Executive summary:

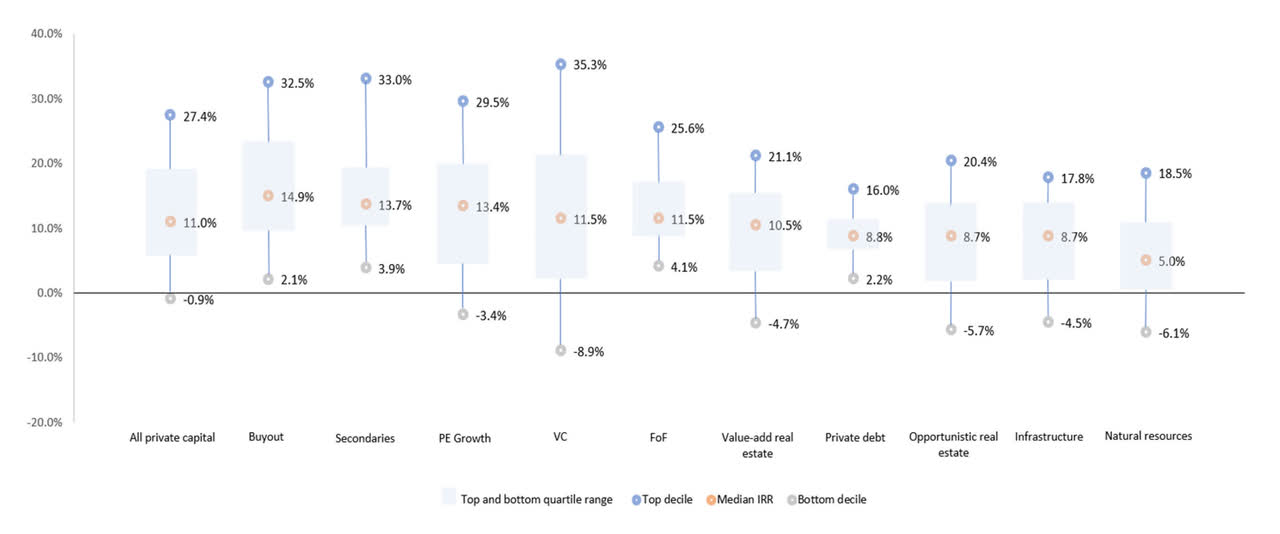

- Manager selection is critical when allocating to private markets, as there is a large degree of variability in returns between the top and bottom quartile funds. This dynamic is much more apparent in private versus public market funds. This makes it imperative to identify and access general partners who are accomplished investors with the potential to generate superior returns within their fund.

- An experienced and well-reputed private markets fund investor (limited partner) can access top-tier private equity general partners and their funds. A fund-of-funds approach allows investors to directly benefit from these relationships through access to highly sought-after funds that otherwise would not be accessible.

- While individual client circumstances and objectives may differ, we believe building a foundational exposure to private markets begins with broad diversification across strategy, geography access point, and vintage year. We think it is prudent for investors—particularly those who are in the early years of their programs—to obtain meaningful exposure to secondaries and co-investments.

When accessing private markets, it’s not a question of if but how.

While most investors would likely agree that the private markets investment proposition is compelling and demands more of a place as part of their strategic asset allocation mix, there perhaps is less agreement on what represents the optimal approach to implementing a private markets investment program. This is an especially critical question given the additional complexity in private markets that must be recognized and properly considered. We strongly believe the optimal approach to constructing a private markets portfolio is a fund-of-funds approach. To understand why, let’s examine how this approach compares to the alternative approach: building such a program in-house. But before we dig too deep, let’s recap the growth story in private markets over the past few decades—and the significant implications for investors.

Private assets: Managing complexity

Investment activities

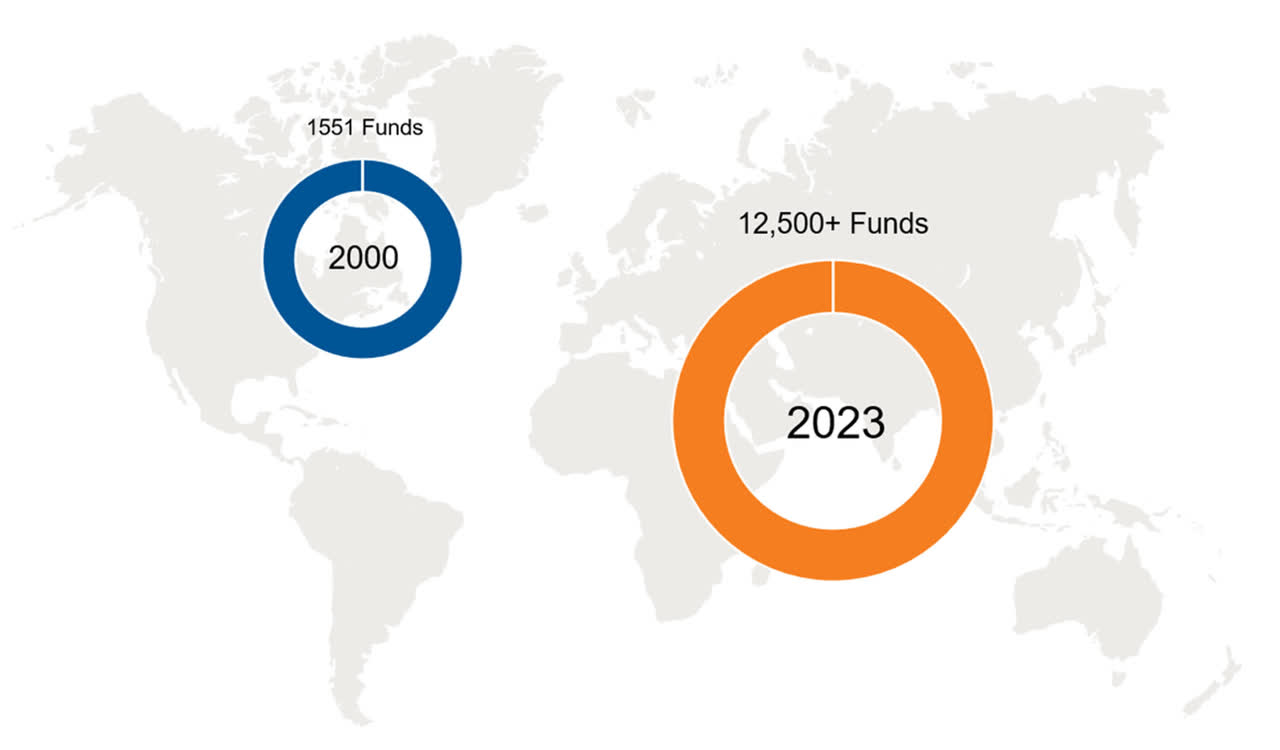

Today, private assets under management globally total $11.7 trillion.1 Commensurate with the industry’s growth over the last 20+ years, there has also been an exponential increase in the number of funds raised by private markets firms. According to data from Hamilton Lane,2 there has been a staggering increase of more than 700% in the number of funds raised over the last 20+ years.

Exhibit 1 highlights the growth in the number of funds raised has risen from 1,551 to over 12,500 funds today.3

Exhibit 1: Growth in the number of funds raised

The implication of such a substantial increase in the number of funds being raised is that investors need the requisite scale, expertise, and global resources to effectively identify, evaluate and select top-tier investment opportunities across the global private markets landscape.

Also, manager selection is crucial to performance. Unlike traditional equity and fixed income managers, where the dispersion of returns is less widespread, performance can vary dramatically among private asset managers. As illustrated in Exhibit 2,4 there is a large degree of variability in the returns between the top and bottom quartile funds. Indeed, the spread in annual internal rate of return (IRR) has been as much as 25.24%. This makes selecting the right managers paramount because even with perfect market views and a thoughtfully constructed portfolio, the negative alpha from poor manager selection can have a sharply adverse impact on achieving the desired outcome. As such, it is imperative to identify and access managers who are accomplished investors with the potential to generate superior returns and construct portfolios around them.

How to invest

Do-it-yourself or outsource to a fund-of-funds

Building a private markets portfolio can be achieved in one of two ways. Firstly, hiring in-house investment professionals to execute an investment process required to build a program is one option. While this can be an attractive option for some investors, costs are associated with hiring investment professionals, manager selection due diligence, internal monitoring and reporting systems, legal expenses, etc.

The other approach, which we firmly believe is the optimal one, is to gain exposure through a FoF. A FoF is a professionally-managed pooled or segregated investment vehicle whereby all investment (i.e., manager selection, portfolio construction, ongoing monitoring) and non-investment (i.e., ODD, legal reviews, reporting) functions are outsourced to a third-party firm. In this case, the burden of building and maintaining a private assets program is taken off the investor, allowing them to achieve access to a well-diversified portfolio even with relatively small commitment amounts.

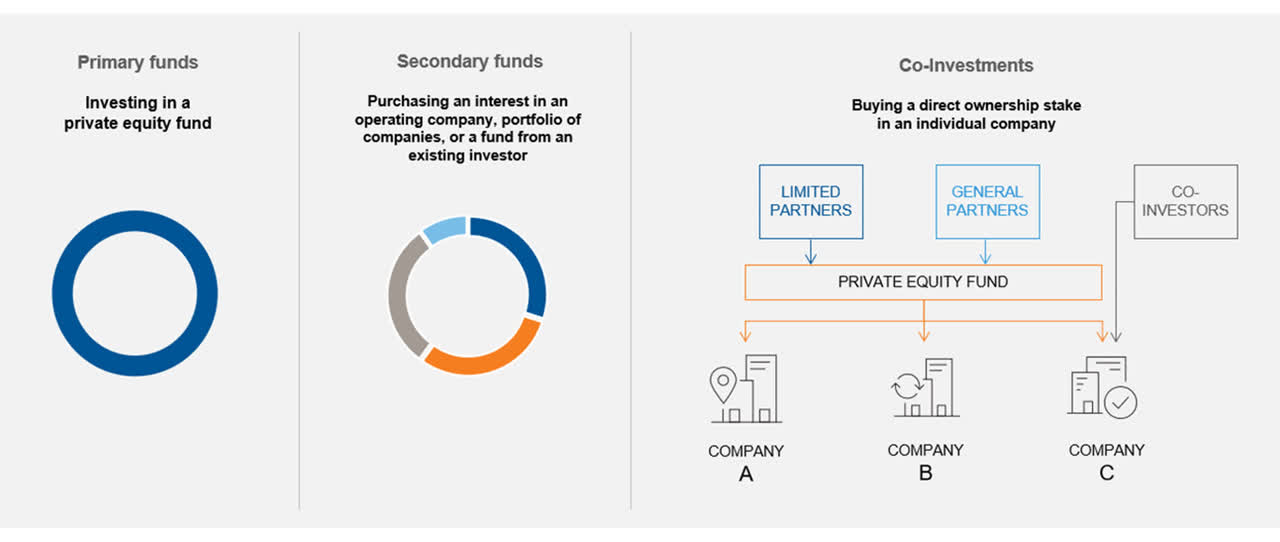

Access points

The three principal ways of accessing private markets are as follows:

As the private markets investment universe has evolved over the last 20 years, the importance of secondary funds and co-investments has grown. That said, the level of expertise and resources required to successfully source, underwrite and structure secondary and co-investment opportunities is beyond the scope of all but the largest and most experienced investors. Utilizing a FoF can provide an investor exposure to all three access points.

Portfolio construction

Private markets solutions are designed with consideration of an investor’s top-down strategic goals and existing total portfolio exposures. Inputs to the portfolio construction process include risk and return objectives, liquidity considerations, and a desire to gain exposure to certain investment themes, sectors, and geographies.

While individual client circumstances and objectives may differ, we believe building foundational exposure to private assets begins with broad diversification across strategy, geography access point, and vintage year. We think it is prudent for investors—particularly those who are in the early years of their programs—to obtain meaningful exposure to secondaries and co-investments.

The advantages of fund-of-funds within private markets

In particular, we see six key advantages that help make a fund-of-funds approach attractive to investors. These are:

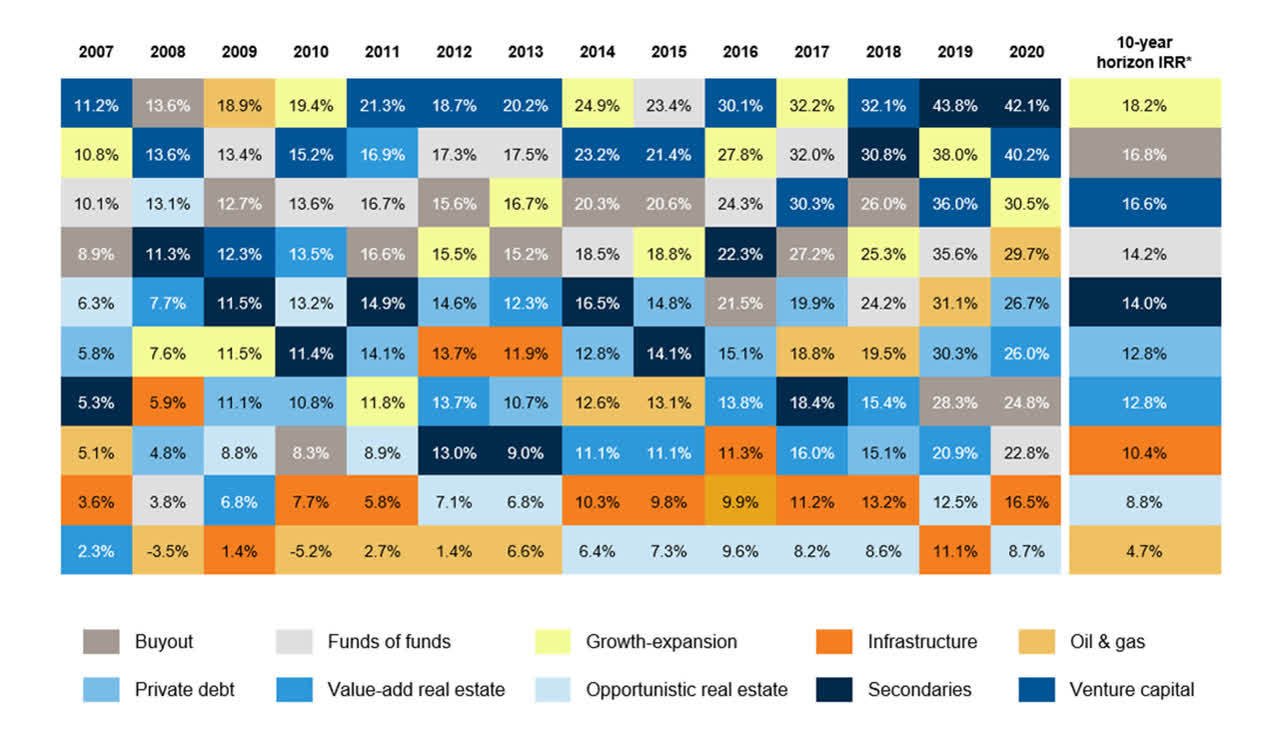

1. Smoother return pattern

As illustrated in Exhibit 3 below, there is significant dispersion across private market strategies returns in any given vintage year. From 2007-2020 the average dispersion between the top and bottom-performing strategy has been 27.7%. Utilizing a FoF approach incorporating different strategies results in a smoother return pattern for investors.

Exhibit 3: Private market strategies’ pooled IRR comparisons by vintage year5

2. Manage downside risk through portfolio diversification

Utilizing a FoF with a disciplined portfolio construction process can effectively manage downside risk. As shown in Exhibit 45 below, even FoFs in the bottom decile of performance did not lose money, and they delivered superior returns relative to other bottom decile managers across strategy type.

Exhibit 4: Private, Closed-End Fund net IRRs by Strategy (vintage years 2002-2016)5

3. Securing an allocation to top-tier private market funds:

By working with an experienced private markets investor with a strong industry reputation and access to top-tier firms, a FoF investor can directly benefit from these relationships through access to highly sought-after funds that would not otherwise be available.

4. Cash flow management:

Given the frequency of capital calls and distributions across a private markets’ portfolio, a FoF can help ease the investor’s burden when managing the underlying cash flows.

5. Reduces complexity:

A key benefit of FoFs is that they remove the burden of additional complexity associated with private market investing from the end investor while allowing them to obtain the benefits of investing in private assets, such as access to a larger opportunity set and superior returns relative to public markets.

6. Access to specialist managers:

We believe those managers who specialize in certain sectors (i.e., industrial, technology, consumer) or market segments such as small-mid buyouts are more likely to have clear areas of expertise relative to generalist managers.

The bottom line

Not surprisingly, investors are increasingly turning to private markets to improve their investment outcomes, given the potential for greater returns and accessing a larger investable opportunity set relative to the public markets. That said, building and maintaining a high-performing private markets portfolio requires specialist research, portfolio management, operational due diligence, and legal resources that are not always found within in-house investment teams. Ultimately, we believe that for most investors, a FoF approach can help best unlock the benefits of private markets.

1 McKinsey & Company, McKinsey Global Private Markets Review 2023: Private Markets Turn Down the Volume, March 2023

2 Hamilton Lane, 2023 Market Overview, March 2023 3 Managers with funds raised in the trailing 10 vintage years 20 years ago as of November 2020 and managers with funds raised in the trailing 10 years ago as of March 2023.

3 Managers with funds raised in the trailing 10 vintage years 20 years ago as of November 2020 and managers with funds raised in the trailing 10 years ago as of March 2023.

4 Cambridge Associates All Private Equity, Venture Capital, Growth Equity and Buyouts, Mezzanine and Distressed, years from 1981 – 2020. Returns shown net of fund fees and expenses. Returns shown through 2020 because in the early life of a fund, IRR may not be meaningful as the fund is still in the investment period and therefore IRR does not truly reflect performance of the fund. Returns for more recent fund vintages may be lower than the returns shown above, and IRRs are more likely to be negative. For illustrative purposes only. The returns shown above correspond to alternative investment products managed by third-party managers. They do not represent the actual investments of the Fund, Russell Investments, or any of its other clients. Past performance is not indicative of future results.

5 Pitchbook, Quantitative Perspectives, U.S. Market Insights, Q1 2023.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-12271

Read the full article here