Investment thesis

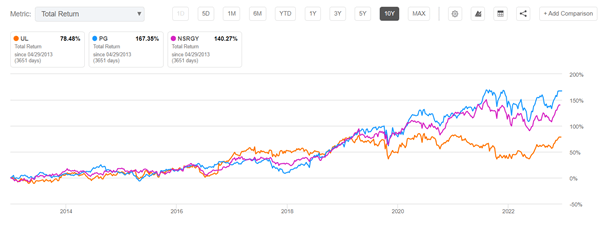

As a European it’s really hard not to have any products in your house from Unilever PLC (NYSE:UL). I am a fan of the “know what you own” concept in investing. I started looking in my own house for products we are using on a daily basis. The amount of products with the UL logo on its package were quite significant. The UL stock has always been very popular in the Netherlands and was praised for its consistency, generous dividend payments and its function as a portfolio stabilizer. However the last years were tough, especially if we compare the 10-year total returns to peers like The Procter & Gamble Company (PG) and Nestlé S.A. (OTCPK:NSRGY).

10-year total return Unilever (Seeking Alpha)

Is investing in UL still worth it? I think it is! In my opinion UL is perfectly set up to be a solid dividend turnaround investment. In this article we’re going to look at the potential catalysts, financials and dividend grades. Finally, we’re going to determine the fair value of UL with free cash flow analysis.

Company overview

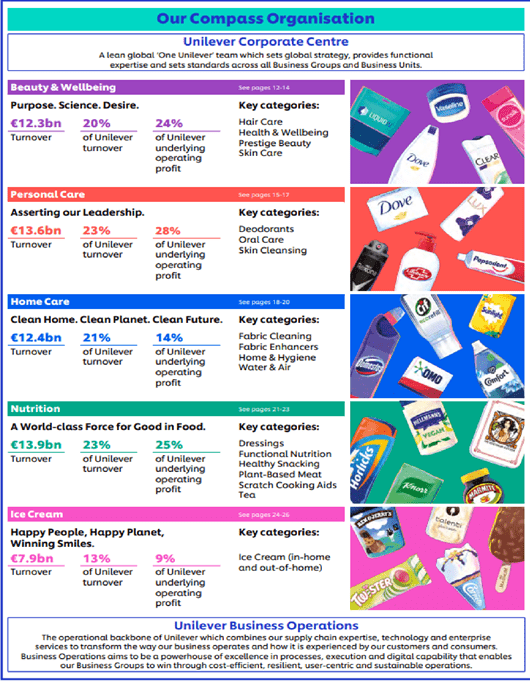

UL is a large multinational which started as a small Dutch enterprise in the 1800s. The company started selling products like butter and soap. On 2 September 1929, Margarine Unie and Lever Brothers fused together and Unilever was officially born. From that moment UL entered a lot of different markets and the company quickly became a household name in the consumer staple landscape. There are over 3.4 billion people that uses their products on a daily basis, which is impressive. At the moment UL has its headquarters in London and has approximately 127000 employees in more than 100 countries. UL has a large portfolio of 400+ different brands, which can be subdivide into different categories (combined with their turnover rate):

- Beauty & Wellbeing (€12.3 billion)

- Personal Care (€13.6 billion)

- Home Care (€12.4 billion)

- Nutrition (€13.9 billion)

- Ice Cream (€7.9 billion)

The product portfolio is well diversified and also turnover is well distributed. In terms of profitability Beauty & Wellbeing accounts for a total of 24% of UL underlying profit, Personal care 28% and Nutrition 25%. These three categories also have the best profit margins.

UL product portfolio (Investor relations)

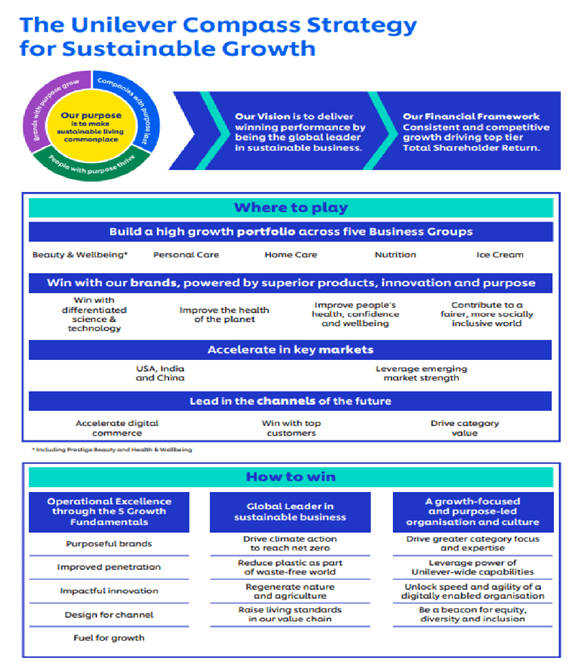

Compass strategy to growth

In the UL 2022 annual report they state that growth will be their priority. In the same year billionaire and activist investor Nelson Peltz joined the board of UL. I think this is fantastic news, because he has a lot of experience and a strong track record in the consumer staple business segment. For example, in 2018 Peltz has joined the board of PG. From that moment in time PG has created a lot of shareholder value. I think Peltz can push UL in the right direction to become a promising turnaround play. I am a fan of his approach to simplify and streamline the portfolio of UL. In 2022 they already started doing some portfolio optimization, shifting more towards products with higher growth perspective and higher margins. For example, UL sold its global tea business and bought brands like Paula’s choice and Nutrafol. In my opinion these are steps in the right direction, because these brands are in the beauty, health & wellbeing segments and have much more potential to increase the profitability of UL. The addition, Peltz is not the only change in board composition. In September 2022 the current CEO, Alan Jope, has announced his intention to retire. The new CEO will be Hein Schumacher and he will start his journey from 1 July 2023. At the moment Schumacher is the CEO of the global dairy company Royal FrieslandCampina and he also has strong experience in developed and emerging markets. Schumacher has worked for The Kraft Heinz Company (KHC) where he was zone president in the greater China (2011-2013) and the Asian Pacific region (2013-2014). This is really important, because I think UL has a strong position in emerging markets and this could be one of the most important growth drivers.

Compass to growth (UL annual report 2022)

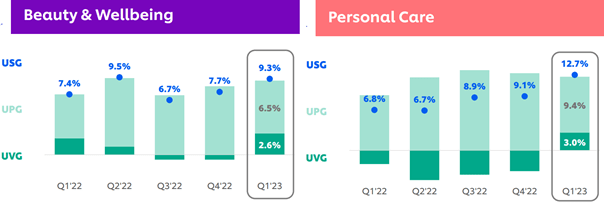

The Q1-2023 trading statement

The Q1-2023 trading statement of UL also looks promising and I think we’re already seeing some signs of the turnaround. There was a 10.5% underlying sales growth and a significant volume improvement (-0.2%) compared to last year, which is very good to see. The volume improvement was mainly driven by the “Beauty and Wellbeing” (+2.6%) and “Personal care” (+3.0%) segments. This could be a result of their initiated compass to growth strategy and portfolio management. The Home care (-2.8%), Nutrition (-1.3%) and Ice cream (-4.1%) segments had experienced shrinking volumes and were still heavily impacted by inflationary pressure.

Volume Improvement (Q1 2023 trading statement)

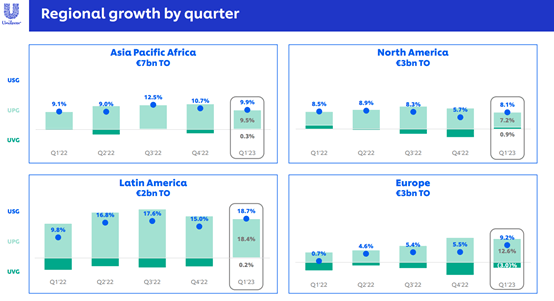

If we take a look at the regional growth we can see a recovery trend in volume growth. Asia Pacific Africa, North America and Latin America already showing some volume growth. The only exception is Europe with a -3% volume decline. UL said in the earnings call that it’s a reflection of ongoing cost pressure on Nutrition and Ice Cream, which has a relatively large footprint in Europe.

Regional growth (Q1 2023 trading statement)

The company is expecting another year of underlying sales growth of 3-5% (more at the upper end) and an improved volume performance compared to its previous fiscal year (FY). They expect a underlying margin of at least 16% for the first half of 2023, which is in line with their 2022 numbers. As this is a trading statement they don’t want to give too much commentary on margins.

Financials

Income statement

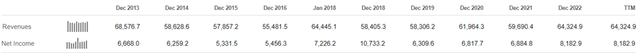

Looking at the income statement we can see there wasn’t revenue growth over the past 10 years. FY 2013 was actually the year with the highest revenue of $68.5 billion and from that point the revenue was moving between the $55.5 and $64.3 billion range. However, it’s hard to judge UL fully on its revenue numbers, because of its divestitures the past years. From a net income perspective there are more positives to mention. The net income grew from $6.7 billion in FY 2013 to $8.1 billion in 2023.

Revenue vs Net income (Seeking Alpha)

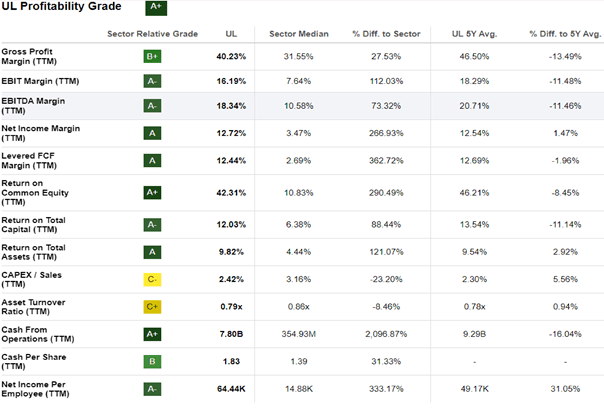

The profitability of UL looks quite attractive. UL has a gross profit margin of 40.23% (31.55% sector median). The EBITDA Margin of 18.34% is also a lot better than the sector median of 10.58%. At the moment the margins of UL are generally lower than their own 5-year average. I think the margins will recover or will get better over time, because of portfolio optimization and decreasing inflationary pressure.

Profitability Unilever (Seeking Alpha)

Balance sheet

The balance sheet of UL is decent, but not the best in its sector. At the end of FY 2022 UL had $4.632.2 billion cash on hand. The net debt of the company has increased a lot over de last 10 years, in FY 2013 they had $11,377.8 billion in debt and it increased to $25.580.9 billion. However, if we compare the numbers from FY 2016 to FY 2022 the net debt went almost nowhere.

UL net debt (Seeking Alpha)

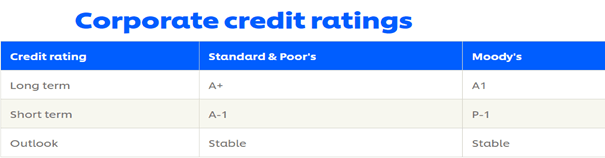

The net debt to EBITDA ratio ($25,580.9 / $11,794.6) of UL is around 2.17, which is reasonable. For example PG has a net debt to EBITDA ratio 1.19, so UL is scoring much less on this metric. UL has a S&P credit rating of A+ and a Moody’s credit rating of A1, which means they have a strong capacity to meet their financial commitments, and they’re somewhat susceptible to economic conditions and changes in circumstances.

Credit Ratings (Unilever investor relations)

I think the balance sheet of UL is healthy enough to handle its debt burden in the long term, but I think it’s not wise to further increase their debt. Especially not for purposes like dividends or share buybacks, which I will further explain in the next section of this article.

Dividend

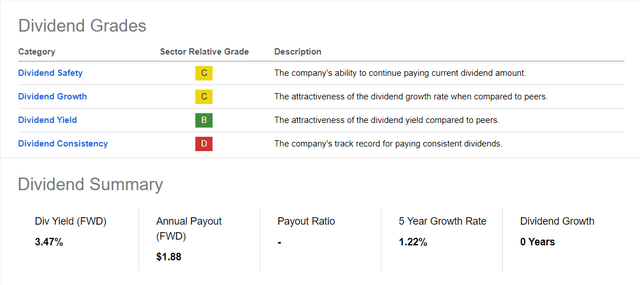

The dividend of UL was analyzed with the dividend grades used from the Seeking Alpha Quant ratings.

Dividend Grades (Seeking Alpha)

Yield and growth

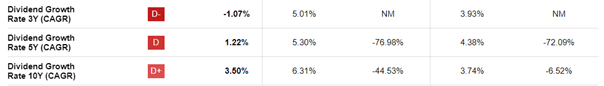

At the current share price UL is offering a dividend yield of 3.47%, which is in my opinion an attractive entry point at the start of an investment. The yield is in line with its own 5-year average of 3.45% and far better than its sector median (2.41%). Although, looking at the 10-year dividend growth history it’s somewhat disappointing. The dividend growth is very choppy and only has a 10-year compound annual growth rate (CAGR) of 3.5%. And to make it even worse, the last 5 years the annual dividend payout almost went nowhere. In the 2022 annual report they speak about the objective of paying a “consistent and attractive dividend” and not specific about a growing one. Over longer periods of time I expect a growing dividend, especially if they can keep growing their earnings and enhance profitability.

Dividend growth rates (Seeking Alpha)

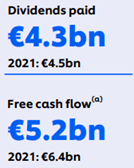

Safety and consistency

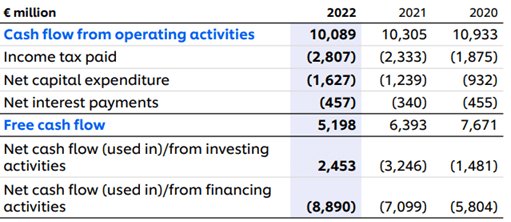

Based on the annual dividend per share of FY 2022 ($1.88) divided by the EPS of FY 2022 ($3.21) the pay-out ratio would be 58.6%, which seems to be a safe ratio. The percentage would be 80.3% doing the same calculation with the dividend per share of FY 2022 ($1.88) divided by the free cash flow per share of FY 2022 ($2.34). As you can see in the picture below the percentage would be even higher if we take the numbers from the 2022 annual report. If we do the math, the total dividends paid (€4.3 billion) is 82.7% covered with total amount of free cash flow (€5.2 billion). With the high percentages in mind, it’s hard to say the dividend is easily covered. In 2022, UL also did a share buyback program of €1.5 billion ($1.63 billion). The amount of dividends paid and the share buybacks combined, comes to a total of €5.8 billion ($6.31 billion), which outpaces the free cash flow quite significantly. In my opinion this is not a good position to be in for longer periods of time. Especially if they pay their shareholder distributions with debt.

Dividend payout compared to free cash flow (2022) (UL annual report 2022)

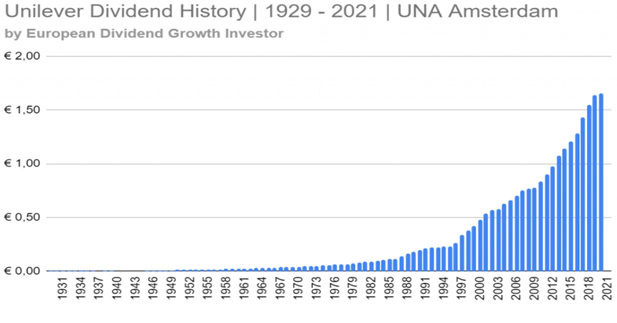

Based on dividend history we can conclude that UL is a very consistent dividend payer. In 1929 the company started paying dividends and there were only a few years where UL wasn’t able to pay a dividend (for example during the second world war).

UL dividend history (Europeandgi)

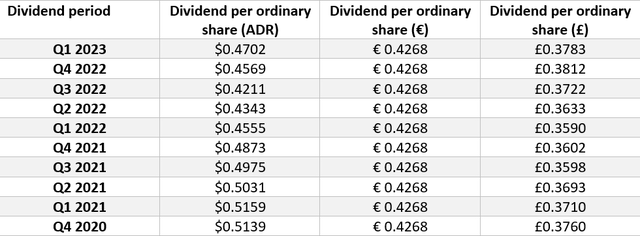

From Q4 2009 UL has started paying a quarterly dividend. This was the case for Unilever PLC shares traded on the London Stock Exchange, Euronext in Amsterdam and the ADRs. Dividends will be received in their own local currency. Looking at the dividend history of UL, it is showing some significant dividend growth over longer periods of time. However, if we look at short-term data, UL is definitely not a “pure” dividend growth play. Currently, the company hasn’t a consistent dividend growth streak anymore.

Dividend Information (Investor relations dividend history)

This is a big contrast compared to the 66 years growth streak of its American peer PG. Personally I prefer year-over-year dividend growth, but in this case it doesn’t have to be that consistent. UL is a European company after all and most of the European company’s don’t have a pure dividend growth policy. However, with the current free cash flow, it would not be wise to raise the dividend at all.

Valuation

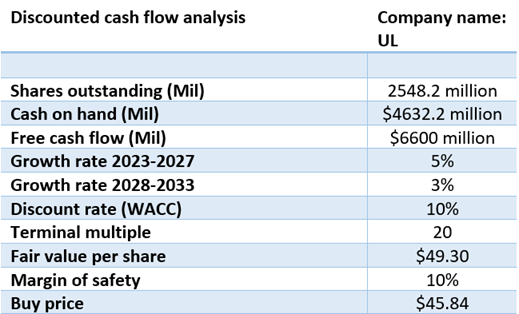

For the valuation of UL I used discounted cash flow analysis. In FY 2022 the free cash flow was €5.2 billion ($5.65 billion). This was less compared to 2020 and 2021. This was caused by lower operating margins, lower underlying volume growth, significantly higher income tax payment and higher net capital expenditures. UL will allocate more capital towards growth the next few years and this affects free cash flow negatively in the short-term.

Free cash flow comparison (UL annual report (2022))

I think the free cash flow in 2023 will be better compared to 2022, because of their increase in volumes in the “Beauty & Wellbeing” and “Personal Care” segments. These are also the most profitable segments, which should boost their free cash flow in the long run. For the analysis I used a free cash flow between the 2021 and 2022 range of €6.0 billion ($6.6 billion). The 10-year free cash flow per share CAGR of UL was only 1.58%. I expect this to be a lot better the next 5 years. Since PG has optimized their portfolio (Jun 2017 – Jun 2022) they achieved a free cash flow CAGR of 8.19%. I think it will be no surprise if UL is going to use the same portfolio blueprint with Peltz on board. Combine this with the other potential catalysts I used a 5-year free cash flow growth rate of 5%. For the 5 years thereafter I used a growth rate of 3%, because it’s harder to make accurate assumptions over longer periods of time.

The terminal multiple of 20 which is around the 5-year pe average and because of the relatively stable business model of UL a higher PE can be justified. I used a discount rate of 10%, because I want an annual return close to the 10 percent range. This comes to a fair value of $49.30 per share. If we subtract a margin of safety of 10% the buy price will be $45.84 per share. At the moment the share price of UL Is $54.27. Compared to my fair value it is 10.1% overvalued.

Discounted cash flow analysis (My own Google spread sheet)

Conclusion

UL is a stable and recession proof stock in the consumer staple sector. With their relatively new compass to growth strategy, portfolio optimization and their strong position in emerging markets should trigger solid growth in the future. From a dividend standpoint UL can be well worth it as an investment in my view. With a starting yield of 3.47% and potential dividend growth in the next few years, UL can also be attractive for income investors. Don’t expect a high dividend growth rate in the short term. However, if the company manages to execute their growth strategy, further dividend growth can be expected. Based on my own free cash flow analysis UL share are 10.1% overvalued. At the moment I give UL a “HOLD” rating. In 2022 I was able to purchase some UL shares with an average buying price of $44.71 and at the current share price I am not in a hurry to buy more. However, I will be more than happy to add more around the $49 dollar range, which comes down to a yield on cost of 3.83%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here