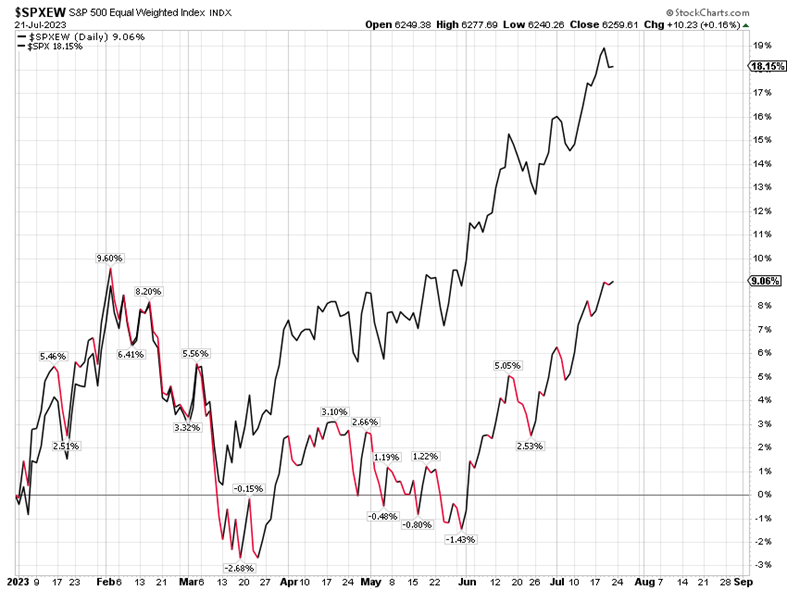

The Equally Weighted S&P 500 is now up solidly for the year, while in late May that equally weighted index was down for the year. A lot has improved in the last few weeks, and that is an overall positive.

Last week, we saw a rotation out of technology stocks into the cyclical sectors of the market, indicating investor sentiment that a recession will be avoided, and a soft landing is now a more likely scenario.

Still, it appears that the correction in the overheated NASDAQ 100 Index has started, and a most likely target will be the index’s 50-day moving average. This is my best guess as of this writing, as when these corrections get going, it is unknowable ahead of time when they will stop.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It is entirely possible that the broad market holds up better than the tech sector if such rotations continue, but that is also unknowable ahead of time. The market will also be paying attention to the economic numbers, which have been OK of late.

That the Fed would deliver 500 basis points of tightening in 15 months, and jobless claims would still be in the low 200k’s, would be difficult to predict ahead of time; but this is what a shortage of workers can do when combined with pent-up post-COVID demand.

Another Unnecessary Fed Rate Hike May Be Coming

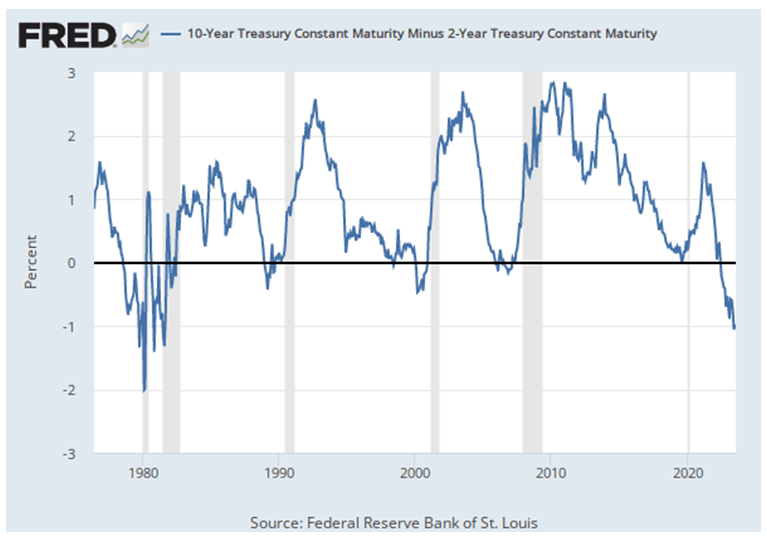

Futures markets and most observers agree that the Fed will hike rates this week by 25 basis points. This would take the Fed funds rate to 5.5%. The yield curve is as inverted as can be, as evidenced by the 2-10 spread, which is the most inverted it has been since Paul Volcker had to engineer two recessions in 1979-80 and 1981-82 in order to break the back of double-digit inflation.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

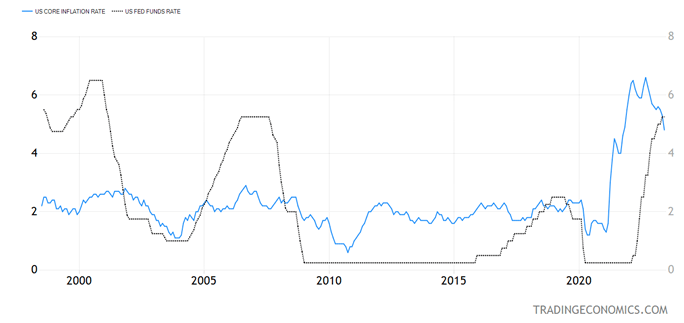

This time around, the overall inflation rate is 3% and falling while the core is at 4.8% and falling too, which is why the Fed will likely hike rates this week. Hiking rates into an inverted yield curve strikes me as foolish, as we never really know if the last rate hike will be the straw that breaks the camel’s back.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If the Fed were to wait three months, I believe both the core rate and overall inflation may decline more, the effects of the war in Ukraine notwithstanding, as this unresolved conflict still could re-escalate.

An inverted yield curve means that monetary policy is restrictive while inflation is falling, making it more restrictive without the lags of monetary policy being felt. This is a questionable strategy, in my view.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

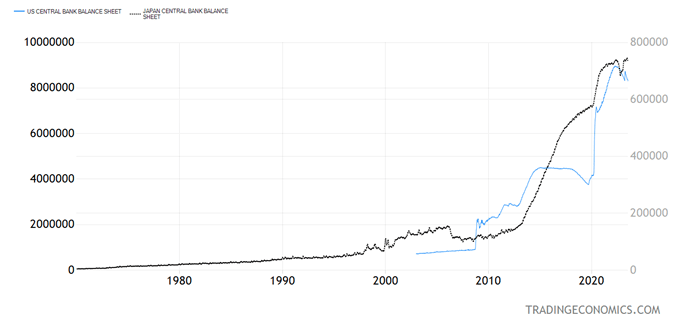

The Fed’s balance sheet is now shrinking and is already below the Silicon Valley Bank-induced bump along with the balance sheets of the ECB, Bank of England, and every major developed economy, other than Japan’s.

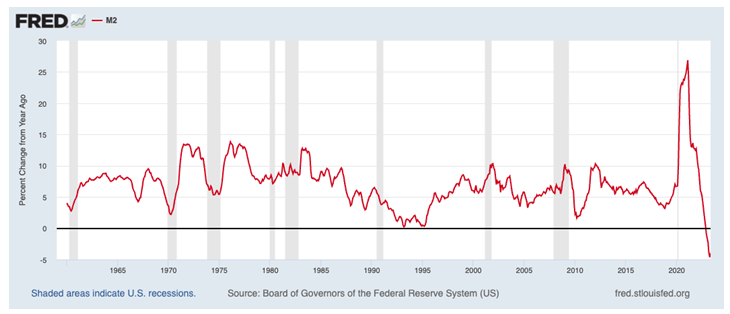

A shrinking balance sheet is a form of monetary tightening, which the Fed says will be ongoing even after the rate hikes are done. All this is happening as the M2 Money Supply is shrinking about 4%/month for an unprecedented sixth month in a row as of May 2023 (the latest data available).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The only good news here is that last month the shrinkage was less than the 4.62% registered in April. This M2 shrinkage suggests that inflation can decline quite a bit more by the end of 2023, making the Fed’s coming rate hike completely unnecessary.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here