This Analysis Gives U.S. GoldMining a Sell Rating

If you have U.S. GoldMining (NASDAQ:USGO), this analysis supports a Sell recommendation.

Although relatively new to the Nasdaq, shares of this junior Alaskan gold explorer have already shown clear signs of being affected by shifting sentiment around gold prices due to some economic indicators turning less supportive of the metal.

The Impact of Bearish Sentiment Surrounding Gold Prices on U.S. GoldMining

According to this analysis, these economic indicators are already putting strong downward pressure on not only the price of gold but also on the shares of U.S. GoldMining Inc.

Since the beginning of May, the price per ounce traded via Gold Futures expiring in August 2023 (GCQ3) has fallen about 3% to a price of $1,959.75 at the time of writing. And the start of the downturn coincides with two key events. The US Federal Reserve’s rate hike of 25 basis points before the pause on June 14, bringing the deposit rate to its current range of 5% to 5.25%, and the economic system’s creation of a number of non-farm payrolls that far exceeded analysts’ expectations for April and May.

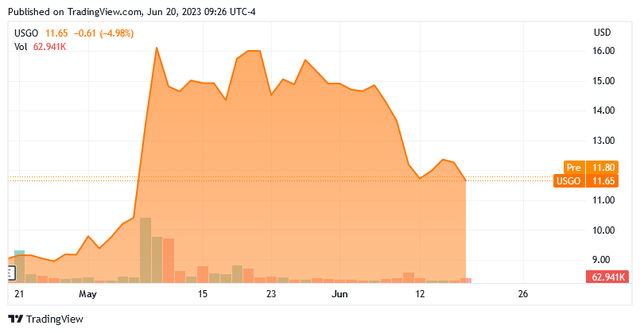

It did not take long for USGO common stock to be impacted and due to the recent negative trend in gold prices, the stock lost more than 20% in just 1.5 months of trading.

Source: Seeking Alpha

About U.S. GoldMining: It Was Formed as a Spin-Out from GoldMining

U.S. GoldMining Inc. was formed from a spin-out of GoldMining (GLDG) — a Vancouver-based explorer and acquirer of gold properties in America — and the shares of U.S. GoldMining Inc. were listed on the Nasdaq stock exchange through an initial public offering completed in April.

The company went public on April 20 with a goal of raising $20 million for exploration and mining studies at the Whistler – a gold and copper mineral project in Alaska — by offering 2 million units at a price of $10 each.

Each unit consisted of one common share traded on Nasdaq-CM under the symbol USGO and one warrant traded on Nasdaq-CM under the symbol USGOW. The warrant entitles the holder to purchase one common share of USGO stock at a price of $13, exercisable for a period of three years from the date of issuance. As a result of the completion of the IPO, GoldMining, the former parent company, should now own 9,622,491 common shares of USGO, representing approximately 79% of USGO’s common stock.

U.S. GoldMining Common Stock Appears to Be Overvalued

Since the IPO and following the surge in gold prices, USGO shares rose to $17.24 intraday on May 10, 2023. Since then, USGO has declined due to the switch to bearish sentiment in gold prices.

An overvaluation problem is emerging for USGO common stock, which currently trades at 12.8 times the former parent company’s stock price. USGO stocks entered the world of Nasdaq-listed companies when the price of gold hit an all-time high. The precious metal could benefit enormously from a boom surrounding its safe-haven status, which this analysis found was partially unwarranted.

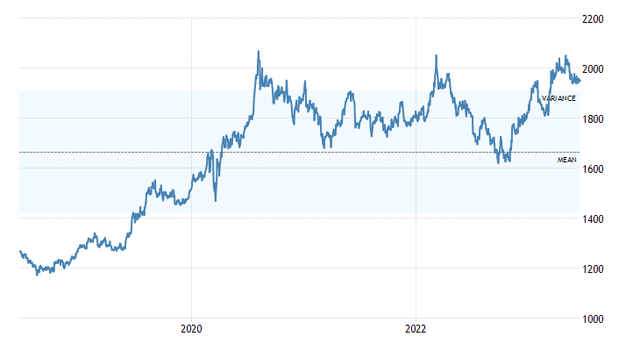

Gold prices remained unreasonably high in 2023 compared to their 5-year moving average price of around $1,670 per ounce (see Trading Economics chart below). This average price was reached by gold prices between October and November 2022 after a series of rate hikes to curb runaway inflation.

Source: Trading Economics

Despite the decline over the past 1.5 months, which could be a harbinger of where the ounce of gold is headed, the precious metal is still trading at a market price that is objectively really inflated.

It is evident that in 2023 the demand for gold has been fueled by the dissemination of information about gold’s properties as a useful hedge against high inflation, against the risk of economic recession due to Fed tightening and against the fear of a collapse of the US banking system.

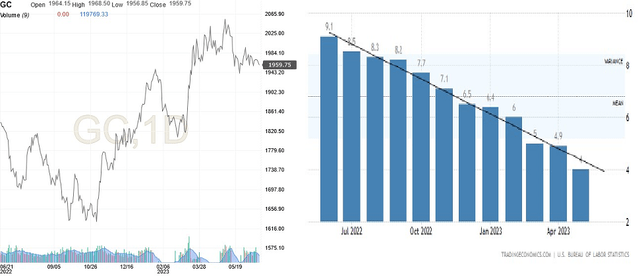

As far as inflation is concerned, alongside the sharp drop in the price of goods and services from a peak of 9.1% in June 2022 to 4% in May 2023, gold prices should have seen a downward trend as well, assuming that there is a positive correlation between the inflation rate and the price of gold. Instead, the precious metal moved in the opposite direction.

This aspect is illustrated by the following screenshot. Comparing Investing.com’s gold price chart with Trading Economics’ inflation chart, we can see that gold has proven itself as a tool to hedge against inflation beyond actual needs.

Source: Investing.com and Trading Economics

As for the looming recession, although it is yet to materialize despite the Fed’s aggressive rate hike policy, economists seem much more optimistic about a soft landing for the business cycle. The latter is a situation of the business cycle in which a stable or mild economic slowdown is accompanied by higher interest rates.

The bankruptcies of Silicon Valley Bank and Signature Bank (OTCPK:SBNY) in March and First Republic Bank (OTCPK:FRCB) in May led to a huge surge in gold demand as investing in the precious metal was seen as a strong hedge against the risk of a bigger problem affecting the US banking system. However, since the third bank closed 1.5 months ago, there have been no further bank failures in the US and the Fed has since hiked rates again. On top of this, Federal Reserve Governors and US Treasury Secretary Janet Yellen gave reassurances about the health of the banking system. So if the current demand for gold were still fueled by the belief that the US banking system is still in danger of collapse, then such fears would be objectively exaggerated and unfounded given the above circumstances.

If the price of gold inexplicably stays too far above its 5-year moving average, there is a good chance the asset is overvalued and the same goes for all gold-price-focused investments, including USGO, which does not even produce the metal but intends to do so in the hope that the exploration activities will lead to successful results.

USGO is an exploration company with an interest in the Whistler Project, a gold-copper exploration project covering 53,700 acres of state land in the Yentna Mining District of Alaska. More specifically, the area where the company’s exploration team intends to unlock value through fully permitted exploration activities is approximately 100 miles northwest of the state capital of Anchorage.

The company intends to conduct mining activities on this property and recover the precious metal from indicated resources of 3 million gold equivalent ounces and inferred resources of 6.4 million gold equivalent ounces. However, there is currently no economic assessment of the project for future production of the metals.

The Stock Valuation

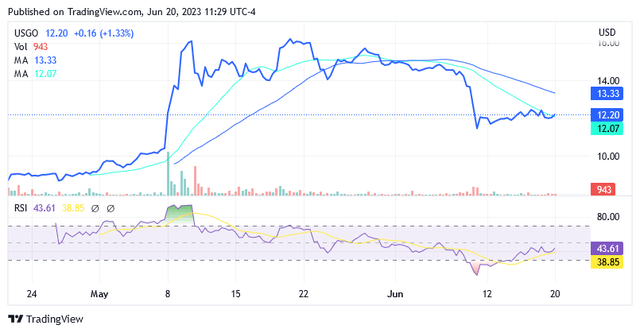

Shares of U.S. GoldMining were trading at $12.20 apiece as of this writing, giving it a market cap of $141.37 million.

Source: Seeking Alpha

Shares have declined significantly since early June, trading below the 50-day simple moving average of $13.33 while near the level of the 20-day simple moving average of $12.07.

However, the investor should not be fascinated by these seemingly favorable comparisons between the stock price and the two technical indicators, but instead pay attention to the factors that point to an overvalued stock, and which have been highlighted earlier in this analysis.

This stock went public at the height of the gold price period and this $12.20 share price, which has only been trading for a few months, will – inevitably – be heavily affected by it. Additionally, this stock price represents the market value of a company that is not yet producing metal, but plans to do so one day. The portfolio consists of a mineral resource that must first be upgraded with all associated risks and costs pending an economic assessment of the project.

The results of exploration activities that the team of U.S. GoldMining Inc. will conduct on the Whistler Gold-Copper Project could have a short-term impact on the stock price. In the meantime, however, the price of the stock will be determined by the movements in the price of gold, which is unlikely to rise from current levels due to the following factors.

The metal is holding below $1,960 an ounce, its weakest reading in the last three months, as it suffers from the US Federal Reserve’s hawkish outlook. The central bank now expects the federal funds rate to come in at 5.6% in 2023, up from March’s estimate of 5.1%, according to Trading Economics. This points to further monetary tightening this year and higher interest rates bode ill for gold prices as investors prefer to invest in fixed income rather than gold, which does not pay incomes.

Conclusion

U.S. GoldMining was formed from a spin-out of Canada’s GoldMining and its shares were listed on the Nasdaq stock exchange in an initial public offering completed in April 2023.

The stock came on the market at a time when gold, the main commodity for the future business activity of USGO, was peaking due to a series of circumstances, significantly bolstering its safe-haven status.

This stock represents a company that has resources for which no estimates, even preliminary, of the economic feasibility of the project have been made.

As such, the stock is most likely overvalued, and with future gold prices suffering from the ever-present possibility of a soft landing (higher interest rates and a resilient economy) rather than a recession, this analysis sees no room for keeping shares of USGO in the portfolio.

Read the full article here