TransUnion (NYSE:TRU) expects double digit sales growth in the international markets in 2023, and most analysts are optimistic about FCF growth in 2023 and 2024. In my view, new products offering decision analytics with real-time identity resolution services or other innovative technologies acquired from M&A transactions represent revenue catalysts. Even considering risks from the total amount of debt or new data regulations, I believe that stock price would be daily valued at $78.5 per share.

TransUnion

TransUnion, a consumer credit reporting agency, is currently considered a valuable data manager, complying with the rules and regulations imposed in each territory in this regard, with the aim of maximizing the experience of customers.

The reference market for this company is the global data and data analysis market, containing an enormous and vast amount of financial and institutional information, telephone activity, credit management and lawsuits, bankruptcies, and account statements. Access to the services of this company includes access to the information base to be used for the benefit of the business of its clients.

TransUnion divides its activities into three operating segments: US, International, and Consumer Interaction markets. The first two segments have logically similar activities and attributions, with the difference that the framework of operations for the first is exclusively local, while the second segment covers its international operations.

Broadly speaking, the services that TransUnion provides through these segments are consumer reports, perspectives based on specific actions and analysis for businesses. These services are usually used to attract consumers, confirm their ability to pay, identify sales opportunities, measure and manage the business risk portfolio, mitigate the possibility of fraud, and identify their customers. TransUnion works with participants in the financial industry, although they also cover what the company calls emerging vertical markets such as communication, technology, services, and entertainment among others.

On the other hand, consumer interaction services are of a similar nature, but they are provided for individuals or private customers who do not belong to a company or business. These are given directly or indirectly. The company directly offers risk identification and management services through a monthly fee, with communication, advice, and control of the platform from mobile devices. Indirectly, the company sells its services through distributor agents, paying a single fee that allows them to trade the company’s products to new customers.

TransUnion provides tools in order to have permanent access and decision-making power over the elements mentioned in the above paragraph. TransUnion is currently active in more than 30 countries in North America, Europe, South America, and Asia.

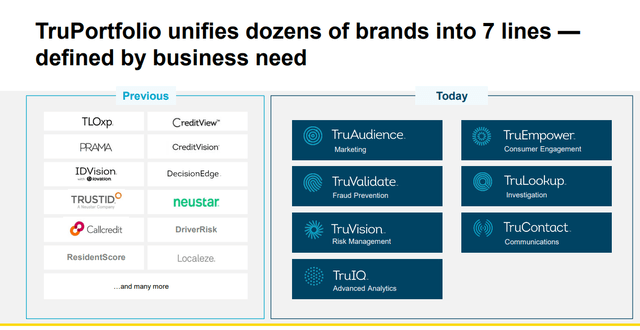

I believe that one of the most notorious recent achievements of TransUnion is the unification of many brands into only 7 lines. I believe that the simplification of the portfolio was a smart move, and will offer cost optimization in terms of marketing efforts and public visibility.

Source: Quarterly Presentation

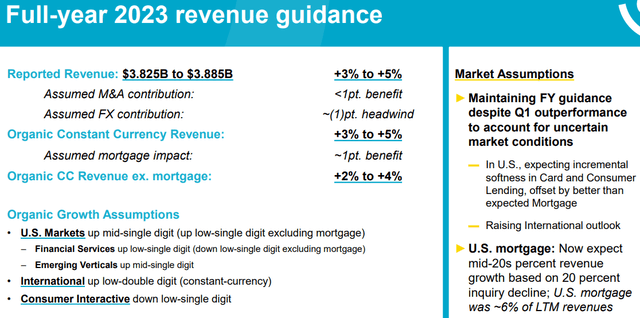

With that about the transformation of the business model, it is worth noting that the guidance for 2023 appears, in my view, quite conservative. The company expects single digit sales growth, with some M&A contribution, but negative effects from the forex markets. With that, TransUnion believes that international operations could bring double digit sales growth.

Source: Quarterly Presentation

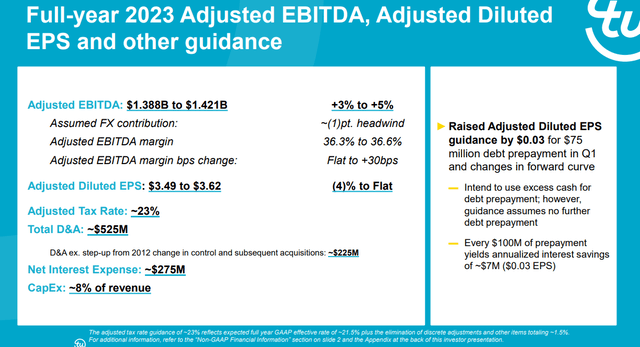

Other beneficial guidance recently given includes an EBITDA margin close to 36%, adjusted EPS of $3.49 per share, and D&A of $525 million.

Source: Quarterly Presentation

Large Competitors

Competition is high, and is mainly given by the quality of the service, the price ratio, and the integration of the models. TransUnion believes that it is well positioned.

Also, the competition varies by region and segment. If we talk about the United States markets, the leading competitors are Equifax (EFX), Experian (OTCQX:EXPGF), and LexisNexis. Equifax and Experian are also important competitors in international markets. These two companies along with Fair Isaac (FICO) and LifeLock are the biggest competitors in the consumer interaction segment.

In this last point, we must add the internet platforms for personal finance and some other agencies with specific niche services that can mean competition in customer retention or access to new customers.

Beneficial Market Expectations With FCF Growth, Net Income Growth, And Sales Growth

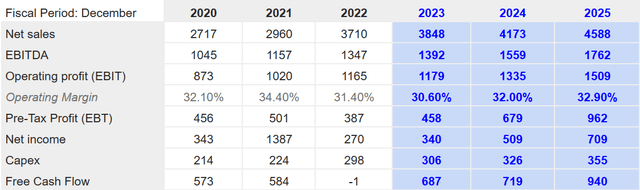

With the guidance given, I believe that TransUnion is worth a quick look because of the expectations of other market analysts. They expect sales growth and EBITDA growth in 2023, 2024, and 2025. Besides, with capital expenditures at close to $306-$355 million from 2023 to 2025, the FCF is also expected to grow from around $687 million in 2023 to $940 million in 2025.

Source: S&P

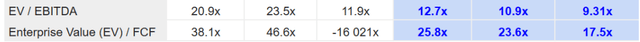

Considering expected sales growth and FCF generation, I do not think that the EV/FCF and EV/EBITDA ratios are that expensive.

Source: S&P

Balance Sheet

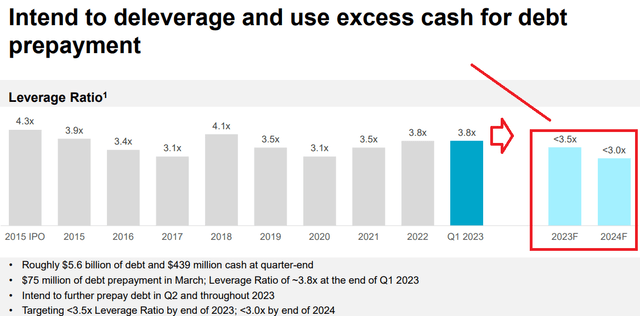

TransUnion reports a stable balance sheet with an asset/liability ratio close to 1x, a significant amount of goodwill, and intangible assets financed by long-term debt. The list of assets and liabilities reported in the last quarterly report are approximately similar to what management reported in December 2022. The total amount of long term debt decreased a bit as promised by management in the past, however I would expect further relevant decreases in the leverage ratio. Management intends to report a leverage ratio close to 3x in 2024.

Source: First Quarter 2023 Earnings

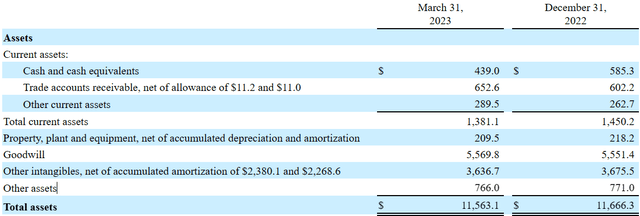

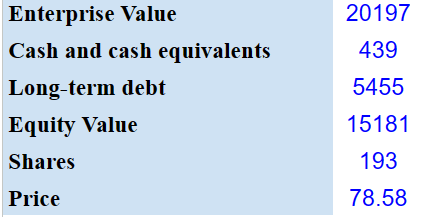

As of March 31, 2023, the company reported cash and cash equivalents of $439 million, trade accounts receivable of $652.6 million, and other current assets close to $289.5 million. Total current assets stood at $1.381 billion, more than the current amount of liabilities.

Property, plant and equipment was equal to $209.5 million, with goodwill worth $5.569 billion, other intangibles of $2.380 billion, and total assets worth $11.563 billion.

Source: First Quarter 2023 Earnings

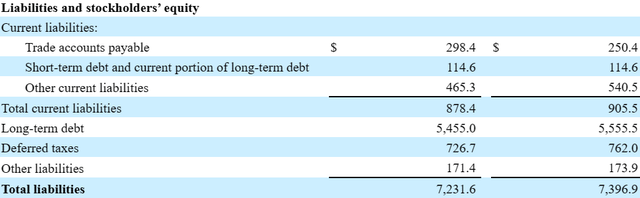

Regarding the list of liabilities, the company noted trade accounts payable of $298.4 million, short-term debt and current portion of long-term debt of $114.6 million, and other current liabilities close to $465.3 million. Finally, with long-term debt worth $5.455 billion and deferred taxes of $726.7 million, total liabilities are equal to $7.231 billion.

Source: First Quarter 2023 Earnings

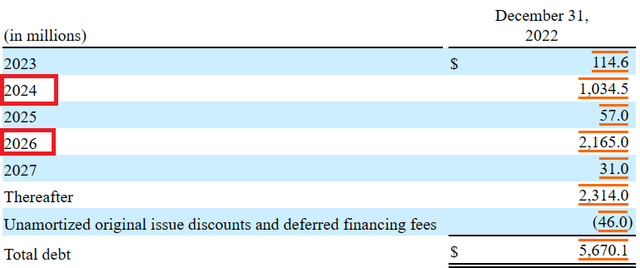

In the last 10-k, the liabilities include $1.0345 billion payable in 2024 and $2.165 billion in 2026 among other contractual obligations. Considering future expectations of free cash flow, I believe that TransUnion will be able to renegotiate its debt terms if necessary.

Source: Annual Report

With Artificial Intelligence, Deep Learning Solutions, And More Products, My DCF Valuation Implied A Valuation Of $75 Per Share

Under my financial model, I assumed that TransUnion will likely penetrate more deeply into new verticals with new products or more refined and developed services. In particular, I think about new products for clients operating in technology, media, tenant and employment, and the public sector. In addition, I believe that TransUnion will successfully design new deep analytics resources and better tools to make credit scoring, forecasting, and client segmentation in the new markets.

Besides, I also assumed further investments in the breadth and depth of data offered to clients and enhancements of TruValidate, TLOxp, and CreditView. As a result, I expect revenue growth from selling new products. Also, existing clients may be willing to pay more money to TransUnion as the number of options would multiply. Also, customers may accept higher prices for better prediction power driven by larger datasets.

I would also expect successful positioning in new market possibilities and expansion of services towards marketing fraud management and digital tools. In particular, further development of data and analytics solutions and improved technologies, including machine learning, artificial intelligence, and deep learning, could bring significant business growth.

As the demand for data and analytics solutions grows across industries and geographies, we will continue to expand the scope of our underlying data, improve our tools and technology and enhance our analytics and technology solutions capabilities to provide innovative solutions that address this demand. As the needs of businesses and consumers continue to evolve, we continue to help them meet their challenges, which our ongoing investments in data, technology and analytics enable us to do more quickly and efficiently, for example with machine learning, artificial intelligence and deep learning. Source: Annual Report

New factors and techniques influencing the anticipated jump in AI products would include unsupervised machine learning or neural networks. More clients may be interested if TransUnion successfully trains machine learning models to identify fraudulent behaviors from previous observations. Besides, clients will likely pay a bit more for faster detection, more efficiency, and new cost-effective AI software. Finally, if regulators accept the new wave of AI technology and compliance does not increase, I expect higher FCF margins.

I believe that it is worth mentioning that the market for AI based fraud management solutions is expected to grow at a CAGR of close to 18%. In my view, if TransUnion successfully launches many more products in this market, I believe that future sales growth could increase.

The sales for AI based fraud management solutions is estimated to rise at 18.0% CAGR between 2021 and 2031. Source: AI in Fraud Management Market Sales Analysis & Opportunity

Besides, further expansion of the presence towards new international markets will most likely enhance revenue growth and FCF generation. In particular, I would expect that more launches like that of CreditVision in the U.S. and globally will likely take place soon. Management made several commentaries in this regard in the last annual report.

We have significant scale in some of the world’s fastest growing markets, such as India and Latin America, which positions us to take advantage of the favorable dynamics in these regions as their populations become more credit active. Source: Annual Report

Finally, I would expect that the previous acquisitions executed by management will be successful. Considering the total amount of goodwill, I believe that shareholders need to like quite a bit some of the acquisitions made in the past. I am optimistic about the real-time identity resolution technology obtained from Neustar.

On April 8, 2022, we completed our acquisition of Verisk Financial Services, the financial services business unit of Verisk Analytics, Inc. Source: Annual Report

We completed two of our largest investments in the history of the company with the acquisitions of Neustar and Sontiq. Neustar, a premier identity resolution company with leading solutions in Marketing, Risk and Communications, enables customers to build connected consumer experiences by combining decision analytics with real-time identity resolution services driven by its OneID platform. Source: Annual ReportSontiq provides solutions including identity monitoring, restoration, and response products and services to empower consumers and businesses to proactively protect against identity theft and cyber threats. Source: Annual Report

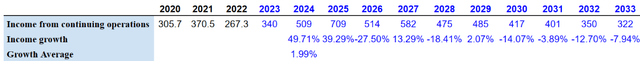

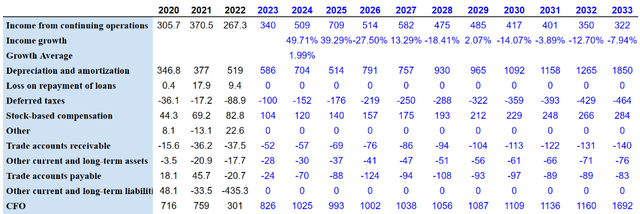

I believe that my financial model includes conservative net income growth and FCF growth. From 2024 to 2033, I assumed a growth average close to 1.99% and net income figures for 2024 and 2023 close to what other analysts reported.

Source: My DCF Model

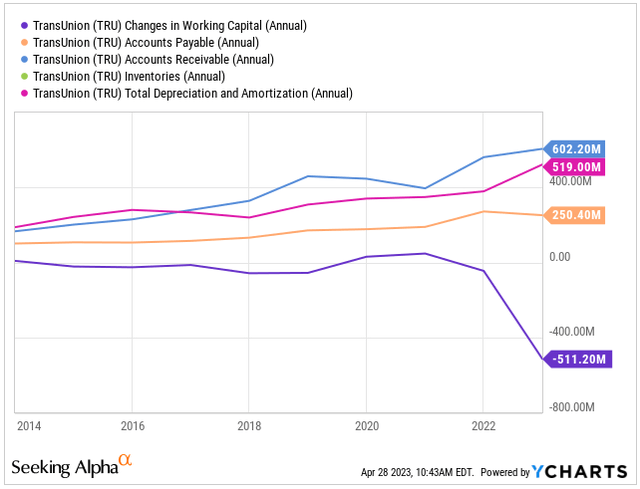

My numbers also included D&A growth from 2024 to 2033, increases in stock based compensation, decreases in accounts receivable, decreases in accounts payable, and CFO growth. I believe that my figures are in line with previous numbers reported by TransUnion. I am not really thinking out of the box in the case of TransUnion.

Source: Ycharts

More in detail, I assumed 2033 income from continuing operations close to $321.55 million, depreciation and amortization of $1.850 billion, stock-based compensation worth $283.5 million, trade accounts receivable close to -$140.5 million, and changes in trade accounts payable of -$84.5 million. Besides, with 2033 CFO close to $1.6915 billion and capital expenditures of -$350.5 million, 2033 FCF would be close to $1341.5 million.

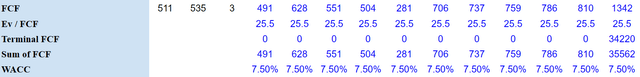

Source: My DCF Model Source: My DCF Model

If we use an EV/FCF multiple of 25x, the terminal FCF would be close to $35 billion. If we also include a WACC of 7.5%, cash and cash equivalents of $439 million, and long-term debt close to $5455 million, the equity value would be at around $15.180 billion, and the fair price would be $78.5 per share.

Source: My DCF Model

Risks

TransUnion is heavily dependent on the US financial market. In this sense, the termination of any of the long-term contracts and the possible inability to maintain innovation in the sector are potential risk factors for the company. All these elements must be put into context regarding the current global economic crisis and the versatility and volatility of these services.

In addition, we must add the myriad of potential or existing regulations and legislation regarding the collection, sale, and use of data as well as privacy laws and other associated legislation. These are variable depending on the region and the penalties for operating outside the proposed legal frameworks. In this sense, non-compliance with the rules or the inability to adapt to new frameworks and legislation could be a complication in operations and brand recognition.

Finally, I believe that even if we assume that FCF growth will likely exist, the risks from the total amount of debt should, in my view, be mentioned. In my opinion, if management fails to find new debt investors, or the credit markets deteriorate, I believe that the total amount of debt could push the valuation down.

Conclusion

TransUnion delivered conservative guidance that included double digit sales growth in the international markets and single digit revenue growth in the United States. I believe that the use of artificial intelligence, machine learning, and decision analytics with real-time identity resolution services could represent a catalyst for revenue growth. Besides, in my view, if TransUnion successfully closes the acquisitions recently reported, and makes good use of the technologies acquired, I would expect business growth. Even taking into account risks from the total amount of debt or new data regulations, I believe that the stock is undervalued.

Read the full article here