Even when fundamental results for a business worsen year over year, the very act of a business exceeding analysts’ expectations can still be perceived by the broader market as bullish. A great example of this can be seen by looking at retail giant Target (NYSE:TGT). Even though the company reported modest sales growth year over year for the first quarter of its 2023 fiscal year, some of its top line readings were weak and it reported a decline in profits and cash flows. Despite this, on the day that this news came out, shares of the enterprise popped up, rising 2.6% for the day. Since then, general market pessimism has pulled the stock back down. This volatility may very well be perceived by some investors as an opportunity to buy in on the cheap. But when you look at how recent results have been and factor in broader economic uncertainty, I would make the case that there are likely better opportunities out there than this.

A surprise to the upside

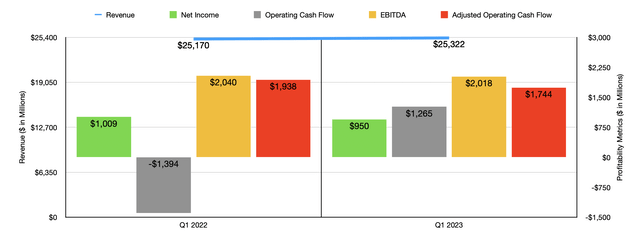

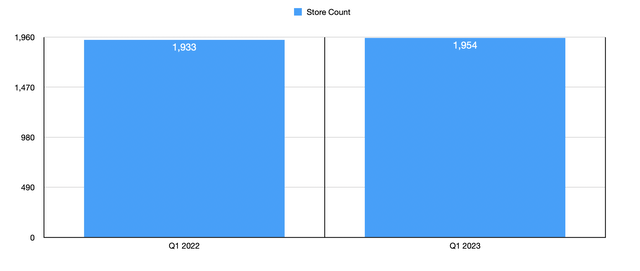

Before the market opened on May 17th, the management team at Target announced financial results covering the first quarter of the company’s 2023 fiscal year. Sales for that time came in at $25.32 billion. That’s only 0.6% above the $25.17 billion the company reported the same quarter one year earlier. However, it also exceeded analysts’ expectations by $65.3 million. This increase in revenue, as small as it was, was driven by some rather mixed financial results. For starters, the company did benefit from the addition of stores that it has in operation. At the end of the most recent quarter, the number of stores that it operates totaled 1,954. That’s up by 6 compared to what the company reported one quarter earlier and it’s 21 stores greater than the 1,933 that the company had one year ago.

Author – SEC EDGAR Data

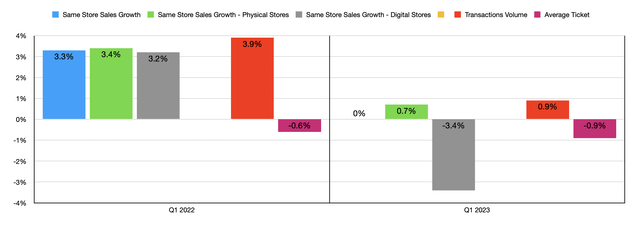

Overall comparable store sales remained flat. That was down from the 3.3% increase experienced for the first quarter of the 2022 fiscal year. But this reading was made-up of a couple of mixed figures. For instance, the company saw a contribution to same store sales growth of 0.9% because of a rise in the number of transactions customers made. But this was exactly offset by a 0.9% decline in the average value of a transaction. The actual physical stores that the company has reported a 0.7% same store sales increase. But this was offset by a 3.4% drop in digital same store sales.

Author – SEC EDGAR Data

Although revenue increased year over year, the same cannot be said of profitability. Earnings per share for the quarter came in at $2.05. That’s down from the $2.16 per share reported one year earlier. But it is $0.20 per share greater than what analysts thought it would be. The earnings per share reported by management translated to net profits of $950 million. That’s down from the $1.01 billion reported one year earlier. Other profitability metrics were largely down as well. The one exception was operating cash flow, which turned from a negative $1.39 billion to a positive $1.27 billion. But if we adjust for changes in working capital, we would see this number drop from $1.94 billion to $1.74 billion. Meanwhile, EBITDA for the business declined from $2.04 billion to $2.02 billion.

Author – SEC EDGAR Data

Even though management reported an improvement in its gross profit margin from 25.7% to 26.3%, with the decline largely stemming from lower freight costs, retail price increases, lower clearance markdown rates, a reduction in digital fulfillment costs because of lower digital volume, and other factors, there were weaknesses elsewhere. For instance, selling, general, and administrative costs grew from 18.9% to 19.8%. Management chalked this up to inflationary pressures, with the most noted involving higher pay and benefits that the company had to make out to its employees. An increase in debt balances, as well as the impact of higher floating interest rates, also pushed interest expense for the company up by $35 million year over year.

Despite these troubles, management has a largely positive view of the 2023 fiscal year. They expect earnings per share to be between $7.75 and $8.75. At the midpoint, this would translate to net profits of $3.82 billion compared to the $2.78 billion reported in 2022. This is in spite of the fact that management is now forecasting an extra $500 million from shrinkage this year. Although it can refer to multiple contributors, shrinkage largely refers to theft of the company’s goods. This is a massive blow to shareholders and it comes on the back of a difficult 2022 fiscal year when the company also reported significant losses associated with theft and other activities like it.

Author – SEC EDGAR Data

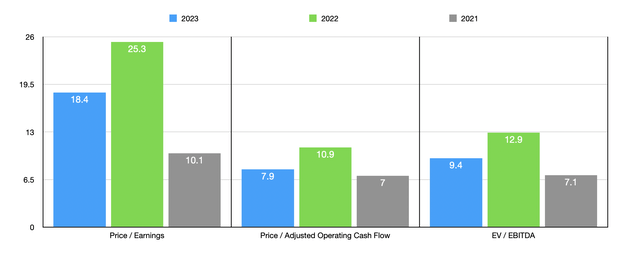

No guidance was given by management when it came to other profitability metrics. But if we assume that they increase at the same rate that earnings are forecasted to, then we would expect adjusted operating cash flow of $8.87 billion and EBITDA of $9.06 billion. Using these results, I was able to value the company on a forward basis for the 2023 fiscal year. Those results can be seen in the chart above. Also in the chart is how the company is priced using data from both 2021 and 2022. As you can see, 2023 is slated to be a better year than 2022 was. But because of the aforementioned weaknesses that the business is sporting, results are unlikely to be as appealing as they were in 2021. As part of my analysis, I also compared the company to five similar firms. These can be seen in the table below. On both a price to earnings basis and an EV to EBITDA basis, two of the five companies were cheaper than Target. Meanwhile, using the price to operating cash flow approach, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Target | 18.4 | 7.9 | 9.4 |

| Walmart (WMT) | 35.0 | 14.2 | 14.8 |

| Dollar General (DG) | 20.2 | 24.5 | 13.4 |

| Dollar Tree (DLTR) | 22.2 | 22.2 | 12.8 |

| The Kroger Co. (KR) | 16.2 | 8.0 | 6.3 |

| Albertsons (ACI) | 9.3 | 4.0 | 4.0 |

Assessing recent performance

In general, I believe that a lot can be gleaned from looking at certain fundamental metrics and how they change over time. Right now, the investment community seems to be very worried about the potential for a hard landing. With interest rates having spiked over the past year or so, aimed at combating inflation, and now coming off of a short lived but painful banking crisis, there are legitimate concerns about what the future holds. By looking at consumer spending patterns, we can get some idea as to how painful the situation is becoming for a sizable chunk of the population more broadly. For instance, if revenue figures are coming in weak, it could indicate that consumers are pulling back. Such a pullback could be a sign of additional of pain to come.

Author – SEC EDGAR Data

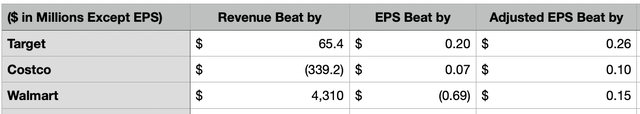

*Taken with Data from here, here, and here

Sticking to three major big box retailers, we do get some interesting insight. Two of the three companies, as you can see in the table above, reported revenue figures that were higher than what analysts anticipated. This on its own does not tell us much. But when we dig a bit deeper, we do find something rather interesting. It should be considered no coincidence that Walmart and Target reported sales that were higher than what analysts expected while the more costly Costco reported sales that fell short of expectations. Missing expectations should not be confused with overall weakness, however. In fact, sales for Costco as a whole grew by 6%, or about 7% if we ignore foreign currency fluctuations and fluctuations in gasoline prices. Comparable store sales growth was an impressive 6% across the company, with a decline in e-commerce sales of 10% negatively affecting the firm. All this means is that the company performed well, but that analysts were expecting rapid growth for a company that is large and quite developed. Such expectations may be unreasonable moving forward.

Author – SEC EDGAR Data

We also get some interesting insight when looking at profitability for these companies. On a GAAP basis, earnings per share for two of the three companies came in higher than what analysts anticipated. And on an adjusted basis, adjusted earnings per share were higher for all three firms. For context, the weakness for Walmart on a GAAP basis had to do with equity investment losses that the company booked. This means that the pain on its bottom line had really nothing to do with management’s core operating performance.

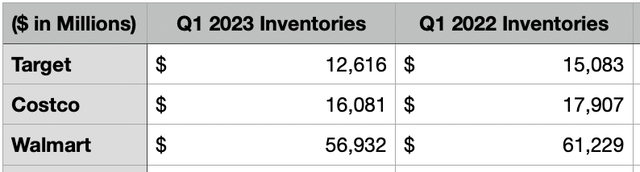

Another data point that we should touch on and where we do see some disparity involves inventory levels. For multiple quarters now, there has been the realization that an inventory glut that was created during the supply chain crisis, as an overreaction to the crisis, needs to be wound down. All three companies I looked at showed progress in this arena. Costco, for instance, saw inventory levels drop 10.2% year over year, while Walmart reported a decline of 7%. The drop for Target was even greater, coming in at 16.4%, with inventory levels declining 6.5% in the span of a single quarter.

Taken together, these data points tell us a lot of valuable information. Although Costco missed forecasts on its top line, all three companies reported fairly attractive results, with two of the three exceeding expectations. This, combined with an active emphasis by the management teams at all three firms has helped to push down inventories, all while management has been able to keep profits higher than anticipated. This shows not only quality management decisions. It also suggests to me that consumer demand remains resilient and that we are unlikely to see significant declines in product pricing in the general merchandise space. This is both a positive and a negative. It’s positive, because it shows that the economy is not yet collapsing. In fact, it indicates a surprising amount of strength out there. On the other hand, it’s also negative because we need to see a weakening in demand in order to put inflationary concerns to bed at last. What this could mean is that an eventual hard landing might become more probable if the picture remains stubbornly impressive because said strength could result in higher interest rates lasting for longer.

Takeaway

When it comes to Target specifically, I must say that I was fairly impressed with how the company performed compared to expectations. Inventory levels continue to drop while sales and profits both exceeded expectations. Interestingly, this follows a trend recently seen when it comes to two other major players in the space. Yes, Costco fell short when it came to revenue. But all three companies held up well from a profit perspective and when it came to reducing inventory levels. This is a sign that consumer demand is currently stronger than expected. This is positive because it means that the economy is doing better than many thought it would be doing. But when you consider that this could cause policy decisions that increase the risk of a hard landing, the picture for shareholders definitely it looks riskier. Because of this, combined with the fact that, on an absolute basis, Target has seen some weakness on its bottom line, I do believe that the ‘hold’ rating I assigned the stock when I last wrote about it in November of last year, is still appropriate.

Read the full article here