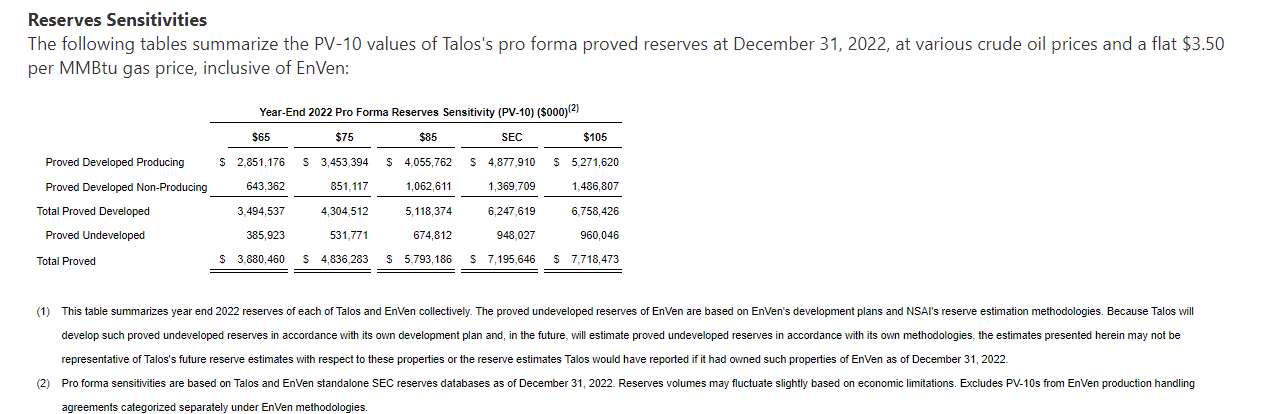

Talos estimated its proforma PD reserves (at the end of 2022) to have a PV-10 of $4.305 billion at the end of 2022 based on $75 WTI oil. Due to recent well underperformance (both in terms of early production rates and production declines), it may be reasonable to reduce the PV-10 to around $4 billion at $75 WTI oil.

Talos’s Reserves (talosenergy.com)

At a 0.8x multiple to PD PV-10, that would value Talos at $3.2 billion in a long-term $75 WTI oil environment. Net of Talos’s net debt, that would put a value of a bit over $17 per share, not including Zama or its Carbon Capture Business. Including those items may make Talos worth around $20 per share instead.

At a 0.7x multiple to PD PV-10, Talos may be worth approximately $17 per share including the value of Zama and its Carbon Capture Business.

Conclusion

Talos Energy has been dealing with recent well underperformance (and other) issues that led it to reduce its 2023 production expectations by around 7%. This has contributed (along with weaker commodity prices) to expectations for a modest amount of cash burn for Talos at current strip now.

On the positive side, Talos was able to get a strong partner for Zama, while derisking and partly monetizing its investment there. I now estimate Talos’s value at approximately $17 to $20 per share in a long-term $75 WTI oil environment. This valuation accounts for recent well underperformance as well as its Zama deal. From a free cash flow perspective, Talos should do significantly better in 2024, independent of commodity prices.

Read the full article here