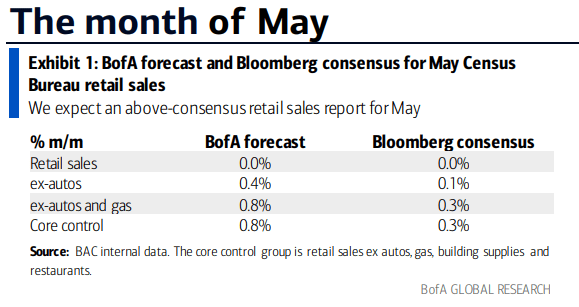

BofA sees a solid retail sales report next week. May consumer spending trends appear healthy according to card data. One of the areas helping to lift discretionary spending is a boon in travel.

Uber Technologies (NYSE:UBER) is the go-to rideshare company globally that is making inroads into new markets and forging new strategic partnerships as its sales and earnings rise sharply. With a new CEO at the helm and potential for leadership in the autonomous vehicle revolution, I see upside potential and have a buy rating.

Big Travel Activity Suggests A Healthy May Retail Sales Report

BofA Global Research

According to Bank of America Global Research, UBER is a mobility platform that services 63 countries, 750+ ridesharing markets, and 500+ Eats markets, and nearly half of Core Platform Revenue is generated outside of the U.S. The company now has over 100mn monthly customers with revenues generated from Mobility, Delivery, and Freight services.

The San Francisco-based $81.4 billion market cap Passenger Ground Transportation company within the Industrials sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

Back in early May, the company reported a modest EPS beat. $0.08 of per-share losses were a penny better than estimates while a 28% YoY revenue rise to $8.8 billion was also better than forecasted. Gross bookings were up 19% from the same period a year ago while adjusted EBITDA was up markedly YoY. The driver of the big rally in the ensuing sessions was its Q2 guide, which appeared conservative to sell-side analysts. A healthy margin was driven by solid ad revenue and insurance costs that were in check. For FY 2023, free cash flow should be near $4 billion.

Earlier this month, UBER announced a partnership with Ford on an EV rideshare adoption program. That strategic mash-up came on the heels of UBER and Waymo’s ridetaxi service agreement in the Arizona market. So far, it appears the new CEO Dara Khosrowshahi appears to be pushing the right buttons (or hitting the right cylinders). Overall, there is plenty of bullish headline risk/reward potential as the company executes new deals and initiatives while growing free cash flow at the same time.

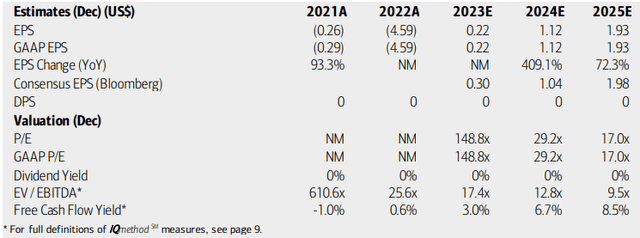

On valuation, analysts at BofA see earnings firmly growing into positive territory this year and in the coming quarters. Per-share profit growth is seen as robust with EPS driving close to $2 by 2025 while the immediate out year features more than $1 of per-share earnings. While no dividends are paid by this high-growth firm, UBER is forecast to grow its free cash flow yield as its price-to-earnings ratios dip to attractive levels looking out two years. The GARP case is alive and well, with an EV/EBITDA ratio that is not all that far above the market’s average on a next-12-month basis.

UBER: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

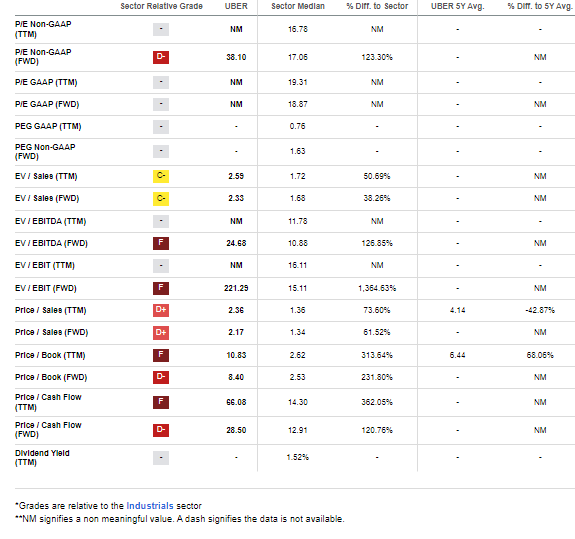

But the stock has rallied big just since its Q1 earnings report. Indeed, price momentum is high while fundamental earnings growth is an A+. If we scan the valuation dashboard, we see that UBER trades at 2.17 times forward revenue – that’s about half the 5-year historical trailing P/S, but its price-to-book ratio is lofty. Let’s look at it this way: If we assume $2 of EPS and apply a 25x multiple (significantly above that of the Industrials sector), then the fair value is near $50. And that would equate to a P/S near 2.7 – still reasonable.

UBER: High Growth Warrants A High Valuation

Seeking Alpha

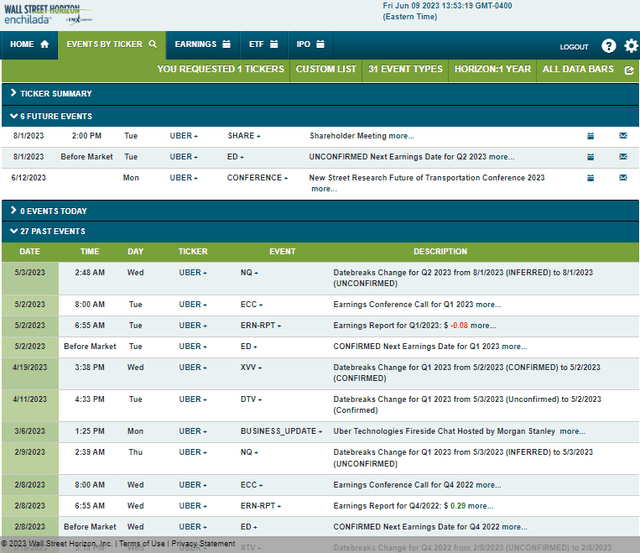

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Tuesday, August 1. That will be a particularly volatile day, most likely, as the firm’s annual shareholders’ meeting takes place later that morning and afternoon. Before August, though, UBER is slated to present at the New Street Research Future of Transportation Conference 2023 on June 12. Other industry players like Tesla and NVIDIA will be there.

Corporate Event Risk Calendar

Wall Street Horizon

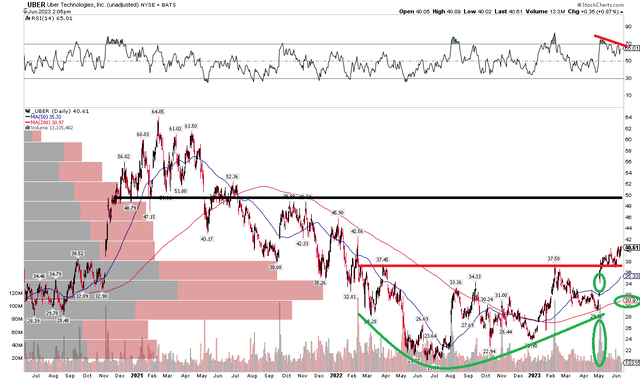

The Technical Take

While the GARP play on UBER appears solid, what does the chart say? Notice in the graph below that shares recently broke through a key resistance level in the $37-$38 range. The stock put in a bearish to bullish reversal, known as a bullish rounded bottom, with a trough just under $20. The breakout above the mid-$30s implies a measured move price objective to the low $50s. Immediately under that, though, I see key resistance from the late 2021 highs and early 2021 range lows.

With a volume spike around its May earnings report and a gap higher, the bulls appear in control. Also, the long-term 200-day moving average is upward-sloping – another arrow in the bullish quiver. What’s concerning near term, though, is a modest negative divergence in the RSI momentum indicator at the top of the chart. I’d like to have seen a more pronounced, higher momentum thrust. For now, however, I see a move to $50 in play.

UBER: Bullish Breakout, Eyeing $50 Upside Target

StockCharts.com

The Bottom Line

Growth investors should consider going for a ride in UBER. The valuation is not all that expensive considering the EPS trajectory. Technicals, meanwhile, buttress the bullish case.

Read the full article here