Thungela Resources Limited (OTCPK:TNGRF) is wrestling a severe cyclical downturn. The company released its six-month trading records on Monday, revealing a significant slump in operating activities, stating that it anticipates its profits to shrink by as much as 75%.

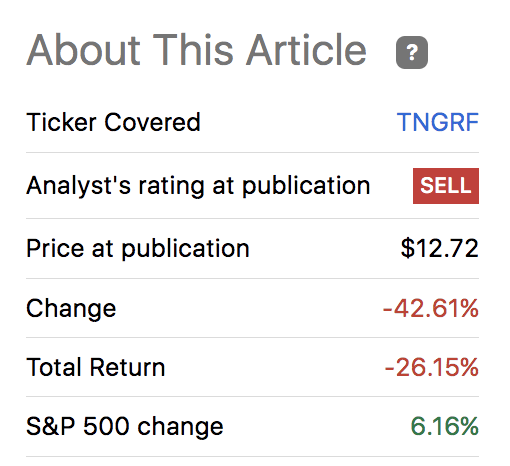

Our previous analysis of the stock forecasted its cataclysmic drop on the promise of weakening coal prices, rising input costs, and systemic pressure. We also argued that the stock was overbought and due for mean reversion.

Preceding Rating (Seeking Alpha)

Many investors might be wondering whether Thungela’s latest slump presents a buying opportunity. Well, from our vantage point, we do not think so, as Thungela’s headwinds have worsened (since our latest report) and seem likely to abate anytime soon.

Here are a few of our latest findings pertaining to Thungela’s operations and, more importantly, its stock’s total return prospects.

Earnings Review and Outlook

Thungela is set to release its half-year earnings report later this month; however, the company revealed a preliminary trading report on Monday, the 12th of June, concurrently stating that shareholders can anticipate a disappointing quarter, led by concerns such as defunct railways, disappointing coal prices, and resilient inflation.

For those unaware, apart from its Rietvlei Colliery, which serves Eskom, Thungela operates an export business model, primarily servicing the needs of Europe, Asia, the Middle East, and North America. Therefore, the company’s pull factors are mostly related to the demand side features of its foreign buyers.

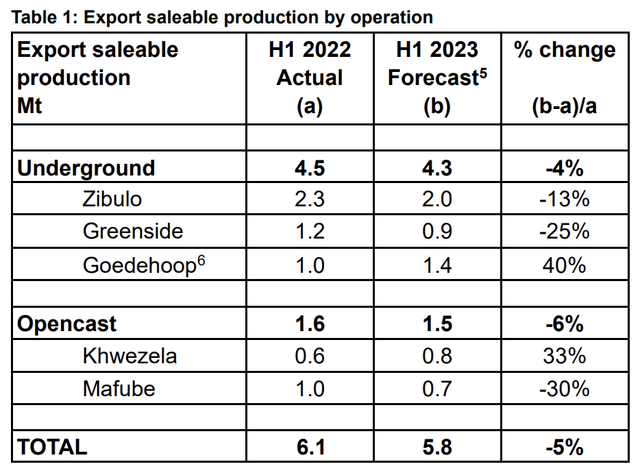

In its six months ended, Thungela experienced a 12% slump in production from its underground mines and a 2% retreat in output from its opencast properties. Apart from Goedehoop and Khwezela, Thungela experienced lackluster production from all its mines due to factors like freight issues in South Africa, the excess market supply of coal in critical regions, and a tame winter in the EU.

Production Report (Thungela)

In our view, both Goedehoop and Khwezela might continue to perform prosperously in the following quarters as the latter is a ramp-up project that started in 2022, and the prior is well situated, feeding from the Kusile power station, which is seen as one of Eskom’s “best hopes” of solving load-shedding.

Sidenote: Maybe just a bit of anecdote; I was in transit passing Goedehoop a few weekends ago, and load pick-up traffic into the facility was denser than I have ever seen.

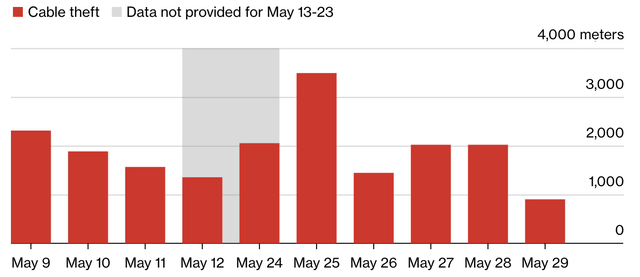

On the other end of the spectrum, Thungela’s other mines are unlikely to recover in due course, as they hold few catalysts that can hold off railroad challenges. In fact, at times during May, Transnet operated at merely 25% of its capacity due to cable theft, and we simply do not see an end to cable theft in South Africa, as poor governance coupled with the continued growth of illicit business in the nation remains unresolved.

Cable Theft South Africa (Bloomberg)

Furthermore, Thungela is facing headwinds from coal prices. For the time being, there is little indication that a reversal in prices will occur as industrial production in China has softened, consumption in the U.S. and EU is slowing, and the overall energy supply mix has corrected since the Russia-Ukraine war’s initial impact.

Coal Prices Mixed Basket (Trading Economics)

In essence, we think structural issues will remain within South Africa, and leveling of demand from abroad provides little hope for a counterargument. The railway concerns mentioned in this section need to be coupled with Eskom’s sustained disaster to fully comprehend and contextualize Thungela’s systemic challenges in the coming years. Click on this link to traverse to one of our previous articles that discusses the Eskom debacle in detail.

Valuation and Dividends

Ex-post ratios show that Thungela is undervalued, with a price-to-book ratio of merely 0.66. However, as investors, we need to factor in what the company’s expected 75% year-over-year decline in profitability will mean for its book value.

Firstly, the value of its asset base will probably weaken. I base this on the fact that impairments are likely to occur in the near term, as mining companies typically incur such impairments when commodity prices recede, FX rates decline, production costs rise significantly, interest rates increase, and a decrease in general peer-based market values occur. And guess what? All of those factors have been realized in the past six months. Moreover, Thungela’s lower profit margin coupled with a higher country risk premium (in South Africa) could result in its residual income value-add settling below the initial estimates.

Here is a round-up of the factors I have just mentioned.

- Coal prices have capitulated.

- The South African Rand has fallen off a cliff since January.

- Regional inflation has remained resilient.

- South African interest rates are at a 14-year high.

- South African risk premiums have jumped.

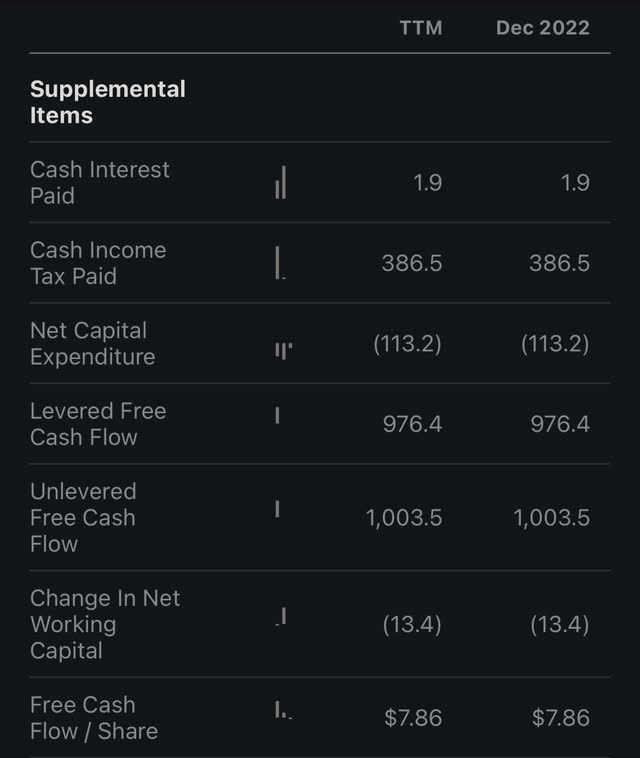

A look at the firm’s dividend prospects suggests an unwelcoming trajectory. Like many South African miners, Thungela’s dividend policy is to release 30% of its operating free cash flow to its shareholders. Thungela paid monster dividends in previous quarters, with a 4-year average dividend yield of 15.55%. However, we expect a softer free cash flow alongside the decline in Thungela’s profitability, concurrently diminishing the stock’s dividend yield.

Thungela’s Annual FCF Ending 2022 (Seeking Alpha)

A Few Contra Points

Although a few positives were mentioned throughout the text, I wanted to create a discreet section to outline a few contra points.

Ensham Acquisition

Thungela recently agreed to acquire a controlling interest in the Ensham Colliery, which is based in Western Australia. Ensham is part of Thungela’s global diversification strategy, which shows that its future business model might be less reliant on South Africa, providing encouraging signs to longer-term investors.

Furthermore, the acquisition could be priced by investors in the short term in anticipation of an expansion of Thungela’s asset base. The project delivered roughly 3.2 million tonnes of high-quality thermal coal in 2022, providing investors with “proof of future value”.

It is expected that the Ensham deal will be wrapped up within the next quarter, providing Thungela’s shareholders with a reason to cheer.

PIC Support

An overlooked factor behind South African stocks is support from the Public Investment Company. The PIC is a state-sponsored investment firm that is gradually buying up large stakes in listed entities within the nation. The PIC currently owns approximately 14.4% of Thungela and is buying aggressively, providing a reason to believe that future demand for the stock from a large institution is in store.

Even though Thungela is listed as an American Depositary Receipt, and the PIC owns the JSE-listed shares, arbitrageurs will probably see to it that the ADR follows a similar trajectory to Thungela’s primary listing.

Technical Price Level

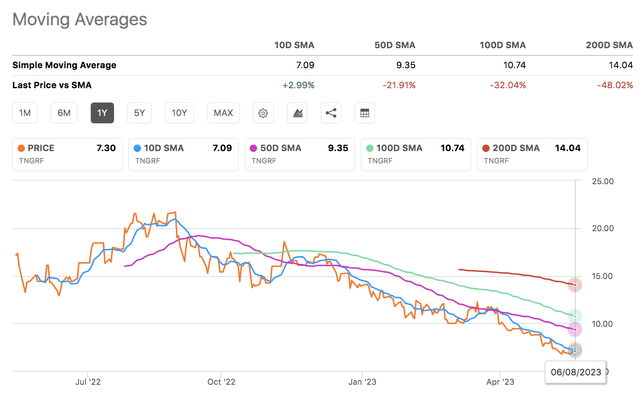

Lastly, there is a strong argument that Thungela’s stock is technically underpriced. The asset is trading below its 50-, 100-, and 200-day moving averages, meaning that an upside is highly likely if mean-variance efficiency holds true.

Seeking Alpha

Final Word

Thungela’s six-month trading report suggests that disappointing half-year financial results are en route. Most of the company’s mines are struggling due to factors such as poor railway activity, resilient input costs, and lower-than-anticipated demand from its export markets.

Positive features are present; for instance, Goedehoop continues to blossom, and the Ensham acquisition is expected to add value. However, we remain net negative on Thungela Resources Limited stock’s prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here