Overview

In today’s analysis, I return to the insurance subsector of the financial industry, covering another big player in this space, The Hartford Financial Services Group (NYSE:HIG), also known just as The Hartford.

As in my previous articles covering this subsector, this is another stock I am adding to my insurance watchlist along with previous ones Prudential Financial (PRU) and MetLife (MET) that I covered. The sector has proven resilience despite market headwinds, and I look for companies that can weather a storm.

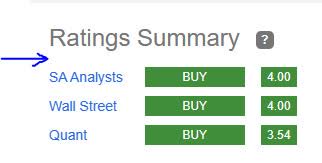

The Hartford gets a Strong Buy rating today, coming in slightly more bullish on this stock than both the SA and Wall Street consensus.

Its positives are proven dividend growth and competitive yield among peers, good P/E valuation and a current share price still in a value buying range, diversification across revenue segments & geographic markets, a high interest rate macro environment favoring its interest-driven assets portfolio, and a strong capital & liquidity position.

Company Brief

To give you a high level overview of what this firm does, from its Wikipedia page, it traces its roots to 1810 in Hartford Connecticut and is a Fortune 500 company in the business of property & casualty insurance, benefits, and mutual funds.

Notable mentions: 13th-largest property and casualty insurance company in the US.

Rating Methodology

Our rating consists of evaluating 5 areas separately: dividend yield, valuation & price chart trends, the company’s revenue & geographic diversification, capital & liquidity strength, and whether the current macro environment helps their business or hurts it. Each category is worth 20 points. A total score of 60 is a hold rating, below 60 is a sell, above 60 is a buy. A score of 100% would be a strong buy.

I then compare my rating against the consensus ratings from SA analysts, Wall Street, and the SA quant system.

Positive & Steady Dividend Growth

Based on Seeking Alpha data, as of June 28 this stock has a dividend yield of 2.38%, with no immediate ex dates coming up, and a dividend of $0.43 per share.

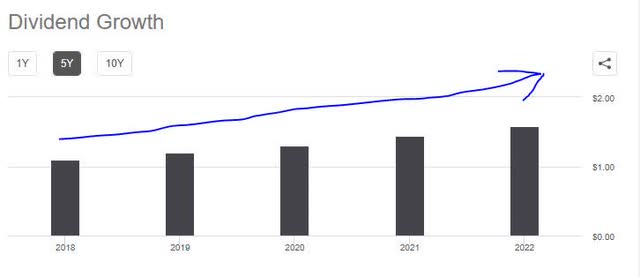

Its 5-year dividend growth was positive:

The Hartford – 5 years dividend growth (Seeking Alpha)

It went from an annual dividend of $1.10 in 2018, to $1.58 in 2022, or nearly a 44% gain over 4 years. In that time, it has paid dividends steadily each quarter without pause or cuts.

Two of its listed peers I will compare to are American International Group (AIG) and Assurant (AIZ) .

Assurant’s current dividend yield is 2.24%, and that of American Intl Group is 2.55%, putting Hartford in the middle of the two in terms of yield, while the three being in a close range.

Based on this data, I would add Hartford to a dividend income portfolio as it is competitive among peers in terms of yield, as well as having positive dividend growth and reliable payouts each quarter.

A Value Buying Opportunity

When considering valuation, I exclusively use Seeking Alpha metrics such as GAAP-based forward price to earnings (P/E) ratio and forward price to book (P/B) ratio.

For this stock, its forward P/E is 8.97, about 1% less than its sector median, and about 6 points less than the benchmark I use which is the S&P500 median of 14.93, which is gotten from Investopedia.

Its forward P/B is 1.46, about 54% above its sector median, and slightly above the 1.0 benchmark I use, which is gotten from Corporate Finance Institute.

Compared to its two peers mentioned earlier, American Intl Group has a forward P/E of 10.03 and a forward P/B of 0.90. Assurant has a forward P/E of 12.08 and a forward P/B of 1.40.

So, Hartford beats its peers on P/E valuation, but on P/B it is slightly more overvalued.

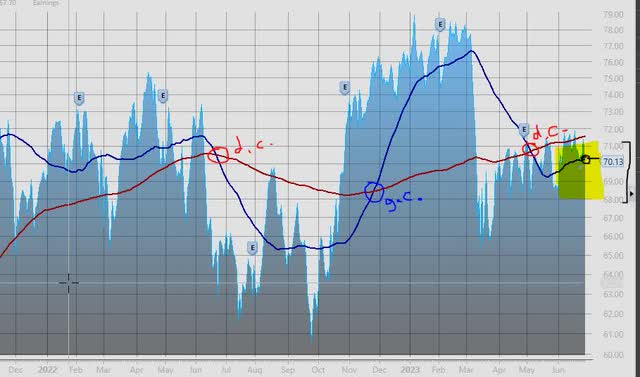

Next, let’s look at the current price chart for June 28th, where the price is trading at $70.13 shortly after market open this Wednesday:

The Hartford – price chart on June 28 (StreetSmartEdge trading platform by Charles Schwab)

The above chart I created tracks the price (mountain formation) against the 50 day SMA (blue line) and 200 day SMA (red line), from the period of Dec 2021 until now.

After the golden cross (g.c.) formation in Dec 2022 and bullish trend, we see the March dip around the time of the regional bank failures, followed by a death cross formation (d.c.) as a lagging indicator of bearish trend.

The area I highlighted yellow is my target buy range for this stock right now, a recommended buy price between $68 and $71, while it remains below its 200 day SMA acting as resistance. This morning’s price of $70.13 puts it in my buy range, for example.

Because Hartford has a good forward P/E valuation, and in my target buy range, I would recommend it as a value buy, although it could use some improvement to its price to book ratio, which is not bad but not great.

However, I am not the only one recognizing the value of this stock.

According to a June 28th article in Marketbeat:

Raymond James & Associates grew its stake in shares of The Hartford Financial Services Group, Inc. by 28.3% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission.

Lots of Revenue & Geographic Diversification

One deep dive into the company website and you can see that this firm is more than just insurance. It is diversified across a portfolio of various solutions including multiple types of insurance (auto, property, casualty, business) as well as employee benefit plans. It also runs a managed funds company called Hartford Funds.

As mentioned in a prior analysis covering the insurance sector, the business model is pretty straightforward: collect a lot more in premiums regularly than you have to pay out in claims, and “invest” the extra cash in an asset portfolio that earns more income.

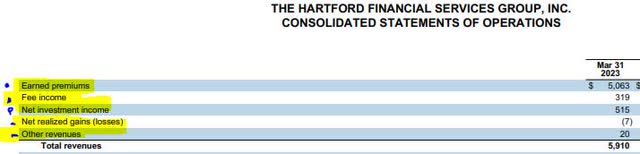

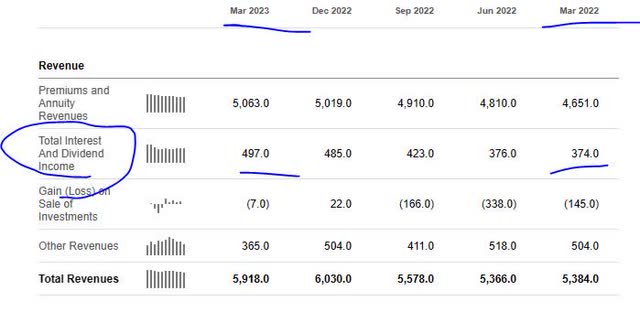

Consider the following from the firm’s Q1 results supplement, showing revenue distribution among 5 key sources: premiums, fees, investments, net gains, and other revenues:

Hartford – Q1 results – revenue by segment (Seeking Alpha Q1 results – financial supplement)

While premiums are the main revenue driver of course, net investment income contributes to about 9% of revenue for the quarter.

In terms of geographic market penetration, one notable thing to point out is that this firm can distribute through a national network of licensed insured agencies across America, similarly to some other insurance brands. It also has a partnership with AARP to offer auto insurance to its members.

So I think this firm is diversified both in revenue and geographic market penetration.

Solid Capital & Liquidity Position

For starters, CFO Beth Costello set a positive tone in her Q1 remarks:

We are actively managing our capital and, in the first quarter, returned $484 million to shareholders through repurchases and dividends.

This is a good sign of capital strength.

Additionally, when looking at the company’s balance sheet, they show positive equity going all the way back to 2021.

Also, their cashflow statement for March 2023 shows positives in both levered and unlevered free cashflow.

It is a cash plenty firm with $152MM in cash on its end of Q1 balance sheet.

In terms of financial position, I would consider it a relatively safe bet for the moment.

Macro Environment of High Interest Rates Favor this Firm

A macroeconomic trend in the last year has been high interest rates, with no signs of going down just yet, after the most recent Fed meeting kept them at bay, and the sentiment from rate traders indicating another rate hike at the next meeting.

I will show how this larger trend has helped this firm specifically, which happens to hold a portfolio of assets that earn interest income.

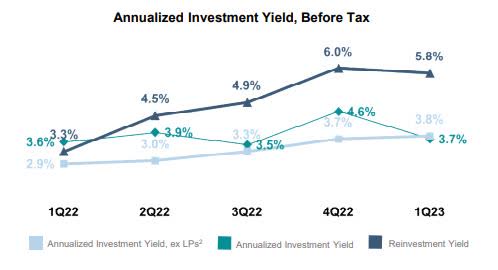

From its last Q1 results presentation, which speaks to growth in investment yield:

Net investment income of $515 million benefited from an increase in fixed income which had a 3.8% yield, before tax, a 10-basis point increase from 4Q22.

Hartford – Q1 results – investment yield (Hartford – Q1 presentation)

Also, here is the income statement tracking a 1 year period, showing YoY growth in interest & dividend income:

Hartford – income statement (Seeking Alpha)

In addition, even CFO Beth Costello mentioned in her Q1 results commentary that “our investment portfolio yield continues to benefit from higher interest rates.“

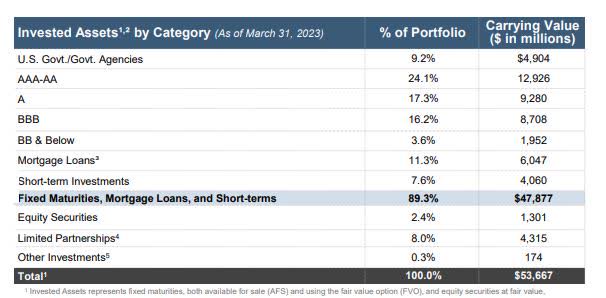

If you look at their asset portfolio, a large portion of it is tied to interest-income assets:

Hartford – asset portfolio (Hartford – Q1 presentation)

Therefore, I would recommend this firm as having a business benefiting from the larger macro environment of high rates, and from a forward looking perspective if I extrapolate over the next few quarters I anticipate continued performance from their interest-driven portfolio as long as the current interest rate environment continues, which it looks like it will.

Risks to my Outlook

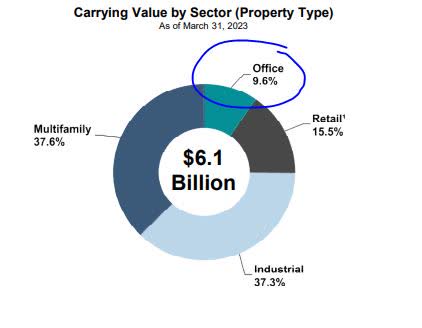

The risk to my bullish sentiment on The Hartford is that I expect investors will question the risk exposure this firm has in its asset portfolio, which could make them hesitant investors in this company’s stock.

This is understandable, considering the recent concerns over exposure to commercial real estate and office properties in particular.

The topic was highlighted in a May 16 article in The Financial Times:

The outlook for the US office sector looks particularly bleak, said Kiran Raichura, deputy chief property economist at Capital Economics.

However, I will show below that The Hartford is managing that risk well at the moment.

Consider that only 9.6% of the carrying value of their commercial mortgage loan portfolio consists of office properties:

Office property exposure (Hartford – Q1 presentation)

Other key notables they mention in their 1st quarter presentation: average loan to value of 52%, greater weight on multifamily & industrial properties, and all loans current through April 27 with no delinquencies.

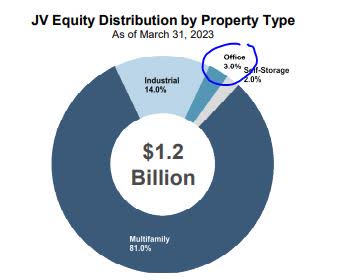

Additionally, their joint venture equity holdings have just 3% exposure to office property.

Hartford – JV Equity by property type (Hartford – Q1 presentation)

So, I think that while the concern for asset risk exposure is warranted among investors, this specific firm seems to be managing that risk well, keeping its exposure to office spaces low.

Conclusion

In conclusion, I reiterate my rating of Strong Buy.

This is slightly more bullish than the consensus from SA analysts, Wall Street, and the SA quant system:

Rating Consensus (Seeking Alpha)

This stock wins in all 5 of my rating categories: dividends, capital, diversification, macro environment, and valuation /price chart.

As mentioned before, I am adding this stock to my watchlist of insurance stocks, in the larger financial sector, as it is an industry worth watching.

Read the full article here