A few months ago, I penned a bullish article on the Invesco DB US Dollar Bullish ETF (NYSEARCA:UUP), arguing that safe haven demand may bid up the U.S. dollar and the UUP ETF will benefit.

In my article, I laid out two possible forward paths for the U.S. dollar:

First, there is the ‘soft landing’ scenario, where investors believe a Fed pause and interest rate cuts can arrest the rapidly unfolding banking crisis / credit crunch. If the Fed can avoid a U.S. and global recession, then a ‘dovish’ Fed will lead to weaker U.S. monetary policy vis-à-vis other global central banks, and the U.S. dollar may weaken.

On the other hand, I believe there is a ‘hard landing’ scenario, where the Fed is forced to pause and cut interest rates because the banking crisis / global credit crunch is escalating.

Based on the available information at the time (March 26th, 2023), I leaned towards the ‘hard landing’ scenario as I feared a regional banking crisis and pending debt ceiling crisis would lead to significant credit contraction and a recession.

Soft Landing In Sight?

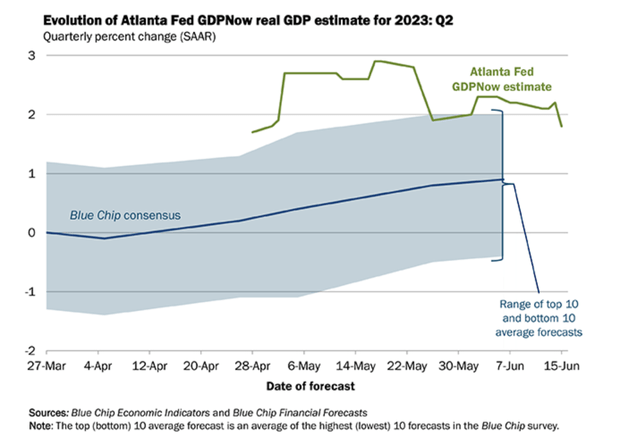

However, in hindsight, I was too bearish as the U.S. economy appears to have absorbed the regional banking crisis without skipping a beat. In fact, consensus estimates for U.S. Q2/2023 GDP have significantly improved from recessionary levels at the end of March to modest growth expectations of ~1% currently, with the Atlanta Fed’s GDPNow tool even more bullish at ~2% real growth (Figure 1).

Figure 1 – GDP growth expectations have improved (atlantafed.org)

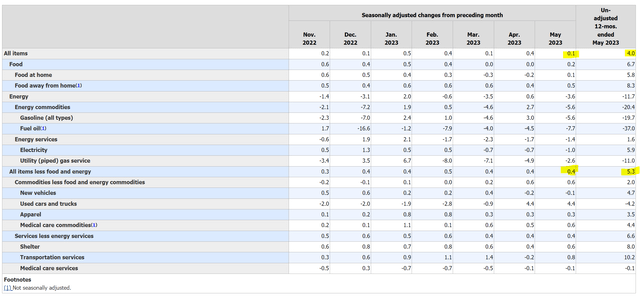

The Fed appears to have successfully achieved a ‘soft landing’, whereby inflation is slowing without pushing the economy into recession as headline CPI inflation dipped to 0.1% MoM or 4.0% YoY in May, the lowest level since April 2021 (Figure 2).

Figure 2 – CPI inflation dipped to 4.0% YoY in May (BLS)

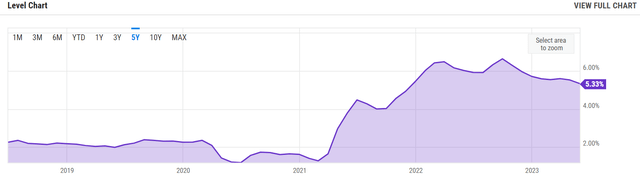

However, looking beneath the hood, investors need to keep in mind that core inflation, excluding volatile food and energy prices, has essentially stalled for the past few months, recording a 5.3% YoY gain in May (Figure 3).

Figure 3 – Core CPI inflation remains stubbornly high (ycharts.com)

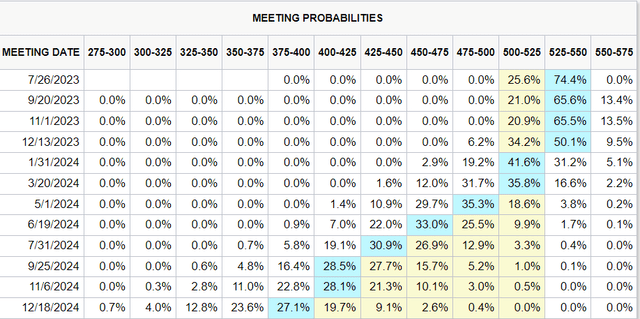

Regardless, financial markets have bought into the ‘soft landing’ thesis, especially as the Fed ‘paused’ their interest rate increases recently at the June FOMC. Despite the Fed’s Summary of Economic Projections (“SEP”) still calling for 1 to 2 rate increases in 2023, most market participants believe the Fed is bluffing and the current interest rate hike cycle in the U.S. is essentially over, with consensus pricing in just 1 additional rate hike in July/September (Figure 4).

Figure 4 – Consensus prices in just 1 more rate hike (CME)

Diverging Monetary Policies Drive Weaker U.S. Dollar

While the Fed is pausing/near the end of its hiking cycle, the rest of the world is still keenly focused on raising interest rates to combat stubborn inflation. We recently saw both the Reserve Bank of Australia (“RBA”) and the Bank of Canada (“BOC”) surprise markets with 25 bps hikes, and the European Central Bank (“ECB”) raised its key interest rates to the highest level in 22 years.

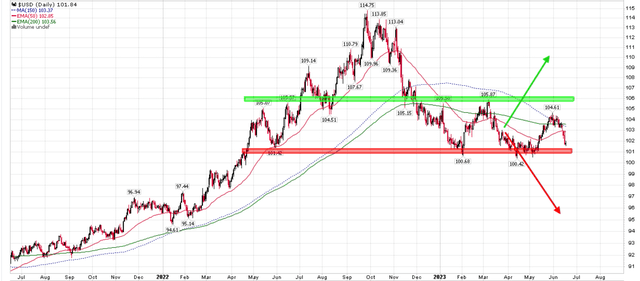

This divergence in monetary policies is the main reason why the U.S. dollar has weakened significantly in recent days, with the DXY Index on the cusp of breaking down through the $100/101 level that I highlighted in my prior article (Figure 5).

Figure 5 – U.S. dollar back in no-man’s land (Author created with price chart from stockcharts.com)

Downgrade On Lack Of Positive Catalysts

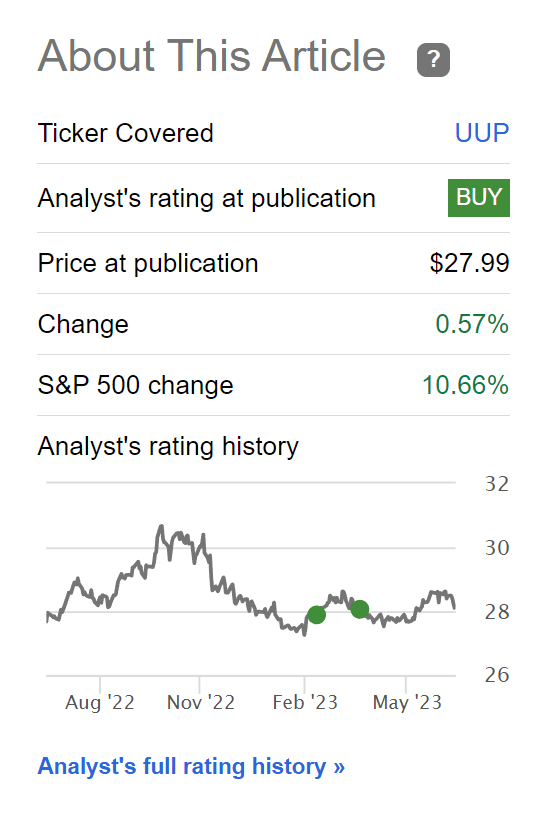

As my ‘hard landing’ scenario is not playing out, I am downgrading my view of the UUP ETF to a hold, pending further developments. Being wrong is part of the game, so we shouldn’t beat ourselves up over it. The key is to have an investment process that helps us assess the risks and opportunities and recognize when to take small losses (or in this case, a small gain), and move on (Figure 6).

Figure 6 – Closing out the trade with a small gain (Seeking Alpha)

Next Few Months Will Be Key For the U.S. Dollar/Global Economy

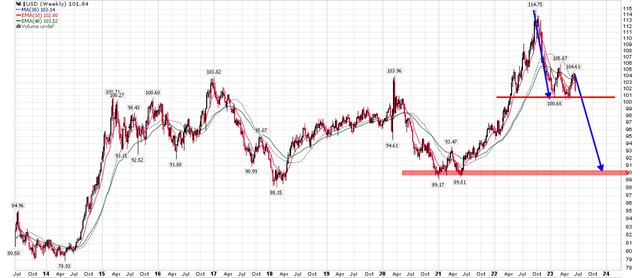

I believe the upcoming few months will prove to be pivotal for the U.S. dollar and the global economy. If we get to the Fall and the Fed has indeed stopped raising interest rates without causing a recession while global growth reaccelerates, then we can see the U.S. dollar break down decisively through $100. In this ‘soft landing’ scenario, the U.S. dollar may retrace back to $90, based on a technical projection from the 2022 to 2023 decline (Figure 7).

Figure 7 – U.S. dollar breakdown could target $90 (Author created with price chart from stockcharts.com)

Traders do not have to rush into this trade. Instead, let us see the U.S. dollar breakdown and global growth reaccelerate – if this scenario plays out, there will be plenty of time to enter with high confidence.

Conclusion

I am downgrading the UUP ETF to a hold. Simply put, the ‘hard landing’ scenario behind my buy recommendation in March is not playing out, as the U.S. economy proves far more resilient than anticipated. With diverging monetary policies, the U.S. dollar may continue to weaken in the coming months.

Read the full article here