Investment Summary

The steel industry isn’t perhaps the most exciting one in the market, not when you compare it to semiconductors or AI-related companies. These industries have gotten far more attention recently, and it seems to have caused some sector rotation as well, as plenty of companies in the industry were down at the beginning of the year. In the case of TimkenSteel Corporation (NYSE:TMST), it reached a low point of around $15.7 per share but has since rebounded a lot. Much because of the successful quarter, the company had to start in 2023.

The net sales in the business increased by 32% sequentially, reaching $323 million in total. With solid cash flows, the company is also able to return a significant amount to shareholders and boost their positions. In total over $28 million was returned to shareholders, which was more than the net income for the quarter, the remaining part seemingly funded by cash at hand. Nonetheless, the company made a solid decision as the average share price they bought at was around $18, meaning they paid a good price for the shares looking back. With strong shareholder incentives from the management of TMST, I think the current price to pay for the business is fair and a great way to introduce a steel company into a portfolio. TMST is therefore a buy from me.

Steel Demand Continues

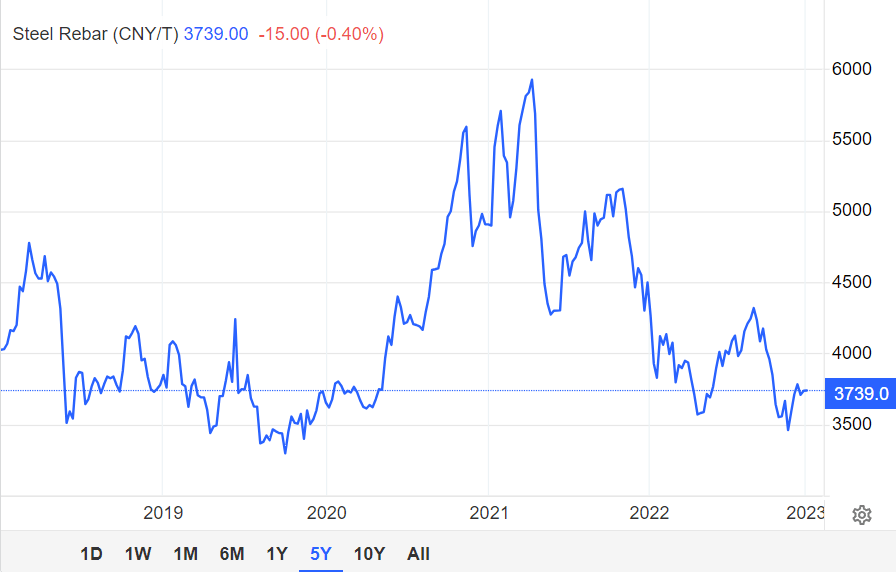

It’s no secret that steel prices have decreased in prices compared to over a year ago when the war in Ukraine began. Looking at the historical steel prices, it often goes in cycles with peaks and valleys. It’s during the euphoric times in the market that companies like TMST can gather vast amounts of capital to later deploy and use for strategic investment and also distribute to shareholders.

Steel Prices (eia.gov)

TimkenSteel operates primarily by manufacturing and selling alloy steel, but also carbon and micro-alloy steel internationally. Their primary end markets include Industrial, Mobile, and Energy. The Industrial market makes up 47% of the sales and plays a crucial role in the continued growth of TMST.

The demand seen across several markets helped encourage TMST to grow production and shipments increased by 35% and with the strong base pricing helped ensure the successful quarter that they had. I reacted to the positive pricing environment, which the company made note of. That speaks highly of the industry in which they are and that there is still a lot of potential here for growth. Despite the recent surge of steel shipments from China, I don’t think it affects TMST that much, of course, it places pressure on US-based companies to have competitive pricing. But seeing as we have plenty of companies moving manufacturing back to the US, I don’t think it will mean a significant impact on the future performance of TMST. The global demand, not just the US demand, is still rising for steel.

Risks

The primary risk with investing in the steel industry I think is the cyclical nature of it. For investors seeking quick profits, it can pose a risk to try and time the market. Even though in many cases, buying when valuations are sky-high and selling when valuations come down and look like a bargain has been a somewhat good strategy, it doesn’t make for a very value-driven approach to investing. I think that when investing in a company like TMST, rather than looking at the growth of earnings, it’s better to see the stability of margins. In this case for has been decent, up high when the cycle of steel tops out, but not dropping as harshly when the cycle loses momentum and prices decline.

Financials

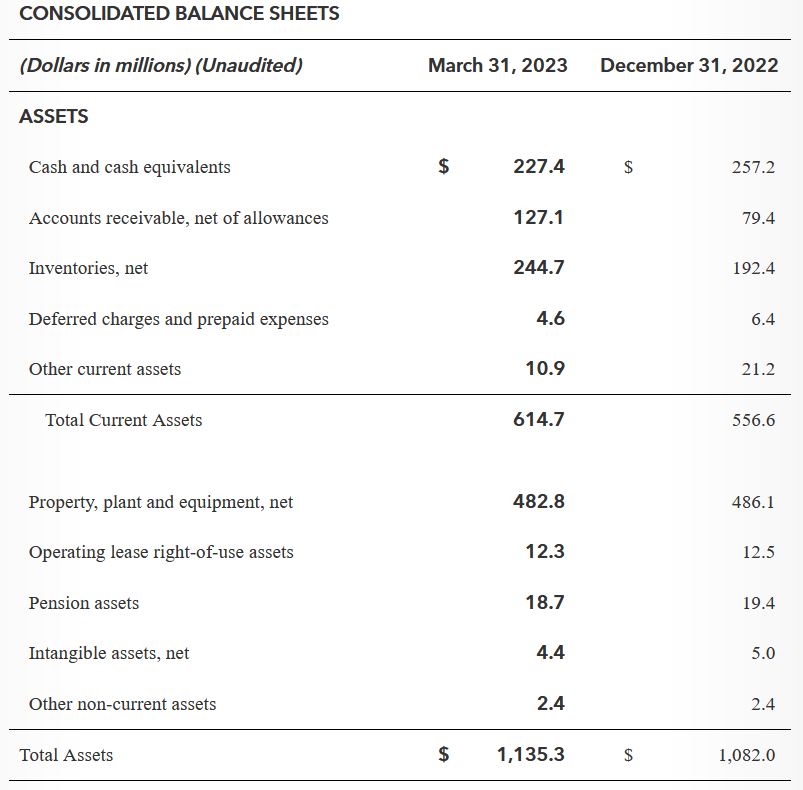

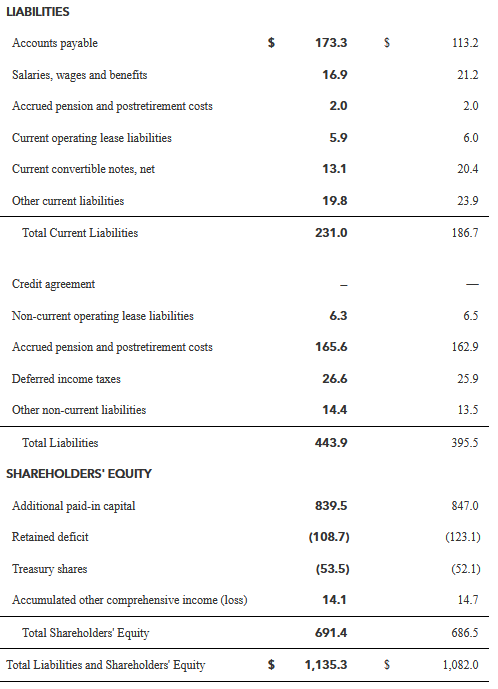

Right now, the balance sheet for TMST is very solid. The company has managed to grow its financial state into a very stable position where debt presents no risk because there is none on the balance sheet. The company paid down all debts in 2021 and since hasn’t taken on anymore. Instead, the capital allocations have been going to shareholders rather than debt repayment for the last 2 years.

Balance Sheet (Earnings Report) Balance Sheet (Earnings Report)

The ratio between total assets and total liabilities sits at 2.58 right now, which is a very healthy spot to be at. The company has achieved a TTM ROA of 3.73% right now, which is down from the 18% it had in Q2 FY2022. As prices have compressed, so will this number. It will be a key point to watch, as the inventory levels of TMST have increased by 27% on just a QoQ basis. In the coming quarters, I hope that the ROA can either stabilize here or move upward if we see more favorable pricing. It could however present a risk if the price of steel goes down. A large number of inventories wouldn’t yield as much anymore and could force the share price to move down more. But all in all, I think the position that TMST is in right now is very healthy and leaves room for some risks like this.

Valuation & Wrap Up

Looking at the valuation of TMST right now, it’s trading below the sector average p/e of 13 and its 5-year average of 15x earnings. I think the current price is at a fair point, it doesn’t necessarily scream undervalued, and neither do I think it’s overvalued.

Stock Price (Seeking Alpha)

Looking at a company in the same industry, it might look not look like such a good deal compared to United States Steel Corporation (X) for example, which has a FWD p/e of just under 6. But what TMST might lack here in terms of valuation makes up for the strong buybacks they have performed over the years and the significantly stronger balance sheet that boasts zero debt and is, therefore, able to support strong yearly buybacks. This leads me to rate TMST a buy right now and, in my opinion, a great way to get exposure to the steel industry with a solid company.

Read the full article here