Earnings of Tompkins Financial Corporation (NYSE:TMP) will likely trend upwards in upcoming quarters thanks to subdued loan growth. Further, a slight margin expansion later next year will likely support earnings. Overall, I’m expecting the company to report earnings of $0.76 per share for 2023 including the loss on sale, and $4.08 per share for 2023 excluding the loss on sale of securities booked in the third quarter of the year. For 2024, I’m expecting the company to report earnings of $4.90 per share. The year-end target price suggests a small downside from the current market price. Based on the total expected return, I’m maintaining a hold rating on Tompkins Financial.

Loss on Securities Sale Not a Problem in the Longer Run

Tompkins Financial reported a loss in the third quarter of 2023 because it realized large losses of around $47.5 million on the sale of $429.6 million worth of investment securities. As interest rates had risen over the last year and a half, the market value of these securities had fallen resulting in large unrealized losses. By selling these securities, Tompkins Financial had converted the unrealized losses (showing up only on the total equity balance) into realized losses (showing up on the income statement).

The company is likely to make up for this realized loss soon because it invested the proceeds from the sale into higher-yielding securities. As mentioned in the earnings release, the securities sold had an average yield of 0.93%, while the securities bought carried an estimated yield of approximately 5.12%.

The company still has a large balance of unrealized loss on its available-for-sale securities portfolio. These losses amounted to $194.6 million at the end of September 2023, or 32% of the total equity balance. Although there is no indication in the earnings release or elsewhere that the management wants to sell more securities, the risk remains. The risk will stand until the unrealized losses reverse, which could partially happen in the latter half of next year.

Nevertheless, I’m not worried because while a sale will hurt quarterly earnings, in the longer run of around a year or so, the sale will turn out to be beneficial. Moreover, I’d like to point out that my tangible book value estimate, and consequently the target price, already incorporates the unrealized loss.

I’m assuming no further big sale of securities till the end of December 2024. Further, I’m expecting fee income to grow at a normal rate. As a result, I’m expecting the non-interest income to decline by 84% in 2023 (due to the loss on sale) and increase by 591% year-over-year in 2024.

Expecting Loan Growth to Slow Down

Loan growth in the last two quarters has far exceeded my expectations. The portfolio grew by 1.5% in each of the second and third quarters of this year, translating to an annualized growth rate of around 6%. In comparison, the five-year compounded annual growth is only 2.4%.

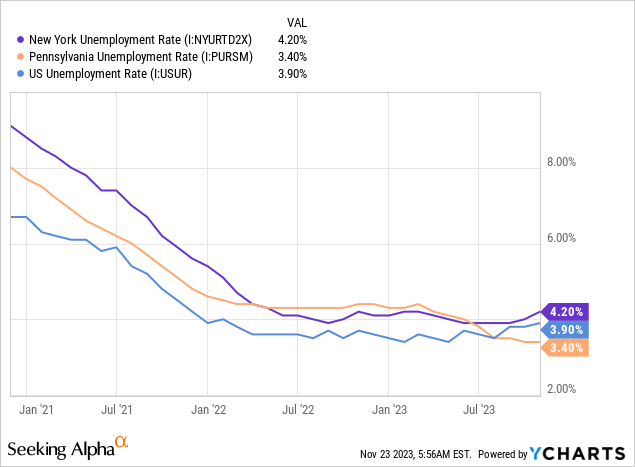

Macroeconomic factors are currently presenting a mixed outlook for loan growth in the near term. Tompkins Financial primarily serves businesses and individuals in New York and Pennsylvania. While New York’s unemployment rate has ticked upward in recent months like the national average, Pennsylvania’s unemployment rate has continued to improve.

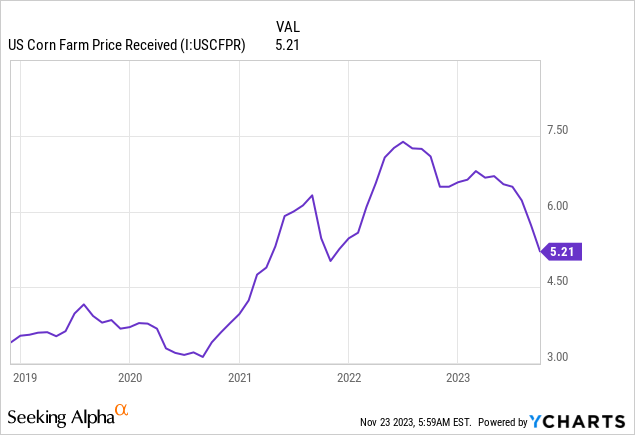

As agricultural loans make up 5% of Tompkins’ total loans, agricultural commodity prices are another appropriate indicator of credit demand. As shown below, corn prices have fallen quite sharply in recent months.

Considering these factors, I’m expecting the quarterly loan growth rate to slow down to 1.0% in the last quarter of 2023, and then further down to 0.9% in the first quarter of 2024. I’m expecting loan growth to stabilize at 0.9% for the remainder of 2024. My anticipated growth rates are above the historical average. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net Loans | 4,878 | 5,209 | 5,033 | 5,223 | 5,439 | 5,638 |

| Growth of Net Loans | 1.8% | 6.8% | (3.4)% | 3.8% | 4.1% | 3.6% |

| Other Earning Assets | 1,301 | 1,995 | 2,369 | 1,967 | 1,780 | 1,834 |

| Deposits | 5,213 | 6,438 | 6,791 | 6,602 | 6,690 | 6,934 |

| Borrowings and Sub-Debt | 735 | 344 | 191 | 348 | 356 | 366 |

| Common equity | 662 | 716 | 728 | 616 | 619 | 754 |

| Book Value Per Share ($) | 44.2 | 48.6 | 49.7 | 42.8 | 43.5 | 53.0 |

| Tangible BVPS ($) | 37.6 | 42.0 | 43.1 | 36.1 | 36.8 | 46.3 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin’s Declining Trend Likely Approaching an End

The margin has declined every quarter since June 2022. Of late, the margin decreased by 8 basis points in the third quarter after declining by 16 basis points in the second quarter of this year. This decline is not surprising as Tompkins’ liabilities are quicker to reprice than its assets.

As mentioned in the 10-Q filing, more interest-bearing liabilities than interest-earning assets are scheduled to mature from October 1, 2023, to September 30, 2024. This re-pricing gap stood at $671 million at the end of September 2023, or 8.7% of total assets. As I’m expecting interest rates to now stabilize through at least the middle of 2024, the re-pricing discrepancy won’t hurt the margin much in upcoming quarters.

Moreover, new loans will get originated at higher rates than the portfolio average as rates are currently higher than last few years. As a result, the production of new loans can be expected to bring up the average loan portfolio yield.

As a result, I’m expecting the declining trend of the margin to stabilize in the last quarter of 2023. Further, I’m expecting the margin to start inching upward in the latter part of 2024 as I’m expecting rate cuts after the middle of next year.

Expecting Earnings to Increase Next Year

I’m expecting earnings of $1.15 per share for the fourth quarter of 2023, which will bring up the full year’s earnings to $0.76 per share. Adjusting for the loss on the sale of securities, I’m expecting earnings of $4.08 per share for this year. I’m expecting earnings to grow sequentially in the last quarter because of loan growth as well as normal non-interest income growth.

Moreover, the anticipated loan growth throughout 2024 and margin expansion during the latter part of 2024 will likely drive earnings next year. I’m expecting the company to report earnings of $4.90 per share for 2024. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net interest income | 211 | 225 | 224 | 230 | 209 | 213 |

| Provision for loan losses | 1 | 17 | (2) | 3 | 4 | 4 |

| Non-interest income | 75 | 74 | 79 | 78 | 12 | 84 |

| Non-interest expense | 182 | 184 | 190 | 196 | 202 | 203 |

| Net income – Common Sh. | 80 | 77 | 89 | 85 | 11 | 70 |

| EPS – Diluted ($) | 5.37 | 5.20 | 6.05 | 5.89 | 0.76 | 4.90 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Compared to my last report on the company, I have reduced my earnings estimate for 2023 because the non-interest income has been lower than my expectations so far this year even after adjusting for the loss on sales of securities.

Unrealized Losses are the Major Source of Risk

The unrealized losses on Tompkins’ available-for-sale securities portfolio are the biggest risk factor, especially after the management realized some of these unrealized losses in the third quarter. A lot of investors consider only the price-to-earnings ratio when they value banks; therefore, their valuation of the company could take a hit if Tompkins converts more unrealized losses into realized losses. As of the end of September 2023, these unrealized losses amounted to $194.6 million, which is around 32% of the total equity balance.

Another source of risk is the large balance of uninsured deposits. As mentioned in the 10-Q filing, the uninsured deposits totaled $3.1 billion at the end of September, representing a hefty 47% of total deposits.

Maintaining a Hold Rating

Tompkins Financial is offering a dividend yield of 4.5% at the current quarterly dividend rate of $0.60 per share. The earnings and dividend estimates suggest a payout ratio of 49% for 2024, which is higher than the five-year average of 38% but still easily sustainable. Hence, I’m not expecting any change in the dividend payout.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Tompkins Financial. Peers are trading at an average P/TB ratio of 1.10 and an average P/E ratio of 9.26, as shown below.

| TMP | DCOM | FMBH | CNOB | LBAI | FBMS | Peer Average | |

| P/E (“ttm”) | 54.47 | 6.92 | 9.07 | 7.95 | 8.39 | 9.59 | 8.38 |

| P/E (“fwd”) | 62.84 | 8.41 | 9.65 | 9.12 | 9.55 | 9.57 | 9.26 |

| P/B (“ttm”) | 1.24 | 0.72 | 0.99 | 0.68 | 0.71 | 0.90 | 0.80 |

| P/TB (“ttm”) | 1.47 | 0.86 | 1.54 | 0.85 | 0.94 | 1.30 | 1.10 |

| Source: Seeking Alpha | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $46.3 gives a target price of $50.9 for the end of 2024. This price target implies a 4.5% downside from the November 22 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.90x | 1.00x | 1.10x | 1.20x | 1.30x |

| TBVPS – Dec 2024 ($) | 46.3 | 46.3 | 46.3 | 46.3 | 46.3 |

| Target Price ($) | 41.6 | 46.3 | 50.9 | 55.5 | 60.2 |

| Market Price ($) | 53.3 | 53.3 | 53.3 | 53.3 | 53.3 |

| Upside/(Downside) | (21.9)% | (13.2)% | (4.5)% | 4.2% | 12.9% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $4.90 gives a target price of $45.4 for the end of 2024. This price target implies a 14.7% downside from the November 22 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.3x | 8.3x | 9.3x | 10.3x | 11.3x |

| EPS 2024 ($) | 4.90 | 4.90 | 4.90 | 4.90 | 4.90 |

| Target Price ($) | 35.6 | 40.5 | 45.4 | 50.3 | 55.2 |

| Market Price ($) | 53.3 | 53.3 | 53.3 | 53.3 | 53.3 |

| Upside/(Downside) | (33.1)% | (23.9)% | (14.7)% | (5.5)% | 3.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $48.2, which implies a 9.6% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 5.1%. Hence, I’m maintaining a hold rating on Tompkins Financial.

Read the full article here