Defense is superior to opulence. – Adam Smith.

The S&P VIX Index (VIX), often referred to as the “fear gauge,” is a valuable tool in assessing market expectations regarding short-term volatility. When the VIX level is low, it usually signifies a period of relative calm and stability in the markets. However, this can also be interpreted as a warning sign that investors should brace themselves for the possibility of sudden and sharp market movements.

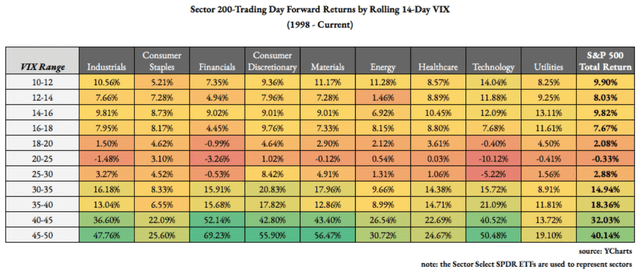

The strategy outlined in the award-winning paper I authored, “Actively Using Passive Sectors to Generate Alpha Using the VIX,” seeks to capitalize on this insight by adjusting sector allocation in advance, shifting focus to low beta defensive sectors that tend to outperform during periods of heightened volatility.

Benefits of Investing in Low Beta Defensive Sectors

Low beta defensive sectors, such as utilities (XLU), consumer staples (XLP), and healthcare (XLV), have several advantages over their high beta counterparts during periods of market turbulence. These sectors tend to exhibit lower price volatility and are less sensitive to overall market fluctuations, offering a degree of stability that can be particularly attractive during uncertain times. Additionally, these sectors often provide essential goods and services, ensuring a stable demand regardless of the economic cycle.

Investing in low beta defensive sectors when the VIX is low allows investors to proactively position their portfolios for potential market disturbances. By doing so, they can potentially capture alpha from the outperformance of these sectors relative to the broader market. Moreover, this strategy helps shield investors from the adverse impacts of sudden volatility spikes that are often associated with low VIX levels.

Conversely, the best returns come from buying Technology INTO a VIX spike because Technology, as a sector, tends to get disproportionately hurt in high volatility regimes relative to other sectors of the stock market.

Actively Using Passive Sectors to Generate Alpha Using the VIX

Current VIX Level and Implications

As of the writing of this article, the VIX level stands at 13.65. This indicates a relatively low level of volatility in the markets, which may signal an opportune time to consider allocating a portion of one’s portfolio to low beta defensive sectors in anticipation of a move back up in vol. By taking a proactive stance and adjusting sector allocation in advance, investors can potentially reap the benefits of this strategy and generate alpha during periods of increased market turbulence, and being defensively positioned in advance.

Behavioral Biases and Outperformance

The outperformance of low beta defensive sectors during periods of heightened volatility can, in part, be attributed to certain behavioral biases exhibited by investors. When faced with market uncertainty and volatile conditions, investors tend to exhibit risk-averse behavior, leading them to seek refuge in more stable, defensive assets. This flight to safety can result in a self-fulfilling prophecy, as the increased demand for these assets can drive their prices higher, further fueling their outperformance.

Another factor contributing to the outperformance of low beta defensive sectors is the so-called “low-volatility anomaly.” This phenomenon, which has been well-documented in academic literature, suggests that low-volatility stocks tend to generate higher risk-adjusted returns than their high-volatility counterparts. These runs counter to traditional finance theory, which posits that higher risk should be compensated with higher returns. However, the low-volatility anomaly has persisted over time, providing further evidence of the potential benefits of investing in low beta defensive sectors.

Conclusion: A Proactive Approach to Sector Allocation

In summary, the strategy of investing in low beta defensive sectors when the VIX level is low offers a compelling opportunity for investors to generate alpha and protect their portfolios from the potentially adverse effects of sudden market volatility. The 2020 NAAIM Founders Award-winning paper, “Actively Using Passive Sectors to Generate Alpha Using the VIX,” highlights the effectiveness of this approach, showcasing the benefits of adjusting sector allocation in advance to take advantage of the behavioral biases that contribute to the outperformance of low beta defensive sectors.

Given the current VIX level, investors may wish to consider adopting a more defensive stance by increasing their exposure to low beta defensive sectors. By doing so, they can position themselves to capitalize on the potential outperformance of these sectors during periods of heightened market turbulence and, ultimately, enhance their overall investment returns.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here