The last time I covered the U.S. Global Jets ETF (NYSEARCA:JETS) was during the turmoil in the banking sector. Back then, I noted that the banking turmoil was not expected to have a lasting impact, but if not contained could affect consumer confidence and erode demand for air travel. Some readers thought connecting the collapse of several banks to air travel demand was a long stretch. The opposite turned out to be true, as I have followed various earnings calls from airlines as well as aerospace & defense companies and they actually confirmed that there had been a short-term pressure on demand but because the fall out in the banking sector was contained, demand rebounded.

International Air Transport Association (IATA) recently updated its expectations for 2023 during the Annual General Meeting hosted in Istanbul. In this report, I will be looking at the results, which provide quite a bullish view of this year.

What Holdings Are In The Jets ETF?

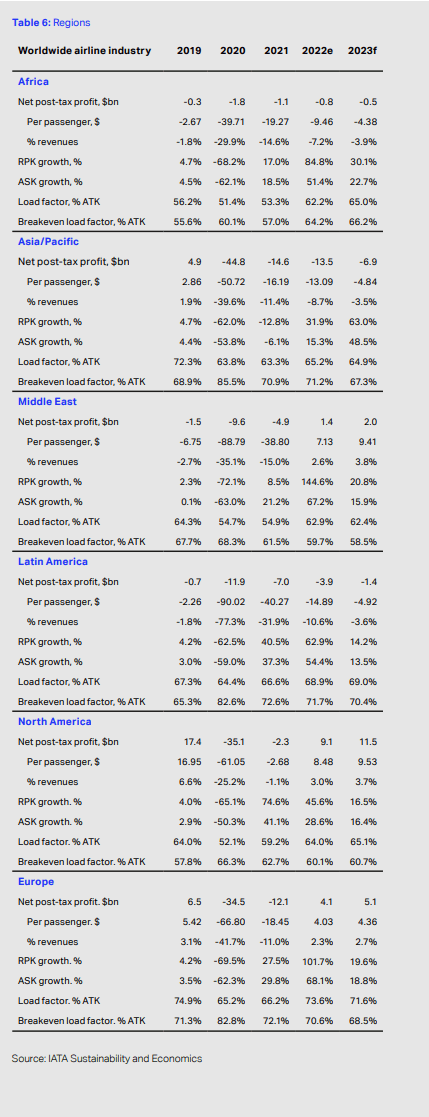

You might wonder why the IATA outlook is relevant for the US Jets ETF, since the IATA outlook is a global outlook. The reason is quite simple, the IATA outlook includes split outs by regions so we can assess the expected performance by region, and it also shows how regions recover relative to one another. Furthermore, the IATA forecast is based on airline surveys, so it is a good representation of the expected industry performance.

The top airline holdings in the U.S. Global Jets ETF are:

- Delta Air Lines (DAL) with 11.0%

- United Airlines (UAL) with 10.6%.

- Southwest Airlines (LUV) with 10.6%

- American Airlines (AAL) with 10.6%

- Air Canada (OTCQX:ACDVF) with 4.6%

- Alaska Air Group (ALK) with 4.1%

- Allegiant Travel (ALGT) with 3.9%

- JetBlue (JBLU) with 3.7%.

- Hawaiian Holdings (HA) with 3.4%

Furthermore, while over 60% of the ETF consists of holdings in the top US airlines the remaining 40% consists of airlines in other regions as well as airport stocks, OEMs and other travel-related stocks.

IATA More Bullish On The Future

While many airlines are running ahead of the 2019 revenues driven by pass through of higher costs and industry capacity constraints, connectivity is still not fully recovered. Domestic routes are 95.8% recovered while international connections are nearly 80% recovered. So, there is still quite some recovery ahead. In December 2022, capacity growth of 18% was expected for 2023. That number is now significantly higher with 25% capacity growth expected driven by higher growth in the Americas and Europe.

The global post-tax profit per passenger is expected to be $2.25, which is a more than double the $1.11 expected earlier. So, the industry is significantly more bullish on the future than it was six months ago. Still, with profits at the higher level of $2.25 they are still less than 40% recovered compared to pre-pandemic. So, the forecast got significantly better, but the reality is that there still is a lot of growth for airlines to recover earnings, and that might be good news for airline stocks and airline focused ETFs.

I won’t be going through the entire forecast line by line, but the most recent forecast is as follows:

IATA

| Net post-tax profit | |||||

| Region | December (Forecast) | June (Forecast) | Change | 2019 | Earnings recovered |

| Africa | $ -0.2 | $ -0.5 | 150% | $ -0.3 | 167% |

| Asia/Pacific | $ -6.6 | $ -6.9 | 5% | $ 4.9 | -141% |

| Middle East | $ 0.3 | $ 2.0 | 567% | $ -1.5 | -133% |

| Latin America | $ -0.8 | $ -1.4 | 75% | $ -0.7 | 200% |

| North America | $ 11.4 | $ 11.5 | 1% | $ 17.4 | 66% |

| Europe | $ 0.6 | $ 5.1 | 750% | $ 6.5 | 78% |

| Total | $ 4.7 | $ 9.8 | 109% | $ 26.3 | 37% |

For Africa and Asia Pacific, which by size are in no way comparable, we observed that profitability has been revised down to a $7.4 billion loss despite capacity growth being higher than previously forecast. So, higher growth is not adding to profits. I would say the main reason is that these regions are in a different phase of the recovery. Profits in Latin America are expected to be worse as well driven by social and economic turmoil in the region.

The better performer without doubt is the Middle East, which saw a 567% upward revision to 2023 earnings expectations and will be executing above pre-pandemic levels. If we look how the region and mostly Emirates has operated, it is not odd we see the region flip from a pre-pandemic loss to a profit. I flew to Mauritius via Dubai in 2019 on Emirates, and what was notable was that the aircraft was packed but the ticket prices were low. What Emirates basically has been doing for a long time is function as a feeder for tourism in Dubai. So, the Emirates fed the passengers into Dubai at a loss but with the aim of boosting tourism spendings in Dubai itself. Right now, demand for air travel is so high that the flights that were earlier executed at a loss can now be operated profitably. Furthermore, the supply-demand imbalance has widened as the capacity growth has been trimmed to 15.9% from 21.2%.

North America is expected to be 66% recovered and its forecast profits were stable. The region that moved the needle is Europe which saw a $4.5 billion increase in the forecast profits and should be 78% recovered compared to pre-pandemic times. The upward revision is driven by a combination of high travel demand, low-cost carrier expansion and easing of supply chain issues as we saw on the big airports during peak summer season in 2022.

So, I would say North America, Europe and the Middle East stand out where North America is mostly the stable factor and Europe is the strong grower.

Should You Buy Into The US Jets ETF?

So, the big question you might have is whether you should buy into the US Jets ETF. Year-over-year, there should be a 15% growth or $1.5 billion in earnings for US carriers and a 19% swing or $3.7 billion growth in earnings for European airlines. My view has been that instead of buying the US Jets ETF, you might be better off handpicking airline names, and that view remains. Moreover, if you want to capitalize on the strength of the European market, the US Jets ETF with less than 10% exposure to European names might not be the most rewarding investment. With that in mind, I would consider other investments in Europe such as Ryanair (RYAAY) and Wizz Air (OTCPK:WZZAF) and possibly Air France-KLM (OTCPK:AFRAF) and Deutsche Lufthansa (OTCQX:DLAKF).

Conclusion: Lot Of Upside Left For The Airline Industry

The overall industry still has a lot of recovery runway ahead, as the total profits are expected to be only 37% recovered compared to pre-pandemic times. The latest update on expected profit levels is a significant increase from the previous forecast from December 2022. Somewhat against my expectations, the Asia-Pacific region profits will be worse and not better even though the capacity growth forecast has been increased.

The big grower in the forecast is Europe, and that makes European airlines perhaps a bit more desirable if you are looking to capitalize on the increased forecast and with a low exposure of the US Global Jets ETF to European airline and airport names that also means that there is no strong argument to buying into the ETF. As a result, I am maintaining my hold rating, noting that you could have more rewarding investments just by handpicking one or a handful names instead of buying the U.S. Global Jets ETF.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here