By Coco Zhang, Ewa Manthey, and Rico Luman

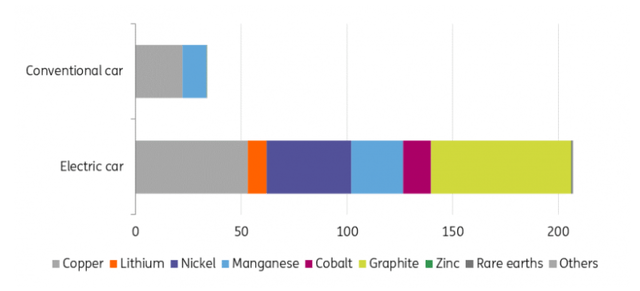

More minerals are used in electric cars compared to conventional cars

IEA, ING Research

Surging battery metal prices pose challenges to the EV industry

The rapid increase in electric vehicle sales during the Covid-19 pandemic has exacerbated concerns over China’s dominance in lithium battery supply chains. Meanwhile, the ongoing war in Ukraine has pushed prices of raw materials – including cobalt, lithium, and nickel – to record highs.

The dependence on specific suppliers is not the only concern. Batteries make up a big part of an EV’s total cost and typically account for 30-40% of their value, but this proportion increases with larger battery sizes.

Rising demand for EVs amid tightening supply chains has also pushed prices of battery materials (including cobalt and lithium) to multi-year highs. This impacts prices, which in turn makes consumers more hesitant to make the shift to electric vehicles.

While prices for nickel and cobalt have come down in the first half of 2023, they are still higher than they have been in previous years. For example, Chinese prices of lithium carbonate (a refined form of the metal that goes into EV batteries) jumped more than 1000% from the end of 2020 to reach a high in November last year. They then lost more than two-thirds of their value through late April, according to data from Asian Metal.

What does the EV battery supply chain look like?

IEA, ING Research

The five key materials for lithium-ion batteries (Li-ion) are lithium, cobalt, nickel, manganese, and graphite, all of which provide the battery with the power to store and release energy for boosting EVs.

Most of the key materials used in electric vehicle production are mined in resource-rich countries, including Australia, Chile and the Democratic Republic of Congo (DRC). There are likely sufficient reserves of minerals in the earth’s crust to satisfy future demand for EV batteries, but scaling up mining is a long and expensive process.

For battery production alone, a conservative estimate from the International Energy Agency (IEA) suggests that by 2030, we will need 50 additional lithium mines and 60 for nickel. We will also need to add 50 new cathode and 40 new anode active material manufacturing plants to produce high-performance battery materials. Currently, it can take between two and seven years to build a new factory, depending on the technology and member state. It takes 10 years on average until a new mine comes online.

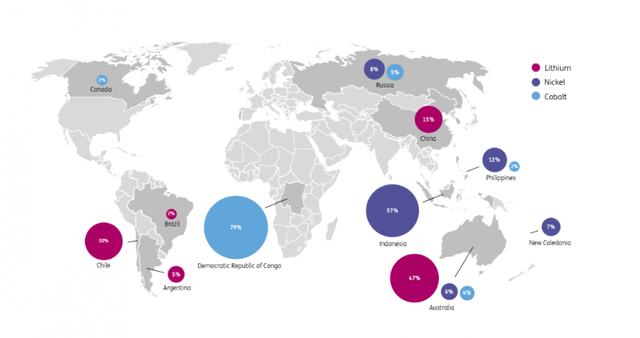

Top battery raw materials producing countries in 2022

USGS, BNEF, ING Research

Lithium

Batteries are now the dominant driver of demand for lithium. For Li-ion batteries, lithium is irreplaceable. Over 70% of global lithium production comes from just two countries: Australia and Chile. Australia is the world’s largest supplier and produces most of its lithium by mining hard rock spodumene, unlike Argentina, Chile and China, which produce it mostly from brine. Chile comes in second, holding more than 40% of the world’s known reserves.

Cobalt

The intensity of cobalt in Li-ion batteries has decreased significantly over recent years, with battery makers moving to higher nickel content chemistries. Cobalt is mainly mined as a by-product of copper or nickel mining, and more than 70% of it is produced in the DRC. Artisanal and small-scale mining is responsible for around 10-20% of the DRC’s cobalt production. Refining is concentrated in China, accounting for around 80% of global capacity, although the country has little of the raw material.

Nickel

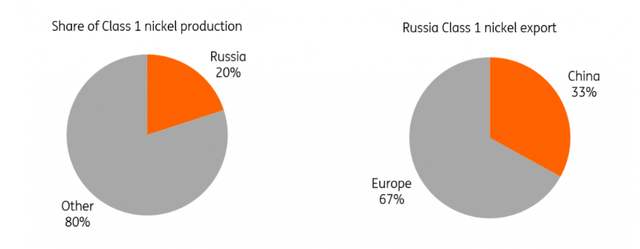

In Li-ion batteries, the use of nickel lends a higher energy density and more storage capacity to batteries. Class 1 nickel (>99.8% purity) is required in battery production, while class 2 nickel (<99.8% purity) cannot be used without further processing. Nickel is primarily found in two types of deposits: sulphide and laterite. Sulphide deposits are mainly located in Russia, Canada and Australia and tend to contain higher-grade nickel. Russia is the world’s largest supplier of Class 1 battery-grade nickel, accounting for around 20% of the global supply. Trade restrictions on Russia would therefore pile pressure on prices. Laterite, which contains lower-grade nickel, is mainly found in Indonesia, the Philippines and New Caledonia. Indonesia, which holds almost a quarter of global nickel reserves, prohibited the export of nickel ore in January 2020 and is now attracting investments into higher-value processing, mostly from China.

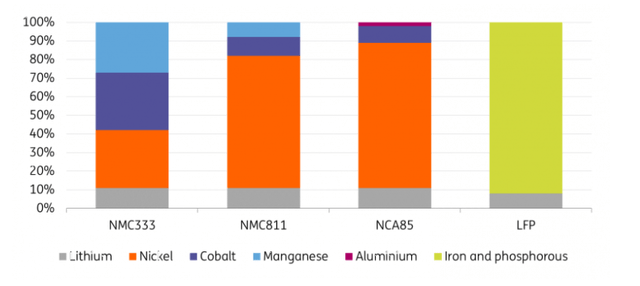

Approximate mineral composition of different battery cathodes

IEA, ING Research

Impact of Russia’s invasion of Ukraine on battery supply chains

Lithium and cobalt were relatively unaffected by the supply disruptions following Russia’s invasion of Ukraine. For nickel, it’s a different story. Russia is the third-largest producer, supplying around 9% and processing around 6% of global nickel in 2021 – but most importantly, it is the world’s largest Class 1 nickel supplier and accounts for around 20% of global supply, most of which is supplied by Norilsk Nickel (OTC:NILSY).

Volatility in the nickel market has become increasingly common over the past year. We’ve seen reduced liquidity ever since the short squeeze seen back in March, when fears of sanctions on Norilsk Nickel (following Russia’s invasion of Ukraine) coincided with a huge short bet by the world’s largest stainless steel producer, Tsingshan. This caused prices to more than double in just a matter of days. The LME was forced to suspend trading for a week and cancel billions of dollars worth of nickel trades.

LME volumes have declined since then, with many traders reducing activity or cutting their exposure due to a loss of confidence in the LME and its nickel contract in the aftermath of the March short squeeze. These low levels of liquidity have left nickel exposed to sharp price swings – even amid small shifts in supply and demand balances. But as the exchange introduced daily price limits and margin requirements fell, volumes started to pick up. The resumption of Asian trading hours has also encouraged more volumes and improved liquidity, which in turn has reduced volatility in the contract. While volumes have stabilised over the past few months, they remain at lower levels than before the nickel crisis last year.

Nickel production & exports (2021)

IEA, ING Research

Battery chemistries are evolving amid tightening supply

Battery technology is evolving rapidly. Most electric vehicle batteries are Li-ion based and are light, small and store a lot of energy. While batteries can vary in composition, they generally rely on the same set of materials.

Li-ion batteries for EVs are either nickel-based – lithium nickel manganese cobalt oxide (NMC) and nickel cobalt aluminium oxide (NCA) or lithium iron phosphate (LFP). Nickel-based batteries have a higher energy density, which gives them more driving range, and they account for the majority of EV batteries outside of China. In general, the higher the nickel percentage in the battery, the higher the energy density that the battery can provide. Nickel-based batteries are also more expensive, mostly due to their use of cobalt and lithium.

In 2022, NMC remained the dominant battery chemistry with a market share of 60%, followed by LFP with a share of just under 30%, and NCA with a share of about 8%, according to the IEA. While nickel-based batteries remain the dominant battery chemistry, there has been a resurgence of LFP battery chemistries over the last few years, mostly driven by the increasing uptake of LFP in electric vehicles in China. Battery manufacturers have been transitioning away from nickel and cobalt because of their high costs, scarcity, and mining ethics. Nickel batteries require an environmentally damaging mining process, while cobalt artisanal mining lacks regulations.

LFP batteries differ from other chemistries in their use of iron (which is abundant and cheap) and phosphorus, rather than the nickel, manganese and cobalt found in NCA and NMC batteries. They have a lower energy density, but they are also cheaper to manufacture as they don’t contain nickel, cobalt and magnesium. They do, however, remain exposed to expensive lithium prices. LFP batteries rely on lithium carbonate instead of hydroxide used for nickel-rich chemistries.

Until now, production has been mostly limited to China but is set to increase on a global scale. Chinese manufacturers, including BYD Co. (OTCPK:BYDDF) and Contemporary Amperex Technology Co., accounted for as much as 99% of global production of LFP cathodes in 2022, according to Benchmark Mineral Intelligence. Tesla (TSLA), Volkswagen (OTCPK:VWAGY) and other major automakers are now already switching to LFP batteries in some of their EV models.

In recent years, alternatives to Li-ion batteries have also been emerging, notably sodium-ion (Na-ion). Na-ion relies on lower-cost materials than Li-ion, resulting in cheaper batteries. Na-ion batteries also completely avoid the need for critical minerals. Sodium is one of the most abundant and geographically spread resources on Earth, and the Na-ion battery developed by China’s CATL is estimated to cost 30% less than an LFP battery. It’s important to note, however, that these batteries do not have the same energy density as their Li-ion counterparts (75 to 160 Wh/kg compared to 120 to 260 Wh/kg).

With the dramatic rise in lithium and other battery materials prices over the last two years accelerating interest, several other cell manufacturers have now joined CATL in establishing a Na-ion supply chain. There are nearly 30 Na-ion battery manufacturing plants currently operating, planned or under construction for a combined capacity of over 100 GWh, and almost all of them are in China. For comparison, the current manufacturing capacity of Li-ion batteries is around 1,500 GWh, according to the IEA.

Na-ion cells are likely to be less sensitive to rising lithium, cobalt and nickel costs, with the lower pack cost providing a key reason to substitute Na-ion batteries for Li-ion applications. While lithium-ion continues to improve, BNEF expects that sodium-ion’s energy density in 2025 will be comparable to that of LFP in the early 2020s when it took a significant share of global battery demand. BNEF anticipates sodium-ion deployment in cars will begin to take off in 2025, with over 15GWh set to be deployed that year.

Chemistry choice and the impact of material pricing

Battery materials play a key part not only in the performance of batteries but also in costs. In LFP cells, for example, materials account for 30% of battery pack prices. The price of lithium plays a relatively large role in determining the final cost of battery chemistries. In 2022, the most drastic increase seen in battery material prices was for LFP batteries at over 25%, while NMC batteries saw an increase of less than 15% according to IEA data. This can be explained by the price of lithium rising at a higher rate than that of nickel and cobalt. Even so, LFP batteries remain less expensive than NCA and NMC per unit of energy capacity.

The price of batteries also varies across different regions. China has the lowest prices on average and manufactures around 65% of battery cells and almost 80% of cathodes, according to the IEA.

Battery swapping can further shake up the EV supply chain

An alternative way of EV charging is emerging in the form of battery swaps, where a depleted battery is replaced by a fully charged one at a dedicated location. Battery swapping could be particularly attractive for trucks, as it can greatly reduce the time needed to charge a heavy-duty vehicle; it could also be useful for light-duty vehicles such as taxi fleets and personal cars because of the flexibility and, in some cases, the lower total cost of ownership (e.g., for two and three-wheelers).

China is leading in battery swapping for both trucks and passenger cars, with the number of swapping stations in China growing by 50% year-on-year to almost 2,000 at the end of 2022. EV manufacturer NIO (NIO) covers two-thirds of that market, with its battery swapping-ready models and dedicated swapping stations. In the US, startup company Ample now operates 12 battery swapping stations in San Francisco, mainly serving Uber (UBER) rideshare vehicles.

If it becomes mainstream, battery swapping could revolutionise the electric vehicle charging scene. At least one battery will be needed per vehicle, so the scale-up of such a business model could add even more pressure to the already tightening global EV metal supply chain. Companies providing such services would need more partnerships to secure an increased level of supply, or they will need to decrease each swappable battery’s capacity as a compromise.

Smaller cars will reduce battery metals demand per unit

So far, the electric vehicle market has leaned on upper-middle-class models, such as Tesla’s Model 3, as well as SUVs like the KIA EV6, Volvo C40 Recharge and BMW IX.

A regulatory incentive for smaller models could lower demand for battery metals significantly, according to research from Transport and Environment for Europe. Analysis from the KiM Netherlands Institute for Transport Policy also indicates that a larger influx of smaller and more affordable middle-class electric vehicles – like the Volkswagen ID2 or the BYD Dolphin and Seagull models – is a requirement for a real breakthrough in the mass market. Ranges will also continue to develop, but given the extra weight, it’s doubtful that efficiency will reach far beyond 500km.

Based on this, we believe that battery demand per unit is set to be lower than the current average as we head towards 2030.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here