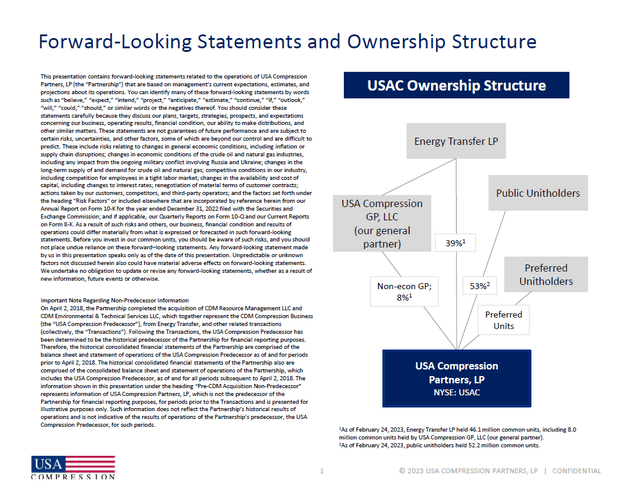

USA Compression Partners LP (NYSE:USAC) is a limited partnership managed by USA Compression GP LLC, the general manager that’s wholly owned by Energy Transfer LP (ET). Please note that Energy Transfer has a large economic interest in USA Compression Partners via ~46.1 million common units, warrants to acquire up to ~10 million common units, USA Compression Partners Series A preferred units, and its general partnership interest. USA Compression Partners provides natural gas compression services in the US and is one of the largest entities in this space according to the firm. Its business primarily caters to infrastructure applications such as centralized natural gas gathering systems and processing facilities, including infrastructure in numerous energy producing regions across the US such as the Permian Basin, Eagle Ford, Marcellus, Bakken, and more. Its services allow for the processing and transportation of natural gas through pipeline systems, and enhancing crude oil production through artificial lift processes.

An overview of USA Compression Partners’ ownership structure. (USA Compression Partners – March 2023 IR Presentation)

USA Compression Partners’ business is heavily influenced by the trajectory of domestic oil, natural gas liquids, and natural gas production. The recovery in US energy production seen since 2021 (I will cover that later on) has been a boon to its business and income-seeking investors should take note. As of this writing, units of USAC yield a juicy ~10.7%.

Booming Business

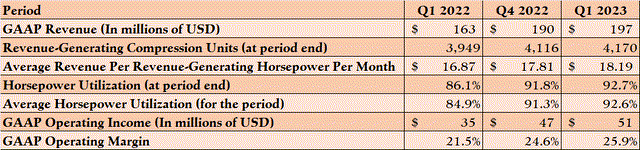

In the upcoming table down below, I complied some key financial and operational data from USA Compression Partners’ first quarter of 2023 earnings update. From the end of March 2022 to the end of March 2023, the number of the company’s revenue-generating compression units grew by 6%, a feat made possible due to significant utilization rate increases and USA Compression Partners’ capital investment program. When combined with its improving pricing power (seen via its average revenue per revenue-generating horsepower per month growing from $16.87 in the first quarter of 2022 to $18.19 in the first quarter of 2023), USA Compression Partners was able to grow its GAAP revenues to $197 million last quarter, up 21% year-over-year.

USA Compression Partners’ financials have been on a powerful upswing of late. (The author, with data provided by USA Compression Partners)

Effective cost management efforts, economies of scale, and ample pricing power enabled the firm to grow its GAAP operating income by 45% year-over-year last quarter, bringing it up to $51 million. Its GAAP operating margin grew by over 440 basis points during this period, hitting 25.9% in the first quarter of 2023. That impressive performance appears to have legs as USA Compression Partners exited March 2023 on a high note with its horsepower utilization rate sitting at 92.7%, up from 91.8% at the end of December 2022 and 86.1% at the end of March 2022.

During the company’s first quarter of 2023 earnings call, management had this to say:

Our first quarter 2023 results are the direct result of our returns-based capital investment strategy and feature consecutive quarterly record revenues, adjusted EBITDA and distributable cash flow. Our financial performance continues to improve with increasing demand driven pricing for our compression services that we continually place under contract for extended tenors compared to historic tenors achievable in prior market cycles.

Our ability to achieve improved price discovery with longer dated contracts for our compression services is complemented further by our ability to increase the size of our active fleet through new unit additions and the continued conversion of legacy units from idle to active status.

USA Compression Partners has been firing on all-cylinders of late and management forecasts that this outperformance will continue going forward. The firm expects to generate $75-$95 million in net income, $490-$510 million in non-GAAP adjusted EBITDA, and $260-$280 million in non-GAAP distributable cash flow (the amount of cash flow left over after covering maintenance-related capital investments) this year. In 2022, the company generated $30 million in GAAP net income, $426 million in adjusted EBITDA, and $221 million in distributable cash flow.

Should the limited partnership achieve its full-year guidance for 2023, the company’s financial performance would record impressive growth across the board. At the midpoint of its guidance, USA Compression Partners expects that its net income will almost triple, its adjusted EBITDA will grow by 17%, and its distributable cash flow will grow by 22% year-over-year in 2023.

Favorable Backdrop

USA Compression Partners has a bright growth outlook underpinned by booming domestic oil, natural gas liquids, and natural gas production. In 2019, crude oil production in the US averaged roughly 12.3 million barrels per day according to the US Energy Information Administration [‘EIA’]. That figure fell down to 11.3 million barrels per day in 2020 before recovering to 11.9 million barrels per day in 2022, according to the US EIA.

In recent weeks, domestic crude oil production has recovered to around 12.3 million barrels per day according to the US EIA. There is room for that figure to climb higher as WTI (the premier US oil pricing benchmark) remains at levels that encourage capital investment in the domestic upstream industry (when WTI is above $60 per barrel, generally speaking, shale plays across the US are profitable to develop).

The US EIA also notes that domestic natural gas production boomed higher in 2021-2023 versus subdued levels in 2020, with production levels in 2023 surpassing records set in 2019. While domestic natural gas prices measured by Henry Hub (the premier US natural gas pricing benchmark) remain low, as has been the case over the past decade outside of major weather events, the outlook for US natural gas production is favorable due to WTI remaining comfortably above $60 per barrel. That’s due to the nature of the production mix of horizontal wells that are hydraulically fractured (otherwise known as fracking activities), as even wells that are considered oil-rich still produce a substantial amount of natural gas and natural gas liquids alongside crude oil (known in the industry as associated natural gas production).

Please note that according to the US EIA, average daily domestic natural gas liquids production hit an all-time high in 2022 and continued to march higher in 2023 on a monthly year-over-year basis. Looking ahead, the outlook for domestic energy production remains bright and that’s great news for USA Compression Partners as the limited partnership has ample growth opportunities ahead of it. Additionally, the promising backdrop ensures that its existing asset base will remain in high demand going forward, seen through its robust utilization rates and ample pricing power of late.

Key Considerations

As noted previously, distributable cash flow is a metric often used by energy infrastructure companies in the US to highlight how much cash flow is left over after covering maintenance-related capital expenditures. However, this metric excludes growth-related capital expenditures and can be misleading. Free cash flow, which I define as net operating cash flow less all capital expenditures, is a better gauge of the ability for a company to make good on its payout obligations (dividends and/or distributions).

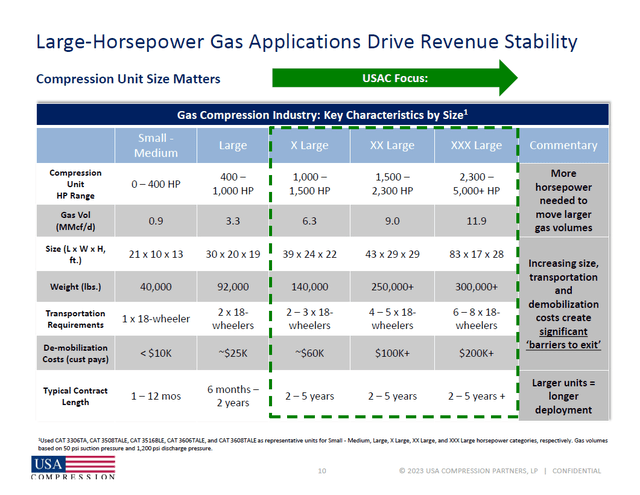

USA Compression Partners intends to spend $26 million covering its maintenance-related capital expenditures and $260-$270 million covering its growth-related capital expenditures this year according to Energy Transfer’s latest 10-Q SEC filing. The bulk of USA Compression Partners’ capital expenditures are going towards growing and upgrading its fleet of natural gas compressors, with a focus on compressors with relatively large amounts of horsepower according to a March 2023 investor presentation.

USA Compression Partners is focused on growing its fleet of natural gas compressors with relatively large amounts of horsepower. (USA Compression Partners – March 2023 IR Presentation)

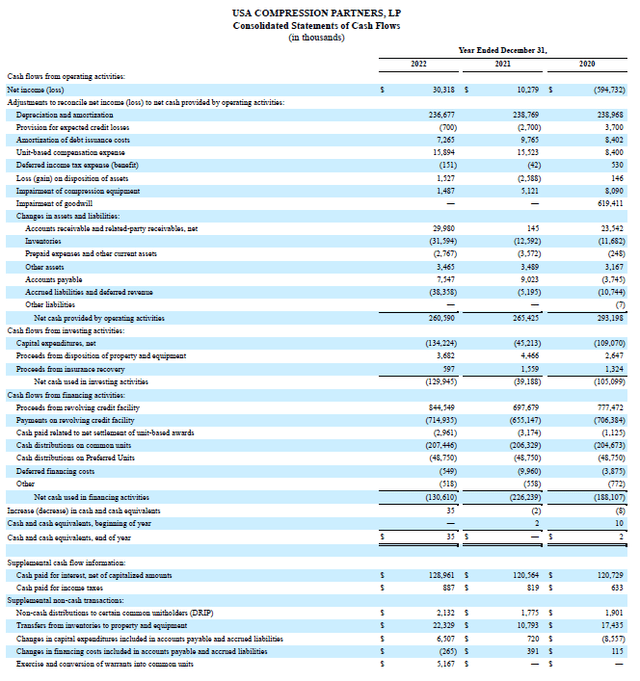

Historically, USA Compression Partners has been comfortably free cash flow positive (generating positive free cash flows in 2020-2022 as you can see in the upcoming graphic down below). In 2022, the firm generated $126 million in free cash flow though it spent $207 million on cash distributions to common unitholders and $49 million on cash distributions to preferred unitholders that same year.

Historically, USA Compression Partners has been comfortably free cash flow positive. (USA Compression Partners – 2022 Annual Report)

The company funds its growth strategy and payouts by tapping capital markets, making it a capital market dependent entity. At the end of March 2023, USA Compression Partners had a negligible amount of cash and cash equivalents on hand with no short-term debt and $2.2 billion in long-term debt on the books. Its large net debt load and minimal cash balance represent a major downside risk to USA Compression Partners, as does its capital market dependent business model. Should USA Compression Partners lose access to capital markets for any reason, its ability to make good on its payouts would come under fire. As an aside, USA Compression Partners remained free cash flow positive during the first quarter of 2023.

The limited partnership has a revolving credit facility that matures at the end of December 2025 with $1.6 billion in aggregate commitments which had $0.9 billion in remaining borrowing capacity at the end of March 2023. USA Compression Partners can utilize its revolving credit facility along with its free cash flow generating abilities and its ability to tap capital markets (via debt and equity issuances) to meet its near-term funding needs. Please note that should market conditions warrant it, the limited partnership’s free cash flow generating abilities could be enhanced relatively quickly by limiting USA Compression Partners’ growth-related capital investments.

Concluding Thoughts

USA Compression Partners’ common units offer investors a hefty yield that’s impressive even in the rising interest rate environment seen in recent years. While investors should be cognizant of the risks posed by the limited partnership’s capital market dependent business model, USA Compression Partners has historically been comfortably free cash flow positive. The company’s outlook is bright in the current crude oil pricing environment. As of this writing, crude oil prices remain supportive of capital investment in shale plays across the US and that’s great news for USA Compression Partners’ existing and future asset base. Its revenues, profits, and cash flows should steadily grow going forward. Income-seeking investors should take a close look at USA Compression Partners.

Read the full article here