Investment thesis

Twilio (NYSE:TWLO) stock has been in a massive decline since the summer of 2021. The stock started bouncing back this year, and Q1 earnings were strong. But, the Q2 guidance was below consensus expectations, and there was a selloff after the earnings release. Since September 2022, the company laid off more than 25% of its workforce, which helped improve the operating margin, which is still negative. It is difficult to forecast to what extent the cost optimization initiatives will mitigate the revenue growth deceleration. Therefore, despite the attractive valuation, I am not investing at this point and assign the stock a “Hold” rating. I would like to see how the nearest quarters will unfold before I make the decision to invest.

Company information

Twilio is a cloud communications platform that enables its customers to embed various communication channels, including messaging, voice, video, and authentication capabilities, directly into their software applications. According to the latest 10-K report, as of fiscal 2022 year-end, the company had over 290,000 active customer accounts.

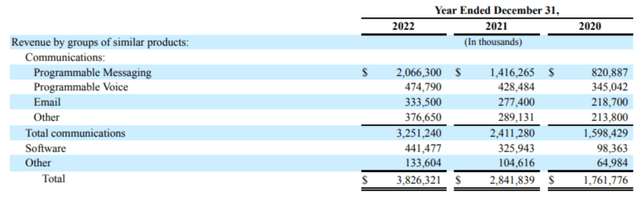

The company’s fiscal year ends on December 31 with a sole reportable segment. In FY 2022, about 34% of the total sales were generated outside the U.S. TWLO disaggregates revenue by groups of similar products, where Programmable Messaging represents more than half of the total.

Twilio’s latest 10-K report

Financials

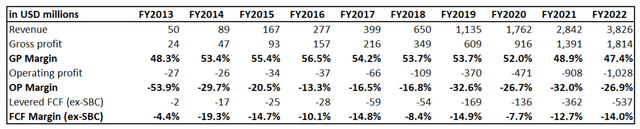

Twilio’s revenue growth over the past decade was impressive, with a staggering 54% CAGR. On the other hand, massive revenue growth did not help to improve the gross margin, which grew between FYs 2013 and 2016, but declined substantially since then. The same with the operating margin, which deteriorated significantly since FY 2016 and is currently far from the positive zone. In the last five years, the company demonstrated a positive free cash flow [FCF] margin, but if we subtract the stock-based compensation [SBC], the FCF ex-SBC margin is negative at double digits. On the other hand, the company reinvests heavily in R&D to improve its offerings. I like the management’s long-term mindset with its firm commitment to innovation, with the R&D to revenue ratio consistently above 25% over the past decade.

Author’s calculations

The balance sheet is a fortress with a massive $4 billion outstanding cash balance, substantially higher than the outstanding debt amount. TWLO has a $2.7 billion net cash position with strong liquidity ratios.

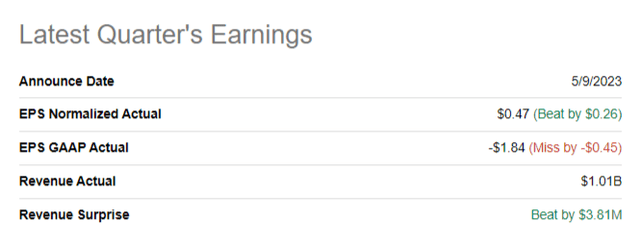

The latest reportable quarter’s earnings were released on May 9. TWLO delivered an above-the-consensus revenue and adjusted EPS performance, but the stock plunged about 16% after the earnings release. This was due to weak 2Q 2023 guidance related to the near-term revenue growth challenges.

Seeking Alpha

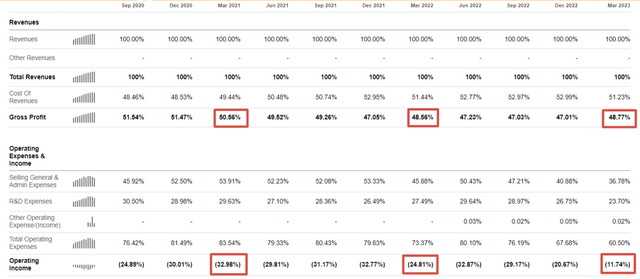

Q1 revenue was up 15%, and the adjusted EPS expanded from zero to $0.47. The gross margin was almost flat YoY. In September 2022, the company announced the plan to lay off 11% of the company’s workforce. In February 2023, TWLO said that another 1,500 employees, or 17% of the total, would be laid off. It is apparent that the second wave of TWLO’s layoffs had no effect on Q1 earnings, but September layoffs helped significantly improve the operating margin. Still, it was insufficient to generate a positive operating profit in Q1.

Seeking Alpha

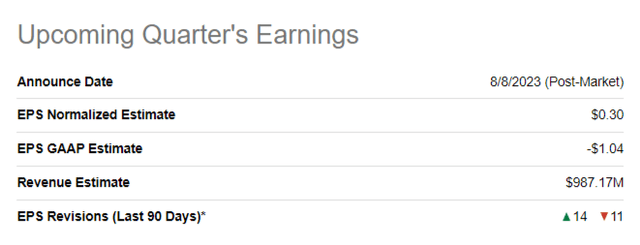

The upcoming quarter’s earnings release is scheduled on August 8, and revenue is expected to go below $1 billion, meaning a sequential drop. On a YoY basis, the top-line growth is expected to be below 5%, which is a substantial deceleration.

Seeking Alpha

I like the management’s initiatives to improve profitability metrics. Still, I would like at how the nearest quarters will unfold and to what extent restructuring initiatives will improve profitability metrics amid the revenue deceleration.

Valuation

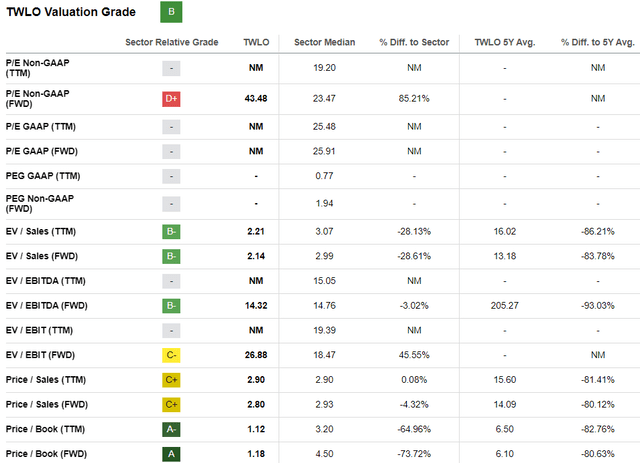

The stock demonstrated a 23% year-to-date rally, outperforming the broad market. Seeking Alpha Quant assigned the stock a relatively high “B” valuation grade, meaning the stock is attractively valued. Indeed, current valuation multiples are mostly lower than the sector median and substantially lower than the company’s 5-year averages.

Seeking Alpha

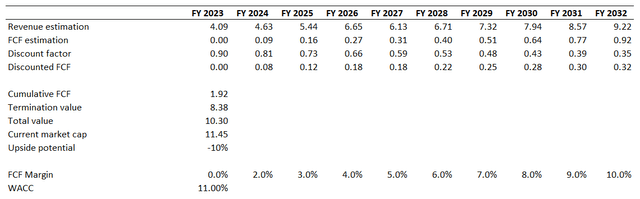

Now let me look at how future cash flows compared to the current market cap with the help of discounted cash flow [DCF] valuation approach. I use an 11% discount rate for TWLO. This might look elevated, but for me, the level of uncertainty regarding the timing of sustainable positive cash flows is high. I have consensus revenue estimates projecting a 9% revenue CAGR over the next decade, which looks conservative. The company’s FCF margin ex-SBC is still in double digits, so I do not expect it to turn positive this fiscal year. I expect it to be at 2% in FY 2024 and to expand further by one percentage point yearly.

Author’s calculations

As we see, the company’s fair value is about $11.3 billion, and the stock might look overvalued. On the other hand, the company is in a substantial net cash position, and if we add up a $2.7 billion net cash position, the business’s fair value will be at $13 billion, which is about 13% higher than the market cap. That said, the stock is undervalued, but the level of uncertainty is very high, especially regarding the FCF margin. Also, let me examine the risks to understand whether the discount is fair.

Risks to consider

TWLO faces the risk of underperforming aggressive growth expectations as a growth company. If the company fails to deliver the projected growth of either revenue or EPS, this is likely to lead to investors’ disappointment and a potential massive sell-off. We already saw a massive sell-off in this name, which started in the summer of 2021, far before the general market downturn of early 2022.

The company’s operating margin is still far below -20% and the timing of the FCF margin ex-SBC turning positive is very uncertain. Overall, TWLO has a rather low “C-” profitability grade from Seeking Alpha Quant because profitability ratios are mostly lower than the sector median and have declined compared to the company’s five-year averages. While TWLO is one of the undisputed leaders in its niche, it looks strange that the company has low pricing power and cannot charge clients fees enough to generate profitability metrics that will match its niche leadership. I consider this a red flag that might indicate that the company’s competitive advantages are weak.

It is also important to underline that the company generates a substantial portion of sales internationally, meaning its earnings are vulnerable to adverse fluctuations in foreign exchange rates.

Bottom line

To conclude, TWLO is a “Hold”. I like the management’s initiatives to optimize costs, but I would like to look at the next couple of quarters to see how this will mitigate the substantial deceleration in revenue. The valuation looks attractive, but I do not think it is worth the risks and uncertainties.

Read the full article here