It pays to have moat-worthy enterprises that operate in a duopolistic industry, especially during times of heightened economic tensions. It’s even better if these companies are trading in value territory and has a solid track record of paying a dividend.

Such I find the case to be with UPS (NYSE:UPS), which, as shown below, currently trades well off its 52-week high of $209. In this article, I discuss why now may be a good time to pick up this dividend giant at a reasonably attractive price.

UPS Stock (Seeking Alpha)

Why UPS?

UPS is a global logistics leader due to its sheer size of being the world’s largest parcel delivery company. It manages a fleet of 100K vehicles and over 500 planes, with a presence in 220 countries and territories. Last year, UPS generated $100 billion in total revenue.

UPS isn’t immune to challenges in the global economy. It started the year strong with higher-than-expected volume in January, close to management’s plan in February, and significantly lower than planned volume in March, as retail sales contracted.

It appears that consumers are feeling the pinch, as food as a percentage of household budgets rose to 9%, up 200 basis points from 7% two years ago, before inflation took hold. With a historically low unemployment rate, labor inflation has caused households to shift dollars away from goods towards services.

These aforementioned factors drove revenue down by 6% YoY during the first quarter to $22.9 billion. Moreover, cost inflation negatively impacted profitability, with operating margin declining by 250 basis points to 11.1%, driving operating profit down by 23% to $2.6 billion.

Long-term risks to UPS include its customer, Amazon (AMZN), which makes up 11% of UPS’ revenue. Nonetheless, Amazon still depends on UPS for much of its shipping needs, and with much of its capital focused on growing its AWS Cloud business, Amazon may not have the inclination to make heavy investments in order to entirely displace UPS and bring its shipping internally.

Moreover, it’s simply hard to compete with UPS’ vast retail network, which includes more than 5,100 locations in the U.S. This gives customers convenient access to drop off packages they’ve sold online or to return packages to sellers. This is reflected by 85% of the U.S. population living within 10 miles of a UPS store.

Plus, management feels confident about reaching an agreement with the Teamsters union by the end of July, and healthcare as an incremental growth opportunity that remains largely untapped. This includes a recent acquisition of Bomi Group, a healthcare logistics provider in Europe, and global expansion of its Premier service, as noted during the recent conference call:

We are continuing to invest in the global expansion of UPS Premier, which is now available in 45 countries with four more to be added this year. Our goal is to become the number one complex healthcare logistics provider in the world to help us get there who plan to open a total of seven dedicated healthcare facilities this year. As a reminder, in the fourth quarter of 2022, we completed the acquisition of Bomi Group and to date, revenue and cost synergy are running ahead of target.

Meanwhile, UPS stands out for having a strong A credit rating from S&P, which should come in handy when it comes to borrowing amidst uncertainty around higher interest rates and U.S. debt ceiling negotiations. It’s also lowly levered, with a net debt to TTM EBITDA of just 1.06x, sitting far below the 3.0x level generally considered safe by ratings agencies.

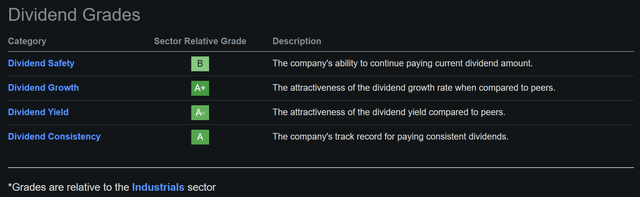

Recent share price weakness has made the dividend yield attractive at 3.8%. The dividend is covered by a 51% payout ratio, and comes with a 12.5% 5-year CAGR and 13 years of consecutive growth. As shown below, UPS’ dividend scores A and B grades for safety, growth, yield, and consistency.

Seeking Alpha

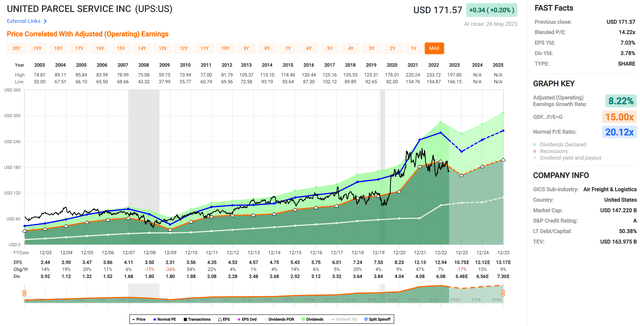

While UPS isn’t dirt cheap at the current price of $171.57 with forward PE of 15.9, I believe it’s reasonably attractive considering the moat-worthy nature of the enterprise and the very strong balance sheet. Plus, it trades comfortably below its normal PE of 20, as shown below. Analysts expect a return to bottom-line growth next year, and have a consensus Buy rating with an average price target of $190, representing a potential 15% total return over the next 12 months.

FAST Graphs

Investor Takeaway

UPS has strengths from its wide-reaching scale and retail network, and has ambitions to become a global healthcare logistics leader. While it has near-term headwinds from economic uncertainty and cost inflation, I believe these factors should improve over time, and are already priced into the stock. With a near 4% dividend yield and strong balance sheet, long-term investors could see meaningful total returns from the current discounted price.

Read the full article here